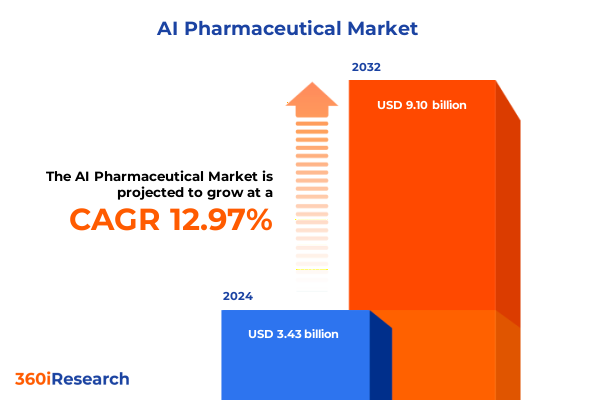

The AI Pharmaceutical Market size was estimated at USD 3.69 billion in 2025 and expected to reach USD 4.22 billion in 2026, at a CAGR of 13.73% to reach USD 9.10 billion by 2032.

Pioneering the Convergence of Artificial Intelligence and Pharmaceutical R&D to Revolutionize Drug Development Paradigms and Enhance Patient Outcomes

The pharmaceutical industry stands at a pivotal juncture where artificial intelligence is no longer a futuristic concept but a practical necessity. Over the past decade, growing computational power and the proliferation of big data have set the stage for AI to permeate every phase of drug development. From initial target identification through late-stage clinical trials, machine learning algorithms and advanced analytics are enhancing predictive accuracy, reducing timelines, and enabling more personalized treatment strategies. This convergence of technology and life sciences is transforming traditional R&D models, driving a shift from reactive problem-solving to proactive innovation.

With regulatory bodies increasingly recognizing the validity of AI-derived insights and real-world evidence, stakeholders across biopharmaceutical, academic, and clinical settings are allocating resources toward digital transformation. Venture capital funding and partnership deals indicate a clear consensus: companies that harness AI effectively will define the next frontier in therapeutic breakthroughs. As we embark on this report, we outline the current landscape, dissect transformative shifts, and explore how a strategic understanding of AI’s capabilities can optimize pipelines, enhance patient outcomes, and unlock new commercial value.

Emergence of Data-Driven Platforms and Collaborative Ecosystems Catalyzing Unprecedented Shifts in Pharmaceutical Innovation and Operational Efficiency

The landscape of pharmaceutical innovation is undergoing transformative shifts driven by the integration of data-driven platforms and collaborative ecosystems. Historically, drug discovery followed a linear path characterized by siloed research groups and sequential handoffs. Today, AI-enabled platforms unify disparate data sources-genomic profiles, electronic health records, chemical libraries, and real-world patient data-into cohesive frameworks that support end-to-end project visibility. By leveraging natural language processing and predictive analytics, these platforms accelerate hypothesis generation and streamline decision-making, ensuring that promising candidates are advanced with greater confidence and fewer surprises.

Simultaneously, strategic alliances are emerging between biopharmaceutical firms, technology vendors, and academic centers to co-develop AI tools and co-manage data assets. These collaborations extend beyond basic research, encompassing joint ventures in clinical trial design, digital health implementations, and post-market surveillance. Such cooperative models distribute risk and pool expertise, creating a fertile environment for innovation. As technology matures, we are witnessing a recalibration of roles: traditional service providers are transforming into solution architects, while pharmaceutical leaders adopt a more hands-on approach to technology integration. These shifts set the stage for sustained improvements in speed, cost-effectiveness, and therapeutic outcomes.

Assessing the Multi-Dimensional Impact of Progressive 2025 United States Tariffs on Pharmaceutical AI Supply Chains and Technology Adoption Strategies

In 2025, the United States implemented progressive tariffs on imported technology components and advanced computing hardware critical to AI development. These measures, aimed at protecting domestic manufacturing and promoting onshore semiconductor production, carry far-reaching implications for pharmaceutical companies heavily dependent on specialized chips and cloud-based services. Rising costs for high-performance processors and data storage solutions have compelled R&D teams to reevaluate procurement strategies and negotiate longer-term supply agreements to stabilize budgets and maintain project timelines.

Beyond direct hardware expenses, tariffs have triggered a ripple effect across service providers and cloud platforms that rely on global supply chains for server deployments. Some contract research organizations have passed additional surcharges to maintain margin targets, while others have accelerated investments in hybrid deployment models that balance on-premises infrastructure with public cloud resources. To mitigate these impacts, leading pharmaceutical AI teams are forging strategic partnerships with domestic vendors, optimizing algorithmic efficiency to reduce computational loads, and exploring federated learning approaches that limit data transfers. Cumulatively, these responses are reshaping cost structures and prompting a broader reconsideration of how to deploy and scale AI capabilities in a more protectionist regulatory environment.

Unveiling Holistic Insights Across Component Deployment End Users and Technology Applications to Map the Fragmented Landscape of Pharmaceutical AI Solutions

A nuanced understanding of pharmaceutical AI requires dissecting the market through multiple dimensions. When viewed through the lens of component, solutions bifurcate into software offerings-ranging from algorithmic pipelines for predictive modeling to natural language interfaces for literature mining-and a spectrum of services that include custom model development, validation, and maintenance. The software tools are increasingly modular, enabling seamless integration into existing R&D workflows, while service frameworks provide the human expertise necessary for regulatory compliance and domain-specific customization.

Deployment mode further delineates the competitive landscape: cloud-based implementations offer elasticity and rapid provisioning, supporting burst compute needs during peak trial phases, whereas on-premises installations deliver enhanced data security and performance consistency, often favored by organizations managing sensitive patient records. End users span contract research organizations that leverage AI to differentiate service portfolios; hospitals and clinics integrating predictive diagnostics into care pathways; pharmaceutical companies orchestrating end-to-end digital labs; and research institutes pioneering foundational models in genomics and cheminformatics.

Technological segmentation reveals a layered ecosystem: deep learning architectures, including convolutional neural networks for image-based assays, generative adversarial networks for synthetic data augmentation, and recurrent neural networks for temporal pattern analysis, coexist alongside machine learning paradigms such as supervised learning for classification tasks, unsupervised learning for clustering molecular libraries, and reinforcement learning for optimization of synthesis protocols. Natural language processing modules power language translation across medical literature, sentiment analysis of real-world patient dialogues, and text mining of regulatory documents. Predictive analytics capabilities undergird forecasting of clinical outcomes and predictive modeling of supply chain bottlenecks. Finally, applications span clinical development activities-data monitoring, patient recruitment, trial design-commercialization workflows in market analysis and sales forecasting, drug discovery functions including lead optimization and target identification, manufacturing and supply chain processes focused on process optimization and quality control, and pharmacovigilance tasks such as adverse event reporting and signal detection.

This comprehensive research report categorizes the AI Pharmaceutical market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- Deployment Mode

- End User

Comparative Evaluation of Regional Dynamics Shaping AI-Driven Pharmaceutical Innovation and Adoption Trends Across Americas EMEA and Asia-Pacific Markets

Regional dynamics exert a profound influence on the pace and direction of AI adoption in pharmaceutical R&D and commercialization. In the Americas, robust investment in digital infrastructure and a mature ecosystem of biotech startups create a conducive environment for rapid prototyping and early-stage validation of AI tools. Regulatory frameworks in the United States and Canada are evolving to accommodate real-world evidence, enabling pilot programs that integrate predictive analytics into clinical trial management and patient stratification.

Across Europe, the Middle East, and Africa, diverse regulatory regimes and varying data privacy standards present both opportunities and challenges. European Union initiatives under the AI Act emphasize transparency and risk management, prompting organizations to develop explainable models that satisfy stringent disclosure requirements. In the Middle East, targeted governmental investments in health technology hubs are accelerating AI-supported translational research, while in Africa, collaborations between international research institutes and local health ministries are leveraging predictive models to address resource constraints and optimize vaccine distribution.

The Asia-Pacific region showcases a dynamic interplay between government policy and private sector innovation. China and Japan have announced national strategies to integrate AI into precision medicine programs, with state-funded consortia focused on genomics-guided drug development. Meanwhile, emerging markets such as India and Southeast Asia combine large patient populations with cost-sensitive business models, driving the development of lightweight machine learning solutions and cloud-native platforms optimized for bandwidth constraints and mobile deployment.

This comprehensive research report examines key regions that drive the evolution of the AI Pharmaceutical market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Pioneers Driving AI Integration and Strategic Collaborations to Accelerate Digital Transformation in Pharmaceutical R&D

Leading technology vendors and pharmaceutical incumbents are forging the path forward by embedding AI at the core of their R&D infrastructures. Several multinational life sciences companies have established dedicated AI centers of excellence to centralize data science resources, standardize model development protocols, and ensure alignment with regulatory requirements. Others have opted for strategic investments in specialized startups, securing minority stakes or distribution rights to accelerate time to market for novel AI applications.

Key technology providers supplying foundational hardware and cloud services are enhancing their offerings with domain-specific modules tailored to pharmaceutical workflows. Semiconductor manufacturers are co-designing AI accelerators optimized for molecular simulation and high-throughput screening, while cloud platforms are packaging pre-validated environments for computational drug discovery. Meanwhile, boutique AI consultancies and contract research organizations are differentiating through deep therapeutic expertise and agile engagement models, offering proof-of-concept frameworks that rapidly demonstrate ROI and inform scalability decisions. Collectively, these players are shaping a competitive landscape defined by strategic partnerships, integrated platforms, and a relentless focus on accelerating the drug development life cycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Pharmaceutical market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AION Labs Inc.

- Arzeda Inc.

- AstraZeneca plc

- Atomwise Inc.

- BenevolentAI Ltd

- Cradle Bio B.V.

- Cyclica Inc.

- Deep Genomics Inc.

- Exscientia plc

- Insilico Medicine Inc.

- IQVIA Holdings, Inc.

- Moderna, Inc.

- Novartis AG

- Owkin Inc.

- PathAI, Inc.

- Pfizer Inc.

- Recursion Pharmaceuticals, Inc.

- Relay Therapeutics, Inc.

- Sanofi S.A.

- Schrödinger, Inc.

- XtalPi Holdings Limited

Actionable Strategic Roadmap for Pharmaceutical Executives to Foster AI Adoption Enhance Collaborative Ecosystems and Mitigate Operational Challenges

To capitalize on emerging opportunities, pharmaceutical executives must craft a clear roadmap that balances innovation with operational discipline. First, organizations should cultivate an AI-ready culture by establishing cross-functional teams that include data scientists, clinicians, regulatory specialists, and business strategists to ensure holistic model development and deployment. Early alignment on governance frameworks and performance metrics will mitigate compliance risks and foster shared accountability.

Second, leaders should prioritize modular pilot projects that address high-value pain points-such as predictive patient recruitment or automated pharmacovigilance-demonstrating tangible benefits before scaling to enterprise-wide platforms. By focusing on use cases with measurable ROI, teams can secure executive buy-in and incremental funding, paving the way for broader adoption.

Third, proactive vendor management and supply chain resilience are critical in the face of evolving tariff regimes. Establishing multi-source agreements and investing in algorithmic efficiency will reduce dependency on single suppliers and optimize total cost of ownership. Finally, forging alliances with academic institutions and technology partners can unlock access to novel methodologies and shared data assets, accelerating innovation while distributing risk across the value chain.

Comprehensive Research Framework Integrating Qualitative Interviews Quantitative Analyses and Secondary Data to Deliver Rigorous Insights into AI Applications

This report is underpinned by a comprehensive research framework designed to capture both quantitative and qualitative dimensions of the pharmaceutical AI landscape. Secondary data sources, including peer-reviewed journals, patent filings, regulatory guidelines, and publicly available corporate disclosures, were rigorously reviewed to map technology trends and competitive dynamics. These insights were complemented by primary interviews with senior executives from pharmaceutical companies, technology vendors, contract research organizations, and regulatory bodies to validate assumptions and uncover emerging pain points.

Quantitative analyses leveraged proprietary datasets and standardized metrics to benchmark adoption rates, technology investment patterns, and partnership activities. Statistical methods were applied to identify correlations between AI maturity levels and key performance indicators, while scenario modeling explored potential impacts of regulatory shifts and tariff implementations. Throughout the process, data integrity and methodological transparency were prioritized, with all findings subjected to multiple rounds of validation and peer review to ensure accuracy and relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Pharmaceutical market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Pharmaceutical Market, by Component

- AI Pharmaceutical Market, by Technology

- AI Pharmaceutical Market, by Application

- AI Pharmaceutical Market, by Deployment Mode

- AI Pharmaceutical Market, by End User

- AI Pharmaceutical Market, by Region

- AI Pharmaceutical Market, by Group

- AI Pharmaceutical Market, by Country

- United States AI Pharmaceutical Market

- China AI Pharmaceutical Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings and Strategic Implications to Highlight the Emergent Role of Artificial Intelligence as a Catalyst in Pharmaceutical Innovation

This executive summary synthesizes multifaceted insights into the transformative role of artificial intelligence in pharmaceutical research, development, and commercialization. From the convergence of AI with traditional R&D processes to the emergence of collaborative ecosystems and adaptive regulatory frameworks, the industry is rapidly evolving toward more predictive, efficient, and patient-centric paradigms. Even as protective tariff policies reshape supply chains, organizations that adopt strategic procurement and flexible deployment models can sustain momentum and preserve competitive advantage.

Holistic segmentation analysis underscores the diversity of software, services, deployment modes, and end-user applications, highlighting the importance of tailored solutions that align with organizational objectives and risk appetites. Regional comparisons reveal that while developed markets drive innovation through infrastructure and regulatory support, emerging economies contribute scalable, cost-effective implementations that extend AI’s reach. Through profiles of leading companies and a detailed research methodology, the findings reinforce the critical need for agile governance, cross-functional collaboration, and targeted pilot initiatives.

Looking ahead, the integration of AI into the pharmaceutical value chain will continue to accelerate, with deep learning, natural language processing, and predictive analytics serving as the cornerstones of next-generation discovery and development. Stakeholders who adopt a data-driven mindset, invest in resilient ecosystems, and engage proactively with regulatory and commercial partners will be best positioned to translate technological potential into sustainable clinical and commercial success.

Engage with Our Expert Associate Director to Secure Comprehensive AI Pharmaceutical Insights and Drive Informed Decision Making for Strategic Initiatives

For deeper insights into how artificial intelligence is reshaping pharmaceutical research and to gain a competitive edge in your strategic planning, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide you with tailored guidance on leveraging the latest market intelligence to inform your next initiative and optimize resource allocation. By engaging directly, you’ll receive a detailed briefing on key trends, regulatory considerations, and best practices for integrating AI across drug discovery, clinical development, and commercialization.

Secure your exclusive access to the complete market research report, customized advisory services, and an in-depth consultation that equips your leadership team with actionable insights. Reach out to Ketan Rohom today to explore partnership opportunities and align your organization’s roadmap with emerging innovations in pharmaceutical AI. Elevate your decision-making process with expert support and drive sustainable growth in an increasingly competitive landscape.

- How big is the AI Pharmaceutical Market?

- What is the AI Pharmaceutical Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?