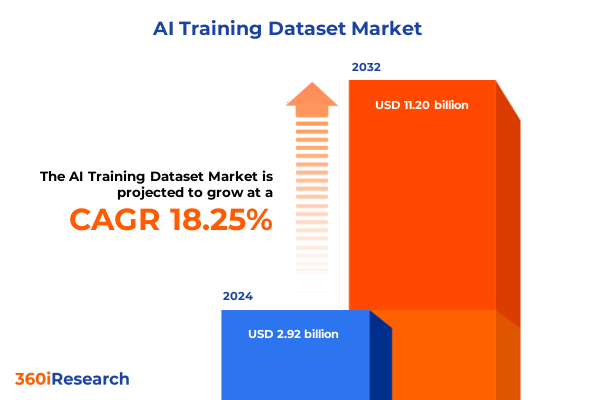

The AI Training Dataset Market size was estimated at USD 3.39 billion in 2025 and expected to reach USD 3.96 billion in 2026, at a CAGR of 18.59% to reach USD 11.20 billion by 2032.

Setting the Stage for an Era of Data-Driven AI: Defining the Foundation and Scope of Training Datasets in a Volatile Global Economy

Setting the foundation for any rigorous exploration of the AI training data market begins with understanding the strategic significance of high-quality, diverse datasets in today’s rapidly evolving environment. Organizations across every industry are recognizing that superior model performance hinges not only on advanced algorithms but also on the breadth, depth, and authenticity of the underlying data. From autonomous driving platforms relying on millions of labeled images to virtual assistants interpreting nuanced human speech, the demand for meticulously curated training assets has surged. Amid this intensifying need, stakeholders face intertwined challenges ranging from ensuring data privacy to navigating volatile trade policies.

Moreover, the broader macroeconomic climate has introduced fresh complexities for data acquisition and management. The acceleration of generative AI applications and the shift toward hybrid cloud infrastructures are reshaping how enterprises collect, validate, and augment their training repositories. Concurrently, heightened scrutiny around data sovereignty and compliance requirements in key jurisdictions is driving a more localized approach to dataset development. This evolving tapestry necessitates a holistic perspective, one that appreciates both technological innovation and the global policy frameworks in which data assets are deployed.

As you embark on this comprehensive report, the aim is to illuminate the critical forces sculpting the AI training data landscape, equipping you with the insights needed to optimize your strategic roadmap. By dissecting transformative shifts, evaluating policy impacts, and unpacking granular segmentation imperatives, this executive summary serves as your compass to harness data as a strategic asset.

Navigating a Rapidly Evolving AI Data Ecosystem Transformed by Breakthrough Generative Intelligence Convergence and Industry-Wide Technological Advances

The landscape of AI training datasets has undergone seismic shifts as generative intelligence and sophisticated analytical algorithms converge to redefine industry benchmarks. The advent of large-language models capable of producing contextually rich narratives has amplified the need for text corpora with unparalleled semantic diversity, while breakthroughs in computer vision have intensified scrutiny on image and video repositories to ensure comprehensive coverage of real-world scenarios. Simultaneously, robotic process automation platforms are demanding meticulously annotated gesture and video streams to refine automation scripts for complex workflows. These technological advances have compelled organizations to rethink legacy data pipelines, integrating continuous feedback loops that bridge data collection, labeling, and model validation in a seamless cycle.

Concurrently, advancements in hybrid infrastructure are catalyzing the proliferation of edge-centric data capture, where localized processing reduces latency and enhances data sovereignty, particularly in regions with stringent compliance mandates. This shift has triggered innovative deployments of private cloud nodes for sensitive data streams, complemented by public cloud environments to handle volume–velocity demands. Moreover, cross-industry collaborations between automotive OEMs, healthcare providers, and financial institutions are ushering in multi-domain datasets that accelerate transfer learning opportunities, unlocking new avenues for efficiency and accuracy.

Taken together, these transformative currents are not only elevating expectations for dataset quality but also driving pragmatic shifts in governance, orchestration, and partnerships. Industry leaders must navigate this complex terrain strategically, balancing the imperatives of speed-to-insight with robust frameworks for data integrity, privacy, and interoperability.

Evaluating the Broad Economic and Operational Consequences of Recent United States Tariff Policies on Global AI Data Supply Chains

The cumulative impact of the United States’ tariff measures announced and implemented through 2025 has reverberated across global AI data supply chains, introducing fresh frictions at every juncture from hardware procurement to dataset distribution. Heightened duties on servers, data center components, and specialized sensors have amplified operational costs for data collection facilities, compelling many enterprises to contemplate localized manufacturing or nearshoring models to mitigate inflated import expenses. These adjustments have, in turn, influenced the total cost of ownership for data annotation operations, particularly those reliant on advanced GPU clusters and specialized imaging hardware.

Beyond hardware, the ripple effects have extended to partnerships with offshore annotation firms and cloud service providers. Increased cross-border transaction costs and administrative hurdles have driven stakeholders to diversify sourcing strategies, blending public data repositories with proprietary private datasets to maintain both cost efficiency and compliance with evolving trade regulations. Moreover, investment cycles have shifted toward synthetic data generation capabilities, where software-driven approaches can replicate complex scenarios without the overhead of physical data capture and the associated tariff burdens.

Industry players must remain vigilant as policy landscapes continue to evolve, anticipating potential escalations or strategic exemptions. Proactive measures such as supplier audits, scenario planning, and incremental onshoring of critical data pipelines will be essential to preserving competitive advantage. By integrating tariff risk assessments into broader data governance frameworks, organizations can safeguard continuity, uphold quality standards, and maintain agility amid geopolitical uncertainties.

Unlocking Market Potential Through Multifaceted Segmentation Insights Spanning Data Types, Components, Annotation Methods, and Technological Innovations

Unpacking the multilayered market segmentation reveals critical levers for tailoring data strategies that align with distinct operational requirements and innovation pathways. Data Type segmentation exposes the nuanced value propositions of audio, image, text, and video assets: music analysis and speech recognition pipelines rely heavily on high-fidelity audio captures, while facial recognition, image recognition, and object detection modules demand pixel-perfect imagery augmented by diverse scenario coverage. Document parsing and text classification engines thrive on large volumes of structured and unstructured text, whereas gesture recognition, video content moderation, and video surveillance systems require temporally coherent frame sequences to ensure model robustness.

Component segmentation underscores the shifting balance between services and solutions: as enterprises scale their AI initiatives, data quality assurance and validation services have emerged as indispensable for guaranteeing annotation accuracy and compliance, while sophisticated software platforms for data collection, annotation tools, and synthetic data generation are increasingly embedded into end-to-end pipelines. This duality highlights the necessity of harmonizing human-led expertise with automated tooling to drive operational efficiency.

Annotation Type further differentiates between the precision of labeled datasets and the exploratory potential of unlabeled assets, guiding stakeholders toward the appropriate balance of supervised and self-supervised learning approaches. Source segmentation illuminates strategic trade-offs between private datasets-offering exclusivity and control-and public repositories that accelerate development timelines but may raise compliance considerations.

Technology segmentation maps core AI capabilities to market demands: computer vision underpins image and video use cases, while machine learning spans reinforcement, supervised, and unsupervised paradigms. Natural language processing fuels text-driven applications, and robotic process automation, with its desktop automation and process orchestration subdomains, streamlines enterprise workflows. AI Type segmentation steers organizations toward generative AI applications for content synthesis and predictive AI for analytical forecasting, shaping investment priorities.

Deployment Mode segmentation reveals the fluid interplay between cloud, hybrid, and on-premises models: private cloud environments secure sensitive data, public cloud systems scale elastically, and hybrid architectures strike a balance of performance and compliance. Finally, Application segmentation spotlights industry verticals-from autonomous vehicles and traffic management in automotive and transportation, through algorithmic trading, fraud detection, and risk management in banking, financial services, and insurance, to diagnostics, medical imaging, precision medicine, and telehealth virtual assistants in healthcare, and customer analytics, inventory management, recommendation systems, and supply chain orchestration in retail and e-commerce-that drive the most pressing dataset requirements. This granular lens empowers stakeholders to architect data strategies that resonate with specific use cases and regulatory landscapes.

This comprehensive research report categorizes the AI Training Dataset market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Data Type

- Component

- Annotation Type

- Source

- Technology

- AI Type

- Deployment Mode

- Application

Unveiling Distinct Regional Dynamics and Growth Catalysts Across the Americas, Europe Middle East & Africa and Asia Pacific AI Training Data Markets

A granular examination of regional dynamics reveals divergent growth drivers and strategic considerations across major geographies. In the Americas, agility and scale are underpinned by robust public and private cloud infrastructures, enabling rapid deployment of hybrid models for high-volume data ingestion. This region’s mature regulatory frameworks, paired with leading hyperscale data center investments, support expansive private dataset initiatives, although privacy mandates continue to shape data localization strategies.

Across Europe, the Middle East, and Africa, stringent data protection regimes necessitate tailored approaches to dataset sourcing and governance. On-premises and private cloud deployments remain prominent for entities navigating evolving compliance directives, while public-private partnerships foster collaborative research on synthetic data generation and privacy-enhancing techniques. Local innovation hubs are increasingly focused on specialized AI applications, such as multilingual natural language processing and advanced image recognition for urban surveillance.

The Asia-Pacific region stands out for its dynamic adoption of hybrid architectures, leveraging both private and public cloud services to balance cost and performance. Rapid urbanization and burgeoning digital economies are driving unprecedented demand for computer vision and predictive AI solutions, particularly in smart city projects and e-commerce personalization. This region’s growing ecosystem of domestic annotation providers and cloud service alliances is accelerating time-to-market for new AI applications.

These distinct regional contours necessitate tailored market entry and expansion strategies, ensuring that dataset initiatives are optimized for local infrastructure, compliance landscapes, and innovation ecosystems.

This comprehensive research report examines key regions that drive the evolution of the AI Training Dataset market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Collaborative Ventures, and Innovation Trajectories Among Leading Providers Shaping the AI Training Data Ecosystem

Within the competitive arena of AI training data, incumbents and challengers alike are charting differentiated paths to capture value across the data lifecycle. Leading providers are forging strategic alliances with hyperscalers to integrate advanced data collection and annotation platforms directly into cloud marketplaces, streamlining customer acquisition and accelerating project kickoff times. Others are investing heavily in proprietary synthetic data generation engines, enabling the rapid creation of scenario-rich datasets for high-stakes applications such as autonomous mobility and precision medicine.

A wave of mergers and acquisitions has also reshaped the landscape, as organizations seek to bolster service portfolios with complementary capabilities in data quality assurance and validation. These consolidations are further complemented by open-source collaborations that democratize access to benchmark datasets while fostering community-driven improvements in annotation standards. Furthermore, several trailblazers are pioneering hybrid human–machine annotation workflows, where active learning frameworks dynamically allocate tasks to human experts only when algorithmic confidence dips below critical thresholds.

As competitive intensity escalates, differentiation increasingly hinges on end-to-end integration, from initial data capture to continuous feedback loops feeding production models. Vendors that can offer seamless interoperability across private and public cloud environments, coupled with rigorous compliance frameworks, are securing the most strategic customer engagements. Ultimately, the firms that marry technological innovation with robust service offerings will define the next chapter of the AI training data ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Training Dataset market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Anolytics

- Appen Limited

- Automaton AI Infosystem Pvt. Ltd.

- Clarifai, Inc.

- Cogito Tech LLC

- DataClap

- DataRobot, Inc.

- Deeply, Inc.

- Defined.AI

- Google LLC by Alphabet, Inc.

- Gretel Labs, Inc.

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Kinetic Vision, Inc.

- Lionbridge Technologies, LLC

- LXT AI Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- Mindtech Global Limited

- Mostly AI Solutions MP GmbH

- NVIDIA Corporation

- Oracle Corporation

- PIXTA Inc.

- Samasource Impact Sourcing, Inc.

- SanctifAI Inc.

- SAP SE

- Satellogic Inc.

- Scale AI, Inc.

- Snorkel AI, Inc.

- Sony Group Corporation

- SuperAnnotate AI, Inc.

- TagX

- Wisepl Private Limited

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Harness AI Training Data Assets and Navigate Emerging Market Complexities

To stay at the forefront of AI data excellence, industry leaders must embrace a proactive, layered strategy that balances technological adoption with governance rigor. First, investing in advanced synthetic data generation capabilities can alleviate supply chain vulnerabilities and skirt tariff-induced cost escalations, while also enabling scenario diversity unattainable through physical data capture alone. Simultaneously, organizations should elevate their data quality assurance and validation frameworks, embedding continuous monitoring and feedback mechanisms to detect annotation drift and ensure model fidelity over time.

Second, diversification of data sourcing-by leveraging both private and public repositories-can optimize development timelines and maintain compliance across multiple jurisdictions. Tailoring deployment modes through hybrid cloud architectures offers the dual benefits of scalability and data sovereignty, which are particularly crucial in regions with stringent regulatory regimes. Third, fostering cross-functional collaboration between data engineers, domain specialists, and compliance officers will streamline the integration of data pipelines into core business processes, unlocking new efficiencies and mitigating operational risk.

Finally, leaders should cultivate strategic partnerships with hyperscale cloud providers, annotation platform vendors, and research institutions to stay ahead of emergent trends in generative and predictive AI. By embedding these recommendations into their strategic playbooks, organizations can transform their data assets from static repositories into dynamic engines of innovation and competitive advantage.

Detailing Rigorous Research Methodology with Data Collection Techniques, Validation Protocols and Analytical Frameworks Supporting Robust Insights

This research leverages a multi-phased methodology designed to ensure the rigor and reliability of insights. Primary data collection encompassed structured interviews with c-suite executives, data architects, and AI practitioners across diverse verticals, yielding firsthand perspectives on challenges and opportunities in dataset acquisition, annotation, and governance. Secondary research incorporated a comprehensive review of publicly available reports, academic publications, and technology vendor white papers to triangulate market dynamics and validate emerging trends.

Quantitative analyses were underpinned by detailed assessments of dataset transactions, platform usage metrics, and service engagement records, with anonymized consortium data contributing to the robustness of volume and velocity estimates. Rigorous validation protocols were applied throughout, including cross-verification of primary interview findings against secondary source benchmarks, iterative data cleansing to resolve inconsistencies, and peer review by an advisory panel of subject-matter experts. Analytical frameworks, such as scenario modeling and sensitivity analysis, were used to explore the implications of tariff shifts and regulatory changes on data supply chains.

This layered approach ensures that the report’s conclusions are both empirically grounded and contextually relevant, equipping stakeholders with a transparent view of research boundaries, assumptions, and methodological limitations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Training Dataset market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Training Dataset Market, by Data Type

- AI Training Dataset Market, by Component

- AI Training Dataset Market, by Annotation Type

- AI Training Dataset Market, by Source

- AI Training Dataset Market, by Technology

- AI Training Dataset Market, by AI Type

- AI Training Dataset Market, by Deployment Mode

- AI Training Dataset Market, by Application

- AI Training Dataset Market, by Region

- AI Training Dataset Market, by Group

- AI Training Dataset Market, by Country

- United States AI Training Dataset Market

- China AI Training Dataset Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3498 ]

Synthesizing Core Findings and Strategic Imperatives to Illuminate the Path Forward in the Dynamic AI Training Data Landscape

In synthesizing the report’s key findings, three overarching themes emerge as pivotal to mastering the AI training data landscape. First, data versatility and quality will continue to eclipse sheer volume as the defining competitive differentiator; organizations that cultivate rich, diverse datasets while maintaining stringent annotation standards will outpace peers. Second, geopolitical and regulatory headwinds-exemplified by evolving tariff regimes-underscore the need for flexible sourcing strategies and localized infrastructure investments. Finally, strategic alignment between technology deployments and business objectives, driven by cross-functional collaboration, is essential to translate data assets into tangible value.

As enterprises chart their path forward, embracing generative AI and advanced machine learning paradigms will unlock new frontiers of innovation, yet these technologies must be underpinned by resilient data governance frameworks. Segmentation insights provide a roadmap for aligning dataset investments with specific use cases, whether in autonomous mobility, financial analytics, healthcare diagnostics, or retail personalization. Regional analyses offer further clarity on how compliance and infrastructure considerations shape deployment choices.

By internalizing these imperatives and weaving them into strategic playbooks, organizations can transform dataset management from a complex challenge into a sustainable competitive advantage. The path ahead demands agility, precision, and foresight, but those who vigilantly adapt will harness data as the ultimate catalyst for AI-driven growth.

Empowering Your Strategic Decisions with Authoritative Market Intelligence: Connect with Our Associate Director to Secure Your Comprehensive AI Training Data Report

For decision-makers poised to capitalize on AI-driven transformation, securing comprehensive market intelligence has never been more critical. Connect with our Associate Director, Sales & Marketing at 360iResearch, Ketan Rohom, to gain personalized insights tailored to your strategic priorities. Ketan’s deep understanding of data-driven ecosystems will guide you through the nuances of segmentation, regional dynamics, and competitive landscapes. By engaging directly, you will unlock early access to exclusive findings, expert analyses, and bespoke recommendations that align with your unique objectives. Reach out today to ensure your organization stays ahead of evolving regulatory, technological, and market pressures by arming your leadership with the authoritative intelligence required for confident decision-making and sustained growth.

- How big is the AI Training Dataset Market?

- What is the AI Training Dataset Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?