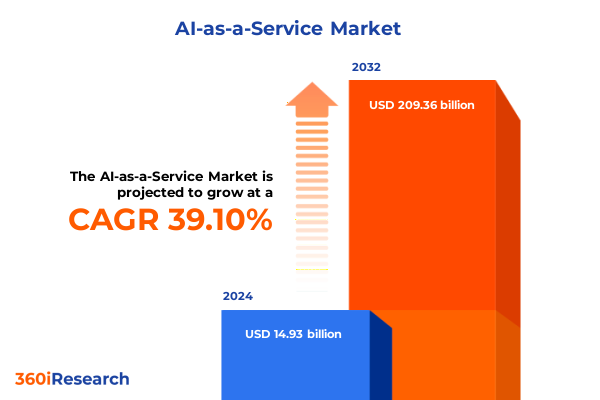

The AI-as-a-Service Market size was estimated at USD 20.45 billion in 2025 and expected to reach USD 28.13 billion in 2026, at a CAGR of 39.40% to reach USD 209.36 billion by 2032.

Unveiling the Critical Foundations and Market Imperatives Driving the Proliferation of AI-as-a-Service in Today’s Digital Ecosystems

The introduction sets the stage by highlighting the unprecedented growth of artificial intelligence delivered as a service, a trend driven by the convergence of scalable cloud infrastructures and advancements in machine learning paradigms. As organizations face intensifying demands for agility and personalization, AI-as-a-Service emerges as a critical enabler, democratizing access to sophisticated capabilities such as natural language understanding, computer vision, and automated decision-making. Through this lens, the opening section frames the report’s purpose: to deliver a holistic overview of key drivers, challenges, and opportunities, ensuring decision-makers are well-equipped to chart their strategic course.

In this rapidly evolving environment, stakeholders must understand not only the technological underpinnings but also the market dynamics that shape investment and adoption. Accordingly, this section underscores the importance of a multi-faceted analysis encompassing regulatory frameworks, ecosystem partnerships, and evolving customer expectations. By weaving together quantitative metrics with qualitative insights, the introduction lays a foundation for deeper exploration in subsequent sections. As a result, readers are primed for an in-depth journey into transformative shifts, tariff impacts, segmentation nuances, regional differentials, and practical recommendations-all critical for harnessing the full potential of AI-as-a-Service.

Exploring the Pivotal Technological Advancements and Ecosystem Evolutions Catalyzing the Rapid Ascent of AI-as-a-Service Solutions

Over the past several years, the technological landscape has undergone profound shifts that have propelled AI-as-a-Service from experimental deployments to mainstream adoption. Initially, the democratization of machine learning frameworks catalyzed innovation, as open-source libraries and pre-trained models enabled faster prototyping. Subsequently, the integration of no-code or low-code platforms broadened participation to non-technical stakeholders, accelerating time-to-value and reducing dependency on specialized data science teams. These developments have fostered an environment where organizations can rapidly iterate on AI-driven applications, from chatbots enhancing customer engagement to advanced data labeling solutions powering supervised learning pipelines.

Concurrently, advances in compute efficiency, driven by GPU and TPU optimizations, have lowered operational costs and enabled real-time inferencing at scale. This confluence of accessible tooling and economic viability has fueled the rise of API-centric delivery models, where enterprises seamlessly integrate vision, language, and automation capabilities via standardized interfaces. Moreover, strategic partnerships between cloud service providers and niche AI vendors have created comprehensive marketplaces, simplifying vendor selection and compliance management. As a result, the market is transitioning from bespoke in-house systems to modular, subscription-based services that can be tailored to unique organizational needs. This transformation underscores a paradigm shift toward agility, scalability, and continuous innovation.

Assessing the Ripple Effects of Newly Imposed US Trade Tariffs on AI Infrastructure Cost Structures and Service Delivery Models

In 2025, United States trade policy introduced a series of tariffs aimed at protecting domestic industries and accelerating sovereign capabilities in critical technologies. These measures have had a material impact on the cost structure and procurement strategies of AI-as-a-Service offerings. Specifically, tariffs on imported semiconductor components and specialized hardware have translated into increased infrastructure expenses for service providers and end-users alike. The immediate consequence has been a re-evaluation of deployment architectures, with many organizations migrating toward optimized cloud-based solutions that internalize hardware management and mitigate direct exposure to tariff-induced price volatility.

Moreover, the broader geo-economic implications have prompted vendors to diversify their supply chains and establish additional regional data centers to balance cost pressures. This strategic realignment has inadvertently introduced benefits such as enhanced data residency options and reduced latency for end-users. However, the shift also brings complexities in regulatory compliance, as providers must navigate a patchwork of local and federal requirements related to data sovereignty and cross-border data flows. Consequently, enterprises are adopting hybrid deployment models that leverage both domestic and international data infrastructures, ensuring compliance while maintaining cost efficiencies. These developments highlight the nuanced interplay between trade policy and technological adoption in shaping the AI-as-a-Service market.

Uncovering Holistic Market Segmentation Dynamics That Illustrate Diverse Adoption Patterns across Services, Technologies, and Industry Verticals

Examining the AI-as-a-Service market through different lenses reveals nuanced patterns of adoption, investment, and value creation. Based on Service Type, organizations are increasingly leveraging application programming interfaces for rapid integration, while sophisticated chatbots and digital assistants address complex user interactions. Data labeling services remain indispensable for supervised learning, yet no-code and low-code platforms are accelerating democratization by empowering teams with minimal technical expertise. Moreover, machine learning frameworks continue to serve as foundational building blocks for bespoke solutions, catering to enterprises that require deep customization and control.

When viewed through the prism of Technology, computer vision applications such as facial recognition and object detection are transforming industries from manufacturing inspection to retail analytics, while image recognition advances enable more granular image-based insights. Natural language processing offerings, including sentiment analysis and comprehensive text analytics, are driving exceptional customer experience enhancements across sectors. Robotic process automation, encompassing customer support automation and workflow automation, is streamlining back-office operations and freeing human capital for strategic tasks. From an Organizational Size standpoint, large enterprises prioritize scalability and integration with existing enterprise resource planning ecosystems, whereas small and medium-sized enterprises focus on cost-effective entry points and rapid deployment to drive immediate business outcomes.

Deployment preferences further segment the market into hybrid models that balance on-premises control with cloud scalability, private deployments that address stringent security mandates, and public cloud options favored for broad accessibility and operational simplicity. Finally, examining End-User verticals reveals distinct value propositions: banking, financial, and insurance firms leverage predictive analytics for risk management and fraud detection; energy and utilities operators deploy visual inspection and maintenance forecasting; government and defense entities pursue secure, mission-critical applications; healthcare and life sciences organizations harness AI for clinical decision support and drug discovery; IT and telecommunications companies optimize network operations; manufacturing units implement defect detection; and retail players employ personalization engines to elevate the consumer experience. This multi-dimensional segmentation underscores the dynamic interplay between service offerings, underlying technologies, organizational imperatives, deployment strategies, and industry-specific drivers.

This comprehensive research report categorizes the AI-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Technology

- Organization Size

- Deployment

- End-User

Assessing Regional Market Forces and Policy Frameworks That Drive Unique AI-as-a-Service Adoption Trends across the Americas, EMEA, and Asia-Pacific

Regional landscapes offer vital insights into how AI-as-a-Service is being shaped by local market conditions and strategic priorities. In the Americas, robust investments in cloud infrastructure and a thriving ecosystem of technology startups are driving rapid uptake across financial services, healthcare, and retail. The region’s emphasis on customer-centric innovation has accelerated the adoption of advanced analytics and conversational AI solutions, while strong regulatory support for data-driven initiatives fuels ongoing growth.

Shifting focus to Europe, the Middle East, and Africa, stakeholders are navigating a balance between rigorous data privacy frameworks and the need for digital transformation in both public and private sectors. The European Union’s comprehensive regulations have encouraged providers to enhance their compliance capabilities, positioning the region as a leader in responsible AI deployment. Simultaneously, burgeoning opportunities in the Middle East and Africa, bolstered by government-led digital agendas, are catalyzing investments in computer vision for public safety and remote medical diagnostics.

In Asia-Pacific, rapid urbanization and large-scale manufacturing operations are creating fertile ground for AI-driven automation and predictive maintenance. Governments across the region are prioritizing AI as a strategic pillar for national competitiveness, resulting in significant funding for research institutions and public-private partnerships. Consequently, enterprises benefit from a rich talent pool and strong support for pilot programs, driving accelerated adoption across energy, telecommunications, and smart city initiatives. These regional insights reveal how local policies, infrastructure maturity, and industry focus converge to shape distinct trajectories for AI-as-a-Service implementation.

This comprehensive research report examines key regions that drive the evolution of the AI-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delving into the Competitive Fabric of Leading Hyperscalers, Niche Innovators, and Disruptive Entrants Shaping AI Service Delivery

The competitive landscape of AI-as-a-Service is characterized by a blend of global hyperscalers, specialized independent software vendors, and emerging disruptors. Leading cloud providers continue to invest heavily in expanding their AI marketplaces, integrating advanced capabilities such as real-time inferencing and edge deployment options. At the same time, niche providers are differentiating through domain-specific expertise, delivering tailored solutions for sectors like healthcare, finance, and manufacturing. This includes the development of pre-trained models optimized for industry use cases, as well as managed services that streamline end-to-end AI lifecycle management.

In parallel, startups to watch are innovating around cutting-edge technologies such as generative AI and automated machine learning, aiming to redefine user experience and accelerate model development cycles. Strategic alliances between technology incumbents and research-focused firms are also gaining traction, fostering rapid commercialization of breakthroughs in computer vision and language processing. Furthermore, M&A activity has intensified as larger firms acquire specialized capabilities to bolster their portfolios and secure talent. Investors are closely monitoring these transactions, viewing consolidation as both a validation of market potential and a catalyst for future competitive dynamics. Within this vibrant ecosystem, collaboration and specialization emerge as the primary factors that separate market leaders from the rest of the field.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Alibaba Cloud

- Amazon Web Services, Inc.

- Avenga International GmbH

- BigML, Inc.

- Booz Allen Hamilton Inc.

- Clarifai, Inc.

- Cognizant Technology Solutions Corporation

- Databricks, Inc.

- DataRobot, Inc.

- Fair Isaac Corporation

- Google LLC by Alphabet Inc.

- H2O.ai

- Hewlett Packard Enterprise Development LP

- Infosys Limited

- International Business Machines Corporation

- Kyndryl Holdings, Inc.

- Levity AI GmbH

- Microsoft Corporation

- NashTech by Nash Squared

- NICE Ltd.

- OpenAI OpCo, LLC

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Siemens AG

Providing a Strategic Roadmap for Enterprise Stakeholders to Build Governance, Collaboration, and Scalable AI Foundations

For industry leaders seeking to harness the full potential of AI-as-a-Service, a clear set of strategic imperatives emerges. Organizations should begin by articulating a robust AI governance framework that aligns technology investments with ethical guidelines and regulatory requirements. This structured approach ensures transparency in model development and fosters trust among stakeholders, a critical consideration as the technology permeates sensitive applications.

Furthermore, leaders are advised to cultivate cross-functional teams that unite data scientists, engineers, and domain experts, promoting a culture of continuous learning and iterative experimentation. Emphasizing modular architectures and API-first design principles enables rapid integration of new capabilities while maintaining system resilience. In addition, strategic partnerships with specialized vendors can accelerate time-to-market and mitigate resource constraints; by leveraging managed services for data labeling or model optimization, organizations can focus internal efforts on high-value activities. Finally, embedding performance measurement mechanisms-such as end-to-end monitoring and feedback loops-facilitates proactive optimization and ensures that AI initiatives deliver measurable business outcomes. By following these recommendations, enterprises will be better positioned to achieve scalable, secure, and ethically grounded AI deployments.

Detailing the Rigorous Blend of Primary Interviews, Quantitative Surveys, and Secondary Intelligence That Underpins the Analysis

To develop the insights presented in this report, a comprehensive blend of primary and secondary research methodologies was employed. Primary research involved structured interviews and workshops with C-level executives, AI practitioners, and procurement specialists across diverse industries. These engagements provided first-hand perspectives on technology selection criteria, implementation challenges, and future investment priorities. Complementing this, surveys were conducted to quantify adoption rates, technology preferences, and budgetary allocations, ensuring statistical rigor and representativeness.

Secondary research encompassed an extensive review of corporate disclosures, regulatory filings, technology whitepapers, and patent databases. Industry conference proceedings and peer-reviewed journals were also analyzed to uncover emerging trends and validate key assumptions. Data triangulation was achieved by cross-referencing findings from multiple sources, while an internal review board ensured methodological consistency and mitigated potential biases. This blended approach delivers a robust evidentiary foundation, enabling stakeholders to trust that the report’s conclusions accurately reflect the current state of the AI-as-a-Service market and anticipate near-term developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI-as-a-Service Market, by Service Type

- AI-as-a-Service Market, by Technology

- AI-as-a-Service Market, by Organization Size

- AI-as-a-Service Market, by Deployment

- AI-as-a-Service Market, by End-User

- AI-as-a-Service Market, by Region

- AI-as-a-Service Market, by Group

- AI-as-a-Service Market, by Country

- United States AI-as-a-Service Market

- China AI-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Highlight Strategic Imperatives and Actionable Insights for Sustainable AI-as-a-Service Adoption

In conclusion, AI-as-a-Service has transcended its nascent stage to become a strategic imperative for organizations seeking competitive differentiation. The convergence of accessible tooling, advanced compute infrastructure, and dynamic partnership ecosystems has lowered barriers to entry and accelerated adoption across industries. Meanwhile, geopolitical developments, particularly trade policies in 2025, have introduced both challenges and opportunities, prompting innovative deployment strategies and supply chain diversification.

By embracing a nuanced understanding of market segmentation, regional divergences, and competitive dynamics, enterprises can navigate complexity and prioritize investments that align with their unique needs. The actionable recommendations outlined herein provide a clear pathway for establishing governance frameworks, fostering cross-functional collaboration, and embedding continuous performance measurement. As the AI-as-a-Service landscape continues to evolve, decision-makers who leverage comprehensive insights and maintain agile execution will be best positioned to capture long-term value and drive sustainable growth.

Unlock Customized Strategic Guidance to Leverage AI-as-a-Service Market Insights through Direct Consultation with a Senior Sales and Marketing Authority

To explore the full depth of market dynamics and secure a competitive advantage in the rapidly evolving AI landscape, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings a wealth of expertise in guiding organizations through strategic decision-making processes, having supported numerous enterprises in aligning their operational goals with cutting-edge AI technologies. By reaching out to Ketan, stakeholders can gain comprehensive insights into industry-specific use cases, best practices for implementation, and tailored guidance on integrating AI-as-a-Service solutions into existing ecosystems. This personalized consultation will clarify how the detailed findings of this research report translate into actionable steps, ensuring the highest return on investment.

Don’t miss the opportunity to leverage the latest intelligence on AI service models, technological paradigms, regulatory shifts, and market entry strategies that will define the next wave of innovation. Contact Ketan today to request a full copy of the report, schedule a detailed briefing, or discuss custom research extensions that answer your unique business questions. Partnering with Ketan ensures you are equipped to navigate uncertainties and capitalize on emerging trends with confidence.

- How big is the AI-as-a-Service Market?

- What is the AI-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?