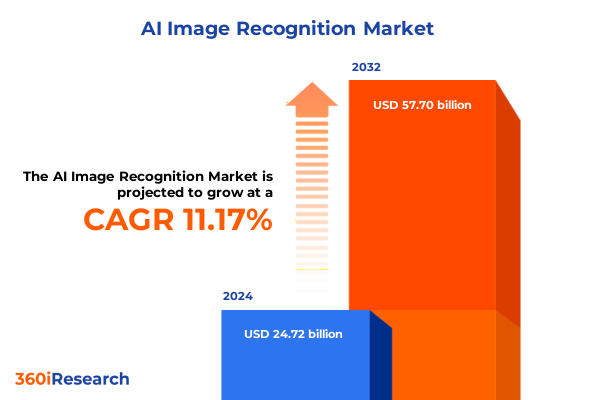

The AI Image Recognition Market size was estimated at USD 27.33 billion in 2025 and expected to reach USD 30.25 billion in 2026, at a CAGR of 11.26% to reach USD 57.70 billion by 2032.

Unlocking the Power of Visual Intelligence as Advances in Deep Learning and Edge Computing Fuel New AI Image Recognition Horizons

Unlocking the transformative potential of AI image recognition begins with understanding its foundational principles and industry drivers. Over the past decade, advances in deep learning algorithms, computational power, and sensor miniaturization have collectively accelerated the ability of machines to interpret, analyze, and act upon visual data in real time.

These technological breakthroughs have ushered in new use cases across sectors, from automated quality inspections in manufacturing to real-time threat detection in security and surveillance. The integration of machine learning frameworks and edge computing architectures has not only improved processing speeds but also enabled on-device analytics, reducing latency and enhancing data privacy. Simultaneously, the confluence of cloud-based services and scalable storage solutions has empowered organizations to process vast image datasets and refine models with greater accuracy.

In tandem, evolving regulatory landscapes around data security and ethical AI practices are shaping vendor strategies, compelling companies to adopt transparent model training practices and robust privacy safeguards. This convergence of technological innovation, operational demands, and policy considerations is redefining competitive dynamics.

As stakeholders across industries recognize the strategic value of visual intelligence, organizations are reallocating resources toward AI image recognition initiatives, setting the stage for an era where visual data drives actionable insights, operational efficiencies, and new revenue streams.

Navigating a New Era of AI Image Recognition Through Hybrid Model Architectures and Explainable AI Innovations

The landscape of AI image recognition has been fundamentally reshaped by the rise of hybrid architectures that seamlessly combine convolutional neural networks with transformer-based models. This hybridization has significantly enhanced pattern recognition capabilities, enabling systems to detect subtle visual cues across diverse imaging contexts. At the same time, innovations in data augmentation techniques and synthetic image generation have expanded the scope of training datasets, bolstering model robustness against real-world variability.

Parallel advancements in hardware accelerators, including application-specific integrated circuits and neural processing units, are driving down power consumption while boosting inference speeds. These improvements facilitate deployment of AI image recognition modules on resource-constrained devices, opening up new frontiers in areas like autonomous vehicles, wearables, and mobile robotics. Furthermore, the proliferation of 5G connectivity has enabled distributed inference pipelines, where preliminary processing occurs at the edge and complex analyses are offloaded to cloud servers, ensuring scalability and responsiveness.

Additionally, increased emphasis on explainable AI techniques is fostering greater trust and adoption among enterprise users. By providing clear visualizations of decision pathways and confidence metrics, organizations can mitigate risks associated with model biases and ensure compliance with evolving ethical guidelines. This trajectory of technological integration, from advanced architectures to transparent analytics, is redefining precision imaging strategies and unlocking transformative applications across industries.

Assessing How Recent United States Tariffs on Imaging Components and AI Technology Are Reshaping Competitive Dynamics and Supply Chains

The introduction of sweeping U.S. tariffs on imported imaging components and AI technology in early 2025 has introduced new complexities into the global supply chain. Broad-based duties, starting at 10 percent on a wide range of components and escalating to 34 percent for Chinese-sourced hardware, have led vendors and integrators to reevaluate sourcing strategies and cost structures.

Suppliers that depend heavily on Asian manufacturing hubs have faced significant margin pressures, prompting a shift toward domestic production and diversification of manufacturing locations. This transition, however, has been neither immediate nor seamless; companies that previously optimized around just-in-time imports now contend with longer lead times, higher inventory carrying costs, and capital investments to repatriate or establish new assembly lines in regions with favorable tariff regimes.

Simultaneously, the legal challenge encapsulated in the V.O.S. Selections case, where the Court of International Trade determined that certain executive tariff orders exceeded presidential authority, underscores the fluid nature of trade policy and its direct bearing on technology markets. As companies await regulatory clarifications, some are leveraging tariff mitigation strategies, such as tariff classification reviews and tariff engineering, to reduce duty liabilities.

Overall, these tariff-driven shifts are accelerating localization trends, incentivizing partnerships with domestic component suppliers, and spurring investment in regional production clusters, all of which are reshaping the competitive landscape for AI image recognition solutions.

Delineating the Market Through Component Technology Application Industry and Deployment Perspectives to Reveal Hidden Growth Opportunities

When examining the AI image recognition landscape through the lens of component segmentation, it becomes evident that hardware innovation is steadily pushing the boundaries of sensor sensitivity and processing throughput. Cameras with higher resolution and dynamic range are complemented by specialized processors and increasingly sophisticated sensors, all of which are augmented by a growing ecosystem of consulting services, deployment expertise, and integration capabilities. Moreover, software innovations-from advanced analytics tools to real-time image processing frameworks and bespoke machine learning algorithms-are central to unlocking the full potential of these hardware components.

Segmenting by technology reveals a diversification of capabilities, as code recognition, facial recognition, and object recognition systems are now complemented by optical character recognition and advanced pattern recognition algorithms. This breadth of technological specialization allows providers to tailor solutions to niche use cases, whether for industrial inspection, identity verification, or contextual content analysis.

Application segmentation further highlights how AI image recognition is permeating both consumer-facing and enterprise domains. Augmented reality platforms, image search engines, and targeted marketing applications leverage visual metadata to create immersive experiences, while scanning and imaging operations in healthcare and manufacturing ensure quality control and diagnostic accuracy. Security and surveillance solutions, in turn, depend on high-precision object and facial recognition to maintain safety and regulatory compliance.

Finally, considering end-user industry segmentation, sectors such as automotive, BFSI, entertainment and media, healthcare, manufacturing, and retail each adopt AI image recognition to address distinct operational challenges. Deployment mode segmentation-spanning cloud-based and on-premise configurations-further allows organizations to balance scalability with data sovereignty and latency requirements. Together, these segmentation perspectives provide a comprehensive view of evolving market priorities and opportunity spaces.

This comprehensive research report categorizes the AI Image Recognition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User Industry

- Deployment Mode

Exploring How the Americas EMEA and Asia-Pacific Regions Drive Innovation and Adaptation in AI Image Recognition Ecosystems

Regional patterns in AI image recognition adoption reflect a blend of technological capacity, regulatory environments, and infrastructure readiness. In the Americas, the United States and Canada benefit from robust R&D ecosystems and a favorable investment climate. Major tech hubs in North Carolina, California, and Ontario drive regional innovation, with enterprises increasingly integrating AI-powered imaging into manufacturing lines, autonomous systems, and consumer electronics.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasizing data protection and ethical AI have spurred development of localized solutions that prioritize privacy and transparency. The European Union’s AI Act and similar legislative initiatives in the UK and GCC nations have motivated vendors to design systems with built-in explainability and compliance features, supporting sectors such as automotive manufacturing in Germany, financial services in the UK, and security infrastructure in the UAE.

The Asia-Pacific region presents a heterogeneous yet dynamic picture, with leading markets like China, Japan, South Korea, and India pushing the frontier in smart city deployments, healthcare diagnostics, and e-commerce personalization. Government-backed innovation programs and industry consortia in China and Korea are driving large-scale pilot projects, while India’s burgeoning startup ecosystem is leveraging affordable sensor arrays and open-source machine learning frameworks to democratize access to visual intelligence.

Collectively, these regional insights underscore the importance of localized strategies in product development, compliance, and go-to-market approaches to address distinctive customer needs and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the AI Image Recognition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Challengers in AI Image Recognition to Understand Strategic Moves and Competitive Differentiators

Leading players in AI image recognition span a spectrum from established technology giants to agile startups. Well-capitalized firms leverage extensive R&D budgets to push the boundaries of model architectures and hardware acceleration, while emerging challengers focus on niche applications and rapid go-to-market capabilities. Strategic partnerships between cloud service providers, semiconductor manufacturers, and algorithm specialists have become increasingly common as companies seek to deliver end-to-end solutions.

Mergers and acquisitions activity has been particularly notable among hardware vendors integrating vertically into software and services offerings. Such consolidation allows companies to offer comprehensive imaging platforms that blend sensor design with proprietary analytics engines. At the same time, software-centric providers are forming alliances with system integrators to streamline deployment and customization for specific industries.

Investment flows into startups specializing in domain-specific recognition tasks-such as medical imaging anomaly detection and precision agriculture monitoring-highlight the continued appetite for specialized AI solutions that tackle unique challenges. Meanwhile, enterprise-grade vendors are enhancing their portfolios with advanced security features, intuitive model management consoles, and scalable architectures tailored to hybrid cloud environments.

This competitive milieu underscores the importance of aligning technological innovation with customer outcomes, ensuring that product roadmaps not only address current market demands but also anticipate emerging industry trends and compliance requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Image Recognition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airy3D Inc.

- Amazon Web Services, Inc.

- Anthropic PBC

- Blippar Group Limited

- Clarifai, Inc.

- Cognitec Systems

- DataRobot, Inc.

- Delaware corporation

- Fritz Labs Inc.

- Google LLC by Alphabet Inc.

- Honeywell International Inc.

- Huawei Cloud Computing Technologies Co., Ltd.

- Infrrd Inc.

- Intel Corporation

- International Business Machines Corporation

- iProov Ltd

- MERCURIO PLATFORM, S.L.

- Microsoft Corporation

- Monolith AI Ltd.

- NEC Corporation

- Nvidia Corporation

- Oracle Corporation

- Panasonic Holdings Co., Ltd.

- Qualcomm Technologies, Inc.

- Snap2Insight Inc.

- Standard Cognition, Corp

- Toshiba Corporation

- Trax Technology Solutions Pte Ltd.

- Vispera Information Technologies

- Ximilar s.r.o.

Strategic Imperatives for Industry Leaders to Capitalize on AI Image Recognition Advances While Mitigating Operational and Regulatory Risks

Industry leaders must adopt a multifaceted strategy to harness AI image recognition effectively and sustain competitive differentiation. First, prioritizing modular architectures that support plug-and-play hardware components and flexible deployment modes can accelerate time to market and accommodate evolving customer requirements. In parallel, embedding explainability frameworks into model development pipelines not only builds stakeholder trust but also facilitates compliance with stringent regulatory standards.

Second, organizations should cultivate strategic partnerships across the ecosystem, spanning hardware suppliers, cloud vendors, and specialized integrators. Such alliances enable rapid scaling, shared R&D investment, and streamlined support channels, which collectively reduce implementation risks. Additionally, aligning with academic research institutions and participating in open innovation consortia can grant early access to breakthrough algorithms and emerging best practices.

Third, investing in talent development and upskilling is essential. Cross-disciplinary teams that combine expertise in computer vision, data engineering, and domain knowledge are better positioned to translate complex visual data into actionable insights. Providing ongoing education on topics such as bias mitigation, adversarial robustness, and ethical AI ensures that implementations remain resilient and socially responsible.

Finally, adopting a robust monitoring framework that leverages real-time performance metrics and feedback loops allows continuous optimization of AI image recognition systems. By proactively identifying drift, retraining models, and incorporating newly acquired data, companies can maintain high accuracy levels and adapt swiftly to changing operational conditions.

Unveiling the Robust Research Framework and Data Collection Approaches That Underpin This In-Depth Analysis of AI Image Recognition Market Dynamics

This research relied on a rigorous combination of primary and secondary data collection methods to ensure comprehensive market coverage and accuracy. Primary research involved in-depth interviews with key stakeholders, including technology providers, system integrators, and end users across industries. These discussions provided nuanced perspectives on adoption drivers, pain points, and future requirements for AI image recognition implementations.

Secondary research entailed a thorough review of public filings, patent databases, industry publications, and governmental policy documents. Tariff announcements, trade litigation rulings, and regulatory guidelines were examined to assess their implications for component sourcing and market access. Additionally, technology white papers and academic journal articles informed our understanding of emerging model architectures and hardware innovations.

Data validation involved triangulating findings from multiple sources, enabling robust cross-verification of adoption rates, technological trends, and regional deployment patterns. Quantitative inputs, such as import-export statistics and production capacity data, were integrated with qualitative insights to construct a holistic view of market dynamics.

Finally, the research approach emphasized transparency and repeatability. Methodological assumptions, data sources, and calculation frameworks are documented in the appendix, facilitating peer review and future updates to the analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Image Recognition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Image Recognition Market, by Component

- AI Image Recognition Market, by Technology

- AI Image Recognition Market, by Application

- AI Image Recognition Market, by End User Industry

- AI Image Recognition Market, by Deployment Mode

- AI Image Recognition Market, by Region

- AI Image Recognition Market, by Group

- AI Image Recognition Market, by Country

- United States AI Image Recognition Market

- China AI Image Recognition Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Learnings and Future Outlook for AI Image Recognition and Tailored Insights to Guide Next-Generation Visual AI Investments

In conclusion, the AI image recognition landscape stands at the confluence of technological innovation, supply chain realignment, and evolving regulatory mandates. Hybrid model architectures and hardware accelerators are driving unprecedented levels of precision, while tariff-induced localization efforts are reshaping competitive supply chains and supplier networks.

Segmentation insights reveal that opportunities abound across hardware components, software solutions, specialized technologies, industry applications, and flexible deployment modes. Regional variances underscore the criticality of tailoring go-to-market strategies to local regulations, infrastructure maturity, and customer priorities.

Strategic imperatives for industry players include fostering ecosystem partnerships, embedding explainable AI frameworks, investing in talent development, and implementing modular, scalable architectures. These actions will enable organizations to navigate operational complexities, ensure compliance, and deliver maximum value from visual intelligence initiatives.

As enterprises and governments accelerate their digital transformation journeys, AI image recognition will continue to emerge as a cornerstone technology. By adopting the insights, methodologies, and recommendations outlined in this report, decision makers can chart a clear path forward, positioning their organizations to capture the full spectrum of benefits that visual AI offers.

Engage Directly with Ketan Rohom to Access In-Depth AI Image Recognition Market Research and Unlock Tailored Strategic Insights

We invite industry visionaries and decision makers to explore this comprehensive market research report by connecting with Associate Director of Sales & Marketing Ketan Rohom. His expertise in AI image recognition market dynamics ensures that your organization will receive tailored insights, practical recommendations, and strategic guidance to stay ahead in this rapidly evolving landscape.

By engaging with Ketan Rohom, you will gain direct access to in-depth analyses, exclusive data interpretations, and scenario planning frameworks that empower you to make informed strategic decisions. Whether you are seeking to refine your technology roadmap, optimize your supply chain in the wake of new tariffs, or identify emerging regional growth pockets, this report provides the granular intelligence your team needs.

Securing your copy of the report also includes a personalized briefing session where Ketan will discuss the findings, address your specific challenges, and outline actionable next steps. This collaborative approach not only enhances your understanding of the AI image recognition ecosystem but also positions your organization to capitalize on the market’s most promising opportunities.

Act now to ensure your competitive advantage in the AI image recognition domain by contacting Ketan Rohom for immediate access to the full research report.

- How big is the AI Image Recognition Market?

- What is the AI Image Recognition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?