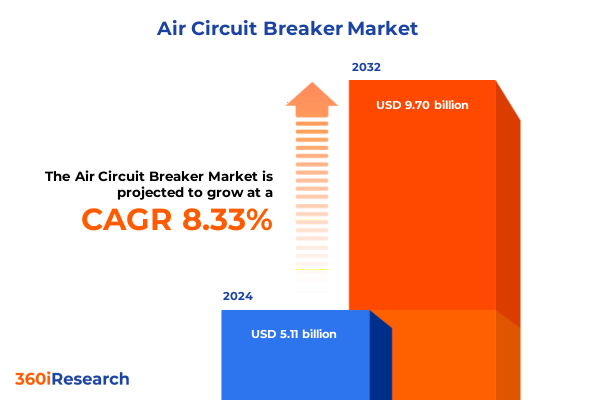

The Air Circuit Breaker Market size was estimated at USD 5.54 billion in 2025 and expected to reach USD 6.01 billion in 2026, at a CAGR of 8.48% to reach USD 9.80 billion by 2032.

Understanding the Critical Role of Air Circuit Breakers in Modern Electrical Infrastructure and Emerging Market Dynamics

Air circuit breakers serve as the backbone of modern electrical systems by safeguarding power networks against overcurrent faults and enabling controlled distribution across commercial, industrial, and utility applications. Their intrinsic ability to interrupt high fault currents quickly and safely underscores their critical role in maintaining operational continuity, preventing equipment damage, and ensuring personnel safety in environments ranging from data centers to power generation facilities. In an era defined by rapid electrification and digital transformation, air circuit breakers provide the reliability and robustness necessary to support mission-critical operations, significantly reducing downtime and enhancing system resilience in the face of growing energy demands.

The global evolution of power infrastructure, driven by initiatives to modernize aging networks and integrate renewable energy sources, has elevated the importance of air circuit breakers as essential components in smart grid deployments and microgrid applications. Advanced monitoring capabilities-such as remote diagnostics, real-time fault detection, and predictive maintenance algorithms-have become standard requirements for next-generation breakers, enabling operators to optimize asset performance and extend equipment lifecycles. Simultaneously, regulatory frameworks and industry standards continue to advance, mandating higher safety and energy-efficiency benchmarks that further reinforce the pivotal function of air circuit breakers across diverse sectors.

Exploring Transformative Industry Shifts That Are Redefining Technological Innovation and Sustainability in the Air Circuit Breaker Landscape

The air circuit breaker industry is undergoing transformative shifts propelled by digitalization and the imperative for sustainability. Digital trip units now embed microprocessor-based intelligence, allowing for real-time communication with energy management systems and seamless integration with Internet of Things (IoT) platforms. This convergence of power protection and digital networks empowers operators to harness predictive analytics, automate fault isolation, and orchestrate rapid recovery protocols-capabilities that were once the exclusive domain of high-end vacuum or SF₆ breakers. Such technological advancements are redefining the very architecture of electrical distribution, enabling scalable solutions that can be modularly deployed across data centers, Commercial buildings, and industrial campuses.

Concurrently, sustainability imperatives have catalyzed the development of more environmentally friendly breaker designs that mitigate reliance on high-global-warming-potential insulating gases and optimize material usage. Manufacturers are increasingly adopting modular and retrofit-friendly configurations that facilitate the upgrade of legacy switchgear with minimal downtime and reduced capital expenditure. Furthermore, the push for electrification in mobility and renewable energy integration has heightened demand for high-performance breakers with advanced arc extinguishing mechanisms. These paradigm shifts collectively underscore a market that is rapidly transitioning from traditional mechanical switching devices to intelligent, adaptive, and eco-conscious power protection solutions.

Navigating the Cumulative Impact of New 2025 United States Tariffs on Global Air Circuit Breaker Supply Chains and Pricing Strategies

Beginning in early 2025, newly enacted United States tariffs have materially altered the supply chain dynamics for imported air circuit breakers and critical components. Tariff levies on enclosure materials, electronic trip units, and specialized alloys have elevated landed costs, prompting OEMs and distributors to reassess sourcing strategies and renegotiate supplier contracts. In response, a number of industry participants have accelerated the diversification of their manufacturing footprints, relocating pivotal production and assembly operations to lower-tariff jurisdictions such as Mexico and Southeast Asia. This strategic realignment seeks to mitigate exposure to levy fluctuations while preserving pricing stability for end users.

While domestic manufacturers have experienced a resurgence in competitiveness due to reduced import volumes, the tariffs have also introduced upward pressure on raw material and component costs. Steel and copper duties continue to reverberate through the value chain, increasing input expenses for both domestic and international breakers. To preserve margin integrity, producers are engaging in long-term fixed-price supply agreements, optimizing design for material efficiency, and exploring alternative insulating and trip unit technologies. End users have adapted by consolidating vendor relationships, leveraging integrated busway-breaker systems, and expanding retrofit services to extend the service life of existing switchgear. As trade policies evolve, the ability to navigate these cost headwinds through agile sourcing and collaborative partnerships will remain a critical determinant of market success.

Unveiling Comprehensive Market Segmentation Across End-Use Industries, Installation Types, Trip Mechanisms, Voltage Classes, Current Ratings & Delivery Models

Diverse end-use industries are shaping the air circuit breaker market’s growth trajectory, with commercial buildings-encompassing hospitals, educational institutes, offices, and shopping centers-requiring reliable protection and energy management solutions. Meanwhile, hyperscale and enterprise data centers demand breakers capable of handling frequent switching operations and high short-circuit capacities, alongside integrated digital monitoring for uninterrupted operations. In the industrial sector, applications span automotive manufacturing, chemical processing, metals and mining operations, and oil and gas facilities, each imposing distinct performance and safety specifications on breakers. Mining environments, whether surface or underground, call for robust enclosures and advanced arc extinguishing mechanisms, while power utilities engage breakers across generation, transmission, and distribution networks, necessitating varying voltage and interruption ratings to meet stringent grid stability requirements.

Installation configurations further segment the market into indoor and outdoor use cases, with floor-mounted fixed or withdrawable breakers serving utility substations and large industrial plants. Panel-mounted designs deliver space-efficient protection for commercial switchboards, while outdoor free-air and metal-clad enclosure options address harsh environmental conditions and public safety mandates. Trip mechanisms range from basic magnetic-only and thermal-magnetic designs, suited to standard protection requirements, to advanced DSP-based and microprocessor-based electronic trip units that enable adaptive protection curves, remote parameter changes, and fault recording. Voltage classifications span low-voltage applications up to 1000V, medium-voltage installations from 1kV to 38kV, and high-voltage needs above 38kV, each with sub-categories to optimize performance. Solutions also differentiate across current ratings, from compact up to 800A units to heavy-duty breakers exceeding 2500A, and pole configurations including two-pole, three-pole, and four-pole variants. Finally, delivery models bifurcate into original equipment manufacturer channels, offering integrated and modular systems, and aftermarket services focused on maintenance replacements and retrofits, underscoring the full lifecycle support intrinsic to modern breaker strategies.

This comprehensive research report categorizes the Air Circuit Breaker market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Installation

- Mechanism

- Voltage Rating

- Number Of Poles

- Delivery Mode

- End-Use Industry

Analyzing Key Regional Market Dynamics Across the Americas, Europe Middle East & Africa, and the Asia-Pacific for Air Circuit Breaker Adoption

The Americas region leads the adoption of air circuit breakers, propelled by the United States’ substantial investments in grid modernization, driven by federal initiatives such as the Infrastructure Investment and Jobs Act and Inflation Reduction Act. Utilities and industrial operators are replacing legacy switchgear with breakers that offer smart monitoring, higher fault-interruption capabilities, and compatibility with distributed energy resources, reinforcing North America’s status as a market innovator. Latin American markets, particularly Brazil and Mexico, exhibit growing demand driven by industrial expansion and regulatory efforts to enhance power reliability and safety.

In Europe, Middle East & Africa, diverse regulatory landscapes and infrastructure priorities create a mosaic of opportunities. Western European utilities focus on decarbonization and digital substations, driving demand for breakers with integrated communication protocols and predictive maintenance features. Meanwhile, emerging economies in the Middle East are investing heavily in renewable energy projects and data centers, necessitating medium- and high-voltage protection solutions. African markets, though nascent, are experiencing infrastructure upgrades supported by multilateral financing, opening prospects for both new installations and retrofits of existing systems.

Asia-Pacific remains the fastest-growing region, fueled by rapid urbanization, industrialization, and rising electricity consumption in China and India. Government initiatives to modernize aging grids and expand rural electrification programs are driving breaker deployment across voltage ranges. Furthermore, the proliferation of hyperscale data centers in Southeast Asia and the rollout of electric vehicle charging networks are intensifying the demand for intelligent, high-throughput breakers. Regional manufacturers are scaling production capacity and forming joint ventures to meet local content requirements, signaling a competitive and dynamic market landscape.

This comprehensive research report examines key regions that drive the evolution of the Air Circuit Breaker market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Shaping Innovation, Competition, and Collaboration in the Global Air Circuit Breaker Industry Landscape

Leading global manufacturers have solidified their positions through continuous innovation, strategic partnerships, and expansive service networks. Siemens continues to drive digitalization with its SENTRON series, integrating cloud-based analytics and remote diagnostics to reduce unplanned outages. Schneider Electric has emphasized modularity and sustainability by incorporating eco-efficient insulation materials and data-driven maintenance platforms in its Masterpact line. ABB’s collaboration with software firms has yielded advanced condition monitoring solutions that leverage machine learning to predict maintenance needs and optimize fault response times. Meanwhile, Eaton has focused on enhancing breaker safety and performance through its Xpert arc flash detection and predictive maintenance algorithms, ensuring compliance with evolving standards. Mitsubishi Electric has expanded its medium-voltage breaker portfolio with hybrid designs that combine vacuum interrupters and SF₆ alternatives for a lower environmental footprint. Collectively, these key players invest heavily in R&D, strategic acquisitions, and regional expansions to address evolving customer demands and regulatory pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Circuit Breaker market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- C&S Electric

- Chint Group

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- General Electric Company

- Hager Group

- Hitachi ltd.

- Hyundai Electric

- Larsen & Toubro

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

Delivering Actionable Strategic Recommendations to Enhance Competitive Agility and Operational Excellence in the Air Circuit Breaker Sector

Industry leaders should prioritize the integration of advanced digital trip units with open communication protocols to enable seamless interoperability with energy management and IoT ecosystems. By adopting standardized data models and partnering with software providers, organizations can offer clients predictive maintenance and asset-management tools that drive operational efficiencies and extend equipment lifecycles. In parallel, accelerating the modularization of breaker designs can reduce installation times and lower logistical costs, enhancing competitiveness in retrofit and new-build projects.

To mitigate ongoing tariff and supply chain challenges, companies should establish multi-regional manufacturing hubs and secure long-term agreements with raw material suppliers. Developing strategic alliances with local assemblers and service partners can also ensure rapid response capabilities and localized support. Additionally, investing in alternative materials and refining design for manufacturability will help reduce exposure to volatile commodity pricing and align with sustainability targets. Finally, cultivating a value-added service portfolio-encompassing remote monitoring, training programs, and turnkey retrofit offerings-will strengthen customer relationships and create recurring revenue streams that underpin long-term growth.

Applying a Rigorous and Transparent Research Methodology for In-Depth Analysis of the Global Air Circuit Breaker Market While Ensuring Data Integrity and Analytical Rigor

The research methodology underpinning this analysis combines rigorous secondary and primary research approaches to ensure accuracy and depth. An extensive review of industry publications, regulatory filings, and patent databases established foundational insights into market dynamics, emerging regulations, and technological advancements. Complementing this, primary interviews were conducted with engineering leaders, procurement managers, and technical specialists across utilities, data centers, and industrial end users to validate market trends and capture evolving customer requirements.

Data triangulation was employed to reconcile quantitative estimates with qualitative feedback, ensuring that market segmentation and growth drivers are robustly substantiated. Detailed breakdowns by end-use industry, installation type, mechanism, voltage class, current rating, and delivery model were cross-verified against multiple data sources to enhance reliability. Finally, iterative reviews by subject-matter experts and cross-functional stakeholders confirmed the coherence and relevance of key findings. This structured and transparent approach provides stakeholders with a high-fidelity view of the air circuit breaker market landscape while safeguarding methodological integrity and analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Circuit Breaker market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Circuit Breaker Market, by Installation

- Air Circuit Breaker Market, by Mechanism

- Air Circuit Breaker Market, by Voltage Rating

- Air Circuit Breaker Market, by Number Of Poles

- Air Circuit Breaker Market, by Delivery Mode

- Air Circuit Breaker Market, by End-Use Industry

- Air Circuit Breaker Market, by Region

- Air Circuit Breaker Market, by Group

- Air Circuit Breaker Market, by Country

- United States Air Circuit Breaker Market

- China Air Circuit Breaker Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3657 ]

Drawing Conclusive Strategic Insights to Guide Future Developments and Investments in the Evolving Air Circuit Breaker Ecosystem

As air circuit breaker solutions evolve to meet the demands of digital grids and sustainable energy ecosystems, industry participants must align strategic investments with emerging application requirements. The transition toward intelligent, scalable, and eco-friendly breaker architectures presents significant opportunities for differentiation through innovation in materials, arc extinguishing technologies, and data analytics. Companies that cultivate agile operational models-capable of responding to tariff fluctuations, regional policy shifts, and end-user customization needs-will emerge as market frontrunners.

Looking ahead, the convergence of renewable integration, electrified transport infrastructure, and next-generation data centers will continue to amplify the importance of robust power protection solutions. Stakeholders should leverage the insights presented herein to inform R&D roadmaps, strategic partnerships, and supply chain optimizations. By embracing a proactive approach to technological adoption, regulatory compliance, and customer-centric service models, organizations can secure a competitive edge in the dynamic air circuit breaker ecosystem.

Secure Immediate Access to the Comprehensive Air Circuit Breaker Market Report by Connecting with Associate Director Ketan Rohom for Tailored Strategic Support

To explore the comprehensive air circuit breaker market insights, secure immediate access to the full research report by reaching out directly to Ketan Rohom, Associate Director, Sales & Marketing. By establishing this connection, you can gain tailored strategic support, benefit from deep-dive analyses, and receive customized data visualizations that align with your organization’s decision-making needs. This engagement promises not only granular market intelligence but also ongoing advisory services to help you capitalize on emerging trends, navigate complex regulatory environments, and optimize your supply chain strategies. Don’t miss the opportunity to strengthen your competitive positioning with actionable insights and expert consultation; contact Ketan Rohom today for prompt and personalized assistance in unlocking the full potential of the air circuit breaker market.

- How big is the Air Circuit Breaker Market?

- What is the Air Circuit Breaker Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?