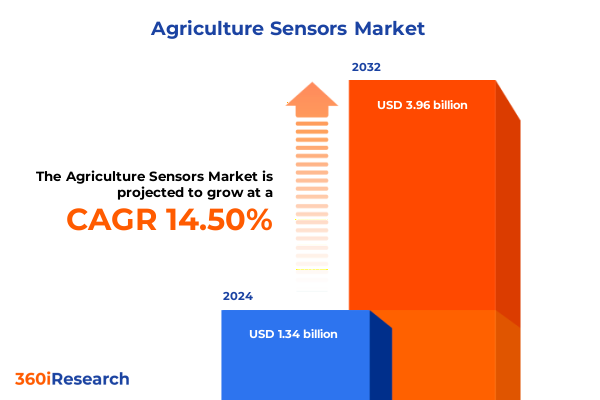

The Agriculture Sensors Market size was estimated at USD 1.52 billion in 2025 and expected to reach USD 1.73 billion in 2026, at a CAGR of 14.66% to reach USD 3.96 billion by 2032.

Emerging sensor technologies and integrated solutions are revolutionizing modern agriculture with data-driven optimization for sustainable yields

The evolution of sensor technologies is ushering in a new era of precision agriculture, where real-time data from the field informs every decision. Farms that once relied on traditional methods are now embracing intelligent sensors that monitor soil moisture, climate conditions, and crop health with unprecedented accuracy. By integrating devices such as controllers, gateways, and advanced sensor modules, growers can tailor irrigation schedules, optimize nutrient delivery, and mitigate risks associated with environmental variability.

With the convergence of analytics platforms and device management software, data collected at the edge is seamlessly transformed into actionable insights. Farmers and agribusinesses are leveraging these insights to predict disease outbreaks, reduce chemical inputs, and enhance overall yield quality. Meanwhile, consulting and installation and maintenance services are ensuring that these complex systems operate reliably, fostering a shift from one-size-fits-all approaches to bespoke, data-driven strategies.

As the agriculture sector seeks to balance sustainability with productivity, the introduction of sophisticated sensor networks is proving to be a transformative catalyst. The integration of sensors-whether for pH measurement, nutrient monitoring, or drone-mounted imaging-has accelerated the transition towards a smarter, more resilient food production system that meets the demands of a growing global population.

Digital transformation and precision automation are reshaping agronomic practices through sensor networks, AI analytics, and scalable connectivity architectures

Over the past several years, the rise of wireless IoT connectivity has unlocked vast potential for remote farm monitoring and automation. Technologies such as LoRaWAN, NB-IoT, and ZigBee are enabling reliable, low-power transmission of soil moisture levels, temperature and humidity readings, and imaging data from satellite and tower-mounted platforms. This connectivity revolution is complemented by wired options, including Ethernet and RS-485, which provide the redundancy and bandwidth necessary for mission-critical operations in large-scale agribusiness applications.

Simultaneously, the proliferation of advanced analytics platforms has empowered farmers to harness machine learning and predictive modeling for crop monitoring and precision farming. Variable rate application and yield mapping tools take inputs from imaging sensors and EC sensors to ensure that resources are applied exactly where they are needed, reducing waste and maximizing efficiency. Climate control and lighting management in greenhouse automation systems further exemplify how digital innovations are reshaping traditional cultivation practices into fully monitored, dynamically optimized environments.

These transformative shifts are underpinned by a broader trend towards integrated service models. Consulting firms and specialized system integrators are guiding stakeholders through the complexities of deployment mode decisions-whether cloud-based, private or public, or on-premise with edge computing capabilities. By offering tailored installation, maintenance, and strategic support, these service providers ensure that the latest sensor and connectivity technologies deliver measurable impact in the field.

Evolving tariff policies in 2025 are driving supply chain realignments and cost pressures across the United States agriculture sensor ecosystem

In 2025, the United States continued to adjust tariffs on key agricultural imports, resulting in cumulative cost pressures for sensor components sourced from tariff-targeted countries. These measures, including a 10% levy on certain Chinese electronic parts and reciprocal duties on goods from Canada and Mexico, have incrementally increased the price of controllers, gateways, and sensor modules. As a result, manufacturers are recalibrating their supply chains, seeking alternative production hubs, and exploring local fabrication to offset rising import costs.

Farmers and agribusinesses have felt the impact of these policy shifts through elevated hardware expenses and supply chain delays. The increased cost of EC sensors, pH probes, and drone-mounted imaging units has led some operations to extend equipment replacement cycles and prioritize the deployment of fewer but more strategically positioned devices. At the same time, service and software providers are absorbing portions of the cost through adjusted maintenance contracts and tiered analytics subscriptions to preserve adoption momentum.

Looking ahead, the tariff-induced market realignments are fostering new partnerships between U.S.-based component manufacturers and technology integrators. While short-term challenges persist, these developments are encouraging a more resilient domestic ecosystem for precision agriculture technologies. The emphasis on nearshoring and diversification of sourcing routes is likely to yield long-term benefits, strengthening the industry’s capacity to innovate and respond to dynamic global trade environments.

Comprehensive segmentation analysis reveals distinctions across offerings, sensor types, connectivity options, applications, end users, and deployment modes

A deep dive into segmentation reveals the multifaceted nature of the agriculture sensor market. Within the hardware offering, components range from controllers and gateways to highly specialized sensor modules, each playing a pivotal role in data acquisition and network reliability. The service segment spans both consulting services, guiding strategic technology adoption, and installation and maintenance, which ensures seamless operation and minimal downtime. On the software side, platforms for analytics translate raw data into forecasts and recommendations, while device management solutions maintain device health and security.

Sensor type segmentation illustrates the diversity of monitoring tools available to producers. Imaging sensors, deployed on drones, satellites, or tower-mounted platforms, capture high-resolution crop visuals that complement nutrient sensors such as EC and NPK variants for targeted soil analysis. Optical devices measure light quality and intensity, while pH sensors provide crucial insights into soil acidity levels. Soil moisture sensors monitor water availability, and temperature and humidity sensors-whether specialized to measure heat or moisture-support climate-responsive agricultural management.

Connectivity options further highlight the range of deployment scenarios. Wired connections using Ethernet and RS-485 underpin high-bandwidth requirements in large installations, whereas wireless IoT technologies like Bluetooth, LoRaWAN, NB-IoT, and ZigBee offer flexible, scalable solutions for expansive or remote sites. Applications such as crop monitoring-whether through remote systems or visual inspection-greenhouse automation, irrigation management, livestock monitoring, and precision farming all leverage these connectivity modes to deliver tailored agricultural insights. Notably, variable rate application and yield mapping within precision farming, along with behavior tracking and health monitoring in livestock, illustrate advanced use cases driven by sensor networks.

Finally, segmentation by end user and deployment mode underscores the market’s breadth. From agribusiness corporations and individual farmers to government agencies and research institutes, diverse stakeholders adopt cloud-based models-whether private or public-or choose on-premise solutions augmented by edge computing to address latency and data sovereignty concerns. This nuanced segmentation framework provides a roadmap for stakeholders to identify and prioritize the most relevant technologies and services for their specific operational needs.

This comprehensive research report categorizes the Agriculture Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Sensor Type

- Connectivity Type

- Application

- End User

- Deployment Mode

Regional dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific are shaping differentiated trajectories for agricultural sensor adoption

Regional dynamics are creating distinct growth pathways across global markets for agricultural sensors. In the Americas, the widespread adoption of cloud-based analytics and digital agriculture policies is accelerating the integration of sensor networks into large-scale row crop and specialty crop operations. Public and private cloud platforms are synergizing with edge computing deployments to enable near-real-time decision support, particularly in the United States and Brazil.

In the Europe, Middle East & Africa region, regulatory emphasis on sustainable farming practices and environmental traceability is fostering investment in nutrient and pH sensors. The pairing of these devices with device management platforms helps ensure compliance with stringent agricultural and environmental standards. Furthermore, greenhouse automation solutions are seeing rapid uptake in countries with established protected cultivation industries, such as the Netherlands and Israel.

The Asia-Pacific market, driven by diverse agroecological zones and governmental modernization initiatives, is embracing a broad spectrum of sensor types and connectivity modes. Drone-mounted imaging is expanding in Australia and India, while LoRaWAN and NB-IoT networks support smallholder farmers in Southeast Asia. Cloud and on-premise deployments coexist to address differing infrastructure capabilities, with edge computing playing a critical role in remote areas where network latency could hinder timely data processing.

This comprehensive research report examines key regions that drive the evolution of the Agriculture Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiles of leading innovators and established players highlight strategic approaches, collaborative ventures, and competitive differentiators within the sensor space

Leading sensor manufacturers are investing heavily in modular hardware designs and strategic partnerships to expand their technology ecosystems. These companies are collaborating with telecom operators to enhance wireless IoT coverage and with cloud providers to optimize data storage and analytics performance. Meanwhile, software innovators are differentiating through advanced machine learning algorithms for crop health prediction and integration with farm management systems to streamline workflows.

Strategic alliances are emerging between established industrial automation firms and agtech startups that specialize in niche sensor applications such as drone imaging, EC nutrient analysis, or precision irrigation controls. By combining legacy expertise in hardware reliability with agile software development practices, these collaborations are accelerating product innovation and driving down total cost of ownership for end users.

Smaller specialized firms, particularly those focused on edge computing solutions, are carving out opportunities by delivering low-latency data processing capabilities essential for time-sensitive agricultural operations like greenhouse climate control. These niche players are also forging relationships with research institutes to validate new sensing modalities and secure early adoption among forward-looking agribusinesses.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agriculture Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acclima Inc.

- Ag Leader Technology, Inc.

- CropX Inc.

- Davis Instruments Corporation

- Deere & Company

- Libelium Comunicaciones Distribuidas S.L.

- Lindsay Corporation

- METER Group, Inc.

- Monnit Corporation

- Pessl Instruments GmbH

- Pycno Agriculture

- Robert Bosch GmbH

- Sentek Technologies Pty Ltd

- Sentera, LLC

- Texas Instruments Incorporated

- Topcon Corporation

- Trimble Inc.

- Yara International ASA

Actionable strategies for industry leaders to capitalize on sensor technology innovations, foster resilience, and drive sustainable growth in agriculture

Industry leaders should prioritize end-to-end integration of sensor networks, analytics, and device management to create unified technology stacks that simplify adoption. By offering bundled hardware, software, and maintenance services, providers can enhance customer loyalty and generate predictable recurring revenues. In addition, investing in modular, upgradeable hardware designs will enable rapid deployment of emerging sensor types without forklift upgrades.

To bolster resilience against trade uncertainties and tariff fluctuations, companies should diversify their component supply chains and expand local manufacturing partnerships. Nearshoring production hubs for key modules and fostering strategic alliances with regional suppliers can reduce lead times and buffer against import duties. Moreover, leveraging regional deployment insights-tailoring solutions to the specific needs of the Americas, EMEA, or Asia-Pacific-will facilitate market penetration and inform product roadmaps.

Finally, embracing open data standards and interoperability protocols will catalyze ecosystem growth. By facilitating seamless integration with third-party platforms and farm management systems, sensor providers can unlock new revenue-sharing models and foster a collaborative marketplace. Investing in robust cybersecurity measures and transparent data governance will further distinguish market leaders by assuring customers of secure and compliant operations.

Brief methodology outlining data sources, research frameworks, validation processes, and analytical techniques underpinning the agriculture sensor market insights

This research integrates qualitative and quantitative approaches to ensure rigorous, evidence-based insights. Primary data is gathered through structured interviews with farmers, agribusiness executives, service providers, and technology vendors, complemented by field surveys that capture adoption patterns across different crop cycles and infrastructure contexts.

Secondary sources, including patent filings, academic publications, industry reports, and government policy documents, are systematically reviewed to track technological advancements and regulatory shifts. Data triangulation and cross-validation techniques are applied to reconcile disparate inputs and verify the reliability of market signals.

Analytical frameworks such as SWOT, PESTLE, and Porter’s Five Forces are employed to evaluate strategic positioning and competitive intensity. Geospatial analysis tools are used to map regional adoption hotspots and identify infrastructure constraints. Finally, the report’s conclusions are stress-tested through scenario analysis to assess potential impacts of tariff changes, connectivity infrastructure developments, and emerging sensor innovations on industry trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agriculture Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agriculture Sensors Market, by Offering

- Agriculture Sensors Market, by Sensor Type

- Agriculture Sensors Market, by Connectivity Type

- Agriculture Sensors Market, by Application

- Agriculture Sensors Market, by End User

- Agriculture Sensors Market, by Deployment Mode

- Agriculture Sensors Market, by Region

- Agriculture Sensors Market, by Group

- Agriculture Sensors Market, by Country

- United States Agriculture Sensors Market

- China Agriculture Sensors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Synthesizing key insights and forward-looking observations to inform decision-making and foster long-term innovation in the agriculture sensor sector

The findings underscore the critical role of integrated sensor ecosystems in driving the next wave of agricultural innovation. Advances in offering segmentation-from hardware to software-combined with a diverse array of sensor types enable tailored solutions for every farming challenge, from crop monitoring and greenhouse automation to livestock tracking and precision farming.

Regulatory environments, tariff landscapes, and regional infrastructure conditions will continue to shape market dynamics, necessitating flexible deployment strategies that balance cloud scalability with edge performance. Collaboration among technology providers, service integrators, and end users remains essential to unlock the full potential of sensor-driven agriculture.

As the sector evolves, companies that anticipate shifts in connectivity standards, diversify their supply chains, and invest in open, interoperable platforms will secure a competitive edge. Ultimately, the successful fusion of sensor innovation, data analytics, and sustainable practices will chart a path toward greater productivity and resilience in global food systems.

Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your in-depth agriculture sensor research report and unlock growth opportunities

Our comprehensive agriculture sensor research report is crafted to empower decision-makers with deep insights into the evolving technology, competitive landscape, and strategic opportunities shaping modern farming. Whether you are seeking to optimize supply chains, integrate next-generation analytics platforms, or expand your reach in key global regions, this report provides the clarity and guidance needed to accelerate growth and outperform the competition.

To gain immediate access to this in-depth resource and explore the data-driven strategies that can transform your business, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will ensure a seamless process from inquiry to report delivery, enabling you to leverage fresh market intelligence without delay.

Secure your copy today and position your organization at the forefront of agricultural innovation, capitalizing on sensor-driven efficiencies and sustainable practices that will define the next decade of agritech advancement.

- How big is the Agriculture Sensors Market?

- What is the Agriculture Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?