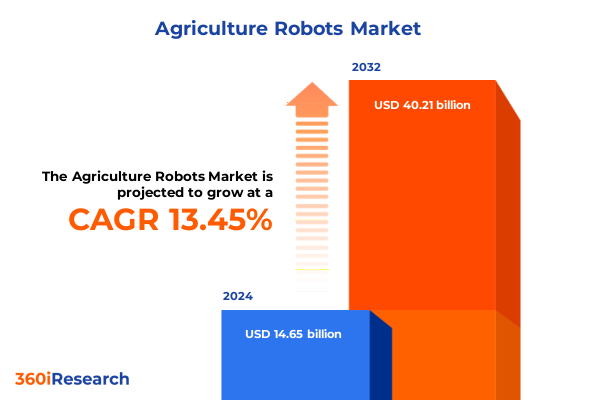

The Agriculture Robots Market size was estimated at USD 16.51 billion in 2025 and expected to reach USD 18.65 billion in 2026, at a CAGR of 13.55% to reach USD 40.21 billion by 2032.

Agriculture robots at the center of a digitally enabled, autonomous farming transformation reshaping productivity, resilience, and sustainability worldwide

Robotics has moved from the periphery of experimental farms into the mainstream of agricultural strategy. What began as isolated projects in autonomous tractors, milking parlors, and aerial imaging has matured into a diverse ecosystem of field robots, drones, and automated handling systems that touch nearly every part of the agricultural value chain. This shift is being driven by a confluence of pressures: chronic labor shortages, climate volatility, stricter sustainability expectations, and the need to produce more food with fewer inputs.

At the same time, advances in machine vision, AI, edge computing, and connectivity are enabling robots to operate in unstructured, dynamic environments that once posed insurmountable challenges. Machines can now navigate complex orchards, recognize individual plants or animals, and make localized decisions in real time. Agricultural robots are no longer limited to repetitive, highly structured tasks; they increasingly serve as intelligent agents that sense, decide, and act across fields, barns, and packing facilities.

The resulting transformation is not merely technological. As robots become integral to operations, they reshape farm business models, labor structures, and relationships between equipment manufacturers, software providers, and growers. Data flows generated by robots are feeding new analytics platforms and decision-support tools, while service-based commercial models are emerging to lower adoption barriers. Against this backdrop, understanding where agriculture robots are delivering tangible value today-and how regulatory and trade developments will shape their trajectory through 2025 and beyond-is critical for equipment makers, technology suppliers, investors, and policymakers alike.

From isolated automation to intelligent ecosystems, agriculture robots redefine how data, labor, and equipment interact across the entire farming value chain

The landscape of agricultural automation is undergoing a fundamental shift from mechanization to autonomy. Traditional equipment focused on amplifying human labor through power and scale; today’s agriculture robots embed perception, decision-making, and connectivity into every operation. Autonomous tractors and robotic implements can follow precise paths, adapt to variable soil conditions, and execute tasks such as seeding, spraying, and tillage with centimeter-level accuracy. Meanwhile, smaller, lighter field robots are emerging as swarms that operate continuously, reducing soil compaction and enabling more frequent, targeted interventions.

Another transformative shift is the integration of robots into broader digital ecosystems. Drones equipped with multispectral sensors generate high-resolution crop maps that feed into analytics engines, which in turn instruct ground robots or variable-rate sprayers on where and how to act. Milking robots collect detailed data on animal health and productivity, which can be linked to feed management systems, veterinary records, and breeding programs. Packaging and sorting robots in post-harvest facilities connect with traceability systems and order management platforms, closing the loop between farm, processor, and retailer.

Commercial and ownership models are also evolving. Robotics-as-a-service offerings allow farmers to access advanced equipment without large upfront capital expenditure, paying instead for acres treated, hours of operation, or units handled. Remote monitoring and over-the-air software updates support continuous performance improvements and offer new levers for differentiation, such as premium service tiers or performance guarantees. These shifts are encouraging new forms of collaboration between machinery manufacturers, software companies, telecom providers, and input suppliers, as ecosystems rather than individual products become the focus of competition.

Finally, sustainability considerations are deeply intertwined with technology choices. Precision application enabled by robots can reduce fertilizer and pesticide use, while autonomous equipment powered by low-emission drivetrains can cut fuel consumption and greenhouse gas emissions. As regulators and supply-chain partners sharpen their focus on climate and biodiversity impacts, agriculture robots are increasingly evaluated not only on productivity gains but also on their contribution to environmental performance and compliance with emerging standards.

Evolving United States tariff policies through 2025 reshape agricultural robotics supply chains, cost structures, and technology sourcing strategies worldwide

Over the last several years, United States tariff policy toward China and other trading partners has become a structural factor shaping the cost and availability of components central to agricultural robots. Successive rounds of Section 301 tariffs have increased duties on a wide range of Chinese-origin electronics, machinery, and industrial inputs, including motors, sensors, semiconductors, and battery materials that feature heavily in robotic platforms. More recently, a reciprocal tariff framework introduced an additional 10% duty across essentially all Chinese imports, layering on top of existing measures and raising landed costs for manufacturers that rely on Chinese supply chains.

China has responded with its own additional duties and targeted measures, at times singling out agricultural machinery, tractors, and large vehicles, as well as a broad range of U.S. farm commodities. These steps temporarily increased price pressure on U.S.-made farm equipment and complicated export prospects for advanced machinery, including high-end robotic systems. China also tightened export controls on critical minerals and technology used in advanced electronics, raising concerns over long-term access to rare earth elements and other inputs vital for motors, drives, and sensing systems inside agriculture robots.

In 2025, tariff dynamics became even more volatile as the U.S. administration announced its intention to impose an additional 100% tariff on essentially all Chinese imports, sending shockwaves through global markets and prompting manufacturers to reassess sourcing and inventory strategies. Although a subsequent trade deal framework and agreement reached in November 2025 led to partial de-escalation-removing some planned increases, maintaining but not expanding the 10% reciprocal tariff, and prompting China to roll back certain retaliatory measures-the episode reinforced the perception that tariff risk is now a persistent feature rather than an anomaly.

For the agriculture robots ecosystem, the cumulative impact through 2025 is multifaceted. Hardware manufacturers in the United States have faced higher input prices for key components and greater uncertainty around lead times, particularly for specialized actuators, wiring harnesses, hydraulic systems, and complex electronics that are still predominantly sourced from East Asia. Some have accelerated efforts to localize or nearshore parts of their supply chain, diversify into alternative sourcing countries such as Vietnam or India, or redesign hardware to reduce reliance on tariff-exposed components. At the same time, tariff schedules and exclusion processes have become strategic considerations in product design and procurement, with legal and trade compliance teams playing a more prominent role in technology road-mapping.

On the demand side, farmers and downstream users have felt the indirect effects through higher equipment prices and more cautious financing conditions. However, tariff-induced cost pressure has also sharpened the value proposition of robotics: when labor is scarce and input costs are rising, systems that improve precision and reduce waste become more attractive. As of late 2025, the combination of partial tariff relief, continued baseline duties, and lingering export-control uncertainties underscores that supply-chain resilience and trade-awareness must remain central pillars of strategy for all participants in the agriculture robots market.

Granular segmentation across products, farm types, sizes, end users, and channels reveals divergent adoption paths for agriculture robot solutions

Viewed through the lens of product type, the agriculture robots space encompasses a continuum from in-field automation to barn systems and post-harvest handling. Field robots include autonomous tractors, robotic sprayers, robotic seeders and planters, robotic weeders and hoers, and harvesting robots, each tuned to specific agronomic tasks and crop systems. Autonomous tractors often serve as the foundational platform, integrating with a range of robotic implements, while smaller specialized units focus on targeted spraying, mechanical weed control, or delicate crop harvesting in fruits and vegetables. Drones complement these machines with aerial imaging and, in some cases, spraying capabilities, offering rapid coverage and data acquisition across large areas.

In the livestock domain, milking robots have become one of the most mature categories, with parallel milking systems and rotary milking systems supporting different herd sizes and barn layouts. These platforms automate milking while capturing detailed data on individual animals, enabling more precise health and production management. In downstream operations, packaging robots such as automated palletizers and robotic arms are gaining traction in packinghouses and processing facilities, addressing labor bottlenecks and enhancing worker safety. Sorting robots, deployed as conveyor-based sorters or vision-based sorters, increasingly rely on advanced imaging and AI algorithms to grade produce by size, color, and quality, supporting consistent standards for retail and export markets.

The diversity of farm types further shapes adoption patterns. Arable farms are using autonomous tractors, robotic sprayers, and seeding systems to enable large-scale precision agronomy, while horticulture operations lean toward specialized harvesting robots, vision-based sorters, and drones for crop monitoring in orchards, vineyards, and greenhouse environments. Livestock farms remain key adopters of milking robots and are beginning to experiment with mobile robots for feeding and barn cleaning. Aquaculture operators are exploring submerged and floating robots for monitoring water quality, feeding optimization, and net inspection, leveraging technologies initially developed for other marine applications.

Farm size is a critical determinant of purchasing behavior and preferred business models. Large-scale farms often have the capital and technical capacity to integrate complex fleets of autonomous tractors, drones, and handling systems, sometimes working directly with manufacturers on early pilot programs. Medium-scale farms seek scalable solutions that deliver clear labor savings and input efficiencies without overburdening management teams, making modular systems and robotics-as-a-service offerings particularly attractive. Small-scale farms require cost-effective, flexible equipment that can be shared within cooperatives or accessed through service providers, creating opportunities for compact robots and drone-based services that minimize upfront investment.

End-user categories also influence requirements. Commercial farmers prioritize reliability, interoperability with existing machinery and software, and rapid payback periods, while government agencies focus on technology that supports food security, environmental monitoring, and rural development initiatives. Research institutions play a pivotal role in testing novel robotic platforms, refining algorithms for field conditions, and validating new use cases under controlled trials before they are scaled commercially.

Sales channels complete the segmentation picture. Direct sales remain important for high-value, complex robotic systems where configuration, training, and integration support are mission-critical. Distributors provide local presence and service capabilities that are especially important in emerging markets or regions with dispersed farm populations. Aftermarket channels, including retrofit kits, software upgrades, and add-on sensors, are becoming more sophisticated, allowing existing equipment fleets to gain robotic capabilities and extending the useful life of capital assets. Together, these segmentation dimensions highlight a market where no single product, farm type, or channel dominates; instead, agriculture robots follow distinct adoption pathways tied closely to operational realities on the ground.

This comprehensive research report categorizes the Agriculture Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Farm Type

- Farm Size

- End User

- Sales Channel

Regional dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific define distinct innovation clusters and commercialization trajectories

Regional dynamics play a decisive role in how agriculture robots are developed, deployed, and scaled. Across the Americas, a combination of large-scale commercial farming, acute labor shortages, and advanced financial and technology ecosystems is driving substantial interest in autonomous tractors, robotic implements, drones, and milking systems. North American row-crop operations are pushing the frontier in large autonomous field platforms, while produce growers in regions such as California, Florida, and parts of Latin America are early adopters of robotic harvesters and vision-guided weeding systems to offset seasonal labor volatility. In South America, particularly Brazil and Argentina, expanding grain and oilseed production is encouraging investments in precision agriculture, with drones and sprayer automation often providing an entry point to broader robotic integration.

In Europe, Middle East & Africa, the story is more fragmented but equally dynamic. European Union member states combine strong environmental regulation, supportive digital strategies, and targeted subsidies to promote precision agriculture, making robots central to efforts to reduce pesticide use, improve soil health, and enhance animal welfare. Smaller average farm sizes in many European countries create demand for compact, highly maneuverable field robots and collaborative approaches such as machinery rings and contractor-based services. In parts of the Middle East, controlled-environment agriculture and high-value horticulture enterprises are piloting robotic systems for greenhouse management and post-harvest handling, often in partnership with international technology providers. Across Africa, adoption is at an earlier stage, but interest in low-cost, robust mechanization and remote sensing is rising, and robotics pilots are beginning to explore how autonomy might leapfrog traditional mechanization constraints in select value chains.

Asia-Pacific represents both a manufacturing powerhouse for robotic components and a rapidly evolving end market. Countries such as Japan and South Korea, facing severe rural labor shortages and aging farmer populations, have long experimented with autonomous machinery and continue to invest in advanced field robots and milking systems. China plays a dual role as a leading producer of drones, sensors, and electronic components, and as a vast agricultural market where government initiatives are promoting digital agriculture and smart equipment. At the same time, tariff and trade tensions between the United States and China influence both the cost base for robots manufactured in the Americas and Europe and the competitiveness of exports into Asian markets. In Southeast Asia, smallholder-dominated landscapes are encouraging service-based models, particularly drone services for crop monitoring and spraying, while Australia and New Zealand are notable for early adoption of autonomous tractors, robotic weed control, and dairy automation.

Taken together, the Americas, Europe, Middle East & Africa, and Asia-Pacific form distinct but interconnected innovation clusters. Cross-regional partnerships, joint ventures, and technology transfers are common, as manufacturers seek to balance access to advanced R&D ecosystems with proximity to high-growth agricultural markets. Regulatory diversity-ranging from drone airspace rules to animal welfare standards and environmental regulations-further differentiates regional trajectories and underscores the need for tailored go-to-market strategies in the agriculture robots arena.

This comprehensive research report examines key regions that drive the evolution of the Agriculture Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Established equipment manufacturers and agile robotics specialists compete and collaborate to shape the next generation of intelligent farm automation

The competitive landscape for agriculture robots is characterized by a blend of established machinery manufacturers, specialized robotics firms, drone and sensor companies, and software platform providers. Major agricultural equipment brands have leveraged their deep understanding of farm operations and dealer networks to introduce autonomous tractors, robotic sprayers, and integrated control systems. Their strategies often center on upgrading existing product lines with autonomy and precision features, offering farmers a path to stepwise automation rather than forcing wholesale fleet replacement. Recent announcements of self-driving tractors equipped with advanced camera systems, on-board AI processors, and remote management capabilities illustrate how these incumbents are positioning autonomy as a mainstream solution to labor shortages and efficiency challenges.

In parallel, agile robotics specialists are targeting specific niches that large generalist manufacturers may not address as quickly. Companies focused on robotic weeding, selective harvesting, vineyard and orchard operations, or greenhouse automation often emphasize lightweight platforms, modular implements, and sophisticated machine vision tailored to specific crops. Many of these players adopt robotics-as-a-service models, bundling hardware, software, and field support into subscription or pay-per-acre offerings that lower barriers to adoption. Their success frequently hinges on close collaboration with growers and research institutions to refine algorithms and mechanical designs for the complexity of real-world field conditions.

Drone and sensing companies represent another critical layer of the competitive ecosystem. Providers of agricultural drones have expanded beyond basic imaging into multispectral, thermal, and hyperspectral sensing, while some have added spraying capabilities. Cloud-based analytics platforms, often powered by AI, convert data collected by drones and field robots into actionable insights on crop health, nutrient status, and pest pressure. Partnerships between these firms and machinery manufacturers are increasingly common, as integrated workflows-from aerial scouting to robotic intervention-become a key differentiator.

Software and connectivity providers are also moving to the forefront. Interoperable farm management systems, telematics platforms, and edge-computing solutions enable coordination of multi-brand fleets of robots and conventional equipment. Cybersecurity and data governance are gaining attention as farm operations become more digitized and robots transmit detailed field and livestock data over public and private networks. This creates opportunities for firms with expertise in industrial IoT, cloud infrastructure, and secure communications to carve out strategic roles in the agriculture robots value chain.

Overall, collaboration is as important as competition. Joint ventures between incumbents and startups, licensing agreements that bring advanced perception algorithms into established equipment platforms, and consortiums focused on shared standards are becoming more common. Companies that combine robust hardware, sophisticated software, strong service capabilities, and an open approach to integration are best positioned to shape the next phase of the agriculture robots landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agriculture Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- AgEagle Aerial Systems Inc.

- Agrobot

- AMBIT Robotics

- BouMatic Robotics Corporation

- CLAAS KGaA mbH

- Clearpath Robotics by Rockwell Automation

- CNH Industrial N.V.

- Deere & Company

- DeLaval Holding AB

- Ecorobotix SA

- FarmWise Labs, Inc.

- FFRobotics

- GEA Group Aktiengesellschaft

- KUBOTA Corporation

- Lely International N.V.

- Monarch Tracto

- Naïo Technologies

- Niqo Robotic

- Robert Bosch GmbH

- SZ DJI Technology Co., Ltd.

- Trimble Inc.

- Verdant Robotics

- XMACHINES

- Yanmar Holdings Co., Ltd.

Strategic actions for industry leaders to navigate disruption, accelerate deployment of agriculture robots, and capture long-term competitive advantage

Industry leaders operating in the agriculture robots space must navigate a complex interplay of technology evolution, shifting farm economics, and geopolitical risk. One of the most actionable priorities is to deepen engagement with end users across different farm types and sizes, using pilot programs, co-development initiatives, and structured feedback loops to ensure that robots address the most pressing pain points in each segment. Listening closely to arable, horticulture, livestock, and aquaculture operators can reveal subtle but critical differences in workflow, infrastructure, and labor patterns that should inform product design and service models.

Strengthening supply-chain resilience is equally urgent. Companies should map their dependence on tariff-exposed components, rare earth elements, and specific geographies, and then pursue diversification through dual sourcing, regionalization, and strategic inventory. Design-for-resilience principles-such as modular architectures that accommodate alternative components, or control systems that can be produced by multiple suppliers-can reduce vulnerability to sudden policy shifts. Where appropriate, industry leaders should make active use of available tariff exclusion processes and monitor ongoing trade negotiations, embedding trade compliance into strategic planning rather than treating it as a purely operational concern.

On the technology front, sustained investment in AI, perception, and human-robot interaction will be essential to extend the range of tasks robots can perform reliably in unstructured agricultural environments. Open interfaces and data standards can help ensure that field robots, drones, milking systems, and post-harvest equipment interoperate within a coherent digital ecosystem, rather than trapping customers in isolated silos. Companies that complement their hardware offerings with robust software platforms, remote monitoring, predictive maintenance, and training will be better positioned to deliver lifecycle value and build long-term customer relationships.

Finally, industry leaders should proactively engage with regulators, financial institutions, and educational organizations. Clear safety frameworks, drone rules, and data governance policies provide the stability necessary for large-scale deployments, while tailored financing instruments can make robotics accessible to medium and small-scale farms. Collaborations with vocational schools, universities, and extension services can help build a workforce capable of operating, maintaining, and optimizing agricultural robots. By aligning commercial strategies with broader societal goals around food security, environmental stewardship, and rural development, companies can not only expand their markets but also strengthen their legitimacy and influence in shaping the future of agriculture.

Robust, multi-source research methodology integrating technology, policy, and value-chain perspectives to deliver decision-ready insights on agriculture robots

The insights presented in this executive summary are grounded in a research methodology that integrates multiple data sources, disciplinary perspectives, and analytical techniques. At its core is a structured review of publicly available information on agricultural robotics, including scientific publications, patents, regulatory filings, standards documents, and industry communications. This literature base provides a foundation for understanding technology readiness levels, emerging application domains, regulatory constraints, and the evolution of business models across different parts of the agriculture robots ecosystem.

To complement these secondary sources, the research incorporates qualitative intelligence from interviews, conference proceedings, and technical presentations involving equipment manufacturers, robotics startups, drone operators, software providers, farmers, cooperatives, and policymakers. These inputs help illuminate real-world deployment experiences, barriers to adoption, and the nuanced ways in which robots integrate with existing farm practices and infrastructure. Particular attention is paid to variations across regions and farm structures, ensuring that insights reflect the diversity of use cases rather than a single archetype.

Analytically, the study employs value-chain mapping, technology road-mapping, and scenario-based assessment. Value-chain mapping clarifies how hardware, software, connectivity, and services interact from component suppliers through to end users, highlighting bottlenecks and leverage points. Technology road-mapping examines the pace of progress in enabling technologies such as machine vision, AI, sensing, and power systems, and how these advances translate into new capabilities for field robots, drones, milking systems, packaging robots, and sorting robots. Scenario-based assessment is used to explore the implications of different policy and trade environments, including shifts in tariff regimes and regulatory frameworks, on investment decisions and deployment trajectories.

Throughout, the methodology emphasizes triangulation of information from multiple independent sources to increase robustness and reduce bias. Rather than relying on any single dataset or viewpoint, the research cross-checks qualitative insights against technical evidence and observed market behavior. This multi-source approach supports decision-ready conclusions for stakeholders who must make strategic choices amid uncertainty about technology evolution, farmer adoption, and geopolitical developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agriculture Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agriculture Robots Market, by Product Type

- Agriculture Robots Market, by Farm Type

- Agriculture Robots Market, by Farm Size

- Agriculture Robots Market, by End User

- Agriculture Robots Market, by Sales Channel

- Agriculture Robots Market, by Region

- Agriculture Robots Market, by Group

- Agriculture Robots Market, by Country

- United States Agriculture Robots Market

- China Agriculture Robots Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Convergence of robotics, AI, and advanced sensing positions autonomous agriculture as a cornerstone of future food security and rural resilience

Agriculture robots have moved firmly into the mainstream of strategic conversations about the future of food and fiber production. No longer viewed as experimental curiosities, they are increasingly seen as practical tools to address chronic labor shortages, rising input costs, and growing demands for environmental accountability. From autonomous tractors and specialized field robots to milking systems, drones, and post-harvest automation, these technologies are demonstrating tangible benefits in productivity, precision, and worker safety across a range of farm types and sizes.

At the same time, the journey toward widespread adoption remains uneven and complex. The diversity of cropping systems, farm structures, regulatory environments, and climatic conditions means that there is no universal blueprint for success. Instead, progress is emerging through a mosaic of local innovations, cross-industry collaborations, and iterative experimentation. Trade tensions and tariff volatility have added another layer of complexity, prompting manufacturers and farm operators to think more strategically about supply chains, sourcing, and long-term partnerships.

Looking ahead, the convergence of robotics, AI, sensing, and connectivity is poised to redefine what is possible in agriculture. Robots that can understand and act on fine-grained spatial and temporal variability in crops and livestock open the door to new paradigms of management that are both more productive and more sustainable. As stakeholders align technology development with the realities of farm operations and the broader imperatives of food security and environmental stewardship, agriculture robots are likely to become a cornerstone of resilient, future-ready agricultural systems worldwide.

Engage with Associate Director Ketan Rohom to unlock tailored insights and acquire the comprehensive agriculture robots market intelligence report

In a period of rapid transformation for global food systems, access to rigorous, technology-focused intelligence on agriculture robots becomes a strategic differentiator rather than a nice-to-have. Decision-makers who understand how autonomy, AI, regulation, and trade policy intersect will be best positioned to de-risk investments, negotiate with partners, and design solutions that resonate with the realities of today’s farms.

To translate the themes and insights highlighted in this executive summary into concrete strategic advantage, it is essential to engage directly with the team behind this research. Associate Director of Sales & Marketing, Ketan Rohom, is available to help you unpack the full findings, tailor them to your organization’s priorities, and identify where in the agriculture robot value chain your greatest opportunities and vulnerabilities lie.

By connecting with Ketan Rohom, you can explore options to purchase the complete agriculture robots market report, arrange custom briefings for executive teams, or commission deeper dives on specific product categories, regions, or regulatory issues. This direct engagement ensures that you do not simply acquire a document but gain an ongoing advisory resource that can support strategic planning, M&A screening, product road-mapping, and policy engagement.

Organizations that move now to secure comprehensive intelligence on agriculture robots will be better prepared to navigate tariff volatility, evolving farm economics, and fast-moving competitive dynamics. Taking the next step with Ketan Rohom enables you to act with greater confidence, align stakeholders around a shared evidence base, and accelerate your journey toward a more autonomous, resilient, and profitable agricultural future.

- How big is the Agriculture Robots Market?

- What is the Agriculture Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?