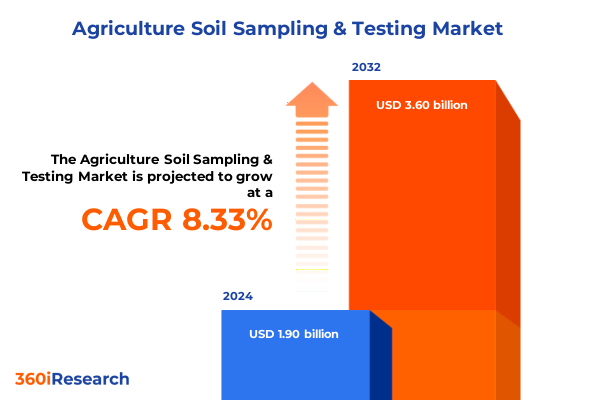

The Agriculture Soil Sampling & Testing Market size was estimated at USD 2.05 billion in 2025 and expected to reach USD 2.23 billion in 2026, at a CAGR of 8.35% to reach USD 3.60 billion by 2032.

Unveiling the Crucial Role of Advanced Soil Sampling and Testing in Securing Sustainable Agricultural Productivity and Environmental Stewardship

Soil sampling and testing stand at the heart of modern agricultural resilience, offering a scientific foundation for informed decision-making that underpins both crop productivity and environmental stewardship. As global pressures intensify-from shifting climate patterns to stricter environmental regulations-rigorous analysis of soil conditions has become indispensable for maintaining crop health and optimizing the use of precious resources. Effective sampling captures a comprehensive snapshot of soil variability across fields, while advanced laboratory testing deciphers the chemical, physical, and biological characteristics essential for customizing nutrient management and enhancing yield stability.

In recent years, the convergence of digital agriculture and laboratory innovation has transformed conventional approaches to soil testing. The proliferation of remote sensing platforms, in-ground sensors, and drone-enabled data collection has enabled near real-time monitoring of soil moisture, nutrient levels, and other critical parameters. At the same time, laboratory techniques-ranging from spectroscopy and physical fractionation to microbial assays-have grown in precision and accessibility, empowering agronomists and growers to detect subtle shifts in soil health before they manifest as yield losses. Moreover, data analytics and artificial intelligence increasingly allow stakeholders to integrate multi-source information into actionable recommendations, fortifying the link between field sampling protocols and laboratory insights.

Against this backdrop, a robust soil sampling and testing framework emerges as both a diagnostic tool and a strategic asset. By systematically pairing field collection methodologies with standardized analytical protocols, industry participants can mitigate agronomic risks and align operational practices with sustainability objectives. Ultimately, the harmonization of field-to-lab processes delivers a comprehensive understanding of soil behavior, equipping agribusinesses, researchers, and policymakers with the clarity needed to address complex challenges around resource efficiency, environmental protection, and food security.

Navigating the Convergence of Precision Agriculture Technologies and Regulatory Imperatives Driving a Paradigm Shift in Soil Sampling and Testing Practices

The soil sampling and testing landscape is undergoing a profound transformation driven by the integration of cutting-edge technologies, evolving regulatory requirements, and intensifying sustainability mandates. Precision agriculture has leapt from the realm of yield optimization into the domain of soil diagnostics, with sophisticated platforms combining GPS-enabled sampling methods, in-field spectrometers, and machine-learning algorithms to map soil variability at an unprecedented scale. As a result, traditional grid- and random-sampling approaches are now complemented by directed sampling protocols informed by real-time sensor data, ensuring that every collected sample delivers the maximum informational value.

At the same time, policymakers across major markets have introduced harmonized soil monitoring frameworks to safeguard long-term soil health and meet climate objectives. In the European Union, negotiators reached a provisional agreement on a directive that mandates common soil descriptors and monitoring methodologies for member states, establishing a unified baseline for assessing chemical, physical, and biological soil parameters while offering financial support to farmers for implementation. This legal impetus has catalyzed investment in standardized sampling programs and capacity-building initiatives, fostering closer collaboration between public bodies, private laboratories, and academic researchers.

Concurrently, the accelerating shift toward digital service delivery has redefined service models across the value chain. Sampling firms are adopting mobile applications to orchestrate field crews, capture geotagged sample data, and streamline data transfer to laboratories, while testing entities are leveraging cloud-based portals to expedite result reporting and integrate soil analytics with broader farm management platforms. This convergence of field-side and lab-side innovations is dismantling data silos, enabling continuous feedback loops that drive iterative improvements in sampling designs and analytical workflows. Together, these developments illustrate a new era in which soil sampling and testing evolve from periodic assessments into dynamic, data-driven systems that underpin resilient and sustainable agricultural operations.

Examining the Far-Reaching Consequences of Recent United States Tariff Measures on Soil Sampling and Testing Supply Chains in 2025

In early 2025, the United States implemented sweeping tariff measures that have reshaped the procurement landscape for soil testing equipment, reagents, and analytical services. On April 5, a universal 10% tariff was applied to most imported laboratory goods, followed by country-specific increases on April 9 that imposed a cumulative 145% duty on Chinese-origin items. While imports from Canada and Mexico remain exempt from the blanket levy, they face a 25% tariff on non-USMCA goods and a 10% tariff on energy and potash imports. These policies have introduced significant cost pressures on laboratories and field service providers reliant on imported instruments and consumables.

Laboratories have begun scrambling to recalibrate their sourcing strategies in response to these elevated duties. Many are prioritizing local or US-based distributors for critical supplies, while others are accelerating efforts to validate alternative reagent suppliers to ensure compliance with regulatory standards. The higher tariffs on scientific components have already contributed to rising operational costs, with affected organizations deferring equipment upgrades and scaling back capital investments in new automation platforms. As supply chains tighten, turnaround times for specialized tests have extended, prompting some service providers to revise their lab capacity plans and staffing models to offset potential bottlenecks.

Farmers and agtech companies have also felt the ripple effects of these tariff policies. Precision agriculture manufacturers dependent on imported sensors, IoT modules, and semiconductors are confronting elevated production costs, which may slow adoption rates of advanced soil monitoring tools in the short term. Tariffs on fertilizer and agrochemical imports have further exacerbated input cost inflation, with potash prices rising for US growers who traditionally rely on Canadian sources. Retaliatory levies by trading partners have introduced additional barriers to US agricultural exports, complicating market access for domestic grain and oilseed producers. In sum, the cumulative impact of these measures underscores the imperative for industry stakeholders to diversify supply networks, bolster domestic manufacturing capabilities, and enhance operational agility in an era of heightened trade volatility.

Illuminating Critical Market Segmentation Perspectives to Optimize Service Delivery End User Engagement and Technological Adoption Across Diverse Crop Types

A nuanced understanding of service modalities reveals how the industry navigates diverse sampling and testing demands. Sampling services have evolved to deliver both comprehensive grid-based coverage and targeted directed sampling, while testing organizations structure their offerings around chemical and physical assays as well as advanced biological and spectroscopy protocols. This duality ensures that soil health assessments can be tailored precisely to agronomic objectives and resource availability.

Across end users, the landscape is defined by a triad of demand drivers: chemical and fertilizer manufacturers seeking to validate raw materials and optimize product formulations; farmers leveraging soil health data for precision nutrient management and yield stabilization; and research institutes along with government bodies conducting longitudinal soil health monitoring programs and policy-driven initiatives. Each segment exhibits distinct service requirements, from rapid turnaround for commercial operations to stringent method validation in regulatory and academic contexts.

The selection of analytical technologies further underscores market diversity. Biological testing has gained prominence as stakeholders seek to quantify microbial biomass and biodiversity, while chemical testing remains the cornerstone for nutrient profiling and contaminant screening. Physical testing elucidates soil texture and structure, informing irrigation and tillage strategies, whereas spectroscopy solutions enable rapid, non-destructive nutrient estimations through spectral fingerprinting. The interplay of these modalities allows for a holistic depiction of soil condition.

Sampling methodologies themselves-directed, grid, and random-introduce varying scales and intensities of data collection, balancing cost, representativeness, and logistical constraints. At the crop level, soil analysis protocols are calibrated to support the unique requirements of cereals and grains, fruits and vegetables, oilseeds and pulses, and turf and ornamental crops. This segmentation ensures that soil testing services align with crop-specific nutrient uptake patterns and management cycles, enabling more precise interventions and resource conservation.

This comprehensive research report categorizes the Agriculture Soil Sampling & Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service

- Technology

- Sampling Method

- Crop Type

- End User

Uncovering Distinct Regional Dynamics Influencing the Adoption of Soil Sampling and Testing Solutions Across the Americas Europe Middle East Africa and Asia Pacific

In the Americas, robust investments in precision agriculture infrastructure have positioned the region at the forefront of service innovation, with large crop producers increasingly leveraging yield monitors, soil mapping tools, and autosteering systems. According to the USDA’s annual Farms and Ranches at a Glance report, approximately 68% of large crop operations in the United States deploy precision agriculture technologies to inform soil sampling strategies and nutrient management decisions. This technological embrace, coupled with well-established laboratory networks and supportive government programs, underscores the region’s capacity to integrate field data with advanced analytical services.

Across Europe, the Middle East, and Africa, regulatory frameworks have catalyzed a harmonized approach to soil monitoring. The EU’s provisional soil resilience directive establishes common soil descriptors and methodological guidelines, reinforcing comparability across member states and strengthening soil health monitoring under the LUCAS program. In parallel, national initiatives in the Gulf Cooperation Council and South Africa emphasize water-use efficiency and contamination control, driving demand for spectroscopy-based nutrient profiling and contaminant screening.

The Asia-Pacific region, characterized by a mosaic of smallholder and commercial agricultural systems, has emerged as the fastest adopter of digital soil monitoring solutions. Companies in India and China are deploying IoT-enabled soil health sensors and mobile platforms to reach farmers at scale, supported by government-sponsored programs such as India’s Smart Precision Horticulture initiative under the Mission for Integrated Development of Horticulture. Meanwhile, academic and private-sector collaboration has fueled the development of digital soil mapping platforms, enabling region-wide insights into soil functionality and resource optimization.

This comprehensive research report examines key regions that drive the evolution of the Agriculture Soil Sampling & Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing the Strategic Positioning and Innovative Capabilities of Leading Soil Sampling and Testing Enterprises Shaping Industry Evolution

Leading service providers in soil sampling and testing are enhancing their capabilities through strategic acquisitions, technology investments, and global partnerships. Eurofins Agro Testing’s acquisition of soil sampling specialist FarmFacts has extended its European footprint and enriched its portfolio of drone-enabled sampling solutions and software platforms for data management. This move reflects a broader trend of consolidation as laboratories pursue end-to-end service delivery models.

SGS, with its extensive laboratory network and accreditation credentials, has expanded its agricultural testing suite to encompass chemical, physical, and pathogen assays tailored to regional requirements. Its precision agriculture solutions integrate spatial mapping, satellite imaging, and agronomic advisory services, enabling clients to optimize nutrient management and mitigate environmental risks. By embedding digital platforms such as Precision Gateway, SGS ensures seamless translation of laboratory results into field-actionable recommendations.

Meanwhile, global analytical service firms such as Bureau Veritas and Intertek have introduced rapid testing kits and advanced water quality services, targeting fertilizer and pesticide verification as well as heavy metal detection in soils. These offerings cater to growers seeking quick turnaround times and regulatory compliance, underscoring the growing importance of agility and quality assurance in laboratory operations. Collectively, these firms are defining industry benchmarks in service breadth, methodological rigor, and digital integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agriculture Soil Sampling & Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&L Canada Laboratories Inc.

- Advantech Manufacturing, Inc. by W.S. Tyler

- Agilent Technologies, Inc.

- AgroCares B.V.

- Agvise Laboratories

- EIE Instruments Pvt. Ltd.

- Eurofins Scientific SE

- Geotechnical Testing Equipment UK Ltd.

- Gilson Company Inc.

- Humboldt Mfg. Co.

- LaMotte Company

- LogiAg

- Martin Lishman Ltd.

- Matest S.p.A.

- Merck KGaA

- Nanbei Instrument Limited

- PerkinElmer Inc.

- Perry Agricultural Laboratory Inc.

- Precision Laboratories LLC

- Premier Tech Chronos

- Rock River Laboratory Inc.

- Soiltech (PTY) Ltd.

- Symbio Laboratories

- Thermo Fisher Scientific Inc.

- Ward Laboratories Inc.

Empowering Industry Leaders with Strategic Roadmaps to Enhance Operational Efficiency Foster Innovation and Strengthen Competitive Advantage in Soil Analysis

Industry leaders must prioritize investments in integrated digital platforms that consolidate field-sampling data, laboratory analytics, and farm management systems. By establishing interoperable data architectures, organizations can reduce manual data handling, accelerate decision cycles, and deliver value-added insights to end users in real time. Such platforms should be designed to accommodate directed, grid, and random sampling outputs alongside multi-modal test results, ensuring flexibility across service offerings.

To mitigate supply chain disruptions, executives should cultivate strategic partnerships with domestic and alternative international suppliers of key laboratory consumables and equipment. Strengthening supplier diversification can alleviate tariff-induced cost pressures and safeguard operational continuity. At the same time, companies should evaluate opportunities to localize manufacturing and validation of critical reagents and calibration standards, aligning with regulatory and quality management requirements.

Furthermore, amplifying technical advisory services-through agronomic training, interactive dashboards, and customized reporting-will enhance client engagement and foster long-term relationships. By translating analytical outputs into actionable nutrient management plans, soil health indicators, and predictive risk models, service providers can position themselves as indispensable partners in sustainable agriculture.

Finally, embracing continuous improvement frameworks-grounded in client feedback, performance metrics, and industry benchmarking-will drive operational excellence. Regularly refining sampling protocols, laboratory workflows, and quality management systems will ensure that service delivery evolves in step with emerging research findings, regulatory mandates, and market demands.

Detailing a Comprehensive Mixed Methodology Integrating Primary Interviews Secondary Research and Data Triangulation to Ensure Robust Soil Sampling and Testing Insights

This research integrates a robust mixed-methodology approach, beginning with primary interviews across multiple stakeholder groups including agronomists, laboratory directors, and senior executives at service providers and equipment manufacturers. These discussions yielded qualitative insights into sampling methodologies, technology preferences, and operational challenges. In parallel, secondary research leveraged public sources such as regulatory publications, academic journals, and industry news portals to validate emerging trends and statutory developments.

Data triangulation techniques were employed to cross-verify findings across primary and secondary inputs. Quantitative data points-such as technology adoption rates, service coverage, and input cost indices-were corroborated with subject-matter experts to ensure consistency and reliability. Additionally, case studies from diverse geographies illuminated best practices in sample collection, analytical workflows, and digital integration.

To enhance the granularity of segmentation analysis, a data-driven framework was applied, mapping service lines to end-user requirements, technology stacks to laboratory competencies, and sampling methods to crop-type applications. This framework supported a structured assessment of market dynamics without engaging in market sizing or forecasting. All methodologies adhere to recognized research protocols, including ISO guidelines for data quality and ethical standards for primary research.

Overall, this methodology ensures that the insights presented are grounded in a comprehensive, transparent, and replicable research process, providing stakeholders with the depth and rigor necessary to navigate the evolving soil sampling and testing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agriculture Soil Sampling & Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agriculture Soil Sampling & Testing Market, by Service

- Agriculture Soil Sampling & Testing Market, by Technology

- Agriculture Soil Sampling & Testing Market, by Sampling Method

- Agriculture Soil Sampling & Testing Market, by Crop Type

- Agriculture Soil Sampling & Testing Market, by End User

- Agriculture Soil Sampling & Testing Market, by Region

- Agriculture Soil Sampling & Testing Market, by Group

- Agriculture Soil Sampling & Testing Market, by Country

- United States Agriculture Soil Sampling & Testing Market

- China Agriculture Soil Sampling & Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Insights to Highlight the Imperative Role of Advanced Soil Analysis Solutions in Addressing Agricultural Challenges and Driving Sustainable Practices

Advanced soil sampling and testing solutions have emerged as foundational tools for addressing the twin imperatives of agricultural productivity and environmental stewardship. The integration of precision agriculture technologies, regulatory harmonization, and digital service models underscores a sector in dynamic evolution, where data-driven clarity informs every stage from sample collection to laboratory analysis. As tariffs and supply chain complexities persist, adaptability and strategic sourcing remain key differentiators for service providers and equipment manufacturers alike.

Segmentation insights reveal a multifaceted market where service modalities, end-user requirements, analytical technologies, sampling methods, and crop applications coalesce to form a vibrant ecosystem. Regional dynamics-from North America’s leading infrastructure to Europe’s structured regulatory framework and Asia-Pacific’s rapid digital uptake-highlight the importance of localized strategies calibrated to market-specific drivers and challenges.

For industry participants, the path forward entails deepening partnerships across the value chain, investing in interoperable digital platforms, and enhancing technical advisory capabilities. By aligning sampling and testing protocols with the unique needs of diverse stakeholders, the sector can unlock greater operational efficiency, foster innovation, and contribute to sustainable agricultural practices.

In conclusion, a rigorous, collaborative approach to soil sampling and testing not only supports immediate agronomic objectives but also establishes a resilient foundation for long-term soil health management. Embracing these strategic imperatives will enable stakeholders to navigate complexity, capitalize on emerging opportunities, and deliver meaningful impact in the pursuit of sustainable food systems.

Connect Directly with an Associate Director to Secure Comprehensive Market Research Insights Elevate Your Strategic Decisions in Soil Sampling and Testing

Get ahead in the evolving sphere of soil sampling and testing by securing detailed, authoritative insights tailored to your strategic needs. Reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to acquire the complete market research report and unlock the data-driven guidance you need to shape impactful decisions and drive sustainable growth

- How big is the Agriculture Soil Sampling & Testing Market?

- What is the Agriculture Soil Sampling & Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?