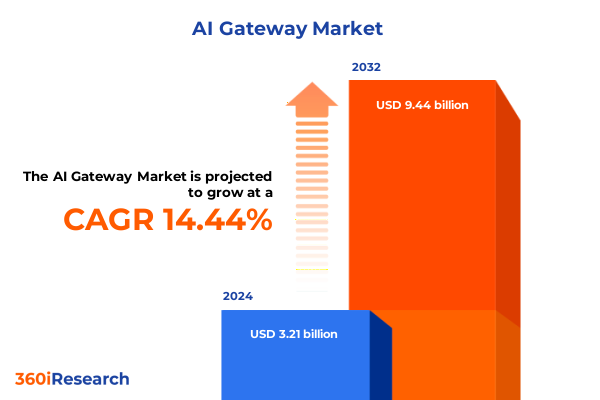

The AI Gateway Market size was estimated at USD 4.31 billion in 2025 and expected to reach USD 4.94 billion in 2026, at a CAGR of 15.53% to reach USD 11.86 billion by 2032.

Unveiling the New Era of Intelligent Edge Connectivity Fueled by AI Gateway Innovations and Strategic Insights for Tomorrow’s Global Digital Infrastructure

In today’s data-driven environment, AI Gateways serve as the critical bridge between sophisticated edge devices and cloud-based intelligence, enabling seamless real-time analytics and decision making. As enterprises pursue agile and scalable digital infrastructure, these devices have emerged as foundational components that support a wide array of applications, from autonomous systems to industrial automation. The proliferation of connected assets and the exponential growth of data volumes have elevated the importance of reliable, secure, and high-performance gateways that can efficiently preprocess, filter, and transmit information. Consequently, organizations across diverse verticals are prioritizing investments in AI Gateway solutions to enhance operational efficiency, reduce latency, and maintain competitive differentiation.

This executive summary distills the core findings of an extensive market research initiative, illuminating the transformative forces shaping the AI Gateway ecosystem while highlighting strategic imperatives for stakeholders. It provides an integrated overview of the market drivers and inhibitors, examines the impact of evolving trade policies, and presents nuanced segmentation insights that reveal the distinct needs of different product types, applications, distribution channels, end use industries, and material innovations. By offering a synthesized perspective on regional dynamics and competitive movements, this summary equips decision makers with the knowledge necessary to navigate complexities and capitalize on emerging opportunities.

Through a balanced combination of qualitative expertise and quantitative rigor, the subsequent sections articulate actionable strategies designed to foster resilience and drive growth. Whether you are a technology provider refining product portfolios, an enterprise architect optimizing deployment models, or an investor evaluating market entry, these insights will serve as a roadmap for informed decision making in the rapidly evolving world of AI Gateways.

Examining the Convergence of Advanced Computing Paradigms Regulatory Dynamics and Ecosystem Collaborations Reshaping the AI Gateway Landscape

Over the past two years, the AI Gateway landscape has been redefined by a convergence of multiple technological, regulatory, and ecosystem shifts that together are propelling the market forward at an unprecedented pace. The maturation of edge AI processing, coupled with the deployment of fifth-generation wireless networks and network slicing capabilities, has enabled real-time inference and ultra-low-latency communication. In parallel, heightened emphasis on data sovereignty and privacy has catalyzed the development of gateways with embedded security protocols, encrypted compute modules, and partitioned processing environments. Such regulatory imperatives are no longer afterthoughts but central design tenets that influence architecture, certification, and partnership models.

Furthermore, this period has seen an intensification of strategic collaborations among hardware manufacturers, cloud service providers, and systems integrators, forming holistic ecosystems that streamline interoperability and accelerate time to value. Co-innovation initiatives have spawned reference architectures that standardize interfaces, simplify deployment, and reduce customization costs. As a result, solution providers are increasingly adopting modular frameworks that allow end users to tailor AI Gateway functionalities to specific use cases without extensive redevelopment. These frameworks foster a services-oriented approach, wherein software updates, security patches, and analytics modules can be delivered over the air, ensuring continuous improvement and compliance with emerging standards.

Consequently, market participants must navigate a dynamic environment in which competitive advantage rests on the ability to anticipate regulatory trajectories, cultivate ecosystem alliances, and deliver flexible, future-proof solutions. The sections that follow unpack these trends in greater detail, highlighting their implications for market entry, product differentiation, and operational resilience.

Assessing the Comprehensive Impact of Recent United States Tariffs on Supply Chains Component Costs and Market Viability in 2025 for AI Gateways

The introduction of new United States tariffs in early 2025 on semiconductor components and electronic modules has exerted a comprehensive influence on the cost structure and supply chain strategies of AI Gateway manufacturers. Tariff levies have escalated the landed cost of critical processing units, memory devices, and integrated sensors, prompting original equipment manufacturers to reevaluate sourcing locations and supplier contracts. These changes have reverberated through inventory procurement cycles, compelling some enterprises to accelerate purchases ahead of tariff enforcement, while others have pursued alternative suppliers in tariff-exempt jurisdictions.

In addition to direct price impacts, the cumulative effect of these trade measures has underscored the importance of supply chain agility and localization. Several leading providers have begun to nearshore assembly operations and secure regional component inventories to mitigate the risk of future tariff fluctuations. At the same time, the heightened cost of imported parts has driven innovation in component consolidation, whereby multi-function chips and system-in-package solutions reduce the total number of tariff-exposed line items. Such design optimization not only curtails exposure to trade policy shocks but also diminishes complexity in board layouts and thermal management.

Looking ahead, industry leaders are advised to integrate tariff scenario planning into their strategic roadmaps, maintain a diversified supplier network that balances cost competitiveness with regulatory compliance, and prioritize partnerships with distributors possessing extensive cross-border logistics expertise. These measures will help organizations preserve margin stability, uphold delivery schedules, and adapt swiftly to evolving international trade environments affecting AI Gateway production and deployment.

Uncovering Critical Segmentation Insights Driving Diversification through Product Types Applications Channels End Use Industries and Material Specifications

A thorough examination of market segmentation reveals the multi-dimensional nature of AI Gateway demand and underscores the strategic importance of targeted offerings. In the product type segment, the market is studied across economy products designed for cost-sensitive deployments, premium products that include both luxury brands with high-performance computing and specialty brands optimized for niche applications, and standard products that balance feature sets with affordability. Each category exhibits unique procurement cycles and technical requirements, informing differentiated go-to-market approaches.

When analyzed by application, the landscape divides into automotive use cases, encompassing commercial vehicles focused on fleet connectivity, electric vehicles requiring advanced battery management and predictive maintenance, and passenger cars equipped with infotainment and driver assistance systems. This contrasts with consumer electronics applications that emphasize compact form factors and low power consumption, as well as industrial deployments demanding ruggedized enclosures, extended temperature tolerance, and deterministic communication protocols for factory automation.

Channel analysis highlights direct sales engagements for enterprise customers seeking end-to-end integration, offline distribution spanning traditional retail stores and wholesale stores that serve regional installers, and online avenues including company websites offering configuration tools alongside e-commerce marketplaces enabling rapid procurement. Each channel presents distinct margin profiles, brand positioning opportunities, and customer support considerations.

Finally, the end use industry perspective uncovers adoption across chemical processing, food and beverage production lines, and healthcare environments where home healthcare monitoring, critical hospital systems, and laboratory instrumentation necessitate stringent reliability and compliance. Underpinning these deployments, material type choices-spanning ceramic modules prized for thermal management, metal housings valued for durability, and plastic enclosures selected for cost efficiency-further differentiate product roadmaps and supply chain strategies. These segmentation insights guide vendors in aligning R&D investments, channel enablement, and marketing campaigns with the specific needs of each segment.

This comprehensive research report categorizes the AI Gateway market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Module

- Application

- End-Use Industry

- Organization Size

- Deployment Mode

Revealing Regional Market Dynamics and Growth Opportunities Across Major Global Territories Including the Americas EMEA and Asia Pacific Sectors

Regional dynamics in the AI Gateway market demonstrate the varying pace of adoption and the influence of local regulatory environments, infrastructure maturity, and vertical priorities. In the Americas, North America leads with a robust ecosystem of cloud providers, telecommunication incumbents, and early-adopting enterprises in automotive and industrial sectors. Demand is fueled by initiatives around smart manufacturing, intelligent transportation systems, and precision agriculture, while Latin America shows emerging interest in digitalized logistics and remote monitoring in agricultural supply chains.

Across Europe, Middle East & Africa, stringent data protection frameworks and environmental directives have accelerated the development of gateways with embedded compliance features, driving vendors to prioritize certifications and standardized security protocols. Western Europe’s advanced manufacturing hubs and oil and gas operations in the Middle East present high-value use cases, whereas Africa’s market, though nascent, offers growth potential through initiatives in smart cities, renewable energy microgrids, and healthcare outreach programs.

In the Asia-Pacific region, aggressive digitalization efforts in China’s industrial sector, Japan’s focus on robotics and factory automation, and India’s nationwide push for infrastructure modernization have collectively created a fertile environment for AI Gateway deployment. Southeast Asian economies are rapidly embracing smart retail solutions and port automation, highlighting the need for flexible, interoperable gateway solutions. Variations in import regulations, local content requirements, and logistical capabilities continue to shape go-to-market strategies across these territories.

This comprehensive research report examines key regions that drive the evolution of the AI Gateway market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Movements and Competitive Edge of Leading Technology Innovators Shaping the Future of AI Gateway Solutions Worldwide

Leading technology innovators are actively reshaping the AI Gateway space through strategic investments, partnerships, and product portfolio expansions that address evolving customer demands. Major networking and enterprise hardware providers have integrated AI Gateway offerings into their edge computing suites, leveraging existing channel networks to accelerate adoption among global corporations. At the same time, specialist industrial automation firms have introduced ruggedized gateways optimized for harsh environments, reinforcing their foothold in factories, utilities, and process control applications.

In parallel, a cadre of emerging vendors has gained traction by focusing on vertical-specific solutions, such as automotive-grade gateways with advanced driver assistance interfaces, and healthcare-certified devices that comply with medical data standards. These nimble providers often collaborate with system integrators and cloud platform operators to co-develop reference architectures that streamline deployment timelines. Additionally, open-source communities are contributing to the landscape by offering customizable firmware and edge AI frameworks, enabling ecosystem partners to differentiate through value-added services.

Competitive differentiation increasingly hinges on the ability to deliver integrated software ecosystems, including device management platforms, security orchestration tools, and analytics pipelines. Vendors that cultivate robust developer support, provide continuous software updates, and foster active user communities are gaining momentum. This dynamic interplay between established global players and innovative newcomers is driving accelerated feature rollouts, pricing competitiveness, and diversified channel engagements in the AI Gateway market.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Gateway market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akamai Technologies, Inc.

- Amazon Web Services, Inc.

- Axway Software S.A.

- Cloudflare, Inc.

- Databricks

- Domino Data Lab

- Ensemble Labs Inc

- Eolink platform

- F5, Inc.

- GitLab Inc

- Google by Alphabet Inc.

- HAProxy Technologies, LLC

- Helicone, Inc

- IBM Corporation

- Infosys Limited

- Intel Corporation

- Kong Inc.

- KRAKEND S.L.

- LangDB

- Lunar.dev

- Microsoft Corporation

- Portkey, Inc.

- Salesforce.com, Inc.

- Solo.io, inc.

- Tata Consultancy Services Limited

- Traefik Labs

- Tyk Technologies Ltd

- WSO2 LLC

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Risk Opportunities and Accelerating Innovation in AI Gateway Markets

Industry leaders can capitalize on market opportunities and mitigate risks by adopting a series of actionable strategies tailored to the AI Gateway ecosystem. First, prioritizing modular hardware architectures that allow rapid customization and component substitution will enhance resilience against trade policy shifts and supply chain disruptions. Investing in multi-tier component qualification, with backup suppliers for critical chips and enclosures, can further reduce single-source risks and foster long-term cost stability.

Second, forging strategic partnerships along the value chain, including collaborations with cloud providers for seamless integration and alliances with industry consortia to stay ahead of regulatory requirements, will strengthen solution portfolios and accelerate go-to-market cycles. Emphasizing security by design-through built-in encryption, identity management, and automated compliance checks-will differentiate offerings and support adoption in highly regulated sectors such as healthcare and finance. Additionally, embracing service-oriented business models, like subscription-based firmware updates and managed analytics services, can unlock recurring revenue streams and deepen customer relationships.

Finally, tailoring channel strategies to segment-specific needs-such as providing hands-on training and certification programs for offline installers, optimizing e-commerce platforms with interactive configuration tools, and equipping direct sales teams with vertical-focused value propositions-will maximize market coverage and customer satisfaction. Combining these measures with continuous monitoring of tariff landscapes, localized inventory planning, and proactive risk assessments will position organizations to navigate complexity and achieve sustainable growth in the AI Gateway market.

Detailing Rigorous Research Methodology Combining Qualitative Insights Quantitative Analysis and Multisource Data Triangulation for Robust Findings

The findings presented in this report are underpinned by a rigorous research methodology that blends qualitative and quantitative approaches to ensure robustness and reliability. In the primary research phase, structured interviews were conducted with senior executives, technical architects, and procurement specialists across leading enterprises and technology vendors. These dialogues provided firsthand perspectives on evolving requirements, decision-making criteria, and forward-looking investment plans.

Complementing the primary insights, extensive secondary research encompassed examination of corporate white papers, industry standards documentation, regulatory filings, and technology roadmaps. This process enabled validation of key trends, benchmarking of competitive positioning, and identification of best practices in gateway design and deployment. To fortify the analysis, multiple data sources were triangulated-cross-referencing qualitative narratives, vendor disclosures, and third-party analytics-to reconcile discrepancies and mitigate bias.

Finally, the segmentation framework was applied to map adoption patterns across product types, applications, channels, end use industries, and material specifications, while regional analysis incorporated localized regulatory and infrastructure considerations. Throughout the research process, iterative reviews with industry stakeholders and technical experts ensured that the conclusions and recommendations reflect pragmatic realities and deliver actionable intelligence for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Gateway market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Gateway Market, by Product Type

- AI Gateway Market, by Module

- AI Gateway Market, by Application

- AI Gateway Market, by End-Use Industry

- AI Gateway Market, by Organization Size

- AI Gateway Market, by Deployment Mode

- AI Gateway Market, by Region

- AI Gateway Market, by Group

- AI Gateway Market, by Country

- United States AI Gateway Market

- China AI Gateway Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesis of Critical Discoveries Illuminating Market Implications Strategic Imperatives and the Path Forward for Stakeholders Engaged in AI Gateway Innovation

This executive summary synthesizes pivotal discoveries across technology evolution, trade dynamics, segmentation nuances, regional variations, and competitive strategies that collectively define the AI Gateway market. The landscape is characterized by relentless innovation in edge AI processing, driven by the convergence of advanced networking, modular architectures, and security regulations that reshape solution architectures. Meanwhile, external factors such as the United States tariffs in 2025 have highlighted the imperative for agile supply chains, nearshoring considerations, and component consolidation to sustain margin performance.

Segmentation analysis revealed that product tiering-from economy solutions to luxury and specialty offerings-aligns with differentiated value propositions, while vertical applications in automotive, consumer electronics, and industrial domains demand bespoke feature sets and certifications. Distribution channels exhibit varied trade-off between direct integration services, traditional offline networks, and digital platforms, each necessitating distinct marketing and support approaches. Regional insights further underscore the role of local regulations, infrastructure readiness, and sector priorities in shaping adoption trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

As competition intensifies, leading and emerging vendors alike must embrace strategic collaborations, prioritize security-first designs, and cultivate developer ecosystems to maintain relevance. By weaving together these critical imperatives, stakeholders can chart a clear path forward-balancing innovation with operational discipline, leveraging data-driven decision making, and proactively addressing evolving market conditions to seize the full potential of AI Gateways.

Connect with Ketan Rohom Today to Access Exclusive AI Gateway Market Research Insights and Accelerate Your Strategic Decision Making with Expert Guidance

This market research report on AI Gateways offers a comprehensive and in-depth exploration of emerging trends, competitive landscapes, and strategic opportunities. To unlock the full potential of these insights and equip your organization with actionable intelligence, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss tailored solutions that align with your priorities and objectives. By engaging with Ketan, you will gain privileged access to proprietary data, one-on-one briefing sessions, and bespoke research supplements that are not publicly available. His expertise in translating complex technical and commercial findings into practical strategies will ensure that you can rapidly operationalize key recommendations, optimize investment decisions, and outperform competitors. Take the next step toward securing a robust understanding of the AI Gateway market, mitigating emerging risks, and securing long-term competitive advantage. Reach out today to schedule a briefing, explore customized research packages, and begin leveraging our rigorous analysis to guide your strategic roadmap.

- How big is the AI Gateway Market?

- What is the AI Gateway Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?