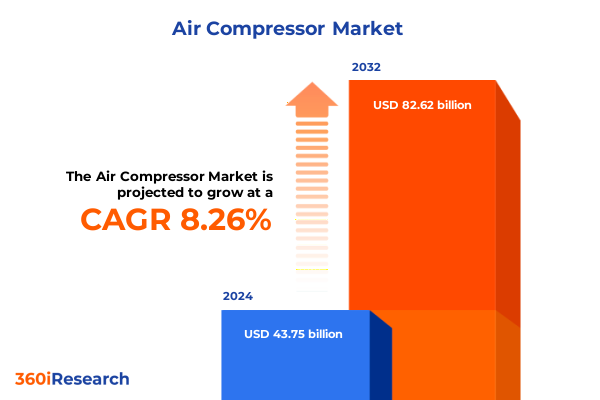

The Air Compressor Market size was estimated at USD 47.13 billion in 2025 and expected to reach USD 50.79 billion in 2026, at a CAGR of 8.34% to reach USD 82.62 billion by 2032.

Navigating the Air Compressor Market Landscape with an Overview of Technological Advancements, Competitive Dynamics, and Strategic Opportunities

Compressed air remains one of the most versatile and indispensable energy sources across industrial, commercial, and infrastructure applications. From powering pneumatic tools on manufacturing floors to driving critical drives in the food & beverage and medical device sectors, the air compressor plays a foundational role in ensuring operational uptime and process efficiency. As global demand accelerates under the twin pressures of automation and sustainability, stakeholders are re-evaluating their compressor strategies to optimize energy consumption, reduce total cost of ownership, and meet increasingly stringent environmental regulations.

Technological innovation has surged in recent years, encompassing leaner motor designs, variable speed drives, and advanced control systems that facilitate real-time monitoring and predictive maintenance. These developments are complemented by the growing adoption of oil-free compression solutions in sectors where product purity is paramount. At the same time, manufacturing consolidation and heightened competitive intensity are prompting vendors to fortify their service networks, bolster digital offerings, and pursue strategic partnerships to capture new revenue streams.

This executive summary sets the stage for an in-depth exploration of market dynamics, regulatory influences, and competitive positioning. It outlines transformative shifts, examines the implications of ongoing U.S. tariff measures, delivers segmentation and regional insights, and highlights leading company strategies. Finally, it culminates in actionable recommendations to help enterprises navigate the evolving landscape and secure sustainable growth.

Identifying the Transformative Shifts Shaping the Air Compressor Industry with Digitalization, Environmental Regulations, and Evolving End User Applications

The air compressor industry is undergoing a profound transformation fueled by digitalization, evolving environmental standards, and shifting end-user requirements. Embedded sensors and IoT connectivity now enable remote performance monitoring, predictive maintenance alerts, and seamless integration with enterprise resource planning systems. This transition to data-driven operations not only minimizes unplanned downtime but also underpins energy management initiatives, helping organizations achieve new efficiency benchmarks.

Simultaneously, environmental regulations at regional and national levels have accelerated the move toward low-emission and oil-free technologies. Manufacturers and end users alike are adopting compressors that incorporate advanced filtration, zero-leakage designs, and optimized motor systems to comply with carbon reduction targets and air quality mandates. As a result, product lifecycles are being extended, and lifecycle cost of ownership is becoming a focal point in procurement decisions.

In parallel, application landscapes are shifting as emerging sectors such as renewable energy, precision healthcare, and electronics manufacturing increase demand for specialized compression solutions. These evolving end-user profiles require adaptable systems that can deliver consistent pressure and purity levels across diverse operating conditions. The confluence of these forces is redefining competitive positioning, prompting legacy players and new entrants to innovate faster and deliver integrated service offerings that extend beyond hardware.

Assessing the Cumulative Impact of United States Tariffs on Air Compressors through 2025 Driven by Section 301 Measures and Supply Chain Realignments

Since 2018, the United States has imposed Section 301 tariffs of up to 25 percent on a broad range of Chinese imports, including many categories of air compressors and related components. While USTR granted temporary exclusions for select machinery and motor equipment, those exclusions largely expired by mid-2024, leaving most imported compressors subject to full duties through at least May 31, 2025. This extension of tariff exclusions was intended to smooth the transition for supply chains still reliant on Chinese manufacturing capacity, yet it also marked a prolonged period of elevated import costs that has persisted into 2025.

Looking ahead, the administration’s finalized modifications propose additional tariff increases on key industrial goods, reinforcing the long-term nature of these measures. As of January 1, 2025, increased Section 301 duties apply to a wider array of machinery and critical components, further intensifying cost pressures on import-dependent buyers and distributors. In response, many original equipment manufacturers have accelerated efforts to near-shore production, diversify sourcing to other low-cost regions, and partner with domestic fabricators to mitigate duty exposure.

The cumulative effect of these policies is reshaping the competitive landscape by boosting the appeal of domestically produced compressors and incentivizing investment in localized manufacturing facilities. While importers face tighter margins, end users are exploring total-cost-of-ownership models that weigh levy impacts alongside performance and service benefits, ultimately driving broader adoption of high-efficiency, locally supported equipment.

Uncovering Key Segmentation Insights across Product Types, Output Power Ranges, Operating Modes, Sealing Technologies, and Diverse End Use Applications

Market segmentation reveals nuanced performance and purchasing patterns across product types, power requirements, and applications. Dynamic compressors such as axial and centrifugal units are favored for high-volume, continuous-operation environments where efficiency and throughput are paramount. Conversely, positive displacement compressors, which include reciprocating piston systems and the broad array of rotary designs-encompassing screw, scroll, and vane variants-dominate scenarios requiring intermittent or variable-flow delivery with tight pressure control.

Additionally, the choice between portable and stationary architectures plays a crucial role in specifying the ideal solution. Mobile compressors facilitate rapid deployment in remote or maintenance-intensive settings, whereas fixed installations optimize energy use and lifecycle costs in centralized plants. Output power considerations further segment the market, with small-capacity units under 50 kW designed for light industrial or workshop contexts, mid-range systems between 51 kW and 250 kW serving mid-tier production lines, and robust installations from 251 kW to above 500 kW underpinning heavy-duty manufacturing and processing operations.

Sealing configuration also dictates suitability: lubricated models continue to offer lower initial capital outlay and higher volumetric efficiency, while oil-free variants cater to purity-sensitive sectors such as food & beverage and medical instrumentation. Pressure capabilities range from low-pressure applications under 20 bar up to specialized high-pressure systems exceeding 100 bar. Further stratification emerges in operating mode choices between electric-driven units and those powered by internal combustion engines, each presenting unique trade-offs in installation complexity, fuel dependency, and emissions. Finally, end-use demands across chemical & petrochemicals, food & beverages, manufacturing, medical, oil & gas, and power generation shape the functional and service attributes that customers prioritize.

This comprehensive research report categorizes the Air Compressor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Type

- Output Power

- Seal

- Maximum Pressure

- Operating Mode

- Application

Exploring Critical Regional Insights in the Americas, Europe Middle East & Africa, and Asia-Pacific Highlighting Demand Drivers and Strategic Hotspots

Regional dynamics within the air compressor market highlight distinct demand drivers and competitive landscapes. In the Americas, infrastructure expansion across oil & gas, mining, and transportation sectors sustains strong demand for both heavy-duty fixed installations and mobile solutions. Energy firms in North America are leveraging high-pressure compressors to enhance upstream recovery, while Latin American manufacturers are increasingly adopting mid-range electric compressors to modernize production processes and reduce reliance on diesel-powered generators.

In Europe, Middle East & Africa, regulatory imperatives around carbon emissions and air quality are accelerating adoption of energy-efficient, oil-free compressor technologies. European legislation targeting industrial energy consumption has spurred investments in variable speed drives and heat recovery modules, while Middle Eastern petrochemical complexes seek robust, corrosion-resistant systems for high-pressure service. African markets, though nascent, are poised for growth as infrastructure development programmes expand access to compressed air utilities in water treatment and telecom applications.

Meanwhile, Asia-Pacific remains the fastest-growing region, underpinned by rapid industrialization and urbanization. Chinese manufacturers are scaling production of compact, cost-effective compressors for domestic consumption and export, while India’s manufacturing renaissance drives demand for both portable and stationary systems. Southeast Asian economies are also boosting capital expenditures on food & beverage and pharmaceutical facilities, raising the profile of oil-free, hygienic compressor options that comply with international quality standards.

This comprehensive research report examines key regions that drive the evolution of the Air Compressor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Company Strategies and Competitive Positioning among Major Air Compressor Manufacturers and Service Providers

Leading companies in the air compressor arena are differentiating through innovation, service excellence, and strategic partnerships. Major equipment manufacturers such as Atlas Copco have expanded their portfolios with integrated digital platforms that offer predictive maintenance analytics, energy consumption dashboards, and remote troubleshooting capabilities. This shift toward servitization enables them to lock in recurring revenue streams while deepening customer relationships through value-added services.

Ingersoll Rand has pursued organic growth bolstered by targeted acquisitions, broadening its footprint in specialty segments such as oil-free and high-pressure applications. The company’s investment in R&D has yielded compressor lines featuring advanced heat recovery modules, enabling users to reclaim waste heat for facility heating or pre-heating processes. Other prominent players, including Kaeser Compressors and Sullair, emphasize modular designs that facilitate rapid installation and scalability, catering to small and mid-sized enterprises seeking minimal downtime during capacity expansions.

Collaboration with technology partners is also reshaping competitive positioning. Several firms have launched co-development initiatives with automation vendors and motor manufacturers to create fully integrated, turnkey solutions for smart factories. Service network expansion remains a core focus, with leading brands establishing regional centers to deliver preventive maintenance, retrofit upgrades, and spare-parts logistics under single-source agreements, thereby enhancing overall equipment effectiveness for end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Compressor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anest Iwata Corporation

- Atlas Copco AB

- BAC Compressors

- Bauer Compressors, Inc.

- BOGE KOMPRESSOREN Otto Boge GmbH & Co. KG

- Ciasons Industrial Inc.

- Cummins Inc.

- Dalgakıran Makine San. Tic. Ve A.S

- Danfoss A/S

- Desran Compressor (Shanghai) Co.,Ltd

- Doosan Corporation

- Eaton Compressor & Fabrication

- Ebara Corporation

- ELANG INDUSTRIAL (SHANGHAI) CO.,LTD.

- Elgi Equipments Limited

- Enea Mattei SpA

- FIMA s.r.l.

- FNA S.p.A.

- Fusheng Co., Ltd.

- General Electric Company

- Hitachi, Ltd.

- Hokuetsu Industries Co., Ltd.

- Hubei Anyi Compressor Co., Ltd.

- Indo-Air Compressors Pvt. Ltd.

- Ingersoll Rand Inc.

- Kaeser Compressors, Inc.

- Kaishan USA

- Kobe Steel, Ltd.

- Kyocera Corporation

- MAT Industries, LLC

- METRO Engineering Equipments Company

- MK Engineering Services

- Nehmeh Agencies & Trading (offshore) SAL

- Neuros Co., Ltd

- Oasis Manufacturing

- Panasonic Holdings Corporation

- Saylor-Beall Inc.

- Shanghai Sollant Energy Saving Technology Co., Ltd.

- Siemens AG

- Stanley Black & Decker, Inc.

- Sulzer Ltd.

- The Gast Manufacturing, Inc.

- Toshiba Compressor

- VMAC Global Technology Inc.

- Werther International

- Xiamen East Asia Machinery Industrial Co., Ltd.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Technological Trends, Supply Chain Resilience, and Sustainable Growth

To thrive in the evolving air compressor landscape, industry leaders should prioritize digital transformation initiatives that integrate real-time monitoring and predictive maintenance into standard offerings. Investing in cloud-based analytics platforms will not only differentiate products but also generate new service-based revenue models anchored in performance guarantees and energy optimization contracts. By leveraging data insights, manufacturers can collaborate more closely with end users to tailor solutions that address specific operational pain points.

Supply chain resilience has become a strategic imperative in light of persistent tariff pressures and global disruptions. Enterprises should diversify sourcing beyond single-country dependencies, cultivate partnerships with regional fabricators, and evaluate near-shoring opportunities to mitigate duty exposure and lead-time volatility. Parallel efforts to localize assembly and parts manufacturing can further strengthen market access and reduce logistical overhead.

Finally, sustainable growth will hinge on aligning product development with green credentials and regulatory frameworks. Leaders must accelerate the launch of oil-free, low-noise compressors equipped with high-efficiency drives, as well as explore emerging technologies such as magnetic bearing systems and advanced filtration solutions. Cultivating cross-sector alliances with utility providers and energy service companies will facilitate wider adoption of compressed air energy storage and waste-heat recovery programs, reinforcing the industry’s role in broader decarbonization efforts.

Detailing the Rigorous Research Methodology Underpinning Our Air Compressor Market Study Combining Primary Insights and Comprehensive Data Analysis

This research combines rigorous primary and secondary methodologies to deliver a comprehensive view of the air compressor market. Primary data was collected through in-depth interviews with key executives, engineering specialists, and procurement managers across end-user industries, supplemented by expert panels that provided qualitative insights into emerging technology adoption and regulatory expectations.

Secondary research encompassed a thorough review of technical papers, industry journals, manufacturing white papers, and government publications, ensuring that the analysis reflects the most recent standards and directives. Pertinent tariff notices, energy efficiency regulations, and environmental policies were cross-referenced with industry commentaries to ascertain their practical impact on equipment design and deployment.

Quantitative analysis employed both top-down and bottom-up approaches. The bottom-up model aggregated unit shipment data, equipment serial number records, and capacity utilization metrics, while the top-down analysis leveraged macroeconomic indicators, industrial output statistics, and energy consumption trends. This dual framework was validated through triangulation techniques, ensuring that the findings are robust and aligned with on-the-ground realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Compressor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Compressor Market, by Product Type

- Air Compressor Market, by Type

- Air Compressor Market, by Output Power

- Air Compressor Market, by Seal

- Air Compressor Market, by Maximum Pressure

- Air Compressor Market, by Operating Mode

- Air Compressor Market, by Application

- Air Compressor Market, by Region

- Air Compressor Market, by Group

- Air Compressor Market, by Country

- United States Air Compressor Market

- China Air Compressor Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Conclude on Growth Imperatives, Innovation Priorities, and Strategic Outlook for the Global Air Compressor Market

The air compressor market stands at a pivotal juncture where technological ingenuity, regulatory imperatives, and geopolitical developments converge to shape its trajectory. Key findings underscore the centrality of digitalization in driving operational efficiency, the growing mandate for oil-free and environmentally friendly systems, and the strategic significance of resilient supply chains in an era of sustained tariff pressures.

Segmentation analysis reveals that while dynamic compressors dominate in high-flow, continuous-operation contexts, the versatility of positive displacement and rotary models ensures broad applicability across light to heavy industrial use cases. Regional insights highlight the Americas’ focus on energy recovery, EMEA’s push for low-emission installations, and Asia-Pacific’s rapid expansion fueled by infrastructure and manufacturing growth.

Looking forward, market participants that effectively integrate digital services, localize manufacturing footprints, and align product innovations with sustainability directives will be best positioned to capture new opportunities. By leveraging the detailed segmentation, company strategy, and tariff impact analyses presented, stakeholders can chart a clear path toward optimized operations, enhanced resilience, and profitable expansion.

Engage with Ketan Rohom Today to Access Exclusive Insights and Secure the Complete Air Compressor Market Research Report for Informed Decision Making

If you are ready to transform your strategic planning with deep market intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the definitive Air Compressor Market Research Report. Engage directly with Ketan to discuss the customized insights that will inform your next investment, support your go-to-market strategies, and align your organization with the most critical industry trends. His expertise in translating complex market data into actionable business opportunities ensures you receive the precise, decision-grade intelligence needed to outpace competitors and capitalize on emerging growth avenues. Contact Ketan today to obtain exclusive access to comprehensive analyses, segmentation breakdowns, regional outlooks, and strategic recommendations that will empower your leadership team for the challenges and opportunities ahead.

- How big is the Air Compressor Market?

- What is the Air Compressor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?