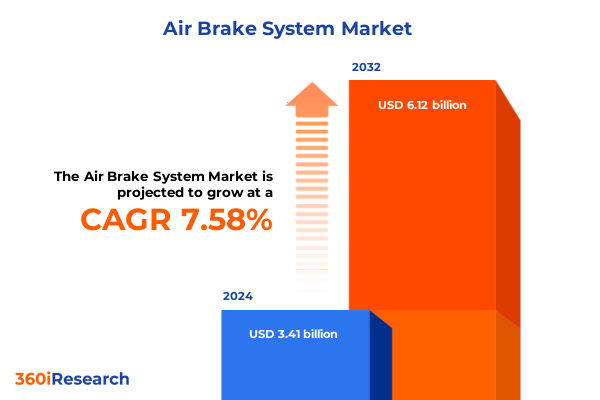

The Air Brake System Market size was estimated at USD 3.60 billion in 2025 and expected to reach USD 3.80 billion in 2026, at a CAGR of 7.87% to reach USD 6.12 billion by 2032.

Unlocking the Dynamics of Modern Air Brake Systems to Illuminate Market Drivers, Technological Evolution, and Strategic Imperatives for Enhanced Safety

In an era where vehicle safety regulations continue to tighten and global logistics demand ever-greater reliability, air brake systems have cemented their role as a critical component in commercial and off-highway vehicles. The evolution of braking technology has been driven by the imperative to protect lives, preserve assets, and enhance operational efficiency across diverse transportation sectors. With heavy-duty trucks, buses, agricultural machinery, and construction equipment all relying on compressed air for braking functionality, these systems serve as the backbone of safe vehicle operation under demanding conditions.

As automation, electrification, and connectivity reshape the automotive and industrial landscapes, the air brake system market faces a period of profound transformation. Stakeholders ranging from original equipment manufacturers to spare parts distributors are navigating complex challenges related to component interoperability, digital integration, and supply chain resilience. Against this backdrop, decision-makers must grasp not only the foundational mechanics of air brake systems but also the broader forces influencing their trajectory. This executive summary aims to synthesize the most impactful trends, regulatory developments, and competitive dynamics defining the marketplace today while illuminating the strategic imperatives for companies seeking to thrive.

Investigating the Key Transformations Redefining Air Brake Systems and Catalyzing the Shift to Intelligent, Highly Responsive Braking Solutions

The air brake system corridor is witnessing a series of transformative shifts that are redefining the benchmarks for safety, reliability, and performance. Foremost among these changes is the migration from purely mechanical and pneumatic controls to sophisticated electronic brake systems. By integrating electronic control units with advanced sensors and modulators, manufacturers are delivering faster response times, adaptive brake force distribution, and seamless coordination with vehicle stability and collision avoidance platforms.

Meanwhile, the convergence of connectivity and intelligent analytics is enabling predictive maintenance strategies that reduce unscheduled downtime. Telematics-enabled brake monitoring systems are alerting fleet operators to potential failures before they occur, optimizing maintenance schedules and minimizing the total cost of ownership. Furthermore, the push for emissions reduction and fuel economy has catalyzed the adoption of lightweight materials and energy-efficient compressors, driving research into composite reservoirs and oil-free designs.

Looking ahead, integration with autonomous vehicle architectures represents the next frontier for braking technology. As driver assistance systems evolve toward higher levels of autonomy, air brake subsystems must communicate seamlessly with lidar, radar, and camera arrays, ensuring split-second decisions during emergency braking scenarios. Collectively, these transformative shifts underscore a pivotal inflection point: the traditional air brake system is no longer a standalone module but rather an interconnected element within a broader, software-defined mobility ecosystem.

Analyzing the Complex Cumulative Impact of 2025 United States Tariffs on Air Brake System Supply Chains, Costs, and Cross-Border Trade Dynamics

The imposition of United States tariffs on imported brake system components in early 2025 has exerted a notable cumulative impact across the global supply chain. With duties targeting steel tubing, electronic control modules, and precision valves originating from several major manufacturing hubs, original equipment manufacturers have confronted rising input costs. These additional expenses have, in some cases, been partially absorbed by producers but have equally prompted price adjustments downstream, affecting fleets and service workshops.

Supply chain continuity has also been tested, as tier-1 suppliers scrambled to reallocate production volumes to alternative regions. In response to tariff-related cost pressures, several manufacturers initiated dual sourcing strategies, diversifying procurement across Southeast Asia and Eastern Europe. This reconfiguration has, however, introduced logistical complexities, lengthening lead times and increasing inventory holding requirements. Meanwhile, small and midsize component distributors have reported margin compression as they navigate a landscape of fragmented pricing and evolving trade regulations.

From a strategic standpoint, the tariff environment has accelerated conversations around nearshoring and vertical integration. Companies are evaluating the feasibility of in-house machining for key components, while partnerships with domestic steel producers have gained traction to mitigate exposure to import duties. Ultimately, the collective effect of the 2025 tariff measures underscores a market in flux, where cost management and supply chain agility have ascended to the forefront of competitive differentiation.

Illuminating Critical Segmentation Insights Revealing Diverse Technology, Distribution Channel, and Application Variations Shaping the Air Brake System Market

A nuanced understanding of the air brake system marketplace emerges through careful segmentation by technology, distribution channel, and application. When examining technological categories, conventional pneumatic brake systems remain prevalent in legacy fleets, offering proven reliability. In parallel, the electronic brake system segment is gaining momentum, with advanced electronic control units interfacing directly with modulator valves and wheel speed sensors to achieve precise brake modulation.

Turning to distribution channels, the original equipment manufacturer network continues to capture significant demand for new vehicle assemblies, while the aftermarket channel retains enduring importance for replacement parts and service. Within the aftermarket, demand cascades through component distributors to repair workshops and ultimately to spare parts retailers that cater to fleet maintenance requirements and the needs of independent service providers.

In application terms, off-highway sectors such as agriculture, construction, and mining deploy air brake systems engineered for rugged performance under extreme loads and dusty environments, whereas on-highway operations prioritize city bus fleets and long haul trucking routes demanding consistent stopping power over extended duty cycles. This interplay among technological advancements, channel dynamics, and diverse operational contexts paints a comprehensive portrait of segmentation insights that stakeholders must navigate.

This comprehensive research report categorizes the Air Brake System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Distribution Channel

- Application

Unpacking Regional Dynamics Spanning the Americas, Europe Middle East & Africa, and Asia-Pacific to Expose Varied Growth Drivers in the Air Brake System Sector

Regional dynamics within the air brake system arena are shaped by distinct regulatory frameworks, infrastructure investments, and industry structures across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, stringent safety standards and expansive roadway networks underpin robust demand for advanced braking systems, particularly among intercity and cross-border trucking operations. Infrastructure modernization efforts further incentivize the adoption of telematics-enabled brake monitoring solutions.

Across the Europe Middle East & Africa region, regulatory initiatives targeting carbon emissions and urban air quality have led to incentives for fleets equipped with electronically integrated brake systems. OEMs are forging alliances with transport authorities to pilot brake performance optimization projects in congested urban centers. Meanwhile, markets in North Africa and the Gulf Cooperation Council are experiencing infrastructure upgrades that fuel demand for off-highway braking solutions in mining and large-scale construction developments.

Meanwhile, Asia-Pacific stands as a hotbed of manufacturing activity, with rapidly expanding commercial vehicle production in China and India driving economies of scale in component fabrication. Growth in e-commerce logistics has accelerated fleet expansions, prompting buyers to seek braking systems that balance cost efficiency with performance consistency. The regional mosaic of trade corridors, environmental regulations, and production capacities underscores the imperative for market participants to tailor their strategic approaches to each distinct geography.

This comprehensive research report examines key regions that drive the evolution of the Air Brake System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Key Performances of Leading Air Brake System Providers Through Innovations, Partnerships, and Unique Differentiators Defining Competitive Advantages

The competitive landscape of air brake systems is populated by a mix of global conglomerates and specialized innovators, each pursuing differentiation through research investments, strategic partnerships, and portfolio expansions. Leading European-based suppliers are leveraging decades of pneumatic engineering expertise while simultaneously developing integrated electronic control offerings. At the same time, North American firms with deep aftermarket distribution networks are forging collaborations with Tier 2 electronics partners to expand their intelligent braking capabilities.

Several players are deploying open innovation models to crowdsource breakthroughs in sensor miniaturization and predictive analytics, collaborating with technology startups and academic research centers. Others have pursued bolt-on acquisitions to secure access to complementary product lines, thereby enhancing their full system offerings. Across the board, emphasis is placed on ensuring interoperability with advanced driver assistance systems and future autonomous platforms, signaling a shift from standalone component sales to holistic braking solutions.

As competitive intensity escalates, service-centric business models have emerged, with some providers offering subscription-based remote diagnostics and performance optimization plans. This evolution toward ongoing service revenue streams highlights the strategic importance of cultivating long-term customer relationships and embedding brake system expertise throughout the vehicle lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Brake System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bendix Commercial Vehicle Systems LLC

- Continental AG

- Eaton Corporation PLC

- Haldex AB

- Knorr-Bremse AG

- Meritor, Inc.

- Nissin Kogyo Co., Ltd.

- Robert Bosch GmbH

- Wabtec Corporation

- Yumak Air Brake Systems

- ZF Friedrichshafen AG

Delivering Actionable Strategies Empowering Industry Leaders to Capitalize on Emerging Technologies, Optimize Supply Chain Resilience, and Elevate Safety Measures

To capitalize on the evolving air brake system landscape, industry leaders should pursue a multipronged approach grounded in technology investment, supply chain resilience, and regulatory alignment. Prioritizing the development of next-generation electronic control units and sensor arrays will enable companies to differentiate through enhanced safety features and data-driven maintenance insights. Concurrently, scaling modular brake platforms can facilitate seamless integration with autonomous vehicle architectures and diverse powertrain configurations.

Supply chain diversification is imperative, with a focus on establishing strategic partnerships across low-tariff countries and accelerating near-shore production capabilities. By implementing real-time visibility tools and collaborating more closely with raw material suppliers, organizations can mitigate the disruptive impact of trade policy shifts. In tandem, aligning with emerging regulatory mandates on emissions and noise pollution by adopting lightweight, oil-free compressor designs will position manufacturers as leaders in sustainable mobility.

Finally, embracing service-oriented offerings such as predictive maintenance contracts and performance monitoring subscriptions can unlock recurring revenue streams. Cultivating these customer-centric models will not only stabilize margins but also foster continuous innovation through direct feedback loops, ultimately driving sustained competitive advantage.

Outlining a Rigorous Research Methodology Incorporating Primary Interviews, Secondary Data Analysis, and Robust Validation for Reliable Market Intelligence

The insights presented in this summary derive from a structured research methodology combining primary and secondary data sources. Primary research comprised in-depth interviews with senior executives at original equipment manufacturers, tier-1 suppliers, and fleet operators, capturing firsthand perspectives on technology roadmaps, procurement strategies, and operational pain points. Additionally, expert consultations with industry analysts and regulatory authorities provided context on policy trends and certification requirements.

Secondary research encompassed a thorough examination of technical whitepapers, trade association publications, and publicly available filings to validate component innovations, patent activity, and partnership announcements. Market intelligence was further bolstered through an analysis of customs and trade data to quantify shifts in import-export flows post-tariff implementation. Data triangulation was achieved by cross-referencing multiple sources and employing an iterative review process to ensure consistency and accuracy.

The methodology also incorporated scenario planning workshops with cross-functional stakeholders to stress-test strategic hypotheses under varying economic and regulatory conditions. This rigorous, multi-layered approach guarantees that the findings reflect real-world developments and provides a solid foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Brake System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Brake System Market, by Technology

- Air Brake System Market, by Distribution Channel

- Air Brake System Market, by Application

- Air Brake System Market, by Region

- Air Brake System Market, by Group

- Air Brake System Market, by Country

- United States Air Brake System Market

- China Air Brake System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Concluding Insights Synthesizing Key Findings and Emphasizing Strategic Paths for Stakeholders to Navigate the Future Trajectory of Air Brake System Innovations

Bringing together the diverse strands of analysis, it becomes clear that the air brake system domain stands at the crossroads of technological innovation, regulatory complexity, and shifting global trade dynamics. Stakeholders who recognize the accelerating shift toward electronic braking subsystems and the imperative for supply chain agility will be best positioned to capture emerging opportunities. Regional nuances-from the Americas’ infrastructure-led growth to Asia-Pacific’s manufacturing prowess-underscore the importance of geographic focus and strategic localization.

The 2025 tariff measures have illuminated vulnerabilities in component sourcing, prompting a reassessment of procurement models and near-shoring options. For leading providers, the path forward lies in marrying robust pneumatic engineering with smart electronics, service-based business models, and partnerships that span the value chain. Cultivating an ecosystem that supports continuous innovation, real-time data exchange, and proactive compliance will prove essential.

Ultimately, the journey ahead demands both technical excellence and strategic foresight. By synthesizing these insights into coherent action plans, companies can navigate the complexities of the modern air brake system market and secure long-term competitiveness within a safety-critical industry.

Engage with Associate Director Ketan Rohom to Unlock Exclusive Air Brake System Market Research Insights and Elevate Your Strategic Decision Making Today

Empower your organization with unparalleled insights into the air brake system market by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. By discussing your strategic priorities and operational challenges, you can access tailored research that addresses your specific business use cases. Whether you seek to deepen your understanding of tariff impacts, technology shifts, or regional market nuances, a conversation with Ketan will enable you to leverage actionable intelligence to drive growth. Schedule a personalized consultation today to explore the full suite of data, analysis, and expert recommendations. Unlock the competitive advantage that only comprehensive market research can provide and position your company at the forefront of innovation in the air brake system landscape.

- How big is the Air Brake System Market?

- What is the Air Brake System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?