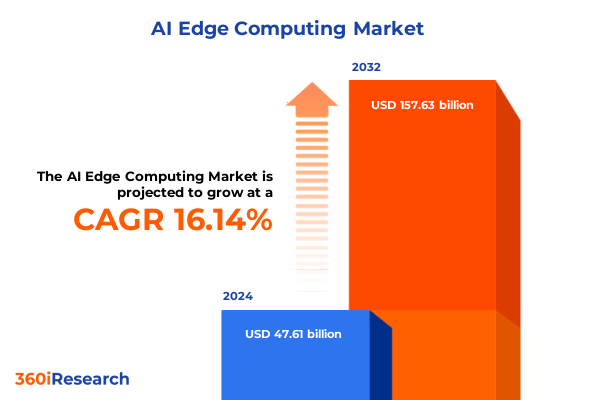

The AI Edge Computing Market size was estimated at USD 47.61 billion in 2024 and expected to reach USD 54.97 billion in 2025, at a CAGR of 16.14% to reach USD 157.63 billion by 2032.

Emerging Dynamics of AI Edge Computing Revolutionizing Data Processing and Enabling Next-Generation Intelligent Applications at the Network Periphery

The rapid proliferation of connected devices, coupled with escalating demands for near-instantaneous data processing, is propelling artificial intelligence toward the edge of the network. As data volumes skyrocket across industrial automation, smart cities, and autonomous systems, reliance on centralized cloud architectures is giving way to AI models deployed directly on edge nodes. This shift empowers enterprises to achieve ultra-low latency for mission-critical decision making, mitigate bandwidth constraints, and strengthen data sovereignty by keeping sensitive information in situ.

In response to these forces, businesses are recalibrating their technology roadmaps to harness the synergy of edge hardware, AI inference engines, and robust connectivity frameworks. Innovative chipmakers are optimizing processors specifically for on-device computing, while software vendors are streamlining model deployment and lifecycle management. Simultaneously, the rollout of 5G and next-generation Wi-Fi networks is laying the groundwork for seamless, high-throughput data exchange between sensors, gateways, and cloud backends.

This executive summary provides a comprehensive overview of the AI edge computing landscape, highlighting the transformative architectural evolutions, regulatory and economic factors reshaping supply chains, and the segmentation and regional dynamics crucial to informed strategy. It also identifies leading industry participants, actionable recommendations for executives, and the rigorous research methodology underpinning these insights.

Evolving Edge Architectures and Connectivity Paradigms Driving Disruption Across Industries Through Enhanced AI-Enabled Decision Making at the Network Edge

As edge computing architectures mature, traditional boundaries between data collection, processing, and storage are dissolving. AI models are no longer confined to centralized data centers; instead, intelligence is distributed across micro data centers, intelligent gateways, and even endpoint devices. This architectural decentralization delivers real-time analytics where it matters most, transforming use cases from predictive maintenance on factory floors to advanced driver assistance in automotive systems.

Moreover, the convergence of edge nodes with high-speed 5G networks and low-power wide-area sensors is driving a new era of connectivity. Network slicing and multi-access edge computing (MEC) enable dedicated bandwidth for critical applications, ensuring consistent performance. At the same time, federated learning techniques allow organizations to collaboratively train AI models across disparate edge devices without centralized data pooling, safeguarding privacy and complying with stringent data protection regulations.

In parallel, software frameworks optimized for resource-constrained environments are emerging, simplifying model compression, acceleration, and deployment. Hardware-software co-design is becoming the norm, with processor manufacturers working hand-in-hand with AI platform providers to deliver turnkey solutions. Consequently, enterprises are witnessing accelerated time-to-value, reduced operational complexity, and enhanced scalability of AI workloads at the edge.

Assessing the Multifaceted Effects of 2025 United States Tariff Policies on Supply Chains Component Costs and Strategic Sourcing Decisions in AI Edge Ecosystem

The expansion of United States tariff measures in 2025 has introduced a layer of complexity to global technology supply chains, particularly affecting components vital to AI edge infrastructure. Tariffs imposed on high-performance processors, specialized sensors, and advanced networking gear have elevated landed costs for original equipment manufacturers and device integrators. Consequently, many organizations are revisiting sourcing strategies to mitigate margin compression.

In addition, elevated import duties have catalyzed regional diversification efforts and nearshoring trends. Companies are forging partnerships with domestic suppliers or shifting production to tariff-exempt jurisdictions to circumvent punitive duties. This reconfiguration not only reduces exposure to tariff volatility but also shortens lead times and strengthens supply chain resilience. However, it introduces fresh challenges in qualifying new suppliers and ensuring consistent component quality.

Furthermore, the increased cost base is driving end users to optimize system architectures through component consolidation and open-source hardware initiatives. Some enterprises are accelerating investments in software-defined solutions that enable greater flexibility and interoperability, offsetting hardware cost increases with streamlined maintenance and upgrade cycles. As a result, the tariff landscape is reshaping procurement, R&D, and deployment strategies across the AI edge computing ecosystem.

Revealing Critical Insights from Component to End-User Industry Segmentation for Holistic Understanding of AI Edge Computing Market Drivers and Use Cases

In examining AI edge computing through the lens of component segmentation, it becomes clear that hardware, services, and software each play pivotal roles in market dynamics. Networking equipment, processors-encompassing both CPUs and GPUs-and a variety of sensors form the foundational hardware layer enabling real-time data capture and inference. Meanwhile, professional services such as installation and integration, ongoing maintenance and support, and specialized training and consulting are critical to ensuring seamless solution deployment and maximizing operational uptime. The software tier, composed of AI inference engines, model optimization tools, and comprehensive SDKs and frameworks, facilitates the efficient deployment, monitoring, and iterative improvement of machine learning models at the network edge.

Data source segmentation reveals distinct application drivers: biometric data fuels security and identity verification use cases, mobile data underpins contextual analytics in consumer and enterprise environments, and sensor data remains the backbone of industrial automation and asset monitoring scenarios. Network connectivity choices-ranging from the ultra-low latency promises of 5G to the ubiquity of Wi-Fi and the reliability of wired networks-further dictate architectural design decisions.

Additionally, organizational considerations influence deployment strategies. Large enterprises, with greater budgetary latitude, tend to pilot bespoke hybrid models that leverage both on-cloud and on-premise resources, whereas small and medium enterprises often adopt turnkey on-cloud or on-premise packages to streamline implementation. Finally, end-user industries such as automotive, business and finance, consumer electronics, energy and utilities, government and public sector, healthcare, retail, and telecommunications exhibit unique performance and compliance requirements, guiding vendors to tailor offerings accordingly.

This comprehensive research report categorizes the AI Edge Computing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Network Connectivity

- Security Approach

- AI Workload

- Organization Size

- Application Area

- Industry Vertical

- End Device Category

- Management Model

Examining How Connectivity Infrastructure and Regulatory Frameworks Shape AI Edge Adoption in Americas Europe Middle East Africa and Asia-Pacific Regions

Regional disparities in AI edge adoption stem from variations in connectivity infrastructure, regulatory regimes, and market maturity. In the Americas, robust investment in 5G deployments and a strong ecosystem of semiconductor fabrication facilities are fueling accelerated edge integration across manufacturing and smart city initiatives. North American companies benefit from favorable intellectual property protections, spurring innovation in proprietary hardware-accelerated inference platforms.

Europe, the Middle East, and Africa present a heterogeneous landscape. Western Europe’s stringent data privacy regulations, such as GDPR, are driving interest in on-premise and hybrid solutions that keep sensitive data within national boundaries. Meanwhile, the Middle East is investing heavily in smart infrastructure projects, leveraging edge computing to optimize energy grids and enhance public safety. In Africa, connectivity challenges are guiding pilot programs that pair solar-powered edge nodes with satellite backhaul.

Asia-Pacific continues to lead in scale, driven by large-scale deployments in automotive manufacturing hubs, consumer electronics production centers, and advanced retail ecosystems. Countries with supportive industrial policies and state-backed research initiatives are pioneering early-stage applications in autonomous vehicles and robotics. As a result, edge computing architectures are being co-developed with local telecommunications carriers to ensure optimal performance in densely populated urban centers.

Overall, regional strategies reflect a blend of governance frameworks, infrastructure readiness, and industry priorities that shape how organizations deploy and scale AI-enabled edge solutions.

This comprehensive research report examines key regions that drive the evolution of the AI Edge Computing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Technological Innovations of Leading Vendors Shaping the Competitive Landscape of AI Edge Computing Ecosystem

Leading technology vendors are adopting differentiated approaches to capitalize on the burgeoning AI edge computing market. GPU-centric companies have expanded their product portfolios with energy-efficient, low-power accelerators tailored for edge inference workloads, while CPU leaders are optimizing architectures to balance general-purpose compute and neural network processing tasks. Networking incumbents are embedding AI offload engines directly into switches and routers, enabling in-network analytics without disrupting existing topologies.

Cloud providers have launched edge-native services that extend their data center capabilities, offering unified development environments and managed orchestration tools. These platforms simplify model deployment across geographically dispersed nodes and provide integrated monitoring dashboards, reducing the operational burden on enterprises. Open-source alliances are also gaining traction, fostering interoperability and community-driven innovation in AI model optimization and data orchestration frameworks.

Strategic partnerships and M&A activity remain at the forefront of vendor strategies. Manufacturers of specialized sensors and chiplets are combining forces to deliver integrated modules, while software companies are acquiring niche startups to bolster inference efficiency and security capabilities. Through these initiatives, vendors aim to offer end-to-end solutions that minimize integration risk and accelerate customer adoption across both greenfield and brownfield environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Edge Computing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Advanced Micro Devices, Inc.

- Amazon Web Services, Inc.

- Arm Holdings plc

- C3.ai, Inc.

- Capgemini SE

- Cisco Systems, Inc.

- Cognizant Technology Solutions Corporation

- Dell Technologies Inc.

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- MediaTek Inc.

- Microsoft Corporation

- NIPPON TELEGRAPH AND TELEPHONE CORPORATION

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Oracle Corporation

- Palantir Technologies Inc.

- Panasonic Holdings Corporation

- QUALCOMM Incorporated

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- SAP SE

- Siemens AG

- Tata Consultancy Services Limited

- Texas Instruments Incorporated

- Wipro Limited

Developing Strategic Roadmaps and Operational Best Practices to Accelerate AI Edge Deployment and Maximize ROI While Mitigating Technical and Regulatory Risks

Industry leaders must articulate clear roadmaps that align technology capabilities with business objectives. To begin, organizations should evaluate use cases against latency requirements, data governance policies, and existing IT investments, enabling targeted pilot programs that validate performance metrics and total cost of ownership. Following successful trials, companies should establish center-of-excellence teams to codify best practices in hardware selection, model governance, and operational support.

In parallel, it is essential to cultivate a robust partner ecosystem. By co-innovating with specialized hardware suppliers, software providers, and systems integrators, enterprises can access pre-qualified solution stacks and benefit from shared risk frameworks. Investing in employee training programs focused on edge AI architecture and security protocols will ensure internal teams are equipped to manage ongoing deployments.

Financial governance must also account for evolving cost structures. Organizations should explore as-a-service consumption models and multi-year support contracts to hedge against technology refresh cycles and tariff fluctuations. Finally, continuous monitoring of regulatory developments, standardization efforts, and open-source community roadmaps will position businesses to adapt swiftly to emerging requirements and capitalize on next-generation edge computing advancements.

Detailing a Robust Research Design Integrating Primary Industry Expert Interviews and Secondary Market Data to Deliver Actionable Insights on AI Edge Trends

This research integrates qualitative insights from in-depth interviews with industry executives and technical experts across the AI edge computing spectrum. Discussions focused on real-world deployment challenges, architecture selection criteria, and emerging technology roadmaps. Complementing these primary interviews, secondary sources-including public filings, academic publications, and neutral industry consortium reports-were systematically reviewed to corroborate findings and contextualize market drivers.

Data collection emphasized triangulation, ensuring consistency between vendor claims, end-user feedback, and empirical benchmarks. Methodical coding of interview transcripts enabled thematic analysis of recurring obstacles, such as power constraints in remote environments and interoperability gaps between proprietary platforms. Secondary data were synthesized to map regulatory landscapes, tariff schedules, and connectivity infrastructure deployment footprints across key regions.

By combining these approaches, the study delivers a holistic perspective on technological trajectories, economic considerations, and competitive dynamics. Rigorous validation steps, including peer debriefing and expert panel reviews, were applied to reinforce the credibility of conclusions and recommendations. This methodology ensures that strategic guidance is firmly rooted in both practitioner experience and objective data analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Edge Computing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Edge Computing Market, by Component

- AI Edge Computing Market, by Network Connectivity

- AI Edge Computing Market, by Security Approach

- AI Edge Computing Market, by AI Workload

- AI Edge Computing Market, by Organization Size

- AI Edge Computing Market, by Application Area

- AI Edge Computing Market, by Industry Vertical

- AI Edge Computing Market, by End Device Category

- AI Edge Computing Market, by Management Model

- AI Edge Computing Market, by Region

- AI Edge Computing Market, by Group

- AI Edge Computing Market, by Country

- United States AI Edge Computing Market

- China AI Edge Computing Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings and Emerging Opportunities to Guide Strategic Decision Making and Foster Innovation in the AI Edge Computing Domain

The convergence of advanced hardware, optimized software, and resilient network architectures is redefining the frontiers of AI deployment. As enterprises embrace edge computing to drive efficiency, enhance customer experiences, and maintain competitive differentiation, it becomes imperative to navigate technical, economic, and regulatory inflection points with clarity.

Critical findings highlight the necessity of a harmonized approach: aligning component selection with service support capabilities and software toolchains, while adapting to shifting tariff landscapes and regional regulatory nuances. Strategic vendor partnerships and modular design frameworks emerge as enablers of scalable, cost-effective implementations. Moreover, organizations that prioritize continuous skills development and maintain agility in sourcing strategies will be best positioned to capture value.

Looking ahead, the maturation of federated learning, the expansion of private 5G networks, and the evolution of open-standard edge platforms will unlock new possibilities for real-time analytics and autonomous systems. By synthesizing these insights, decision makers can craft informed roadmaps that balance innovation with operational rigor, setting the stage for sustained growth in the AI edge computing domain.

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure Comprehensive AI Edge Computing Market Intelligence

Engage directly with Ketan Rohom, Associate Director of Sales and Marketing, to obtain deep-dive insights and customized support guiding your strategic initiatives in AI edge computing. His expertise can help align the latest market intelligence with your organization’s unique priorities, ensuring you capitalize on emerging technology shifts. Reach out today to explore tailored research packages, exclusive data access, and strategic advisory services designed to accelerate your competitive advantage.

- How big is the AI Edge Computing Market?

- What is the AI Edge Computing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?