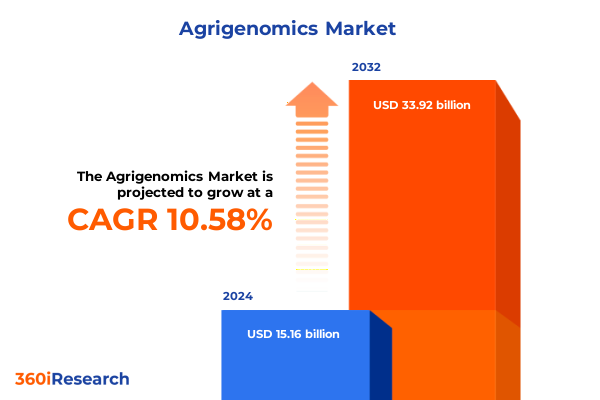

The Agrigenomics Market size was estimated at USD 3.55 billion in 2025 and expected to reach USD 3.87 billion in 2026, at a CAGR of 9.26% to reach USD 6.61 billion by 2032.

Agrigenomics Is Ushering in a New Era of Precision Agriculture and Livestock Improvement Through Cutting-Edge Genomic Tools

Agrigenomics stands at the forefront of a scientific revolution, merging genomic innovations with traditional agricultural practices to enhance crop resilience, livestock health, and overall food system sustainability. By employing tools such as high-throughput sequencing, molecular breeding, and advanced bioinformatics, researchers can pinpoint genetic traits that drive yield improvements, disease resistance, and environmental adaptability. This multidimensional approach enables breeders and producers to navigate challenges posed by climate change, evolving pest pressures, and resource constraints while meeting growing global food demands.

The United States has been a pioneer in adopting genetically engineered crops and biotechnological practices, with more than nine in ten acres of major field crops-corn, cotton, and soybeans-now cultivated using biotech varieties. This widespread acceptance underscores the critical role that genomic technologies play in modern agriculture, transforming seed development cycles and accelerating the delivery of value-added traits across diverse crop species. As agrigenomics continues to evolve, stakeholders across the value chain are poised to leverage genomic insights to optimize production, reduce chemical inputs, and bolster food security for future generations.

Innovations in Gene Editing, Multi-Omics Integration, and AI-Powered Analytics Are Redefining Agricultural Genomics Research and Applications

Within the agrigenomics landscape, technological convergence has sparked transformative shifts that redefine traditional breeding paradigms. Innovative gene editing platforms now allow for precise modifications at specific genomic loci, compressing trait development timelines from a decade to mere years. By targeting genes associated with drought tolerance, pest resistance, and nutrient efficiency, scientists can engineer crop varieties that align with both environmental goals and market demands. This precision reduces reliance on trial-and-error approaches, paving the way for more predictable and efficient breeding outcomes.

Simultaneously, multi-omics integration is reshaping data analytics in agrigenomics. The fusion of genomic, transcriptomic, and proteomic datasets through AI and machine learning algorithms accelerates the discovery of genotype-to-phenotype relationships. Advanced bioinformatics software now enables real-time visualization of molecular interactions, empowering research institutes and agritech firms to iterate on breeding strategies more rapidly. These synergies between cutting-edge analytics and high-throughput experimentation mark a leap forward in our ability to develop resilient, high-performing agricultural varieties.

Assessment of How Recent U.S. Tariffs on Agricultural Inputs and Biotech Components Reshaped Agrigenomics Supply Chains in 2025

The introduction of new U.S. tariffs in 2025 has exerted complex pressures on agrigenomics supply chains, particularly impacting imported reagents, sequencing instruments, and precision ag technologies. A notable example emerged when Syngenta reported that, despite its prior preparations and mitigation strategies derived from earlier tariff cycles, the 2025 levies have continued to alter cost structures for synthetic inputs and biological research materials. These shifts have led research laboratories and agricultural biotech firms to explore alternative sourcing strategies and domestic manufacturing partnerships to stabilize input availability.

In parallel, U.S. farmers are grappling with the dual challenges of elevated input costs and potential retaliatory measures from trade partners. The imposition of steep duties on exports such as corn and soybeans has contributed to reduced farm incomes and constrained capital expenditure on emerging precision agriculture technologies. As a result, agtech startups reliant on microarrays, PCR machines, and sequence-based diagnostics have encountered supply delays and have had to adjust pricing models to reflect increased import expenses. Despite these headwinds, the sector has demonstrated resilience by strategic rerouting of supply chains, intensifying collaboration with local equipment manufacturers, and accelerating efforts to repatriate critical component production.

Insightful Perspectives on Agrigenomics Segmentation Spanning Product Offering, Advanced Technologies, Diverse Applications, and End-User Profiles

In examining agrigenomics through the lens of product offerings, it becomes evident that consumables such as kits and reagents continue to underpin discovery and validation studies, while instruments like microarray scanners, PCR machines, and advanced sequencers facilitate high-throughput data acquisition. Complementing these hardware and consumable platforms, bioinformatics software and specialized consulting services deliver interpretive power, transforming raw molecular data into actionable breeding decisions.

Turning to technology segmentation, bioinformatics thrives on sophisticated data analysis software and robust database management systems, enabling stakeholders to manage vast genomic datasets. Next-generation sequencing platforms, paired with Sanger sequencing for targeted assays, coexist alongside precise gene-editing methods such as CRISPR and TALEN, while complementary genotyping techniques leverage both microarray-based arrays and PCR-based assays. Transcriptomics applications further refine insights through qPCR arrays and high-depth RNA sequencing pipelines.

From an application standpoint, agrigenomics solutions address a broad spectrum of needs, ranging from improving animal health and livestock breeding to optimizing crop improvement and sustainable cultivation practices. Disease diagnostics harness molecular tools to detect pathogen-related vulnerabilities, and personalized nutrition initiatives explore the interface between genomic profiling and customized feed formulations. Finally, end-user adoption spans agricultural biotechnology companies pushing R&D frontiers, research institutes driving foundational science, government and research organizations setting policy and funding agendas, and seed companies integrating genomic traits into commercial varietal portfolios.

This comprehensive research report categorizes the Agrigenomics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Crop & Organism Focus

- Application Area

- End User

Distinct Regional Dynamics Shaping Agrigenomics Progress Across the Americas, EMEA’s Regulatory Pivot, and Asia-Pacific’s Strategic Biotech Expansion

In the Americas, the United States leads with robust frameworks for research funding, regulatory support, and private-sector investment, complemented by Canada’s science-based, product-focused regulatory approach to gene-edited plants and livestock feeds. These policies ensure that gene-edited crops are evaluated by their end-use profiles rather than their development methods, fostering an environment of innovation and predictable market access for domestic producers and exporters.

Across Europe, Middle East, and Africa, the European Union is advancing a landmark legislative package to classify new genomic techniques into two regulatory pathways-one that exempts naturally occurring or conventionally bred equivalents from stringent GMO rules and another that maintains comprehensive risk assessments for more complex modifications. This regulatory evolution aims to balance safety, transparency, and competitiveness, offering clear labeling, patent disclosure requirements, and opt-out options for member states.

In the Asia-Pacific region, China’s ambitious 2024-2028 biotechnology initiative underscores the strategic importance of agrigenomics for national food security. With guidelines to develop homegrown gene-editing tools and breed multi-resistant crops, China is expanding its GM corn acreage and seeking independent, controllable seed sources for staple grains. This initiative extends to high-yielding livestock varieties, reflecting a comprehensive approach to boost productivity and resilience across plant and animal agriculture.

This comprehensive research report examines key regions that drive the evolution of the Agrigenomics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Agrigenomics Providers and Innovators Driving Advancement Through Strategic Alliances, Acquisitions, and Platform Diversification

Leading companies in the agrigenomics ecosystem are forging strategic alliances, expanding through targeted acquisitions, and diversifying their platforms to meet evolving research demands. A prime example is Thermo Fisher Scientific’s acquisition of Olink, a proteomics leader, which integrates proximity extension assay capabilities into existing life sciences solutions, creating a seamless pathway from genomic to proteomic analysis. This move underscores how major instrument providers are broadening their portfolios to support multi-omics workflows critical for agrigenomics applications.

Innovative startups and platform companies are also making significant inroads. Durham-based Pairwise has pioneered CRISPR-based precision breeding to develop novel leafy greens with consumer-friendly traits, showcasing the potential of gene editing beyond staple cereals. Meanwhile, smaller service labs and contract research organizations are leveraging cloud-based bioinformatics pipelines coupled with on-demand wet-lab nodes to support cooperative and resource-constrained breeding programs.

Amid these developments, long-read sequencing vendors such as Pacific Biosciences and Oxford Nanopore continue to capture interest for structural variation and polyploid genome analysis, positioning themselves as essential partners for crop and livestock genome characterization projects. As consolidation trends persist, companies that can deliver integrated solutions across consumables, instruments, and analytics will shape the competitive landscape in agrigenomics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agrigenomics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Illumina, Inc.

- Neogen Corporation

- Pacific Biosciences of California Inc.

- Eurofins Genomics LLC

- Thermo Fisher Scientific Inc

- Oxford Nanopore Technologies plc

- Keygene N.V.

- Corteva, Inc.

- Bio-Rad Laboratories, Inc.

- Daicel Arbor Biosciences by Daicel Corporation

- Bayer AG

- Revvity, Inc.

- BGI Genomics Co., Ltd.

- Cibus, Inc.

- Genus plc

- Inari Agriculture, Inc.

- NRGene Technologies Ltd.

- Curio Genomics by Takara Bio USA Holdings, Inc.

- Hamilton Company

- AgriPlex Genomics

- Celemics, Inc.

- IGA Technology Services srl

- Novogene Co., Ltd.

- Standard BioTools Inc.

Practical Strategic Imperatives for Industry Leaders to Strengthen Resilience, Foster Innovation, and Navigate Regulatory Complexities in Agrigenomics

To navigate the complexities of agrigenomics, industry leaders should prioritize strategies that build operational resilience while unlocking next-generation innovation. First, strengthening domestic supply chains for critical reagents and sequencing components will mitigate tariff-related disruptions and ensure continuity of research pipelines. Engaging with local manufacturing partners and fostering public-private collaboration can accelerate the development of alternative sourcing solutions.

Second, proactive regulatory engagement is essential. By participating in policy consultative processes-whether shaping new genomic technique frameworks in the EU or supporting science-based guidelines in North America-companies can influence rules that affect approval timelines and market access. Establishing early communication channels with regulatory agencies and leveraging industry associations can streamline compliance pathways and reduce uncertainty.

Finally, fostering cross-sector partnerships between biotech firms, academic institutions, and agri-businesses will drive integrated, multi-omics platforms. Collaborative R&D consortia can pool resources to address shared challenges, such as phenotyping infrastructures and data-sharing protocols, while enabling tailored solutions for region-specific agronomic needs. Embracing open innovation models will help stakeholders unlock synergies that propel agrigenomics forward.

Comprehensive Research Design Combining Primary Stakeholder Engagement, Rigorous Secondary Analysis, and Quantitative Validation for Agrigenomics Insights

This report synthesizes findings from a rigorous three-phase research design. In the primary research phase, in-depth interviews were conducted with senior executives from leading agrigenomics companies, regulatory experts, and academic thought leaders to capture current challenges and emerging opportunities. These discussions informed the development of a structured questionnaire for stakeholder surveys, providing quantitative validation of qualitative insights.

The secondary research phase entailed a comprehensive review of peer-reviewed publications, government strategies, and reputable news sources. Regulatory databases, patent filings, and policy announcements were systematically analyzed to map the evolving legislative environment across key regions. Proprietary case studies and expert commentaries further enriched the contextual narrative.

Finally, data triangulation and validation were performed by cross-referencing interview findings with publicly available datasets, trade associations’ reports, and regulatory filings. This integrative approach ensures that the insights presented herein reflect a balanced, evidence-based perspective on the current state and future trajectory of agrigenomics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agrigenomics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agrigenomics Market, by Product Type

- Agrigenomics Market, by Technology

- Agrigenomics Market, by Crop & Organism Focus

- Agrigenomics Market, by Application Area

- Agrigenomics Market, by End User

- Agrigenomics Market, by Region

- Agrigenomics Market, by Group

- Agrigenomics Market, by Country

- United States Agrigenomics Market

- China Agrigenomics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Closing Reflections on Agrigenomics’ Rapid Evolution and Its Critical Role in Securing Sustainable Food and Fiber Systems for Future Generations

As agrigenomics continues its rapid ascent, the convergence of precision breeding, high-throughput analytics, and dynamic regulatory landscapes underscores its transformative potential for global agriculture. The ability to edit genomes with surgical accuracy, integrate multi-omics data streams, and harness AI-driven insights signals a new chapter in crop and livestock improvement. Coupled with strategic regional initiatives-from regulatory realignment in Europe to China’s biotechnology roadmap and North America’s product-based frameworks-these developments promise to redefine sustainable food systems and bolster resilience against multifaceted challenges.

By adopting forward-looking strategies that emphasize supply chain robustness, regulatory collaboration, and cross-sector innovation, stakeholders can harness agrigenomics to drive productivity gains and environmental stewardship. The synthesis of cutting-edge science and pragmatic business approaches will be instrumental in translating genomic breakthroughs into field-ready solutions. In the face of an increasingly complex global food landscape, agrigenomics stands as a pivotal force for securing future food security and advancing agricultural sustainability.

Connect with Ketan Rohom to Unlock In-Depth Agrigenomics Market Intelligence and Tailor Solutions for Strategic Growth Opportunities

To explore how this comprehensive analysis can empower your strategic planning and drive market leadership, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings a deep understanding of agrigenomics dynamics and can guide your team to tailor research insights into actionable business solutions. Engage with him to secure your competitive edge, refine your market entry approaches, and accelerate opportunities in precision agriculture and biotechnology.

- How big is the Agrigenomics Market?

- What is the Agrigenomics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?