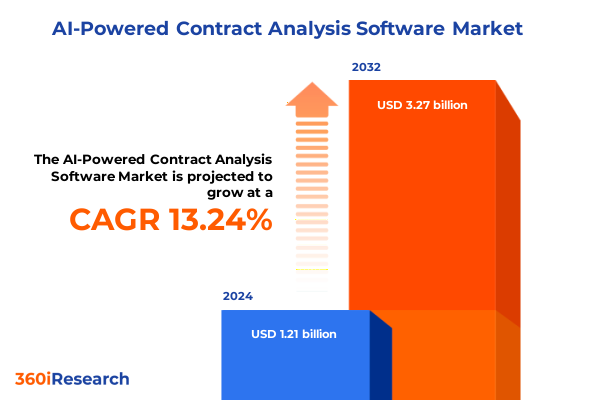

The AI-Powered Contract Analysis Software Market size was estimated at USD 3.48 billion in 2025 and expected to reach USD 4.27 billion in 2026, at a CAGR of 23.59% to reach USD 15.35 billion by 2032.

Harnessing Artificial Intelligence to Revolutionize Contract Analysis and Streamline Risk Management Across Enterprise Operations Globally

Artificial intelligence-driven contract analysis solutions have rapidly gained traction across legal, procurement, and compliance departments as organizations seek to reduce manual workloads and elevate strategic decision-making. Corporate legal teams have transitioned from traditional manual review processes to AI-augmented platforms capable of parsing complex contracts in minutes, empowering attorneys to focus on high-value tasks such as risk negotiation and stakeholder engagement. A recent Financial Times analysis noted that major enterprises are increasingly choosing to build in-house AI tools or adopt off-the-shelf options based on resource considerations. Meanwhile, survey data indicate that AI adoption in contract review has surged, signaling robust momentum in its early stages of implementation across industries.

Underpinning these platforms are natural language processing models and machine learning algorithms engineered to identify clauses, extract obligations, and flag deviations from standard playbooks. Generative AI features now offer summarization and clause suggestion capabilities that streamline negotiation workflows without supplanting human judgment. In fact, industry benchmarks project that AI-driven contract reviews can yield substantial time efficiencies, allowing legal professionals to reallocate hundreds of hours annually to strategic advisory roles. As a result, organizations are embracing a hybrid approach that marries algorithmic precision with expert oversight to mitigate risk and ensure compliance excellence.

Transitioning to AI-powered contract analysis also aligns with broader digital transformation efforts aimed at driving operational resilience. By reducing cycle times and enhancing data visibility, these solutions support more agile contract lifecycles and foster cross-functional collaboration among legal, finance, and procurement teams. This integration not only accelerates deal closure rates but also strengthens enterprise-wide governance frameworks in an increasingly complex regulatory environment.

Identifying Strategic Technological Trends That Are Reshaping Contract Analysis Workflows and Accelerating Adoption Within Complex Legal Environments

Artificial intelligence evolution in contract analysis is marked by the rise of large language models that excel at context-aware document interpretation. These systems leverage vast legal corpora to generate precise clause suggestions and robust risk assessments, moving beyond basic pattern recognition to deliver actionable insights in real time. According to Thomson Reuters, generative AI usage among legal professionals nearly doubled in one year, with 26% of organizations actively integrating these capabilities into workflows. Complementing this, industry thought leaders highlight the transition from rule-based systems to adaptive machine learning frameworks that continuously refine accuracy through user feedback loops.

Furthermore, the adoption of cloud-native contract management platforms has reduced infrastructure friction and enabled seamless integration with enterprise resource planning and customer relationship management systems. The U.S. government’s recent AI strategy emphasizes the importance of full-stack deployment models and expedited data center construction-initiatives that accelerate access to high-performance computing resources and support scaling of AI workloads. With APIs now facilitating real-time data exchange across legal, procurement, and finance applications, organizations are embedding contract intelligence within broader digital ecosystems to drive cross-functional alignment and continuous process optimization.

In parallel, analytics and reporting functionalities have emerged as pivotal differentiators, offering stakeholders granular visibility into contract portfolios and performance metrics. This shift toward data-driven decision-making empowers legal teams to proactively identify non-standard clauses, track obligation milestones, and forecast renewal windows with greater confidence. As a result, advanced analytics modules are becoming indispensable for organizations aiming to enhance compliance enforcement and negotiate from an informed position in complex contractual engagements.

Evaluating How New 2025 United States Trade Tariffs Are Reshaping Costs and Infrastructure Strategies for AI-Powered Contract Analysis Solutions

In March and April 2025, the U.S. government implemented reciprocal tariffs on a broad array of technology-related imports, notably raising duties on semiconductors, server hardware, and networking equipment. Tariff rates on key semiconductor components doubled, compelling major chip suppliers to reassess global supply chain architectures to comply with U.S. trade policy objectives. These measures have a downstream effect on on-premises contract analysis deployments, where increased costs for securing high-performance computing servers translate into higher total cost of ownership for software providers and end users alike.

Beyond hardware, industry analysts at IDC have underscored the indirect inflationary repercussions of these tariffs on software and services segments. As vendors face steeper infrastructure expenses due to tariffs, many have been compelled to incorporate these additional costs into their pricing models for contract analysis platforms, potentially dampening adoption in price-sensitive segments. Moreover, extended lead times for hardware procurement have disrupted project timelines, prompting organizations to explore lifecycle extension strategies and preventive maintenance to mitigate capital outlay pressures.

Amid this uncertainty, AI-powered contract analysis software vendors are adapting by accelerating cloud-first strategies, migrating workloads to tariff-exempt data center locations, and forging localized partnerships to buffer against policy-driven cost volatility. Industry groups have noted that the prospect of further tariff escalations has catalyzed a shift toward hybrid infrastructure models, enabling legal and procurement functions to leverage elastic cloud resources while maintaining on-premises capabilities for sensitive data governance requirements.

Uncovering Distinct Market Segments Based on Component Types, Pricing Models, Industry Verticals, Deployment Preferences, and Organization Size Dynamics

The market for AI-powered contract analysis software can be classified by component into services and software, with services encompassing implementation, integration, support and maintenance, and training, and software modules spanning analytics and reporting, contract creation, contract lifecycle management, and contract review and negotiation. Complementing these functional layers, providers adopt various pricing models to align with customer consumption preferences, ranging from pay-per-use for flexible workloads to perpetual licenses for single upfront investments, as well as subscription-based approaches that balance ongoing access with predictable expenditure.

Industry adoption further diverges across end user verticals, where financial institutions and insurance firms prioritize advanced reporting capabilities for compliance auditing, while government agencies emphasize robust negotiation workflows and document standardization, and healthcare organizations focus on rapid creation and review to manage service agreements. Deployment modalities also influence buyer choices, with cloud solutions offering scalability and centralized updates, while on-premises installations appeal to enterprises with stringent data residency and security mandates.

Finally, organization size shapes purchasing strategies, as large enterprises leverage comprehensive, enterprise-grade editions to integrate across multiple departments, while small and medium-sized enterprises seek streamlined packages that deliver core functionality with rapid time to value. This segmentation framework underscores the importance of tailored solution design and pricing approaches to meet diverse buyer requirements and maximize adoption across varied organizational contexts.

This comprehensive research report categorizes the AI-Powered Contract Analysis Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Pricing Model

- End User Industry

- Deployment

- Organization Size

Analyzing Regional Adoption Patterns and Growth Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific to Inform Contract Analysis Strategies

In North America, adoption of AI-enabled contract analysis tools has reached a pivotal juncture, driven by legal teams’ mandates to elevate efficiency and manage compliance risk. According to the inaugural AI in Legal Departments benchmarking report, 38% of surveyed North American legal teams already employ AI contract review capabilities, with another 50% actively exploring integration to streamline workflows and reduce manual bottlenecks. Similarly, a recent state of contracting survey highlighted that nearly two-thirds of legal professionals are actively evaluating AI solutions, reflecting a broader enterprise commitment to digital transformation and data-driven decision-making in the Americas.

Across the United Kingdom and European Union jurisdictions, generative AI adoption is gaining momentum, supported by regulatory frameworks such as GDPR that elevate the importance of data governance and privacy within contract intelligence platforms. A global report revealed that 65% of law firms in the U.S. and U.K. now use AI for document review or contract analysis, underscoring parallels between transatlantic markets in terms of early-stage technology integration and the drive for enhanced compliance controls. Public sector entities across Europe are also piloting AI modules to expedite procurement contracts, indicating an expansion beyond private-sector applications and hinting at future cross-government use cases.

In the Asia-Pacific region, a diverse landscape of regulatory environments and market maturities has spurred heterogeneous adoption patterns. Early adopters in Australia and Singapore are harnessing platforms such as Thomson Reuters’ CoCounsel to democratize access to contract intelligence and enhance productivity while safeguarding sensitive data through robust confidentiality protocols. Meanwhile, emerging economies across Southeast Asia and India are accelerating investments in cloud-based contract analysis solutions to standardize sprawling contract repositories and comply with evolving data localization requirements, setting the stage for continued growth in this dynamic market.

This comprehensive research report examines key regions that drive the evolution of the AI-Powered Contract Analysis Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Vendor Strategies, Partnerships, and Innovation Approaches Driving Competitive Positioning in the AI-Enabled Contract Analysis Software Space

Global technology and information service providers have made strategic acquisitions and forged partnerships to embed AI contract analysis capabilities within broader legal ecosystems. Thomson Reuters has integrated its CoCounsel platform across flagship legal research suites, enabling seamless clause extraction and risk scoring within familiar interfaces, while LegalOn Technologies emphasizes a turnkey experience with prebuilt playbooks and tailored reporting dashboards, reflecting a shift toward packaged, ready-to-deploy solutions. Meanwhile, niche platforms such as Casetext’s CoCounsel leverage advanced large language models to deliver real-time contract summarization and drafting assistance, underscoring an innovation-led approach backed by venture capital commitments and OpenAI partnerships.

Established enterprise IT vendors and service integrators are also shaping the competitive landscape through hybrid propositions that blend on-premises deployments with managed cloud services. During a recent corporate hackathon, Hewlett Packard Enterprise’s legal team developed a bespoke AI solution for contract lifecycle workflows, demonstrating the potential for in-house innovation beyond vendor-supplied offerings. Providers like Luminance have responded by enhancing their analytics engines and expanding language support to meet the requirements of global legal departments, thereby reinforcing their foothold in multi-jurisdictional environments.

At the same time, a cadre of agile startups is emerging with targeted use cases and flexible engagement models. Harvey AI, which secured significant funding to accelerate development of M&A due diligence modules, exemplifies a specialized strategy focused on high-value transactional workflows. Similarly, early-stage ventures such as Legora have introduced lightweight solutions optimized for SMEs, highlighting user-centric design and rapid onboarding to capture market share in segments underserved by legacy systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI-Powered Contract Analysis Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agiloft, Inc.

- AI Labs Inc.

- AILawtech Sp

- Anthropic

- AssemblyAI

- BlackBoiler

- C3.ai

- CobbleStone Systems Corp.

- Codeium

- Cognizant Technology Solutions Corporation

- Cohere Inc.

- Conga by Apttus

- Conga Corporation

- ContractPodAi, Inc.

- Contractzy

- Coupa Software Incorporated

- Databricks, Inc.

- Dataiku

- DataRobot, Inc.

- DataToBiz

- DocJuris, Inc.

- DocuSign, Inc.

- Draftspotting Technologies Private Limited

- Ebravia, Inc.

- Eleks, Inc.

- ElevenLabs Inc.

- Evisort Inc.

- Evisort, Inc. by Workday

- Figure AI, Inc.

- Gatekeeper

- Genie AI

- Google LLC by Alphabet Inc.

- HyperStart CLM by HyperVerge

- Icertis Inc.

- Inflection AI, Inc.

- International Business Machines Corporation

- Ironclad

- Ironclad, Inc.

- Ivo AI, Inc.

- Juro Limited

- Kira Systems

- LEGALFLY

- LegalOn Technologies, Inc.

- LegalSifter, Inc.

- LinkSquares, Inc.

- Litera Corp.

- Luminance Limited

- OpenAI Inc.

- SAP SE

- Scale AI, Inc.

- SIRIONLABS PTE

- Spellbook

- ThoughtRiver Limited

- Zycus Infotech Private Limited

Providing Strategic Prescriptions for Industry Leaders to Leverage AI Capabilities, Optimize Integration, and Elevate Contract Lifecycle Management Effectiveness

To successfully harness the transformative potential of AI-powered contract analysis, industry leaders should first establish a clear governance framework that delineates roles, responsibilities, and accountability for data stewardship and model oversight. Embedding robust change management practices and investing in targeted training programs can bridge the gap between AI-driven automation and human expertise, ensuring that legal and procurement teams adopt new workflows with confidence while maintaining high standards of accuracy and regulatory compliance.

Next, organizations should evaluate hybrid deployment architectures that balance the agility of cloud-based offerings with the control afforded by on-premises installations, particularly in jurisdictions with stringent data residency and security regulations. By instituting vendor diversification strategies and leveraging API-driven integrations, enterprises can minimize the risk of vendor lock-in and achieve greater resilience against policy-induced cost fluctuations such as the technology tariffs introduced in 2025.

Additionally, aligning AI contract analysis investments with segment-specific needs is critical. Enterprises that prioritize complex negotiation workflows may opt for advanced analytics and reporting modules to gain deeper insights into risk exposure, while those seeking rapid standardization of high-volume, low-complexity agreements might emphasize pay-per-use or subscription-based software suites. Finally, maintaining an active feedback loop with software vendors and internal stakeholders enables continuous refinement of AI playbooks, driving incremental value and reinforcing competitive advantage in dynamic market environments.

Detailing the Rigorous Research Framework, Data Collection Techniques, and Analytical Approaches Underpinning the AI-Powered Contract Analysis Software Study

This study employed a rigorous, multi-phased research framework designed to capture the complexities of the AI-powered contract analysis landscape. Primary research included structured interviews with legal, procurement, and IT decision-makers across diverse industries, as well as detailed discussions with leading software vendors to understand product roadmaps and competitive differentiators. Secondary research drew on a broad array of reputable sources, encompassing industry reports, academic journals, regulatory publications, and key media articles to contextualize emerging trends and policy shifts.

Quantitative data collection involved surveying hundreds of in-house legal professionals to benchmark adoption patterns, use case priorities, and satisfaction levels. Where available, proprietary survey results were triangulated against publicly disclosed metrics and expert commentary to ensure data integrity. The segmentation analysis was rooted in an established five-dimensional framework, spanning component types, pricing models, end-user industries, deployment modalities, and organization size, enabling nuanced insights into buyer behaviors and vendor positioning.

Analytical techniques included thematic content analysis to identify recurring patterns in qualitative feedback, as well as comparative evaluation of vendor capabilities across standardized criteria. Findings were further validated through expert roundtables and peer review, fostering a consensus-driven interpretation of market dynamics. This comprehensive methodology underpins the reliability of the report’s strategic recommendations and supports stakeholders in making informed decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI-Powered Contract Analysis Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI-Powered Contract Analysis Software Market, by Component

- AI-Powered Contract Analysis Software Market, by Pricing Model

- AI-Powered Contract Analysis Software Market, by End User Industry

- AI-Powered Contract Analysis Software Market, by Deployment

- AI-Powered Contract Analysis Software Market, by Organization Size

- AI-Powered Contract Analysis Software Market, by Region

- AI-Powered Contract Analysis Software Market, by Group

- AI-Powered Contract Analysis Software Market, by Country

- United States AI-Powered Contract Analysis Software Market

- China AI-Powered Contract Analysis Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Findings and Strategic Implications for Stakeholders Capitalizing on AI-Driven Contract Analysis Innovation and Market Trends

The landscape of AI-powered contract analysis software is rapidly evolving, characterized by advanced language models, modular deployment frameworks, and sophisticated analytics capabilities that collectively redefine how organizations manage contractual obligations and mitigate legal risk. Key technology shifts, including the integration of generative AI and cloud-native architectures, have enabled real-time clause extraction and risk scoring, facilitating more strategic interactions between legal teams and internal stakeholders. This convergence of AI and legal expertise is driving a fundamental transformation in contract lifecycles, from initial creation through negotiation, execution, and ongoing compliance.

Simultaneously, external factors such as the imposition of 2025 U.S. tariffs on technology hardware and semiconductors have exerted upward pressure on infrastructure costs, prompting both vendors and end users to reassess deployment strategies and accelerate cloud-first initiatives. The nuanced interplay between pricing models and organizational segments-across service and software components, industry verticals, and enterprise size tiers-further underscores the need for tailored solution design and adaptive go-to-market approaches.

Regional analyses reveal that North American and European legal markets are at the forefront of adoption, leveraging regulatory imperatives and digital transformation mandates, while Asia-Pacific jurisdictions exhibit a growing appetite for contract intelligence, particularly in markets with robust data privacy frameworks. Leading vendors are responding with a spectrum of offerings ranging from enterprise-grade suites to specialized SME-focused platforms, supported by partnerships, in-house innovation, and strategic funding rounds.

Collectively, these insights highlight actionable pathways for stakeholders to harness AI-driven contract analysis as a strategic asset. By embracing hybrid deployment models, establishing governance structures, and aligning investments with specific organizational needs, industry leaders can optimize operational efficiency, strengthen compliance controls, and unlock new avenues of competitive differentiation.

Prompting Industry Decision-Makers to Engage with Ketan Rohom for Access to the AI-Powered Contract Analysis Market Research Report to Enhance Outcomes

To acquire the full breadth of insights, executive leadership teams and strategic decision-makers are invited to connect with Ketan Rohom, Associate Director, Sales & Marketing. By engaging directly, interested organizations can secure immediate access to a comprehensive market research report on AI-powered contract analysis solutions. This report offers in-depth analyses, tailored recommendations, and actionable data that empower legal, finance, and procurement functions to optimize workflows, mitigate risk, and drive competitive advantage. Accelerate your strategic initiatives by partnering with an expert who can guide you through key findings and practical applications of advanced contract analysis technologies.

- How big is the AI-Powered Contract Analysis Software Market?

- What is the AI-Powered Contract Analysis Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?