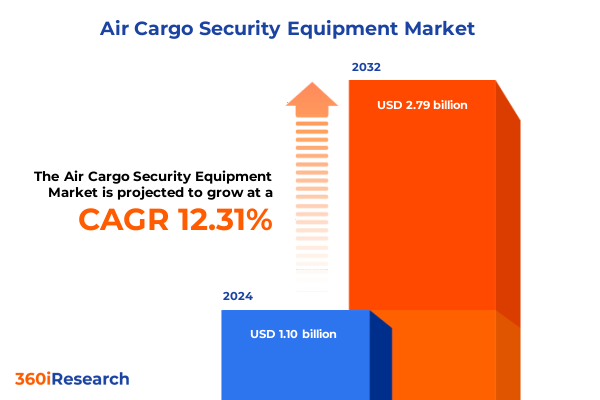

The Air Cargo Security Equipment Market size was estimated at USD 1.23 billion in 2025 and expected to reach USD 1.39 billion in 2026, at a CAGR of 12.34% to reach USD 2.79 billion by 2032.

Setting the Stage for Comprehensive Air Cargo Security Equipment Analysis to Safeguard Global Supply Chains Amid Evolving Threat Environments

Air cargo constitutes a critical artery in the global trade ecosystem, accounting for a substantial proportion of world commerce by value and facilitating time-sensitive shipments across continents. As threats evolve and illicit actors employ increasingly sophisticated concealment techniques, the imperative for robust screening and detection capabilities has never been greater. Federal mandates now require that every shipment undergoes rigorous inspection protocols to thwart potential security breaches and protect downstream stakeholders in the supply chain. These developments underscore the high-stakes nature of securing air cargo, where technological agility and operational resilience are paramount to safeguarding both passengers and economic interests.

Amidst fluctuating geopolitical tensions and burgeoning high-value e-commerce volumes, air cargo security equipment has emerged as a frontline defense against emerging threats. Regulatory frameworks instituted by national authorities compel operators to adopt advanced imaging, trace detection, and automated threat recognition solutions to comply with stringent screening requirements. This transformation reflects a broader convergence of security imperatives and commercial pressures, catalyzing investment in next-generation systems that deliver both throughput efficiency and heightened detection accuracy. Consequently, industry stakeholders are recalibrating their strategies to integrate cutting-edge equipment and data-driven processes into core operational workflows, ensuring seamless compliance and risk mitigation.

Emerging Technological and Operational Paradigm Shifts Reshaping the Air Cargo Security Equipment Market and Compliance Landscape

The landscape of air cargo security equipment is undergoing a profound metamorphosis driven by rapid technological innovation and shifting regulatory expectations. On one hand, federal research initiatives are fast-tracking the development of full-skid computed tomography scanners and next-generation explosives trace detection platforms capable of non-invasive analysis at high throughput rates. Through collaborative efforts among government, industry, and academic partners, novel algorithms and hardware prototypes are transitioning from laboratories into operational use, signifying a decisive shift toward proactive risk management and data-centric screening processes.

Simultaneously, the mandate for comprehensive, end-to-end cargo screening has intensified, with operators required to implement 100 percent inspection protocols and adhere to stringent chain-of-custody requirements. This regulatory environment has propelled adoption of portable, drone-mounted, and handheld systems that offer modular deployment options for remote or surge operations. As a result, stakeholders are investing in agile architectures that can seamlessly integrate fixed and mobile solutions, bolstering resilience against supply chain disruptions and adapting to evolving threat vectors.

Assessing How the 2025 U.S. Tariff Measures Have Rippled Through Air Cargo Security Equipment Supply Chains and Cost Structures

The United States’ tariff measures instituted in early 2025 have exerted multifaceted pressures on air cargo security equipment supply chains, amplifying both cost structures and logistical complexity. The broad application of a 10 percent reciprocal tariff on all imports and elevated rates for steel and aluminum have reverberated through manufacturing and distribution channels, contributing to a surge in air freight costs as operators expedite shipments to circumvent impending duties.

In particular, the abrupt removal of the de minimis exemption for goods originating from China has galvanized a significant uptick in per-kilogram charges, with some routes experiencing rate increases exceeding thirty percent. Such escalations have intensified budgetary constraints for cargo screening service providers and airports that depend on optimized capital expenditures for critical security hardware. Furthermore, key industry associations have lobbied for targeted exemptions, highlighting the role of specialized security components in preserving broader aviation safety objectives.

Against this backdrop, suppliers and end users face the dual challenge of maintaining compliance with stringent screening mandates while navigating an elevated tariff environment that has elevated lead times and procurement costs. As tariffs continue to evolve in response to bilateral negotiations and potential retaliatory actions, organizations must adopt dynamic sourcing strategies and engage with policymakers to secure relief for security-critical equipment.

In-Depth Examination of Market Segmentation by Equipment, Technology, Application, Installation, and End-User Profiles for Strategic Clarity

A nuanced understanding of market segmentation illuminates divergent demand patterns across equipment types, technology modalities, application scenarios, installation approaches, and end-user profiles. Equipment offerings range from high-resolution X-ray systems and dual-energy computed tomography scanners to millimeter-wave imagers and manual analysis tools embedded within explosive trace detection workflows. Within computed tomography, further differentiation between single-energy and dual-energy modalities informs choice of automated software for threat recognition versus reliance on manual interpretative expertise.

Delving deeper, technological architectures encompass imaging technologies that span two-dimensional X-ray and advanced three-dimensional computed tomography modalities, microwave detection suites, radiation detectors utilizing gamma rays or neutrons, and terahertz-based non-destructive inspection systems. Each technology pathway offers distinct trade-offs in sensitivity, false-alarm management, and throughput, mandating careful alignment with operational imperatives.

When contextualized by application context, the line between containerized cargo, loose bulk shipments, and palletized freight dictates scanner selection, procedural workflows, and facility layout. The choice of fixed versus portable installation further augments this complexity, as logistics hubs increasingly deploy drone-mounted scanners, handheld spectrometers, and mobile van-based screening assets to manage peak loads and emerging contingencies.

End users, spanning commercial airlines, major and minor airport authorities, cargo terminal operators, and government security agencies, each impose unique requirements on security equipment performance, certification, and support services. Airports differ markedly in capacity thresholds and throughput imperatives, while cargo operators balance regulatory compliance against operational efficiency. Collectively, these segmentation dimensions shape an ecosystem of bespoke solutions and service models that cater to the multifaceted needs of air cargo stakeholders.

This comprehensive research report categorizes the Air Cargo Security Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- Installation Type

- Application

- End User

Regional Dynamics and Differentiated Drivers Influencing Demand for Air Cargo Security Equipment Across the Americas, EMEA, and Asia-Pacific

The Americas region exhibits mature infrastructure and robust regulatory frameworks that drive high adoption of advanced computed tomography systems and automated threat recognition software. North American airports, supported by significant capital investment, have been early adopters of dual-energy scanners integrated with AI-driven analytics, while Latin American hubs increasingly prioritize portable and modular screening solutions to extend coverage across dispersed geographies. Continued emphasis on public-private collaboration furthers modernization efforts and fosters a competitive aftermarket for service and maintenance offerings.

In Europe, Middle East, and Africa (EMEA), evolving security directives and harmonized standards under European aviation authorities have accelerated the deployment of radiation detection technologies and terahertz modalities, particularly for high-risk cargo corridors. Meanwhile, Middle Eastern logistics hubs leverage extensive hub-and-spoke networks to trial drone-based inspection systems and advanced trace detection platforms, responding to complex threat matrices and high throughput demands. Across Sub-Saharan Africa, portable detection equipment and handheld devices serve as critical enablers for nascent screening regimes and cross-border interdiction efforts.

The Asia-Pacific region is characterized by escalating e-commerce volumes and strategic investments in end-to-end supply chain digitization. China’s revocation of the de minimis exemption has prompted regional shippers to explore onshore warehousing paired with automated CT skid scanners to mitigate tariff pressures. Simultaneously, Southeast Asian airports are integrating multi-view tomosynthesis and automated explosives trace detectors to streamline operations at burgeoning cargo terminals. Japan and South Korea, leveraging domestic technology ecosystems, pioneer alternative gas and helium-3 radiation detectors to address both counterterrorism and narcotics smuggling challenges.

This comprehensive research report examines key regions that drive the evolution of the Air Cargo Security Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Strategic Partnerships, and Competitive Advantage in Air Cargo Security Equipment

Leading suppliers within the air cargo security equipment domain are distinguished by their breadth of technological portfolios, global service footprints, and strategic partnerships. Rapiscan Systems, anchored in Torrance, California, spearheads research and development across a spectrum of X-ray and metal detection platforms while operating major production and distribution facilities across North America, Europe, and Asia-Pacific regions. The company leverages modular design principles to customize scanning lines for high-volume cargo hubs and field-deployable mobile units that address emergent security contingencies.

Smiths Detection complements this offering with a strong focus on artificial intelligence–enabled threat recognition and proprietary explosive trace detection instruments. The firm’s dual-energy computed tomography scanners, certified under stringent U.S. regulatory lists, feature algorithms that enhance discrimination between benign materials and potential threats. By integrating machine learning workflows, Smiths Detection enables higher throughput rates while minimizing false alarms and manual override requirements.

L3Harris Technologies and Leidos inject further competitive dynamism through acquisition-led expansions of analytical software portfolios and cloud-based data management services. Their solutions package real-time analytics dashboards with automated reporting modules, catering to large-scale cargo terminals and government security agencies. Analogic Corporation and Astrophysics Inc. round out the leading cohort with differentiated focus areas in millimeter-wave and terahertz inspection systems, offering niche capabilities for non-invasive detection across high-value cargo lanes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Cargo Security Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3DX-RAY Ltd

- Adani Systems Inc.

- Analogic Corporation

- Astrophysics, Inc.

- Autoclear LLC

- C.E.I.A. S.p.A.

- EAS Envimet Group

- ENSCO, Inc.

- Gilardoni S.p.A.

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Morpho Detection, LLC

- Nuctech Company Limited

- OSI Systems, Inc.

- Raytheon Technologies Corporation

- Safran Identity & Security SAS

- SICK AG

- Smiths Detection Group Limited

- Unival Group GmbH

- VOTI Detection Inc.

Actionable Strategic and Operational Recommendations for Industry Stakeholders to Enhance Resilience, Security, and Regulatory Alignment

Industry leaders should prioritize investment in artificial intelligence and machine-learning frameworks that enhance detection accuracy and optimize throughput. By partnering with technology incubators and academic consortia, organizations can pilot advanced algorithms in live operational contexts, enabling iterative refinement and rapid scaling of proven solutions. Close engagement with regulatory authorities is critical to secure targeted exemptions for security-essential equipment under evolving tariff regimes, mitigating cost escalations while preserving uninterrupted access to critical components.

Supply chain diversification emerges as a strategic imperative, as reliance on a narrow set of manufacturing geographies exposes operators to tariff volatility and logistical bottlenecks. Establishing multi-sourcing agreements and nurturing domestic assembly capabilities will reduce lead times and enhance budgetary certainty. Additionally, the integration of portable and drone-mounted screening assets offers flexibility to manage peak throughput periods and sudden risk escalations without substantial capital reconfiguration of existing fixed installations.

To achieve sustainable compliance and performance optimization, stakeholders must develop continuous training and certification programs for personnel, ensuring proficient handling of advanced screening technologies. Collaborative data-sharing frameworks between carriers, terminals, and security agencies will also bolster holistic threat visibility and facilitate predictive maintenance protocols that maximize equipment uptime.

Methodological Approach Leveraging Primary Interviews, Secondary Research, and Data Triangulation to Ensure Robust Market Insights

This research synthesizes insights derived from a dual‐track methodology combining qualitative interviews with industry executives, security technology specialists, and regulatory officials alongside comprehensive secondary desk research. Primary data collection involved structured interviews with supply chain managers at major airports, cargo terminal operators, and representatives from leading equipment vendors to validate market dynamics and segmentation drivers.

Secondary research encompassed a thorough review of government policy documents, industry white papers, technology roadmaps published by regulatory agencies, and peer‐reviewed publications on emerging detection modalities. Market segmentation frameworks were refined through iterative triangulation of vendor product catalogs, procurement records, and publicly available tender announcements. Data integrity was upheld via cross‐validation against multiple independent sources and statistical correction techniques, yielding a robust foundation for actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Cargo Security Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Cargo Security Equipment Market, by Equipment Type

- Air Cargo Security Equipment Market, by Technology

- Air Cargo Security Equipment Market, by Installation Type

- Air Cargo Security Equipment Market, by Application

- Air Cargo Security Equipment Market, by End User

- Air Cargo Security Equipment Market, by Region

- Air Cargo Security Equipment Market, by Group

- Air Cargo Security Equipment Market, by Country

- United States Air Cargo Security Equipment Market

- China Air Cargo Security Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Insights on Key Takeaways, Strategic Imperatives, and the Future Trajectory of Air Cargo Security Equipment Markets

In conclusion, the air cargo security equipment market is poised at a critical juncture, driven by converging forces of heightened regulatory scrutiny, technological innovation, and dynamic global trade flows. Strategic segmentation analysis reveals that stakeholders must align equipment choices with nuanced operational scenarios, from fixed deployment at major hubs to mobile inspections in emerging markets. The ripple effects of U.S. tariff policies underscore the importance of agile procurement strategies and proactive engagement with policymakers to safeguard supply chain continuity.

As industry leaders adopt advanced imaging, trace detection, and automated analytics, they will unlock new efficiencies and reinforce security postures against sophisticated threat vectors. The imperatives for collaboration, workforce upskilling, and ecosystem integration will define the next wave of market leadership, ensuring that air cargo remains a secure, efficient, and resilient channel for global commerce.

Connect with Associate Director Ketan Rohom to Secure Comprehensive Air Cargo Security Equipment Market Research for Informed Decision-Making

To delve deeper into the comprehensive analysis of air cargo security equipment and harness the strategic insights contained within our full market research report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through our detailed findings, methodological rigor, and tailored recommendations to support your organization’s decision-making process and competitive positioning. Secure your copy of the report and engage with an industry expert to accelerate your next moves in this dynamic market space. Connect today to transform market intelligence into actionable advantage and stay ahead of evolving security and regulatory landscapes.

- How big is the Air Cargo Security Equipment Market?

- What is the Air Cargo Security Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?