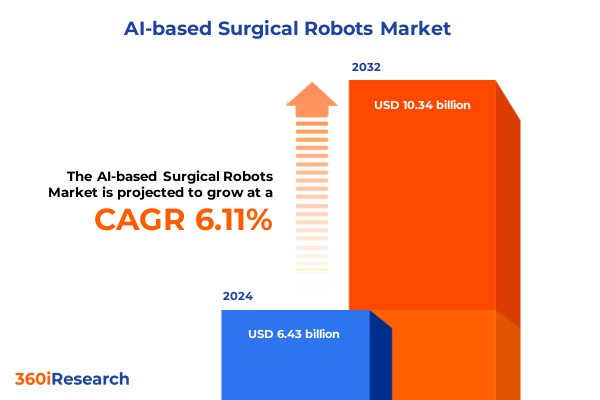

The AI-based Surgical Robots Market size was estimated at USD 6.75 billion in 2025 and expected to reach USD 7.09 billion in 2026, at a CAGR of 6.27% to reach USD 10.34 billion by 2032.

Exploring how artificial intelligence–driven surgical robotics are revolutionizing operative precision, patient safety, and healthcare efficiency with transformative innovation

The convergence of artificial intelligence and robotic surgery is redefining the boundaries of precision and patient care, signaling a revolutionary shift in operative methodology. As advanced algorithms empower surgical platforms to assist surgeons with enhanced dexterity and real-time decision support, healthcare institutions worldwide are recognizing the dual promise of improved outcomes and operational efficiency. From preoperative planning driven by machine learning to intraoperative tactile feedback enhancements, the technological ecosystem surrounding AI-powered robots is maturing at an unprecedented pace.

Against a backdrop of rising demand for minimally invasive procedures and mounting pressures to optimize healthcare costs, these intelligent systems facilitate streamlined workflows and elevate procedural consistency. Moreover, the integration of virtual and augmented reality for surgical simulation is shortening learning curves for new users while mitigating risk by allowing surgeons to rehearse complex cases in immersive environments. This synergy between robotics hardware, sophisticated imaging systems, and data analytics platforms has laid the groundwork for a fundamentally new era of patient-centric care.

In this context, stakeholders from medical device manufacturers to hospital administrators are collaborating to refine regulatory pathways, establish cybersecurity protocols, and develop reimbursement frameworks that reflect the value proposition of AI-assisted surgery. As we embark on an exploration of transformative shifts, policy impacts, segmentation nuances, and regional dynamics, this executive summary presents a clear, actionable narrative for decision-makers seeking to capitalize on the accelerating evolution of AI-driven surgical robotics.

Unveiling paradigm shifts in robotic surgery driven by next-generation machine learning, advanced imaging, and regulatory advancements shaping clinical adoption

The landscape of robotic surgery is witnessing a cascade of transformative shifts anchored in breakthroughs across machine learning, imaging modalities, and system autonomy. In recent years, advancements in deep learning have enabled robotic platforms to interpret intraoperative data streams, enhancing real-time tissue recognition and surgical navigation. Concurrently, the introduction of high-resolution three-dimensional imaging and augmented reality overlays is refining surgeons’ situational awareness, enabling more precise and minimally invasive approaches.

Beyond the operating room, the maturation of digital twin models and simulation environments powered by artificial intelligence is revolutionizing preoperative planning, practitioner training, and risk mitigation. These virtual replicas leverage rich datasets to predict outcomes under varying procedural scenarios, allowing teams to optimize surgical strategies before entering the theater. Moreover, collaborations between robotics developers and academic research centers are accelerating the validation of fully autonomous procedures, moving beyond supervised assistance toward the promise of end-to-end automated interventions for routine tasks.

Regulatory authorities are adapting to these innovations by crafting specialized pathways that balance patient safety with expedited market access. In parallel, reimbursement policies are evolving to recognize the long-term value proposition of fewer complications, shorter hospital stays, and reduced readmissions. As these forces converge, they are reshaping competitive dynamics, inspiring new entrants, and propelling an ecosystem where digital, mechanical, and algorithmic capabilities coalesce to define the next generation of surgical excellence.

Assessing the compounded effects of 2025 United States import tariffs on surgical robotic components, supply chain realignment, and cost structures across the industry

The imposition of cumulative United States tariffs on robotic systems and related components throughout 2025 has created a complex cost environment that is influencing sourcing strategies, pricing models, and supply chain configurations. While targeted duties under Section 301 and Section 232 have traditionally focused on steel, aluminum, and select electronics, recent expansions now encompass specialized control units, imaging modules, and semiconductor sensors integral to advanced surgical robots. Consequently, manufacturers have experienced increased landed costs, compelling them to reassess international partnerships and production footprints.

In response to elevated import duties, several original equipment manufacturers have accelerated investment in domestic assembly and localized component production. This shift has required collaboration with regional semiconductor fabs and contract manufacturers to ensure continuity of supply, albeit at higher capital expenditures. At the same time, tier-1 suppliers of control systems and robotic arms are negotiating long-term contracts to hedge against further duties, often passing incremental costs downstream to healthcare providers through revised pricing arrangements.

Despite these headwinds, industry participants are leveraging strategic alliances and joint ventures to mitigate tariff impact. For example, cross-border R&D collaborations are focusing on interchangeable module designs that qualify under tariff exemptions, while parallel efforts aim to secure duty-free treatment for medical devices through enhanced classification protocols. As the tariff regime continues to evolve, the interplay between trade policy, manufacturing localization, and cost management will remain a defining factor in the adoption curve for AI-powered surgical robotics.

Deep analysis of market segmentation reveals multifaceted opportunities across components, autonomy levels, system types, applications, and healthcare provider channels

A nuanced understanding of market segmentation is essential to identify pockets of opportunity and align product portfolios with end-user needs. In terms of hardware, control systems, imaging arrays, robotic arms, and sensors & actuators represent critical pillars, each demanding precise engineering and rigorous validation to meet the stringent requirements of surgical environments. Complementing these tangible assets, services such as installation, training, maintenance, and support form the backbone of successful deployments, ensuring that healthcare professionals can maximize utilization while minimizing downtime. On the software front, AI and machine learning algorithms, AR and VR simulation tools, and data analytics platforms provide continuous insights, augmenting clinical decision-making and supporting outcome tracking.

Beyond component analysis, the delineation of robotic system types-encompassing AI-enabled autonomous platforms, tethered configurations, and more flexible untethered solutions-highlights divergent development trajectories and integration complexities. Equally impactful is the segmentation by degree of autonomy, from fully autonomous surgical robots capable of executing predefined procedural steps to semi-autonomous systems that share control between surgeon and machine, and supervised AI-assisted devices where human oversight remains paramount.

Application-based segmentation further uncovers distinct use cases, including specialized interventions in cardiothoracic, general, gynecological, neurosurgical, orthopedic, and urological domains, each carrying unique clinical imperatives. Finally, insights into end-user categories-ranging from ambulatory surgical centers to large hospital networks and boutique specialty clinics-shed light on purchase drivers, utilization patterns, and support requirements across diverse care settings. Such granular perspective empowers manufacturers and healthcare providers to tailor strategies that resonate with specific clinical and operational demands.

This comprehensive research report categorizes the AI-based Surgical Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Robotic System Type

- Level of Autonomy

- Application Areas

- End-User

Comparative regional dynamics highlight how the Americas, Europe, Middle East & Africa, and Asia-Pacific regions are driving AI-robotic surgery adoption and innovation

Regional dynamics in the global AI-powered surgical robotics arena exhibit distinct patterns of adoption, investment, and regulatory progression. In the Americas, established healthcare infrastructures and robust reimbursement frameworks have facilitated early uptake of advanced robotic platforms, with key academic medical centers pioneering minimally invasive procedures. Strong private-public partnerships are driving collaborative R&D, particularly in digital health integration and perioperative analytics, establishing the region as a crucible for next-generation innovation.

Across Europe, the Middle East & Africa, the landscape is characterized by heterogeneous market maturity and divergent regulatory landscapes. Western European nations benefit from streamlined approval processes and centralized reimbursement mechanisms, enabling cost-benefit analyses that favor advanced surgical interventions. Meanwhile, emerging markets in the Middle East and select African economies are leveraging healthcare modernization initiatives to upgrade surgical suites, often seeking cost-efficient systems that can deliver consistent outcomes in lower-volume settings.

The Asia-Pacific region presents the fastest growth trajectory, driven by escalating healthcare expenditures, expanding private hospital networks, and a deepening pool of skilled surgeons trained in robotic methodologies. Governments across East and Southeast Asia are incentivizing local manufacturing and innovation clusters, yielding homegrown robotics start-ups that challenge established incumbents. In parallel, regional consortia promote harmonized regulatory frameworks to expedite clinical trials and approvals, further accelerating market penetration of intelligent robotic platforms.

This comprehensive research report examines key regions that drive the evolution of the AI-based Surgical Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators in AI-enabled surgical robotics and their strategic maneuvers to dominate market share through partnerships, acquisitions, and technological breakthroughs

Leading the charge in AI-enabled surgical robotics, Intuitive Surgical continues to expand its ecosystem through iterative enhancements to its cornerstone platform, integrating advanced imaging modalities and refined haptic feedback. Parallel to these continuous improvements, partnerships with global academic centers have yielded real-world evidence supporting broader reimbursements. Medtronic has intensified its focus on modular system architectures, collaborating with semiconductor giants to optimize sensor fusion and streamline hardware customization for specific procedural segments.

New market entrants, including CMR Surgical, have leveraged a lean design philosophy to deliver cost-effective, modular systems aimed at lower-volume care centers, while established medical device conglomerates are accelerating acquisitions to incorporate AI expertise. Strategic alliances between robotic system developers and digital health firms are creating comprehensive care solutions that blend predictive analytics with post-operative outcome tracking, deepening the value proposition for hospital networks.

Moreover, specialty robotics firms are securing exclusive distribution agreements in high-growth regions, enhancing localized service capabilities and localized software support. These moves reflect a broader shift toward ecosystem partnerships that transcend traditional vendor-client relationships, emphasizing co-development, shared data standards, and scalable cloud-based orchestration of surgical services. Such strategic maneuvers position industry leaders to capture incremental value across the surgical continuum and cement their foothold in the evolving landscape of AI-powered robotics.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI-based Surgical Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accuray Incorporated

- Activ Surgical, Inc.

- Asensus Surgical US, Inc.

- CMR Surgical Limited

- Globus Medical, Inc.

- Intuitive Surgical, Inc.

- Johnson & Johnson Services, Inc.

- KUKA AG

- Medtronic PLC

- Monteris Medical Corporation

- Moon Surgical

- Neocis, Inc.

- Noah Medical Corporation

- Olympus Corporation

- Robocath SAS

- Shimadzu Corporation

- Siemens AG

- Smith & Nephew PLC

- Stereotaxis, Inc.

- Stryker Corporation

- Synaptive Medical Inc.

- THINK Surgical, Inc.

- Titan Medical Inc.

- Virtual Incision Corporation

- Zimmer Biomet Holdings, Inc.

Actionable strategies for industry leaders to navigate policy headwinds, accelerate AI integration, diversify supply chains, and capitalize on emerging surgical opportunities

Industry leaders must adopt proactive tactics to maintain competitive advantage in a terrain marked by regulatory flux and supply chain disruptions. Foremost, developing flexible sourcing models that blend domestic production with low-cost international partnerships will hedge against future tariff escalations and component shortages. Concurrently, channeling R&D resources into interoperable software architectures can facilitate rapid integration of third-party modules and AI enhancements, allowing platforms to evolve alongside clinical needs.

Forging deep collaborations with healthcare providers is equally vital; co-creation initiatives and pilot programs can generate robust clinical evidence, inform reimbursement discussions, and engender long-term customer loyalty. Moreover, addressing the scarcity of specialized talent through training academies and certification programs in AI-driven surgical methods will expand the pool of qualified operators and accelerate technology adoption. Engaging early with regulatory bodies to co-design safety and efficacy protocols can streamline approval timelines and ensure that emerging systems align with evolving standards.

Finally, establishing multichannel go-to-market strategies that encompass direct sales, value-added distribution, and digital service offerings will empower organizations to tailor engagement models for different end-user segments, from high-volume hospital networks to boutique specialty clinics. By executing these strategic imperatives, stakeholders can not only navigate immediate headwinds but also shape the trajectory of surgical innovation for years to come.

Rigorous research methodology combining expert interviews, healthcare data analysis, and comprehensive secondary research to deliver validated market insights

The insights presented herein stem from a rigorous, multi-tiered research methodology designed to ensure both breadth and depth of analysis. Primary research encompassed in-depth interviews with surgeons, hospital administrators, regulatory experts, and robotics engineers, facilitating a nuanced understanding of adoption barriers, performance benchmarks, and operational imperatives. These firsthand perspectives were complemented by quantitative surveys across a representative sample of healthcare facilities, yielding data on utilization patterns, purchasing criteria, and service expectations.

Secondary research included a comprehensive review of scientific literature, patent filings, clinical trial registries, and industry white papers to trace technological advancements and competitive positioning. Proprietary databases were leveraged to track M&A activity, patent applications, and supply chain shifts, while regulatory filings were monitored to map evolving approval pathways and tariff policy changes. All data streams underwent rigorous triangulation, cross-validating findings against multiple sources to mitigate bias and enhance reliability.

Advanced analytics techniques, including thematic sentiment analysis and scenario modeling, were applied to synthesize qualitative insights with quantitative metrics, generating forward-looking strategic narratives. The result is a robust, actionable framework that equips decision-makers with the clarity and confidence to navigate the intricate landscape of AI-driven surgical robotics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI-based Surgical Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI-based Surgical Robots Market, by Component

- AI-based Surgical Robots Market, by Robotic System Type

- AI-based Surgical Robots Market, by Level of Autonomy

- AI-based Surgical Robots Market, by Application Areas

- AI-based Surgical Robots Market, by End-User

- AI-based Surgical Robots Market, by Region

- AI-based Surgical Robots Market, by Group

- AI-based Surgical Robots Market, by Country

- United States AI-based Surgical Robots Market

- China AI-based Surgical Robots Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing key findings on AI-powered surgical robots to inform strategic decision-making, foster innovation, and guide investments in the evolving surgical landscape

The evolution of AI-powered surgical robotics represents a pivotal milestone in the broader digital transformation of healthcare. As systems become more autonomous and intelligent, they will fundamentally reshape the dynamics of operative care by enhancing precision, reducing variability, and optimizing resource utilization. The interplay of regulatory adaptation, supply chain resilience, and strategic partnerships will determine which organizations emerge as leaders in this new era.

By dissecting transformative shifts, tariff impacts, market segmentation, and regional dynamics, this analysis illuminates the critical levers that stakeholders must engage to succeed. Manufacturers that invest in modular, software-driven architectures alongside service excellence will capture differentiated value, while healthcare providers that cultivate AI proficiency and data-centric workflows will drive better outcomes and operational efficiency. Furthermore, a proactive stance on policy engagement and talent development will fortify competitive positioning.

Ultimately, the promise of AI-enhanced robotic surgery lies not only in novel technologies but in the collaborative ecosystems that bring them to life. Through informed strategy, agile execution, and relentless innovation, industry participants can harness the transformative power of intelligent robotics to deliver safer, more efficient, and patient-centered surgical care.

Contact Ketan Rohom to secure your comprehensive report and gain exclusive insights that will empower your strategic growth in the AI-based surgical robotics market

To explore the future of AI-enhanced surgical robotics and gain an unparalleled edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing, for immediate access to the full market research report. This comprehensive analysis equips decision-makers with actionable data, in-depth trend commentary, and foresight into technological advancements shaping the surgical robotics ecosystem. Engage with our expert team to discuss tailored insights, address specific business challenges, and secure a data-driven roadmap for capitalizing on emerging opportunities. Don’t let uncertainty slow your trajectory; partner with Ketan Rohom to harness critical intelligence that will drive innovation, streamline strategic planning, and maximize competitive advantage in this fast-evolving market.

- How big is the AI-based Surgical Robots Market?

- What is the AI-based Surgical Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?