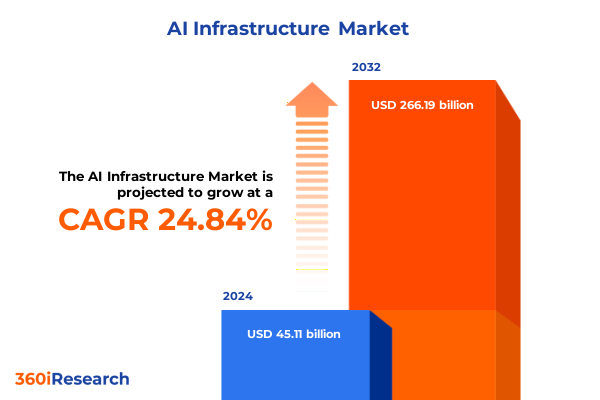

The AI Infrastructure Market size was estimated at USD 48.71 billion in 2025 and expected to reach USD 61.29 billion in 2026, at a CAGR of 26.59% to reach USD 253.89 billion by 2032.

Establishing the Context for AI Infrastructure Adoption Amidst Accelerated Technological Breakthroughs and Growing Organizational Imperatives

As enterprises across the globe accelerate their digital transformation journeys, the underlying infrastructure that powers artificial intelligence has risen to the forefront of strategic planning. Innovations in processor architectures and system design are converging with the growing adoption of AI-driven applications, creating a convergence point where capability meets demand. Leading organizations recognize that without a clear understanding of the evolving AI infrastructure landscape, investments risk falling short of performance expectations and total cost of ownership objectives. Consequently, it has become imperative to lay a firm foundation of market awareness and technical insight before embarking on procurement or deployment initiatives.

This executive summary distills the critical forces shaping AI infrastructure today, presents an in-depth look at recent policy and regulatory shifts, and highlights key segmentation imperatives that inform tailored strategies. By weaving together qualitative analysis of hardware, software, and services with an examination of deployment models and end-user requirements across diverse industries, readers will be equipped with a holistic view that bridges high-level trends with operational realities. The following sections are designed to guide decision makers through the major inflection points that define the current moment in AI infrastructure evolution.

Unveiling the Transformational Shifts Reshaping AI Infrastructure from Emerging Architectures to Evolving Ecosystem Dynamics

The AI infrastructure ecosystem is in the midst of a profound transformation driven by breakthroughs in semiconductor design, advances in interconnect technologies, and the proliferation of cloud and edge computing paradigms. At the hardware level, the rise of specialized AI accelerators and composable system architectures has unlocked new performance thresholds, enabling organizations to process complex machine learning workloads with unprecedented speed and efficiency. Simultaneously, software platforms are evolving to provide unified frameworks that simplify model training and deployment across heterogeneous compute environments.

Ecosystem partnerships and open-source initiatives are also reshaping the vendor landscape, reducing integration friction and fostering innovation through collaborative development. Companies are increasingly leveraging shared reference designs and standardized APIs to accelerate time to market and ensure interoperability between layers of the stack. As these transformative shifts continue to unfold, enterprises must navigate a marketplace where agility and adaptability are as critical as raw compute performance, aligning their strategic roadmaps with emerging architectural patterns and evolving best practices.

Analyzing the Ripple Effects of 2025 United States Tariff Adjustments on the AI Infrastructure Supply Chain and Investment Landscape

In 2025, the United States implemented a series of targeted tariffs that have reverberated through global supply chains, particularly affecting the cost structures and procurement strategies for AI infrastructure. Hardware manufacturers reliant on imported high-end compute components have encountered increased input costs, prompting some to seek alternative assembly locations or negotiate long-term supplier agreements to mitigate margin erosion. These actions have had a dual effect of decelerating short-term deployment cycles while galvanizing efforts to diversify sourcing and onshore critical production capabilities.

Moreover, the tariff adjustments have catalyzed a renewed focus on software and services offerings as organizations look to offset capital expenditure pressures through managed solutions and consumption-based models. System integrators and consulting firms have reported heightened demand for guidance on optimizing existing assets and designing tariff-resilient architectures. As investment priorities adapt to this new fiscal landscape, stakeholders must weigh the trade-offs between localized manufacturing for compliance and the performance benefits of globalized component ecosystems.

Deriving Actionable Insights from Multi Dimensional Segmentation Spanning Offerings Deployment Modes and Industry Specific Applications

A granular examination of the market across offerings reveals that hardware investments continue to be driven by the necessity for AI accelerators and high-performance compute nodes, complemented by networking fabric and storage subsystems capable of handling massive datasets. Concurrently, demand for services spans from strategic consulting engagements to hands-on implementation, ongoing support and maintenance, and specialized training programs designed to upskill in-house teams. On the software front, enterprises are prioritizing comprehensive AI frameworks and platforms alongside robust data management tools, advanced optimization and monitoring suites, and rigorous security and compliance solutions to safeguard sensitive workloads.

Deployment type insights further underscore the industry’s shift toward hybrid models: cloud infrastructures leveraging IaaS, PaaS, and SaaS options coexist with edge deployments in automotive, factory, healthcare, and retail environments, while on-premise solutions remain critical for large enterprises, small and medium businesses, and emerging startups with unique performance or regulatory requirements. Finally, the lens of end-user verticals highlights differentiated use cases-from customer analytics, fraud detection, and risk management in financial services to genomics, medical imaging, and patient analytics in healthcare, with additional applicability in energy trading, grid management, citizen services, infrastructure management, and supply chain optimization. Taken together, these segmentation dimensions reveal nuanced patterns of adoption and evolving investment priorities across the AI infrastructure ecosystem.

This comprehensive research report categorizes the AI Infrastructure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Deployment Type

- End User

Navigating the Diverse Regional Tapestry and Strategic Nuances Impacting AI Infrastructure Evolution across Three Major Global Markets

Looking across geographic regions, the Americas continue to lead in the deployment of large-scale AI infrastructure projects, driven by substantial investments from hyperscale cloud providers and a competitive landscape characterized by aggressive R&D spending. This region also benefits from a mature ecosystem of technology startups and established OEMs collaborating on next-generation compute innovations. In contrast, Europe, the Middle East, and Africa present a tapestry of regulatory frameworks and funding mechanisms, where pan-regional initiatives aim to strengthen local manufacturing capabilities and data sovereignty, even as national governments invest in digital transformation agendas.

Meanwhile, the Asia-Pacific region stands out for its rapid adoption of edge computing use cases in automotive and manufacturing sectors, underpinned by government-led industrial digitization programs and a burgeoning local supply chain for semiconductors and system integration. This regional dynamic is further amplified by strategic partnerships between global cloud providers and regional telecom operators, accelerating the rollout of distributed AI services. Understanding these distinct market dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific is crucial for stakeholders seeking to calibrate their go-to-market strategies and align resource allocation with regional growth vectors.

This comprehensive research report examines key regions that drive the evolution of the AI Infrastructure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading AI Infrastructure Innovators and Strategic Movers Driving Competitive Dynamics and Technology Leadership

Innovation leaders in AI infrastructure are distinguished by their integrated approach to hardware-software co-design and deep ecosystem collaboration. Key technology providers are investing heavily in custom ASIC development and open-source software stacks to deliver turnkey solutions that address end-to-end requirements. At the same time, hyperscale cloud operators are differentiating their offerings through scalable orchestration platforms and proprietary performance optimizations, positioning themselves as both infrastructure providers and technology partners.

Strategic alliances between chip manufacturers, network equipment vendors, and systems integrators have given rise to reference architectures that streamline deployment cycles. Consulting firms and managed service providers are enhancing their portfolios with vertical-specific accelerators and domain-expert services to reduce integration risk and speed time to value for customers. In addition, emerging entrants focused on security and compliance are carving out niche positions by providing encryption, identity management, and audit trail solutions that integrate seamlessly with existing AI stacks. These competitive dynamics underscore the importance of cross-sector collaboration and continuous innovation for companies seeking to maintain a leadership position.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Infrastructure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices Inc.

- Alibaba Cloud

- Amazon Web Services, Inc.

- Arm Holdings plc

- Baidu Inc.

- Cerebras Systems

- Cisco Systems Inc.

- CoreWeave

- Dell Technologies Inc.

- Google LLC

- Graphcore

- Groq Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Intel Corporation

- Meta Platforms Inc.

- Micron Technology Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- Samsung Electronics Co. Ltd.

- SK hynix Inc.

- Synopsys Inc.

- Taiwan Semiconductor Manufacturing Co., Ltd.

Translating Insights into Strategic Imperatives with Actionable Recommendations for Executive Stakeholder Engagement and Operational Excellence

To capitalize on the opportunities inherent in the evolving AI infrastructure market, industry leaders should first prioritize a modular architecture strategy that accommodates both current workloads and future technological advances. This requires building a flexible foundation of compute, networking, and storage subsystems that can be upgraded incrementally and managed through unified orchestration platforms. Collaboration with hardware vendors to secure early access to next-generation accelerators will further position organizations to pilot advanced use cases and benchmark emerging performance metrics.

Second, executives must develop a comprehensive skills development program that balances internal training with external consulting and managed services. By fostering a culture of continuous learning and cross-functional collaboration, organizations can ensure that technical teams remain adept at deploying, optimizing, and maintaining complex AI environments. Third, companies should adopt a multi-regional deployment framework that aligns local regulatory compliance and data sovereignty requirements with performance and latency objectives. Leveraging a blend of cloud, edge, and on-premise architectures will enable stakeholders to tailor solutions to specific use cases and customer segments while maintaining operational agility.

Finally, stakeholders should implement a robust vendor evaluation process that incorporates proof-of-concept trials, interoperability testing, and security assessments. By embedding these practices into procurement cycles, leaders can mitigate integration risks and achieve faster time to value. Collectively, these strategic imperatives will empower decision makers to translate deep market insights into actionable roadmaps that drive both innovation and operational efficiency.

Defining the Robust Mixed Methodology Framework Ensuring Rigor and Reliability in the AI Infrastructure Market Research Process

This research methodology is grounded in a rigorous mixed-methods approach, combining primary and secondary data to ensure comprehensive coverage and analytical depth. The secondary research phase involved extensive review of technical white papers, industry publications, regulatory filings, and proprietary databases to map market trends and technological advancements. Concurrently, primary interviews were conducted with senior executives, solution architects, and domain experts across hardware vendors, cloud providers, system integrators, and end-user organizations to capture first-hand insights and validate emerging themes.

Data triangulation was employed to reconcile discrepancies between different information sources, while a structured framework was used to standardize inputs across offerings, deployment models, and end-user segments. Qualitative findings were supplemented with scenario-based case studies to illustrate real-world applications and investment considerations. Throughout the process, strict data governance protocols and confidentiality agreements ensured the integrity and proprietary protection of all interview data and proprietary inputs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Infrastructure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Infrastructure Market, by Offering

- AI Infrastructure Market, by Deployment Type

- AI Infrastructure Market, by End User

- AI Infrastructure Market, by Region

- AI Infrastructure Market, by Group

- AI Infrastructure Market, by Country

- United States AI Infrastructure Market

- China AI Infrastructure Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2703 ]

Summarizing Key Takeaways and Synthesis of Critical Findings to Equip Decision Makers with Clarity and Confidence

Throughout this analysis, key themes have emerged that underscore the critical interdependence of hardware, software, and services in driving AI infrastructure innovation. The shift toward specialized accelerators and composable architectures, combined with evolving tariff landscapes and regional dynamics, presents both challenges and opportunities for stakeholders. By examining segmentation across offerings, deployment types, and end-user verticals, we have highlighted the nuanced pathways through which organizations can tailor their investments to meet performance, compliance, and cost objectives.

As decision makers reflect on these findings, the importance of agility, ecosystem collaboration, and strategic vendor partnerships becomes evident. Executives equipped with a nuanced understanding of policy impacts, regional differentiators, and competitive dynamics are better positioned to navigate uncertainty and capitalize on the next wave of AI-driven transformation. This report serves as a foundational roadmap for leaders intent on building resilient, future-ready infrastructure environments that sustain long-term growth and innovation.

Engage with Ketan Rohom for Exclusive Access and Personalized Guidance to Secure the Comprehensive AI Infrastructure Market Intelligence Report

For organizations poised to harness the transformative power of AI infrastructure, securing the insights and intelligence contained within our market research report represents an unparalleled opportunity to stay ahead of the curve. Ketan Rohom, Associate Director of Sales & Marketing, is ready to provide personalized guidance and address any inquiries you may have as you tailor these strategic findings to your unique business context. Reach out today to explore flexible licensing options, engage in a one-on-one consultation to align the report’s discoveries with your growth objectives, and gain early access to quarterly updates that ensure you remain at the forefront of innovation. Don’t miss this chance to convert deep market intelligence into decisive action-contact Ketan Rohom to embark on your journey toward operational excellence and competitive leadership in AI infrastructure.

- How big is the AI Infrastructure Market?

- What is the AI Infrastructure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?