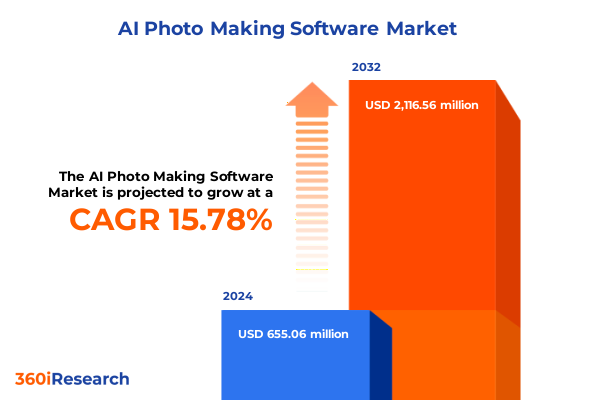

The AI Photo Making Software Market size was estimated at USD 751.41 million in 2025 and expected to reach USD 864.50 million in 2026, at a CAGR of 15.94% to reach USD 2,116.56 million by 2032.

Revolutionizing Visual Storytelling Through Generative AI Photo Creation and Its Strategic Implications for Content Innovation and Creative Workflows

The emergence of AI-driven photo creation software represents a paradigm shift in the creative process, transforming traditional image editing into an automated, generative experience. What began as simple algorithmic filters has evolved into sophisticated platforms capable of producing entirely new visual assets based on text prompts or source imagery. This democratization of creative tools not only broadens access for individual users but also empowers enterprises to streamline workflows, reduce time-to-market for visual content, and unlock new possibilities in advertising, e-commerce, and entertainment.

Fueling this transformation is an unprecedented influx of investment in generative AI technologies. According to data compiled for TechCrunch by financial tracker PitchBook, funding for generative AI companies more than doubled year-over-year in 2024, underscoring strong investor confidence in the potential of these solutions. Capital pours into ventures developing diffusion models, GANs, and neural network architectures optimized for high-resolution imagery, catalyzing rapid innovation across desktop, web, and mobile applications.

Moreover, business adoption has accelerated significantly. Recent survey findings reported by Forbes reveal that nearly three-quarters of executive leaders now engage with generative AI at least weekly, a marked increase from the previous year. This shift signals growing executive recognition of AI’s capacity to enhance creativity, boost productivity, and deliver more personalized, engaging visual experiences. As a result, AI photo creation software has become a strategic imperative, driving competitive differentiation and operational efficiency across industries.

Unprecedented Technological and Market Shifts Driving Rapid Transformation in AI Photo Software Capabilities and User Adoption Trends

Recent years have witnessed transformative shifts in the AI photo creation landscape, propelled by breakthroughs in generative algorithms and model architectures. Cutting-edge diffusion techniques now enable photo-realistic image synthesis at remarkable speeds, while transformer-based models translate text descriptions into complex visual scenes. These advances have redefined the boundaries of what is possible, allowing users to generate high-fidelity backgrounds, incorporate intricate stylistic effects, and even simulate dynamic lighting conditions with minimal manual intervention.

Concurrently, integration across platforms has accelerated adoption. Solutions that were once confined to powerful workstations have migrated to cloud-hosted and hybrid environments, offering scalable GPU access that democratizes intensive compute workloads. Furthermore, mobile applications now leverage on-device AI accelerators to perform real-time enhancements, ensuring that AI-driven editing tools are accessible to a broader audience. This convergence of desktop, cloud, and mobile has unlocked seamless workflows, enabling professionals and hobbyists alike to create, refine, and publish visual content from anywhere.

In parallel, user expectations and use cases have evolved dramatically. Background replacement, batch processing, and portrait enhancement features are now complemented by advanced photo generation and synthesis capabilities that facilitate entirely new creative directions. As a result, organizations can deliver hyper-personalized imagery tailored to individual preferences and market segments, driving deeper engagement and stronger brand experiences. The confluence of these technological and market forces underscores an inflection point where AI photo software becomes indispensable in the digital content ecosystem.

Assessing the Comprehensive Impact of 2025 U.S. Trade Tariffs on AI Photo-Making Software Ecosystems and Related Hardware Supply Chains

The imposition of higher trade tariffs in 2025 has exerted substantial pressure on the ecosystem underpinning AI photo creation software, particularly through its reliance on specialized hardware imports. Research indicates that broad tariffs on semiconductor and electronic components critical to AI servers and data centers have disrupted established supply chains, leading to increased procurement costs and logistical bottlenecks. The cascading effect has been a rise in total cost of ownership for AI infrastructure, prompting firms to reevaluate deployment strategies.

Moreover, analysis from industry observers emphasizes that tariffs on completed server units and GPU-based accelerator boards have created imbalances between component exemptions and finished goods duties. While stand-alone chips may avoid direct levies, the assembled servers incorporating those chips face elevated duties, eroding cost advantages for domestic AI companies. This discrepancy has heightened the complexity of sourcing decisions and forced many organizations to absorb tariff-induced price increases or delay expansion plans.

In addition, the broader directive to reshore critical manufacturing has accelerated government incentives for domestic semiconductor fabrication. Although this shift aims to bolster long-term resilience, the upfront capital requirements and extended lead times for new facilities introduce near-term resource constraints. Consequently, AI photo software providers are collaborating more closely with hardware vendors and cloud service platforms to secure priority access and mitigate supply uncertainties, reflecting a recalibrated approach to managing geopolitical risk in a tariff-heavy environment.

Illuminating Critical Market Segments Shaping the Diverse Landscape of AI Photo-Making Solutions and Tailoring Strategies for Distinct User Needs

An analysis of market segmentation reveals critical nuances that shape product development and go-to-market strategies in the AI photo creation domain. When considering software delivery models, offerings span from one-time single license packages to subscription-based platforms and fully managed Software-as-a-Service deployments. Each model carries distinct value propositions: perpetual licenses appeal to users seeking upfront control, subscription tiers enable continuous feature updates and scalability, and SaaS solutions remove the complexity of local infrastructure.

Integration preferences further delineate user requirements across desktop software and mobile applications. Desktop environments furnish power users with extensive customization, batch processing capabilities, and high-resolution output, whereas mobile apps emphasize convenience, real-time editing, and social sharing. As mobile device performance continues to approach workstation levels through dedicated AI accelerator chips, the demarcation between these segments is becoming more fluid, prompting vendors to deliver consistent experiences across both form factors.

Deployment choices also play a pivotal role, spanning cloud-hosted, on-premises, and hybrid architectures. Pure cloud solutions offer elasticity and remote collaboration, on-premises installations ensure data sovereignty and latency control, and hybrid configurations blend the two to optimize cost and performance. This flexibility allows enterprises to tailor implementations according to regulatory constraints, security mandates, and seasonal demand spikes.

From an application standpoint, core functionalities encompass background replacement, portrait enhancement, and batch processing, while advanced modules introduce full photo generation and synthesis capabilities. Although traditional editing tasks remain foundational, the growing appetite for generative creativity is shifting R&D investment toward algorithms that can autonomously produce novel visual content.

Finally, user type segmentation highlights divergent needs among enterprise users, individual hobbyists, and professional creators. Within the corporate segment, advertising agencies, design studios, and media companies demand robust collaboration features, white-label options, and workflow integrations. Meanwhile, professional users such as content creators, graphic designers, and professional photographers prioritize precision, custom preset controls, and output consistency. Individual users often seek intuitive interfaces, prebuilt templates, and community-driven content libraries to accelerate personal projects.

This comprehensive research report categorizes the AI Photo Making Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Integration

- Deployment Mode

- Application

- User Type

Decoding Regional Dynamics in the AI-Powered Photo Creation Market to Uncover Growth Drivers and Emerging Opportunities Across Key Geographies

Regional dynamics in the AI photo creation market underscore diverse growth drivers and adoption rates. In the Americas, strong uptake is driven by Silicon Valley innovation and widespread cloud infrastructure, enabling startups and established companies alike to iterate rapidly on new generative features. North American organizations benefit from mature developer ecosystems and ample access to GPU-accelerated compute resources, fostering a fertile environment for AI-powered imaging breakthroughs.

Across Europe, Middle East & Africa, regulatory frameworks concerning data privacy and intellectual property shape deployment priorities. European creative agencies often adopt hybrid on-premises architectures to maintain compliance with stringent GDPR rules, while in EMEA emerging markets leverage mobile-first strategies to capitalize on widespread smartphone penetration. Moreover, localized partnerships with regional cloud providers help bridge connectivity gaps and deliver optimized performance for end users.

In the Asia-Pacific region, rapid smartphone adoption and vibrant digital ecosystems fuel a surge in mobile-centric AI photo tools. Domestic technology giants integrate generative capabilities directly into social media and e-commerce platforms, driving consumer awareness and viral content creation. Simultaneously, government support for AI research and domestic chip manufacturing has intensified, positioning APAC as both a major consumer and a strategic innovator in next-generation photo synthesis technologies.

This comprehensive research report examines key regions that drive the evolution of the AI Photo Making Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Initiatives and Competitive Movements Among Leading Companies Shaping the Future of AI Photo Creation Technology

Leading companies in the AI photo creation space are pursuing varied strategic initiatives to gain competitive advantage. Established incumbents continue to enhance flagship applications by embedding advanced generative modules, optimizing algorithm efficiency, and expanding cloud service partnerships. These players leverage brand recognition and expansive distribution channels to reinforce their market positions and accelerate enterprise adoption.

Simultaneously, nimble startups are capturing attention with specialized solutions focused on vertical use cases such as e-commerce product imagery or personalized marketing content. By emphasizing seamless API integrations, customizable model fine-tuning, and developer-friendly SDKs, these challengers are carving niches that complement broader platform offerings. Their agility in iterating features and responding to emerging trends has led to several strategic acquisitions by larger vendors seeking to augment their generative capabilities.

Collaboration between software providers and hardware vendors has also intensified, as access to high-performance GPUs and AI accelerators becomes a critical enabler. Co-development programs ensure that innovation in chip design and neural network optimization advances hand in hand, yielding performance gains that directly benefit end-user applications. This convergence of software-hardware roadmaps is accelerating time-to-market for new generative functions and reinforcing the value proposition of integrated AI photo creation services.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Photo Making Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe, Inc

- Aftershoot Pvt Ltd.

- AIEASE

- Bending Spoons S.p.A.

- Canva Pty Ltd

- Cutout.Pro

- CyberLink Corp.

- DEEP-IMAGE.AI sp. z o.o.

- DESIGNS.AI by Pixlr

- Flair AI

- Fotor

- Imagen

- Lensa

- Leonardo Interactive Pty Ltd

- Microsoft Corporation

- PhotoEditor.ai.

- Photoroom, Inc.

- PicsArt, Inc.

- PicWish

- Pixelcut

- PromeAI

- Recraft, Inc.

- Skylum

- Topaz Labs

- Truesight Technology Inc.

Actionable Strategies and Tactical Roadmaps for Industry Leaders to Capitalize on Opportunities and Mitigate Risks in AI Photo Software Market

Industry leaders seeking to capitalize on the momentum in AI photo creation must adopt a multifaceted approach. First, investing in modular, cloud-native architectures will provide the elasticity needed to support rapid feature rollouts and fluctuating demand patterns. By architecting microservices around core generative engines, organizations can scale individual components independently and minimize resource waste.

Furthermore, cultivating strategic partnerships with cloud hyperscalers and GPU suppliers can secure preferential access to high-performance infrastructure and reduce exposure to geopolitical supply risks. Through committed usage agreements, firms can negotiate favorable pricing tiers and priority provisioning, ensuring uninterrupted compute capacity for critical workloads.

Equally important is the emphasis on user experience differentiation. Tailoring interfaces to the needs of specific segments-such as streamlined batch workflows for enterprises or simplified, guided prompts for novice users-will enhance adoption and retention. Coupling these efforts with robust analytics to track feature utilization and performance feedback can inform iterative product development, yielding solutions that resonate deeply with target audiences.

Lastly, embedding privacy-centric design and transparent data handling practices will build trust in AI-driven creative tools. By offering on-device processing options or clear opt-in controls, companies can address regulatory requirements and alleviate concerns around intellectual property and personal data usage, further solidifying their competitive positioning.

Rigorous and Transparent Mixed-Methodology Design Underpinning the Credibility and Depth of AI Photo Creation Market Intelligence Insights

This research employs a rigorous mixed-methodology framework to ensure the integrity and depth of its findings. Secondary data sources include industry white papers, academic journals, and reputable news outlets, which were systematically reviewed to establish a comprehensive view of technological and regulatory landscapes. Concurrently, primary research involved structured interviews with key stakeholders across software providers, hardware vendors, and end-user organizations, enabling real-world perspectives on adoption drivers and implementation challenges.

Data triangulation techniques were utilized to validate qualitative insights against quantitative observations, ensuring consistency and reliability. Analytical rigor was applied through thematic coding of interview transcripts and cross-referencing supply chain analyses with tariff policies and global trade data. Quality assurance protocols, including peer reviews and methodological audits, underpinned the entire research process to deliver actionable intelligence to decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Photo Making Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Photo Making Software Market, by Product Type

- AI Photo Making Software Market, by Integration

- AI Photo Making Software Market, by Deployment Mode

- AI Photo Making Software Market, by Application

- AI Photo Making Software Market, by User Type

- AI Photo Making Software Market, by Region

- AI Photo Making Software Market, by Group

- AI Photo Making Software Market, by Country

- United States AI Photo Making Software Market

- China AI Photo Making Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Evolutionary Trajectory and Strategic Imperatives Driving Growth in AI-Enabled Photo Creation Solutions

In summary, the AI photo creation market stands at a pivotal juncture where generative capabilities, infrastructure dynamics, and regulatory considerations converge. Stakeholders must navigate complex segmentation imperatives-ranging from delivery models and integration preferences to deployment architectures and user typologies-while remaining agile in response to regional nuances and tariff-driven supply chain shifts. Competitive success will hinge on the ability to align strategic collaborations, technological innovation, and user-centric design in a cohesive, forward-looking roadmap that anticipates the next wave of creative automation.

Connect Directly with Ketan Rohom to Unlock Comprehensive Market Intelligence and Acquire the Full In-Depth AI Photo Creation Market Research Report

To explore the full breadth of insights and strategic guidance on AI-powered photo creation, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through an unparalleled depth of market intelligence tailored to your organization’s objectives and facilitate acquisition of the complete, comprehensive market research report that positions your business to lead in this dynamic landscape

- How big is the AI Photo Making Software Market?

- What is the AI Photo Making Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?