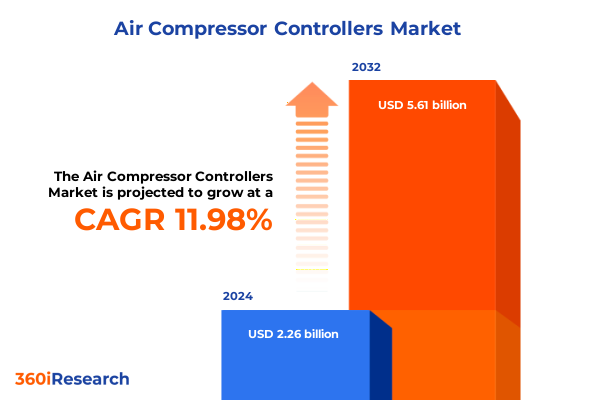

The Air Compressor Controllers Market size was estimated at USD 2.49 billion in 2025 and expected to reach USD 2.75 billion in 2026, at a CAGR of 12.25% to reach USD 5.61 billion by 2032.

Setting the Stage for Precision and Efficiency in the Dynamic Air Compressor Controller Market Amid Technological Revolution and Evolving Demand

The air compressor controller sector stands at the forefront of industrial automation, serving as the critical nexus between mechanical compression systems and digital control frameworks. Controllers regulate essential parameters such as pressure setpoints, cycle durations, and safety interlocks, thereby ensuring optimal performance, uninterrupted operation, and adherence to stringent safety standards. As global industries pursue higher productivity and lower energy consumption, these devices have transitioned from simple mechanical switches to sophisticated electronic systems capable of real-time adaptation and remote management.

Recent advancements have seen the integration of Internet of Things connectivity and artificial intelligence algorithms into controller architectures, enabling predictive maintenance, performance optimization, and fault diagnosis with unprecedented precision. These smart controllers collect and analyze operational data, alerting operators to potential inefficiencies and facilitating proactive interventions that minimize downtime while extending equipment lifespan.

Simultaneously, increasing emphasis on regulatory compliance and environmental stewardship has elevated the strategic importance of energy-efficient control solutions. Industry leaders are now evaluating controllers not only for their operational capabilities but also for their contribution to emissions reduction and alignment with corporate sustainability objectives. This report introduction sets the stage for a detailed exploration of how transformative technologies, evolving tariffs, and targeted segmentation shape the air compressor controller landscape.

Unveiling Technological, Regulatory, and Energy-Efficiency Shifts Reshaping Air Compressor Controller Solutions Across Global Industries

Industrial decision-makers face a convergence of technological breakthroughs, tightening regulations, and rising energy costs that are collectively reshaping the air compressor controller landscape. Smart control solutions now leverage machine learning models and adaptive feedback loops to modulate compressor output in real time, matching airflow delivery to fluctuating demand profiles with minimal wastage. This dynamic responsiveness represents a significant departure from legacy fixed-speed controls, delivering both operational flexibility and cost savings.

Concurrently, governments and regulatory bodies worldwide are enforcing stringent energy efficiency benchmarks and emissions targets, compelling manufacturers to integrate eco-friendly control features into their products. The global emphasis on reducing carbon footprints has spurred innovation in controller software and hardware, driving the adoption of modular systems that can be upgraded to meet evolving compliance requirements without wholesale equipment replacement.

Moreover, the trend towards comprehensive modular architectures, which allow seamless integration of advanced sensors, network interfaces, and user-friendly HMI platforms, is reshaping procurement strategies. Organizations now prioritize controllers capable of supporting future technology enhancements, reflecting a shift from single-function devices to holistic control ecosystems that deliver continuous operational improvements and strategic agility.

Examining the Cumulative and Sequential Impacts of 2025 United States Tariffs on Air Compressor Controller Supply Chains and Pricing Dynamics

In 2025, the United States implemented a series of reciprocal tariffs and duty increases that have had a pronounced impact on industrial automation components, including air compressor controllers. An executive order issued on April 2, 2025 introduced a baseline 10% tariff on virtually all imports, which was layered over existing duties and expanded to 125% on certain China-origin goods effective April 9, 2025. These measures, enacted in response to evolving trade policy objectives, have substantially elevated landed costs for imported controller assemblies and electronic modules.

Meanwhile, core Section 301 tariffs of up to 25% on Chinese-manufactured industrial equipment remain in force, creating a multi-tiered duty structure that amplifies price inflation throughout the supply chain. Controller manufacturers sourcing microprocessors and specialized circuits from Asia have encountered persistent cost pressure, prompting reassessment of sourcing strategies and inventory buffering to mitigate further duty fluctuations.

These cumulative tariff burdens have led major OEMs to introduce surcharge mechanisms to offset increased material expenses. For example, one global automation provider announced a 3.2% tariff surcharge on its product lines effective March 2025, explicitly attributing the adjustment to new steel, aluminum, and country-of-origin levies. This surcharge approach has passed incremental costs to end users while supply chain realignments continue to unfold.

Revealing Critical Insights from Multi-Dimensional Segmentation Across Control Modes, End-Use Industries, Power Sources, Lubrication Types, Installation Types, and Output Phases

The segmentation of the air compressor controller market reveals nuanced demand patterns that inform product development and go-to-market strategies. Analysis by control mode distinguishes between electronic controllers-further divided into microprocessor-based and PLC-based systems-integrated controllers that combine pressure sensing and actuation modules, and traditional pressure switches. Each category addresses distinct application requirements, from high-precision industrial automation to cost-sensitive utility installations.

Equally critical is the end-use industry segmentation, which spans sectors such as construction, manufacturing, mining, oil and gas, pharmaceuticals, power generation, and wastewater treatment. Manufacturing applications further bifurcate into automotive and food & beverage subsegments, reflecting divergent performance and compliance demands. Power source segmentation contrasts electric and pneumatic controllers, while lubrication type segmentation differentiates oil-free and oil-lubricated designs. Installation preferences emerge in fixed versus portable classifications, and electrical compatibility is addressed through single-phase and three-phase output phases. This multi-dimensional view illuminates targetable opportunities and informs tailored solution roadmaps.

This comprehensive research report categorizes the Air Compressor Controllers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Control Mode

- Power Source

- Lubrication Type

- Installation Type

- Output Phase

- End-Use Industry

Mapping Regional Dynamics and Strategic Growth Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific Air Compressor Controller Markets

Regional analysis highlights distinct growth drivers and market characteristics across the Americas, Europe Middle East & Africa, and Asia-Pacific markets. In the Americas, infrastructure modernization initiatives in North America and accelerated industrialization in Latin America have elevated demand for controllers capable of supporting complex manufacturing systems within automotive, food processing, and energy sectors. Supply chain resilience has become a priority, driving interest in controllers with flexible connectivity options and spare parts availability.

Within Europe Middle East & Africa, stringent energy efficiency directives emanating from the European Union’s Green Deal have spurred adoption of advanced control solutions designed to comply with eco-design requirements. Concurrently, Middle Eastern and African markets are investing heavily in large-scale oil and gas, petrochemical, and desalination projects, where robust, high-performance controllers are essential for continuous operation in challenging environments. Political and trade dynamics within the EMEA region influence procurement cycles, underscoring the value of local partnerships and service networks.

The Asia-Pacific region remains the fastest-growing epicenter for compressor controller adoption, driven by rapid industrial expansion in China, India, and Southeast Asia. As urbanization continues and energy infrastructure evolves, facilities demand intelligent controllers capable of integrating with plant-wide automation platforms and supporting predictive maintenance regimes. Regional manufacturers are also localizing production to mitigate currency volatility and expedite delivery, further accelerating market penetration.

This comprehensive research report examines key regions that drive the evolution of the Air Compressor Controllers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Strategic Initiatives, Innovations, and Collaborative Partnerships Shaping the Air Compressor Controller Competitive Landscape

Leading industry players are pursuing differentiated strategies to capture value across the controller ecosystem. Atlas Copco, renowned for its compressed air solutions, has embedded IoT-enabled analytics modules in its latest controller lineup, enabling remote performance monitoring and service diagnostics that reduce on-site intervention requirements. Schneider Electric has intensified its focus on sustainability-driven innovation, launching controllers with advanced energy-optimization algorithms and seamless integration with building management systems to support corporate decarbonization targets.

ABB is advancing its digital portfolio with modular control platforms designed for rapid deployment in smart manufacturing environments, while Ingersoll Rand leverages decades of domain expertise to deliver robust, user-friendly controllers with embedded fault-detection routines. These corporations emphasize strategic partnerships, such as collaboration agreements with cloud service providers and sensor manufacturers, to broaden their solution scope. Meanwhile, specialized firms are emerging with niche offerings-such as fully wireless controllers for portable compressor units-underscoring the competitive intensity and pace of technological evolution within this sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Compressor Controllers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arya Electronics & Controls Pvt. Ltd.

- Atlas Copco AB

- Ceccato Aria Compressa

- CMC NV

- DFX Technologies, LLC

- Eaton Compressor & Fabrication, Inc.

- Emerson Electric Co.

- FS-Elliott Company, LLC

- General Electric Company

- Haringa Compressor Inc.

- Hitachi Industrial Equipment Systems Co., Ltd.

- Ingersoll Rand

- J.P. Sauer & Sohn Maschinenbau GmbH

- Johnson Controls International PLC

- Kaeser Compressors, Inc.

- M-Tech Control

- Petrotech

- QED Environmental Systems by Graco Inc.

- Rockwell Automation, Inc.

- SAM Controllers

- Schneider Electric

- Shenzhen Inovance Technology Co., Ltd.

- Siemens AG

- Smartgen(Zhengzhou) Technology Co., Ltd.

- WAK Devices LLC

Presenting Actionable Strategic and Operational Recommendations to Empower Industry Leaders in Optimizing Air Compressor Controller Performance and Market Presence

To thrive in an environment defined by rapid innovation and evolving regulatory frameworks, industry leaders must adopt a dual focus on technological excellence and operational resilience. Companies should streamline product roadmaps to align with modular hardware architectures and open software protocols, ensuring seamless upgrades as digital standards evolve. Investing in scalable cloud-based analytics platforms will empower organizations to extract actionable insights from fleet-wide operational data, driving continuous improvement in energy utilization and uptime performance.

Moreover, supply chain diversification is paramount. By establishing dual-source agreements for critical electronic components and identifying nearshore manufacturing partners, firms can mitigate tariff-driven cost volatility and reduce lead times. Engaging in collaborative technical alliances with sensor suppliers and network infrastructure providers will accelerate the development of integrated control ecosystems that address emerging use cases in predictive maintenance and autonomous operations.

Finally, cultivating deep, value-added service capabilities-such as remote commissioning, training programs, and performance-based maintenance contracts-will differentiate offerings and reinforce customer loyalty. Providers that demonstrate both engineering leadership and a consultative service model will secure sustained competitive advantage.

Detailing Robust Research Methodologies Ensuring Data Integrity, Reliability, and Comprehensive Coverage of Air Compressor Controller Market Trends and Insights

This comprehensive study synthesizes insights derived from a rigorous, multi-stage research approach. Primary research involved in-depth interviews with senior executives and technical specialists across manufacturing, energy, and regulatory bodies, ensuring direct input from decision-makers who influence controller procurement and deployment strategies. Secondary research encompassed review of manufacturer technical documentation, industry standards publications, and trade association reports to triangulate data and validate emerging trends.

Quantitative analysis included assessment of tariff schedules, equipment shipment statistics, and macroeconomic indicators sourced from government databases and international trade registries. Qualitative evaluation leveraged case studies of pilot implementations and best-practice deployments to illustrate operational outcomes. Data integrity was upheld through cross-verification with third-party sources and continuous consultation with subject-matter experts.

Key research assumptions, definitions, and segmentation criteria are documented to provide transparency and reproducibility. This structured methodology underpins the reliability of the presented findings and supports informed decision-making in the dynamic air compressor controller market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Compressor Controllers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Compressor Controllers Market, by Control Mode

- Air Compressor Controllers Market, by Power Source

- Air Compressor Controllers Market, by Lubrication Type

- Air Compressor Controllers Market, by Installation Type

- Air Compressor Controllers Market, by Output Phase

- Air Compressor Controllers Market, by End-Use Industry

- Air Compressor Controllers Market, by Region

- Air Compressor Controllers Market, by Group

- Air Compressor Controllers Market, by Country

- United States Air Compressor Controllers Market

- China Air Compressor Controllers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Forward-Looking Perspectives on the Critical Role of Air Compressor Controllers in Future Industrial and Energy Applications

Drawing on a wide spectrum of data sources and stakeholder perspectives, this analysis confirms that air compressor controllers are central to next-generation industrial productivity and sustainability initiatives. Technological advancements in IoT, artificial intelligence, and modular hardware have elevated control solutions from mere regulation devices to strategic enablers of operational intelligence. Concurrently, regulatory shifts-particularly in energy and trade policy-have introduced new complexities that require adaptive sourcing and pricing strategies.

Segmentation insights underscore the need for tailored product portfolios that address the granular requirements of specific control modes, end-use applications, and regional preferences. Leading players have demonstrated that success hinges on integrative ecosystems that combine hardware, software, and service offerings to deliver measurable performance improvements. As markets continue to globalize, the ability to navigate tariff implications and supply chain dynamics will be as critical as technical innovation.

In conclusion, stakeholders equipped with granular intelligence on evolving technological, regulatory, and competitive factors will be best positioned to capitalize on growth trajectories and mitigate emerging risks in the air compressor controller market.

Discover How to Access In-Depth Air Compressor Controller Market Intelligence with Ketan Rohom for Tailored Insights and Strategic Advantage

For those seeking a comprehensive and nuanced understanding of air compressor controller dynamics, partnering with Ketan Rohom, Associate Director of Sales & Marketing, offers direct access to the full market research report tailored to strategic decision-making. Through a one-on-one consultation, you can explore detailed analyses of control mode innovations, end-use industry trajectories, and regional growth patterns that are critical to maintaining competitive advantage. By engaging with Ketan Rohom, you gain the opportunity to customize the insights to your organization’s specific requirements, ensuring that your investment in technology and infrastructure aligns with emerging regulatory frameworks and supply chain realities. Reach out today to secure your copy of the in-depth report and unlock actionable intelligence that will guide your next strategic moves in the evolving air compressor controller market.

- How big is the Air Compressor Controllers Market?

- What is the Air Compressor Controllers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?