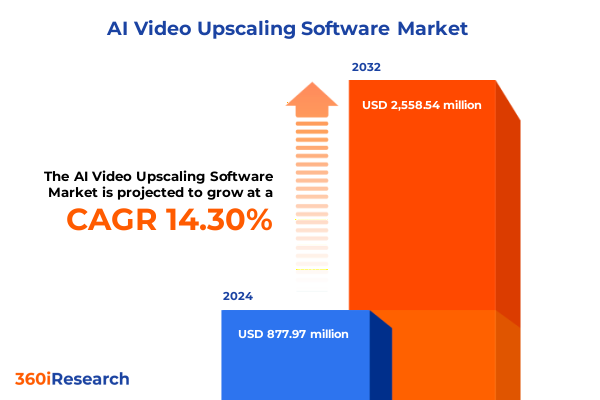

The AI Video Upscaling Software Market size was estimated at USD 995.79 million in 2025 and expected to reach USD 1,131.72 million in 2026, at a CAGR of 14.43% to reach USD 2,558.54 million by 2032.

Uncovering the Evolution and Growing Significance of AI Video Upscaling in Modern Content Creation and Distribution Ecosystem

AI video upscaling has rapidly evolved from a niche research endeavor into a pivotal tool driving the next chapter of content creation. What began as simple interpolation techniques has given way to sophisticated neural network–driven approaches able to reconstruct missing details and enrich visual fidelity. Today’s leading algorithms deploy convolutional neural networks that learn from vast datasets, enabling them to interpolate textures, reduce noise, and restore intricate elements such as facial features and environmental details with remarkable precision. This evolution is reshaping how video content is produced, repurposed, and consumed.

Against a backdrop of surging demand for high-definition and 4K-plus content, the significance of AI-driven upscaling cannot be overstated. Streaming services and digital platforms are faced with the dual challenge of maximizing user engagement while repurposing legacy archives originally shot in standard definition. As content libraries balloon, AI upscaling offers a cost-effective pathway to breathe new life into older footage, extending the commercial viability of classic titles and generating fresh viewer interest. Moreover, social media influencers and mobile content creators are integrating on-device upscaling tools to elevate production quality, demonstrating the technology’s broadening accessibility and utility in professional and consumer domains alike.

Examining the Technological Advancements and Industry Disruptions Fueling the Next Wave of AI-Driven Video Enhancement Solutions

The AI video upscaling landscape is undergoing transformative shifts fueled by breakthroughs in model architectures and collaborative ecosystems. In recent months, research teams have introduced next-generation diffusion models and GAN-based frameworks capable of balancing computational efficiency with unparalleled detail enhancement. These architectures leverage multi-frame context to anticipate motion artifacts and preserve temporal coherence, supporting near real-time performance that aligns with live streaming and on-premise post-production demands. Simultaneously, slicing-edge inference accelerators embedded in GPUs and SoCs are driving down latency while offering scalable throughput for cloud-based platforms, enabling content houses to integrate upscaling directly within their rendering pipelines.

Beyond pure algorithmic strides, the industry is witnessing a convergence of hardware and software partnerships. Major GPU vendors have begun bundling dedicated upscaling libraries with their SDKs, while software providers collaborate with cloud hyperscalers to streamline GPU cluster provisioning. Moreover, the rise of API-first delivery models is fostering an open ecosystem in which developers can embed upscaling services into editing suites, web players, and custom workflows. These interconnected trends are expanding the use cases of AI video upscaling beyond restoration and archiving into live sports broadcasting, gaming, and immersive media experiences.

Analyzing the Cumulative Effects of 2025 United States Tariff Adjustments on AI Video Upscaling Technology Supply Chains and Cost Structures

In 2025, the cumulative impact of U.S. tariff adjustments has added a complex layer to AI video upscaling supply chain dynamics. New levies on assembled server modules and cooling infrastructure have driven up hardware acquisition costs, prompting data center operators and service providers to recalibrate expansion timelines. As President Trump’s administration maintains significant duties on imports from Taiwan and China, including GPUs critical for AI inferencing, providers are exploring alternative procurement routes through USMCA partners in Mexico and Canada to mitigate up to 32 percent tariffs through rules-of-origin exemptions.

Despite limited exemptions for raw semiconductor chips, many AI accelerators are subject to duties when integrated into finished products, undermining cost predictability. Major chipmakers and systems integrators have publicly warned of margin pressures and potential supply constraints in their 2025 earnings reports, underscoring the risks for those reliant on high-end GPUs for model training and real-time upscaling deployments. Broad economic analyses further suggest that a sustained 25 percent tariff on semiconductor imports could reduce U.S. GDP growth by approximately 0.18 percent in the first year, with cumulative losses reaching into the trillions over a decade, amplifying concerns across AI and automotive verticals alike.

Gaining In-Depth Understanding of Pricing Models Deployment Modes Delivery Methods Resolution Tiers and Application Verticals Driving Adoption Dynamics

A nuanced examination of the AI video upscaling market reveals distinct adoption patterns shaped by pricing frameworks, deployment preferences, delivery channels, resolution objectives, and vertical applications. Organizations are weighing flexible freemium entry points against pay-per-use scenarios, perpetual licensing, and subscription-based models that ensure predictable revenue streams and continual feature updates. At the same time, strategic considerations around control and security influence choices between cloud-hosted solutions and on-premise installations, with hybrid approaches emerging to balance scalability and data governance.

Integration requirements further differentiate offerings, as some developers offer API endpoints for seamless embedding in existing workflows, while others provide plugin modules tailored to popular editing suites or standalone applications for end-to-end processing. Meanwhile, users’ resolution targets range from HD enhancements at 720p to sophisticated upscaling into 4K and 8K tiers, with intermediary 2K and Full HD levels serving broadcast and digital signage use cases. Vertically, demand spans automotive manufacturers seeking in-cabin camera clarity, consumer electronics firms embedding upscaling in next-generation displays, healthcare and research institutions upscaling medical imaging sequences, and media and entertainment studios leveraging AI upscaling for broadcast, film production, and online streaming. Security and surveillance organizations are also capitalizing on CCTV and law enforcement applications to enhance footage quality for critical investigations.

This comprehensive research report categorizes the AI Video Upscaling Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Software Type

- Pricing Model

- Output Resolution

- Content Type

- Platform

- Application

- End User Industry

- Deployment Mode

Exploring Regional Adoption Patterns and Strategic Opportunities Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics across the Americas, Europe Middle East and Africa, and Asia Pacific reveal differentiated drivers and adoption velocities in AI video upscaling. In the Americas, robust streaming service penetration and well-established cloud infrastructures have accelerated enterprise investments in upscaling platforms, while the presence of leading independent software vendors nurtures a competitive environment that fosters rapid innovation. Meanwhile, smaller broadcasters and creative agencies in Latin America are increasingly adopting cost-effective cloud-based upscaling services to modernize local content libraries.

In Europe, the Middle East, and Africa, regulatory emphasis on data sovereignty and privacy has elevated the appeal of on-premise and hybrid upscaling deployments. European Union data protection standards compel large media conglomerates to adopt solutions that offer localized processing and rigorous compliance features. At the same time, government-backed initiatives in the Middle East and Africa are promoting digital media infrastructure expansion, driving demand for versatile upscaling tools capable of addressing both emerging market budgets and high-end production requirements.

Asia Pacific constitutes a dynamic frontier for AI upscaling, with rapid 5G rollouts, mobile-first consumer behaviors, and aggressive content localization strategies propelling widespread adoption. Regional tech giants and startups alike are embedding upscaling capabilities into mobile apps and e-commerce platforms, while manufacturing hubs in China, South Korea, and Japan are integrating advanced upscaling modules into next-generation televisions and capture devices to satisfy escalating consumer expectations.

This comprehensive research report examines key regions that drive the evolution of the AI Video Upscaling Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Competitive Strategies Shaping the AI Video Upscaling Software Landscape in 2025

The competitive arena of AI video upscaling software is populated by an array of pioneering vendors offering differentiated value propositions. Topaz has solidified its reputation through multi-frame analysis engines and advanced motion correction capabilities, enabling artifact-free upscaling at resolutions up to 16K when paired with high-performance GPUs. Adobe’s integration of Firefly AI Enhance within its Creative Cloud ecosystem exemplifies a seamless in-suite upscaling experience, empowering editors to generate context-aware details without departing from familiar interfaces, albeit under a subscription model that may deter budget-conscious creators.

NVIDIA’s Video Super Resolution offerings demonstrate real-time browser- and player-based upscaling powered by RTX GPU acceleration, driving both consumer and enterprise use cases through hardware-integrated inferencing pipelines. Even so, the exclusivity to specific GPU architectures continues to shape market segmentation. Emerging entrants such as DVDFab and Reelmind.ai differentiate themselves through one-click presets and community-trained models tailored for scenarios ranging from anime restoration to vintage film aesthetics, illustrating the value of specialized workflows that cater to niche creative demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI Video Upscaling Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- AVCLabs Inc.

- CyberLink Corp.

- FENGTAO SOFTWARE LIMITED.

- Fotor Inc.

- Freepik Company S.L.

- HitPaw Co., Limited

- MAGIX Software GmbH

- Movavi Software Limited.

- Nero AG

- Neural Love OÜ

- NVIDIA Corporation

- Pixocial Technology Pte. Ltd.

- Pixop ApS

- Remini

- Tensorpix d.o.o.

- TLDR Technologies,Inc.

- Topaz Labs LLC

- TURBO STUDIO S.A.S.

- UniFab.ai.

- VanceAI Technology.

- Veed Limited

- Vidmore

- Winroad Holdings Limited.

- Wondershare Technology Group Co., Ltd.

Offering Actionable Strategic Pathways for Industry Leaders to Capitalize on Emerging AI Video Upscaling Opportunities and Market Evolution

To navigate the evolving AI video upscaling environment, industry leaders should adopt a multipronged approach that balances technological innovation with strategic partnerships. First, investing in proprietary model research that optimizes inference performance on mainstream GPU architectures will yield competitive differentiation and lower total cost of ownership. At the same time, forging alliances with cloud hyperscalers and hardware vendors can secure preferred pricing and early access to new accelerator technologies, enabling service offerings to maintain leading performance thresholds.

Second, establishing flexible commercial constructs-such as tiered usage agreements and modular deployment options-will cater to diverse budget profiles and risk appetites, expanding the addressable market beyond traditional media studios. Third, embedding upscaling services via open APIs and plugin integrations will streamline adoption among third-party developers, fostering an ecosystem that amplifies product stickiness and network effects. Finally, prioritizing data security and regulatory compliance, particularly in regions with stringent data sovereignty mandates, will build trust and unlock opportunities with government entities and industries handling sensitive visual data.

Outlining the Rigorous Research Framework Data Collection Protocols and Analytical Techniques Employed to Ensure Comprehensive Market Understanding

Our investigation employed a systematic research framework combining primary interviews with key stakeholders, secondary data collection, and robust analytical methodologies. Primary insights were obtained through structured dialogues with software developers, hardware providers, end-user organizations, and industry experts, ensuring a 360-degree perspective on adoption drivers, technological barriers, and strategic priorities. Simultaneously, secondary inputs were synthesized from publicly available financial statements, technology white papers, patent filings, and leading trade publications to contextualize emerging patterns and benchmark competitive performance.

Analytically, the study leveraged scenario analysis to assess the impact of tariff-induced cost variations on supply chain resilience, alongside qualitative segmentation exercises to delineate buyer preferences across pricing, deployment, and application dimensions. Regional adoption trajectories were evaluated through market maturity indices reflecting infrastructure readiness, regulatory environments, and ecosystem partnerships. This comprehensive approach ensured the reliability and validity of our findings, equipping decision-makers with actionable insights to inform strategy formulation and resource allocation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI Video Upscaling Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI Video Upscaling Software Market, by Software Type

- AI Video Upscaling Software Market, by Pricing Model

- AI Video Upscaling Software Market, by Output Resolution

- AI Video Upscaling Software Market, by Content Type

- AI Video Upscaling Software Market, by Platform

- AI Video Upscaling Software Market, by Application

- AI Video Upscaling Software Market, by End User Industry

- AI Video Upscaling Software Market, by Deployment Mode

- AI Video Upscaling Software Market, by Region

- AI Video Upscaling Software Market, by Group

- AI Video Upscaling Software Market, by Country

- United States AI Video Upscaling Software Market

- China AI Video Upscaling Software Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2385 ]

Summarizing Critical Insights and Forward-Looking Perspectives on AI Video Upscaling to Inform Strategic Decision-Making and Investment Priorities

In summary, AI video upscaling software has transitioned from a specialized enhancement utility into a foundational component of modern video workflows. Technological advancements in neural architectures and the proliferation of cloud and edge computing are driving unprecedented performance and accessibility, while evolving tariff landscapes introduce new supply chain considerations. Segmentation analysis highlights that differentiated pricing models, deployment modes, resolution targets, and vertical applications will guide adoption strategies, with regional nuances shaping go-to-market approaches.

Looking ahead, competitive success will hinge on the ability to innovate at the algorithmic level, cultivate strategic alliances across hardware and cloud ecosystems, and deliver flexible commercial and deployment options that address regulatory demands. By integrating these elements, stakeholders can harness AI video upscaling to unlock latent value in legacy content, enrich live broadcasts, and support emerging immersive and mobile experiences, thereby positioning themselves for sustained growth in a rapidly maturing market.

Engage with Ketan Rohom to Unlock Comprehensive AI Video Upscaling Market Intelligence and Drive Your Strategic Growth Initiatives Today

Take the decisive step toward unlocking unparalleled insights into the AI Video Upscaling Software market by securing your copy of our comprehensive research report today. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to leverage tailored guidance and in-depth analysis designed to empower your strategic growth initiatives. Whether you seek customized briefings, executive summaries, or detailed data modules, Ketan will ensure you receive the support necessary to translate market intelligence into actionable competitive advantage. Contact him now to elevate your understanding, identify high-impact opportunities, and accelerate your pathway to market leadership in the rapidly evolving AI video upscaling landscape.

- How big is the AI Video Upscaling Software Market?

- What is the AI Video Upscaling Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?