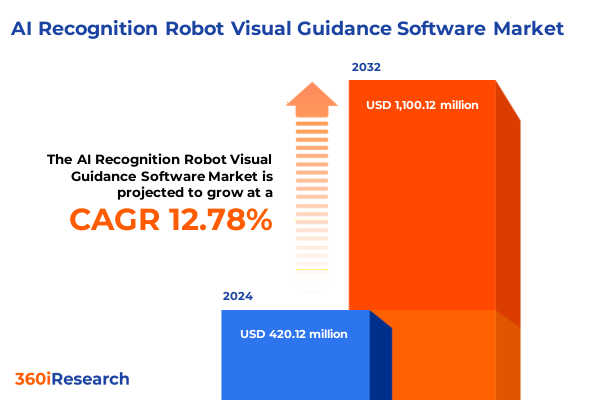

The AI Recognition Robot Visual Guidance Software Market size was estimated at USD 462.21 million in 2025 and expected to reach USD 525.70 million in 2026, at a CAGR of 13.18% to reach USD 1,100.12 million by 2032.

Pioneering Intelligent Vision Solutions That Redefine Robotic Perception And Propel Automated Systems Into A New Era Of Precision And Efficiency

The advent of intelligent robotic visual guidance represents a paradigm shift in automation, where machines no longer simply execute preprogrammed tasks but perceive, interpret, and respond to their surroundings in real time. This generation of systems leverages high-resolution imaging sensors coupled with advanced AI algorithms to unlock a level of situational awareness that was once confined to human cognition. By integrating sophisticated object detection, scene understanding, and path planning technologies, these robots can adapt to dynamic environments, enhancing efficiency and reliability across a multitude of applications.

Moreover, the convergence of edge computing and cloud-based analytics has accelerated the deployment of vision-guided robotic solutions. Edge devices capture and preprocess critical visual data at the source, while cloud platforms enable scalable deep learning model training and continuous performance optimization. This hybrid architecture not only reduces latency but also ensures robust data security and compliance with evolving regulatory frameworks. Consequently, organizations can achieve higher throughput, improved quality control, and reduced downtime as these systems seamlessly integrate into existing operational infrastructures.

In this context, stakeholders are positioned at the cusp of a transformative era where the fusion of hardware innovations, software breakthroughs, and services expertise defines competitive advantage. As we explore the multiple dimensions of this market-from component-level advancements to strategic regional dynamics-it becomes clear that mastering the intersection of AI and robotics is imperative for those seeking to redefine the future of automation.

Emerging Technological Paradigms And Market Forces Rapidly Reshaping The AI-Powered Robot Vision Landscape With Unprecedented Capabilities And Opportunities

Over the past decade, transformative shifts have reduced the barrier to entry for developing and deploying AI-driven visual guidance. The proliferation of open-source deep learning frameworks, coupled with increasingly affordable high-performance GPUs, has democratized access to computer vision capabilities. Organizations of all sizes can now train convolutional neural networks and generative adversarial networks with unprecedented speed, fostering an environment ripe for innovation and experimentation.

Simultaneously, advances in sensor technology have delivered more compact, energy-efficient hardware capable of capturing high-fidelity imagery under diverse operational conditions. Infrared, laser, and ultrasound sensors now complement traditional optical cameras, extending perception capabilities into challenging environments where variable lighting, temperature extremes, or particulate interference would otherwise hinder performance. These multidimensional data streams, processed through real-time analytics, enable robots to execute complex tasks such as collision avoidance, trajectory optimization, and surface defect detection with remarkable precision.

Furthermore, the integration of middleware and unified vision processing platforms has streamlined the development lifecycle, reducing integration costs and enabling rapid scalability. Application programming interfaces and data integration tools facilitate seamless interoperability between disparate systems, whether on-premise or cloud-based. In conjunction with professional services, training, and support, this ecosystem empowers businesses to harness AI vision in industrial automation, logistics, quality inspection, surveillance, and beyond, thereby driving a comprehensive transformation across the automation landscape.

Examining How Escalating U.S. Tariffs On Semiconductors And Vision Hardware Are Reshaping Costs Supply Chains And Strategic Decisions Across The Industry

The introduction of heightened U.S. tariffs on semiconductors and related components has reshaped the cost structure and strategic calculus of AI visual guidance deployments in 2025. Under the Section 301 measures, the tariff rate on imported semiconductors escalated to 50 percent as of January 1, 2025, directly impacting the procurement costs for processors, GPUs, and advanced image sensors critical to vision-guided robotic systems. This doubling of duties compared to prior rates prompted many integrators to reevaluate their global sourcing strategies and spurred conversations about onshoring critical chipset production.

Simultaneously, tariffs on optics, infrared modules, and laser sensors compounded cost pressures, compelling manufacturers to explore domestic component partnerships. The ripple effects extended beyond hardware; increased import duties elevated total system costs, squeezing margins for both solution providers and end users. Small and medium enterprises, in particular, found it challenging to absorb these additional expenses without passing them along through price adjustments, which in turn impacted project timelines and budget allocations.

Despite these headwinds, the policy environment has inadvertently catalyzed growth for U.S.-based suppliers. Leading domestic chipmakers and optics firms have experienced a surge in demand as companies seek tariff-free alternatives. For example, ON Semiconductor reported a notable uptick in orders for its CMOS image sensors, contributing to robust Q1 2025 earnings growth estimates approaching double digits. As a result, the competitive landscape is evolving: while some players grapple with increased import costs, others are capitalizing on reshored manufacturing and local supply chain resilience to drive innovation and maintain cost competitiveness.

Unveiling Insights Across Component Technology Application Deployment And End-User Dimensions To Illuminate Market Nuances Driving Innovation And Strategic Focus

An in-depth analysis of market segmentation reveals nuanced growth drivers and strategic imperatives across multiple dimensions. From the component perspective, high-performance hardware such as cameras, processors, and sensors continues to command significant investment, while software platforms offering real-time analytics and vision processing frameworks are gaining traction among enterprises seeking to optimize operational insights. Services encompassing professional consulting, system integration, and ongoing maintenance form a critical backbone that ensures end-to-end solution viability and performance continuity.

On the technology front, computer vision methodologies like feature extraction and object detection lay the groundwork for more advanced deep learning architectures, including convolutional neural networks and generative adversarial networks, which enable robots to navigate complex tasks with greater autonomy. Machine learning paradigms, featuring supervised learning for pattern recognition and reinforcement learning for adaptive control, are elevating the sophistication of robotic guidance systems in dynamic settings.

Application-oriented segmentation highlights diverse use cases, from assembly line automation and automated sorting to color inspection and intrusion detection, each demanding tailored system configurations and specialized algorithmic approaches. The deployment continuum, spanning cloud, hybrid, and on-premise models, further influences solution design, with edge devices playing a pivotal role in latency-sensitive environments.

Finally, end-user industries-ranging from aerospace and defense to healthcare and retail-exhibit distinct requirements, driving customization in diagnostics, UAV guidance, surgical robotics, and store automation. Recognizing the interdependencies among these segmentation layers is essential for stakeholders aiming to align product development roadmaps and go-to-market strategies with evolving customer demands.

This comprehensive research report categorizes the AI Recognition Robot Visual Guidance Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment Type

- Application

- End User

Assessing Regional Dynamics To Highlight Growth Drivers Challenges And Strategic Priorities Across Americas Europe Middle East Africa And Asia-Pacific Markets

Regional dynamics underscore the importance of localized strategies and diverse market conditions. In the Americas, robust investment in industrial automation and logistics infrastructure has created fertile ground for vision-guided robotics. Government initiatives supporting advanced manufacturing and infrastructure modernization are driving demand for integrated hardware and software solutions, while a strong ecosystem of domestic suppliers mitigates the impact of global trade uncertainties.

In Europe, the Middle East, and Africa, regulatory harmonization efforts and an emphasis on quality inspection across automotive and food and beverage manufacturing sectors are fueling adoption. The region’s focus on sustainable automation and energy-efficient operations aligns with the growing integration of vision processing platforms in edge and hybrid deployments. Strategic partnerships between OEMs and system integrators are proliferating, especially in the aerospace and defense verticals where stringent performance and safety requirements prevail.

Across the Asia-Pacific landscape, market maturity varies widely. Led by technology powerhouses in Japan and South Korea, there is significant uptake of deep learning–based solutions in robotics guidance and surveillance applications. Meanwhile, emerging markets in Southeast Asia and India are witnessing gradual growth, propelled by expanding manufacturing bases and government programs aimed at digital transformation. The diversity of deployment scenarios-from cloud-centric smart cities to on-premise factory automation-demands versatile offerings and localized support frameworks.

Understanding these regional nuances enables stakeholders to tailor value propositions, forge strategic partnerships, and align go-to-market plans with regional investment trends and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the AI Recognition Robot Visual Guidance Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Sector Innovators Highlighting Their Strategic Investments Technological Breakthroughs And Market Positioning To Illuminate Competitive Landscapes

The competitive landscape is characterized by a blend of established incumbents and agile newcomers, each leveraging different approaches to secure market leadership. Major hardware providers continue investing in sensor miniaturization and processor optimization to deliver higher performance at lower power consumption. Conversely, software specialists are forging alliances to embed advanced analytics into robust vision processing platforms that offer both cloud-based scalability and edge compute capabilities.

In the platform domain, key players have unveiled modular architectures that enable rapid integration of third-party APIs and data tools, fostering a collaborative ecosystem. Vision processing platforms now feature predictive analytics modules alongside real-time monitoring capabilities, allowing end users to preemptively address operational bottlenecks and optimize throughput. Middleware and integration software firms have differentiated through seamless data pipelines that support multi-vendor hardware and AI models, ensuring interoperability across diverse deployments.

Meanwhile, systems integrators and service providers are expanding their footprints by offering end-to-end solutions, encompassing training, consulting, and ongoing support. These holistic offerings mitigate the complexity of deploying advanced vision-guided robotics and help end users accelerate time-to-value. Leading companies are further distinguishing themselves through vertical-specific solutions, tailoring configurations for applications such as UAV guidance in defense, surgical robotics in healthcare, and automated sorting in logistics.

As competitive pressures intensify, the ability to rapidly innovate, forge cross-industry partnerships, and deliver comprehensive value-added services will determine market positioning. Those organizations that excel in both technology development and deployment support are poised to capture a disproportionate share of growth in this dynamic sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Recognition Robot Visual Guidance Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Amazon Robotics LLC

- Cognex Corporation

- FANUC Corporation

- Google LLC

- Inspekto A.M.V. Ltd.

- Intel Corporation

- ISRA VISION AG

- Jidoka Technologies Private Limited

- Keyence Corporation

- KUKA Aktiengesellschaft

- Landing AI, Inc.

- Mech-Mind Robotics Technologies Ltd.

- MVTec Software GmbH

- NVIDIA Corporation

- OMRON Corporation

- OpenCV.ai, Inc.

- Robovision BV

- SenseTime Group Inc.

- Viso.ai AG

Actionable Strategic Imperatives For Industry Leaders To Navigate Emerging Market Complexities Optimize Supply Chains And Drive Sustainable Competitive Advantage

To thrive in a landscape defined by rapid technological change and shifting policy environments, industry leaders must adopt a multifaceted strategy. Securing supply chain resilience through diversified sourcing and strategic inventory management will mitigate the risks associated with tariff volatility and shipping disruptions. Proactively engaging with policymakers and participating in industry consortia can also influence trade regulations and create more favorable operating conditions for AI-driven robotics.

Investment in R&D must remain a central priority, with a focus on advancing sensor fusion techniques, real-time inference at the edge, and explainable AI models that enhance trust and transparency. Collaboration between hardware and software development teams will ensure that new algorithms are optimized for emerging processor and GPU architectures, unlocking performance gains and reducing total cost of ownership.

Equally important is the cultivation of talent through targeted training programs and partnerships with academic institutions. Developing specialized skill sets in computer vision, deep learning, and systems integration will bolster organizational capabilities and support complex deployments. Moreover, fostering a culture of continuous learning and cross-functional collaboration will drive innovation and accelerate solution delivery.

Finally, forging strategic alliances with complementary technology providers and system integrators will expand market reach and create integrated offerings that address end-to-end customer needs. By combining complementary strengths, companies can deliver differentiated value propositions, accelerate adoption in vertical-specific use cases, and secure a sustainable competitive edge.

Detailing The Rigorous Multi-Phase Research Methodology Underpinning Data Collection Analysis And Validation Ensuring Unparalleled Insights And Market Reliability

This report’s findings are underpinned by a systematic research approach combining primary and secondary methodologies. Primary research involved in-depth interviews with senior executives from leading hardware manufacturers, software developers, system integrators, and end-user organizations. These discussions provided firsthand perspectives on emerging technologies, adoption barriers, and investment priorities across multiple regions.

Secondary research encompassed a thorough review of industry publications, regulatory filings, patent databases, and public financial reports. Market segmentation frameworks were validated through triangulation of quantitative data and expert insights, ensuring robustness and reliability. The analysis of tariff impacts leveraged official statements and trade commission documents, coupled with real-world supply chain observations from procurement specialists.

Quantitative data points were synthesized using statistical modeling to identify growth patterns and adoption trends within component, technology, application, deployment, and end-user segments. Qualitative insights were further refined through workshops with domain experts, facilitating scenario development and stress testing of key assumptions. This multi-phase process delivered actionable intelligence tailored to the unique dynamics of AI-driven robotic visual guidance.

Quality assurance protocols, including peer review and editorial oversight, ensured consistency and accuracy across all sections. The result is a comprehensive, evidence-based report that equips stakeholders with the clarity and confidence needed to navigate a rapidly evolving market environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Recognition Robot Visual Guidance Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Recognition Robot Visual Guidance Software Market, by Component

- AI Recognition Robot Visual Guidance Software Market, by Technology

- AI Recognition Robot Visual Guidance Software Market, by Deployment Type

- AI Recognition Robot Visual Guidance Software Market, by Application

- AI Recognition Robot Visual Guidance Software Market, by End User

- AI Recognition Robot Visual Guidance Software Market, by Region

- AI Recognition Robot Visual Guidance Software Market, by Group

- AI Recognition Robot Visual Guidance Software Market, by Country

- United States AI Recognition Robot Visual Guidance Software Market

- China AI Recognition Robot Visual Guidance Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4134 ]

Synthesizing Core Insights From Technological Evolution Market Shifts And Strategic Imperatives To Guide Stakeholders Through A Transformative Vision Landscape

In summary, the AI-powered robotic visual guidance market stands at the intersection of technological innovation, policy-driven shifts, and evolving regional dynamics. The convergence of advanced sensors, AI algorithms, and scalable computing architectures has unlocked new levels of autonomy and precision, while emerging tariff regimes have realigned supply chains and reshaped cost structures. Market segmentation insights highlight the interplay between hardware components, software platforms, and application-specific requirements, underscoring the importance of end-to-end solution orchestration.

Regional analyses reveal distinct growth trajectories and strategic priorities across the Americas, EMEA, and Asia-Pacific, emphasizing the need for tailored approaches that account for regulatory landscapes, infrastructure maturity, and local supplier ecosystems. Competitive analysis illustrates the critical role of cross-industry partnerships and value-added services in differentiating market propositions, while actionable recommendations outline strategic imperatives for resilience, innovation, and talent development.

With a robust research methodology anchoring these insights, stakeholders are equipped to make informed decisions, optimize resource allocation, and capitalize on emerging opportunities. As the automation landscape continues to evolve, organizations that embrace integrated vision-guided robotics and adapt to shifting market forces will be best positioned to lead the next wave of industrial transformation.

Engaging Thought Leaders To Unlock Comprehensive Market Intelligence And Propel Strategic Decision-Making With Expert Guidance From Associate Director Of Sales & Marketing

Are you ready to transform your strategic approach with the latest market intelligence in AI-driven robotic visual guidance? Reach out to Ketan Rohom, an experienced Associate Director of Sales & Marketing, to gain access to an in-depth market research report that unpacks critical trends, competitive landscapes, and actionable insights. Engage directly with expert guidance tailored to address your unique challenges and opportunities.

By securing this comprehensive report, you will empower your leadership with data-driven analysis to optimize investments, refine go-to-market strategies, and identify new avenues for growth. Don’t miss the opportunity to harness the foresight and expertise necessary to steer your organization toward sustained success in the rapidly evolving AI recognition and robot visual guidance arena. Contact Ketan Rohom today to elevate your decision-making with unparalleled market clarity.

- How big is the AI Recognition Robot Visual Guidance Software Market?

- What is the AI Recognition Robot Visual Guidance Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?