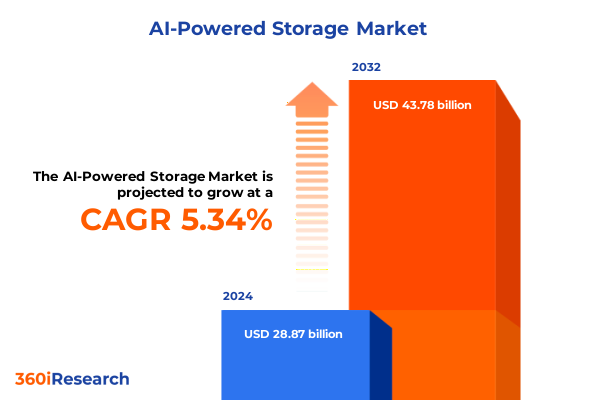

The AI-Powered Storage Market size was estimated at USD 30.38 billion in 2025 and expected to reach USD 31.97 billion in 2026, at a CAGR of 5.35% to reach USD 43.78 billion by 2032.

Navigating the Era of AI-Driven Storage Transformation: Embracing Intelligent Data Infrastructure for Enterprise Resilience

The rapid integration of artificial intelligence into every aspect of enterprise operations has ushered in a transformative era for data storage. Legacy systems, designed for predictable growth patterns and transactional workloads, are proving inadequate in the face of ever-increasing data volumes, real-time analytics demands, and automation requirements. As organizations accelerate their digital transformation journeys, they require storage infrastructure capable of not only housing massive quantities of unstructured data but also deriving actionable intelligence from it in real time.

Against this backdrop, the AI-powered storage paradigm has emerged as a critical enabler of innovation. By embedding machine-learning algorithms directly into storage hardware and software layers, these systems can optimize data placement, predict and prevent failures, and automate routine management tasks. Recent industry developments-such as Pure Storage’s launch of a unified Enterprise Data Cloud with an intelligent control plane that automates governance and compliance-underscore the strategic shift toward AI-driven solutions that streamline infrastructure and enhance operational resilience.

This executive summary provides senior decision-makers with a concise yet comprehensive overview of the forces reshaping the AI-powered storage landscape. It synthesizes transformational trends, examines regulatory and economic headwinds, and highlights segmentation, regional, and competitive insights. Ultimately, it equips executives with the knowledge needed to navigate complex market dynamics, anticipate emerging opportunities, and craft strategies that harness the full potential of AI-enabled storage technologies.

Accelerating Data Complexity and Infrastructure Evolution Reshaping the Storage Landscape in the Age of Artificial Intelligence

Over the past two years, the storage industry has experienced an unprecedented acceleration of innovation driven by data complexity and evolving workload demands. Organizations are moving beyond traditional tier-based architectures toward hyper-converged and software-defined systems that integrate compute, storage, and networking into cohesive platforms. This convergence, fueled by the proliferation of generative AI and real-time analytics, demands low-latency, high-throughput environments optimized for model training and inference workloads.

Simultaneously, hybrid and multi-cloud strategies have gained prominence as enterprises seek flexibility and cost efficiency. Storage solutions that seamlessly orchestrate data across on-premises arrays, edge nodes, and public cloud environments are becoming indispensable. The rise of retrieval-augmented generation techniques highlights the need for intelligent caching and indexing frameworks that deliver contextual data with minimal delay. Organizations are increasingly embedding AI into storage arrays to dynamically adapt data placement policies and predict capacity constraints, thereby reducing manual overhead and enhancing reliability.

Emerging edge computing deployments further illustrate the landscape’s transformation. By processing data closer to its source-whether in manufacturing plants, retail stores, or IoT networks-enterprises can address latency-sensitive use cases and comply with data sovereignty regulations. Edge-enabled AI storage solutions are thus redefining how and where data is managed, enabling new business models and unlocking efficiencies that traditional central-data-center approaches cannot achieve.

Escalating Trade Barriers and Supply Chain Volatility Shaping the Economic Impact of 2025 U.S. Tariff Policies on Storage Infrastructure

The re-imposition of high tariffs on imported components for AI infrastructure has introduced new economic pressures on storage deployment and expansion. Steep duties of up to 145% on certain Chinese-manufactured data-center equipment have escalated procurement costs, while additional levies on materials such as aluminum, steel, and networking gear have disrupted supply chains and extended lead times. Companies reliant on offshore manufacturing are grappling with increased capital expenditure requirements just as demand for AI-driven workloads is peaking.

Moreover, the tariff exposure for AI data-center physical components is projected to reach tens of billions in additional annual costs. Analysis indicates that U.S. importers may incur upwards of $13.6 billion per year in tariffs on core data-center inputs alone, significantly impacting infrastructure budgets and ROI calculations. These financial headwinds are compelling cloud providers and hyperscalers to evaluate alternative sourcing strategies, accelerate domestic manufacturing initiatives, or adjust service pricing models to preserve margins.

In parallel, hardware manufacturers such as Seagate and Western Digital face uneven tariff rates based on assembly locations, with duties ranging from 10% to over 50% on finished drives imported into the United States. This variance is amplifying cost volatility and forcing enterprises to renegotiate contracts, reassess vendor partnerships, and explore in-country production options to ensure uninterrupted access to critical storage technologies.

Dissecting the AI-Powered Storage Ecosystem Through Comprehensive Component Deployments Organization Sizes End-User Industries and Application Segments

A nuanced view of the AI-powered storage market emerges when analyzed through multiple segmentation dimensions. Component-level differentiation reveals three primary strata-hardware platforms, services engagements, and software capabilities-each evolving with specialized subsegments. Hardware innovations are driving high-performance arrays and disaggregated architectures, while services span managed offerings for maintenance and expertise-based professional consulting. Software intelligence encompasses analytics modules, security frameworks, and storage management suites that coordinate and optimize data flows across heterogeneous environments.

When considering storage media, distinctions between spinning disk, hybrid, and solid-state technologies surface. Traditional HDDs persist for archiving, but advanced interfaces such as SAS and SATA, alongside high-speed NVMe and SATA SSDs, cater to latency-sensitive and throughput-intensive AI workloads. Organizational scale introduces further complexity: large enterprises demand integrated, enterprise-grade solutions bolstered by global support, whereas small and medium enterprises prioritize cost-effective, turnkey deployments with scalable upgrade paths.

Deployment models also diverge between cloud-native services and on-premises architectures, each offering unique advantages in elasticity, control, and regulatory compliance. Industry verticals-from financial services and government to healthcare, telecommunications, manufacturing, media, and retail-drive distinct storage requirements and security postures. Finally, application use cases such as archiving, backup and recovery, big data analytics, content management, and database management dictate specific performance, reliability, and compliance characteristics essential for mission-critical operations.

This comprehensive research report categorizes the AI-Powered Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Storage Type

- Organization Size

- Deployment Mode

- End-User Industry

- Application

Regional Divergence and Growth Drivers Unveiling the Dynamics of Americas EMEA and Asia-Pacific Markets in AI-Powered Storage Adoption

Geographic dynamics reveal pronounced contrasts in adoption patterns and growth trajectories across the Americas, EMEA, and Asia-Pacific regions. In North America, substantial cloud infrastructure investments and favorable regulatory frameworks have positioned the United States as a leader in AI storage deployments, supporting hyperscale, enterprise, and government initiatives alike. A robust domestic manufacturing renaissance is also underway, with policy incentives encouraging onshore production to mitigate tariff exposure.

Meanwhile, Europe, the Middle East, and Africa are witnessing a diversification of storage strategies driven by stringent data protection regulations and the emergence of regional cloud champions. Organizations in EMEA emphasize data sovereignty and security compliance, spurring demand for localized on-premises and sovereign cloud storage solutions. Sustainability mandates and renewable energy commitments further influence infrastructure site selection and design.

Across Asia-Pacific, rapid digitalization and AI adoption are fueling unparalleled demand for advanced storage capabilities. Leading hyperscale operators such as AWS are injecting billions into new cloud regions to serve burgeoning markets, underscoring Asia-Pacific’s status as the fastest-growing storage market segment. Despite geopolitical challenges and tariff-related cost pressures, enterprises and governments in the region continue to prioritize strategic investments in intelligent storage infrastructure to support scalable AI and big data applications.

This comprehensive research report examines key regions that drive the evolution of the AI-Powered Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Industry Leaders and Innovators: Uncovering How Key Companies Are Shaping the AI-Powered Storage Revolution

Key market participants are differentiating through technological innovation, strategic partnerships, and ecosystem investments. Pure Storage has reinforced its position by launching a unified Enterprise Data Cloud platform that leverages AI for data governance, automation, and cost optimization, enabling seamless management across hybrid environments and bolstering its subscription revenue model.

In the hardware domain, Seagate and Western Digital are capitalizing on surging demand for high-capacity nearline drives tailored for AI workloads. Seagate’s mass-capacity portfolio continues to dominate data center deployments, while Western Digital is expanding its NVMe and hybrid offerings to address performance-critical use cases. Concurrently, startups such as VAST Data and CoreWeave are pioneering architectures that integrate compute and storage for AI acceleration, partnering with hyperscalers and cloud providers to deliver turnkey solutions.

Major cloud service providers, including Amazon Web Services, Microsoft Azure, and Google Cloud, remain central to market expansion by embedding intelligent storage services within their broader AI and analytics offerings. Their investments in specialized data lake solutions, replication technologies, and automated tiering capabilities drive broader adoption and set benchmarks for service-level performance. This competitive landscape is defined by convergence between established incumbents and agile disruptors, each seeking to capture value in an ecosystem defined by scale, intelligence, and integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI-Powered Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Company

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Intel Corporation

- NetApp, Inc.

- Pure Storage, Inc.

- Seagate Technology Holdings plc

- Western Digital Corporation

Proactive Strategies and Actionable Recommendations Guiding Industry Leaders to Thrive Amid AI and Storage Infrastructure Disruptions

Industry leaders must adopt a multifaceted strategy to thrive in this rapidly evolving environment. First, diversifying supply chains and investing in regional manufacturing partnerships will mitigate tariff-induced cost volatility and ensure timely access to critical components. Building strategic alliances with local hardware producers and exploring nearshoring options can reduce lead times and enhance resilience.

Second, organizations should accelerate the adoption of software-defined and hyper-converged storage architectures that embed AI-driven automation and predictive analytics. By prioritizing solutions with built-in intelligence-ranging from dynamic data tiering to proactive failure detection-enterprises can streamline operations, reduce downtime, and lower total cost of ownership.

Third, embracing a hybrid multi-cloud approach will yield the flexibility to balance performance, security, and cost considerations. Establishing governance frameworks that orchestrate data movement and access policies across cloud and on-premises environments ensures compliance and optimizes workload placement. Leaders should also prioritize workforce upskilling to support new operational paradigms, fostering cross-functional teams capable of leveraging AI-powered storage insights for strategic decision-making.

Rigorous Research Methodology Underpinning Data Collection Primary Interviews and Analysis Frameworks Ensuring Insightful AI-Powered Storage Market Findings

This analysis draws upon a rigorous research framework combining secondary and primary methodologies. Secondary insights were collected through a comprehensive review of industry publications, trade journals, and verified news sources, ensuring alignment with contemporary developments in AI and storage technologies. Concurrently, primary data was obtained via structured interviews with senior executives, storage architects, and cloud operations specialists at leading enterprises and service providers.

To ensure robustness, the study employed a triangulation approach, cross-referencing qualitative insights from expert dialogues with quantitative data extracted from publicly available import/export records, tariff schedules, and financial disclosures. Segmentation and regional analyses leveraged a standardized taxonomy covering components, storage media, organizational scale, deployment mode, end-user industries, and application use cases. This enabled consistent, multidimensional comparisons across market slices.

All findings were validated through peer review by a panel of domain experts, ensuring impartiality and accuracy. The resulting strategic lenses provide a holistic view of the AI-powered storage market, illuminating key drivers, constraints, and emerging opportunities for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI-Powered Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI-Powered Storage Market, by Component

- AI-Powered Storage Market, by Storage Type

- AI-Powered Storage Market, by Organization Size

- AI-Powered Storage Market, by Deployment Mode

- AI-Powered Storage Market, by End-User Industry

- AI-Powered Storage Market, by Application

- AI-Powered Storage Market, by Region

- AI-Powered Storage Market, by Group

- AI-Powered Storage Market, by Country

- United States AI-Powered Storage Market

- China AI-Powered Storage Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Bridging Innovation and Strategy Concluding Reflections on Harnessing AI-Powered Storage to Navigate Emerging Data Challenges and Opportunities

The convergence of artificial intelligence and data storage represents a paradigm shift with profound implications for enterprise IT strategy. Organizations that harness AI-driven intelligence within their storage infrastructure can unlock efficiencies, reduce operational complexity, and derive real-time insights from vast, unstructured datasets. Conversely, failure to adapt may result in escalating costs, performance bottlenecks, and strategic disadvantages.

Looking ahead, the AI-powered storage market will continue to evolve as new architectures, edge deployments, and sustainability imperatives take center stage. Industry participants must remain vigilant to regulatory changes, economic headwinds such as tariff fluctuations, and technology inflections driven by quantum computing and next-generation memory media. By integrating the insights presented in this summary, executives can formulate adaptive roadmaps, balance risk with opportunity, and position their organizations at the forefront of data innovation.

In this dynamic landscape, success will be defined by agility, collaboration, and a relentless focus on embedding intelligence at every layer of the storage stack.

Partner with Ketan Rohom to Secure Your Comprehensive AI-Powered Storage Market Report and Drive Informed Strategic Decision Making Today

If you’re ready to gain a competitive edge and make data-driven decisions, reach out to Ketan Rohom, Associate Director of Sales & Marketing at our research firm. He can guide you through the comprehensive AI-Powered Storage market analysis, answer your questions in detail, and tailor insights to your organization’s specific needs.

Contacting Ketan will provide you with immediate access to the full report, as well as a personalized consultation to explore strategic implications and next steps. Don’t miss the opportunity to leverage expert guidance and deepen your understanding of this rapidly evolving industry landscape.

- How big is the AI-Powered Storage Market?

- What is the AI-Powered Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?