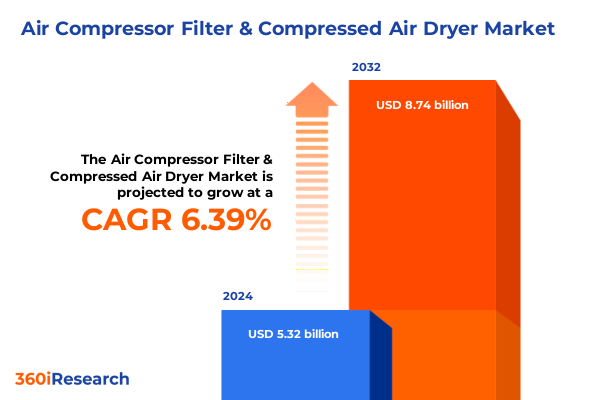

The Air Compressor Filter & Compressed Air Dryer Market size was estimated at USD 5.59 billion in 2025 and expected to reach USD 5.88 billion in 2026, at a CAGR of 6.58% to reach USD 8.74 billion by 2032.

Discover How Air Compressor Filters and Compressed Air Dryers Have Become Indispensable for Ensuring Efficiency, Reliability, and Quality in Diverse Industrial Sectors

Compressed air systems have become the lifeblood of modern industry, powering critical operations from production lines to process utilities. Within these systems, filters and dryers serve as the unsung heroes that ensure air purity, protect downstream equipment, and maintain product quality. As plants strive for higher levels of efficiency and reliability, the importance of effective air treatment cannot be overstated. Without proper filtration and drying, moisture and contaminants can compromise pneumatic tools, lead to costly maintenance, and even trigger regulatory noncompliance in sectors with stringent air quality standards.

Across automotive assembly lines, pharmaceutical cleanrooms, and food & beverage processing facilities, the demand for clean, dry air continues to rise. This upward trajectory is fueled by the ongoing shift toward automation, where even minute particles and moisture can disrupt sensor-based systems or contaminate sensitive processes. In parallel, energy conservation efforts and sustainability mandates are driving the adoption of advanced equipment capable of reducing operational costs and carbon footprints. As a result, stakeholders are increasingly focused on solutions that balance capacity, performance, and lifecycle economics, positioning filters and dryers at the forefront of investment decisions.

Embracing Digitalization, Sustainability, and Automation as Game-Changing Forces Redefining the Air Filtration and Drying Market Landscape

The compressed air treatment industry is undergoing profound transformation under the dual forces of digitalization and environmental stewardship. Manufacturers are embedding smart sensors within filters and dryers to capture real-time data on dew point, pressure differential, and contamination levels, enabling predictive maintenance and reducing unplanned downtime. With systems now connected to enterprise networks, performance optimization has shifted from reactive troubleshooting to proactive asset management, unlocking significant energy savings and extending equipment life.

Simultaneously, a heightened focus on sustainability is reshaping product development priorities. Equipment designers are integrating eco-friendly desiccants, low-GWP refrigerants, and advanced heat recovery features to minimize environmental impact and comply with evolving regulations. The emergence of hybrid dryer technologies that combine desiccant and refrigeration methods exemplifies this trend, delivering ultra-dry air with reduced power consumption. As regulatory bodies tighten permissible emissions and incentivize energy efficiency, manufacturers capable of offering greener, high-performance solutions are setting new benchmarks and gaining market share.

Assessing the Far-Reaching Consequences of Four-Year US Section 301 Tariffs and Exclusion Policies on Air Compressor Filtration and Drying Equipment Trade

Since 2018, the United States has maintained a series of Section 301 tariffs on Chinese-origin goods to address unfair trade practices, with duty rates ranging from 7.5% to 25% across multiple product lists. While certain exclusions-for items such as animal-feeding machinery and electric motors-have been extended through mid-2025 to support domestic sourcing transitions, many industrial equipment categories remain subject to hefty duties. This tariff framework continues to exert upward pressure on the costs of imported filtration and drying components, compelling OEMs and end users to reevaluate supply chains and inventory strategies.

Furthermore, a legislatively mandated four-year review of Section 301 duties concluded that some tariffs could be increased by up to 100% for selected goods effective January 1, 2025. This potential escalation has prompted stakeholders to engage in exclusion requests, hedging against future cost volatility and securing relief on critical machinery imports. However, the temporary nature of exclusions-often limited to a few months-means that long-term sourcing decisions, manufacturing footprints, and investment plans must factor in the broader uncertainty of U.S.–China trade dynamics.

Deep Dive into Market Segmentation Highlighting Diverse End Use Industries, Product Types, Flow Rates, Pressures, and Sales Channels Dynamics

The market encompasses a diverse set of end-use industries, ranging from automotive assembly and electronics production to food & beverage processing, heavy manufacturing, oil & gas operations, and pharmaceutical facilities. Each of these sectors imposes distinct requirements for air purity, moisture removal, and particulate control, driving tailored filter and dryer configurations. Product offerings bifurcate into dedicated dryers-spanning desiccant, membrane, and refrigerated technologies-and specialized filters, which include activated carbon, coalescing, oil vapor, and particulate variants. Complementing this, flow rate expectations vary considerably, with systems designed for below 500 Cfm through to those exceeding 1,000 Cfm, while operating pressures typically cluster between 7 to 14 bar, with outliers on either side of that range. The choice between offline and online sales channels further influences selection and service models, as customers weigh the benefits of direct manufacturer support against distributor networks and digital procurement platforms.

This multi-dimensional segmentation underscores the complexity of the market landscape. As customers seek integrated solutions, vendors are challenged to align product portfolios with specific capacity needs, sector regulations, and purchasing preferences, ensuring seamless compatibility and rapid deployment.

This comprehensive research report categorizes the Air Compressor Filter & Compressed Air Dryer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Flow Rate

- Pressure

- Sales Channel

- End Use Industry

Exploring Regional Dynamics and Growth Drivers Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Compressed Air Treatment Markets

Regional dynamics in the compressed air treatment market reflect broader economic and regulatory themes. In the Americas, robust automotive and food processing sectors are the primary drivers, with stringent quality mandates and cost containment imperatives fueling investments in energy-efficient dryers and low-pressure-drop filters. Market participants here emphasize rapid service response and flexible financing to meet OEM and end-user uptime targets.

Across Europe, the Middle East & Africa, demand is shaped by strict environmental directives, especially in Western Europe, alongside expansion in oil & gas infrastructure in the Gulf region. These trends are elevating the adoption of high-performance desiccant and hybrid dryers that can handle fluctuating ambient temperatures and meet diverse climatic conditions, while distributors in EMEA focus on value-added service contracts and regulatory compliance assistance.

In the Asia-Pacific zone, accelerating industrialization and government initiatives to modernize manufacturing drive significant growth. Countries such as China and India are scaling up factory automation, creating demand for compact, smart-enabled filtration and drying solutions capable of integrating with digital control systems. Meanwhile, Australia’s mining and utilities sectors seek heavy-duty equipment with high reliability and minimal maintenance requirements.

This comprehensive research report examines key regions that drive the evolution of the Air Compressor Filter & Compressed Air Dryer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Expansion, and Strategic Partnerships in the Air Compressor Filter and Dryer Sector

Leading companies are intensifying their focus on strategic acquisitions, product innovation, and digital service offerings. Atlas Copco, for instance, resumed its $32.8 million expansion at the Voorheesville, New York facility after pausing due to tariff uncertainties. This plant not only produces large-scale carbon dioxide compressors but now supports an enhanced compressed air treatment equipment lineup following the acquisition of a Canadian dryer and filter distributor.

Meanwhile, Ingersoll Rand has launched the RSb15-22ie/ne air compressor and its ECOPLANT cloud-based control platform, integrating real-time monitoring and machine learning to optimize energy consumption, reduce downtime, and lower carbon footprints. These next-generation offerings exemplify the drive toward smart, data-driven air treatment systems that deliver both operational efficiency and sustainability gains.

Other market stalwarts-including Parker Hannifin, Donaldson Company, Kaeser Kompressoren, and Sullair-are similarly investing in modular filtration racks, zero-purge desiccant dryers, and nanotechnology-enhanced filter media. By diversifying channel partnerships and expanding aftermarket services, these players aim to deepen customer relationships and capture a greater share of lifecycle service revenues.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Compressor Filter & Compressed Air Dryer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Copco AB

- BEKO Technologies GmbH

- BOGE Kompressoren GmbH

- Donaldson Company, Inc.

- ELGi Equipments Ltd.

- Gardner Denver, Inc.

- Hitachi Industrial Equipment Systems Co., Ltd.

- Ingersoll Rand, Inc.

- Kaeser Kompressoren SE

- MANN+HUMMEL GmbH

- Parker Hannifin Corporation

- Quincy Compressor, Inc.

- SPX Flow, Inc.

- Sullair, LLC

- Van Air Systems, Inc.

Strategic Roadmap of Actionable Recommendations Designed to Enhance Operational Efficiency, Sustainability, and Competitive Advantage in Compressed Air Systems

Industry leaders should initiate pilot programs to evaluate smart filtration and drying solutions within critical applications, leveraging real-time data to benchmark performance improvements and energy savings. By collaborating with technology providers on proof-of-concept trials, companies can gain early insights into total cost of ownership reductions and operational resilience gains.

Further, executives must develop a clear roadmap for migrating legacy systems to hybrid or desiccant refrigeration-based dryers, prioritizing equipment that aligns with corporate sustainability targets and regulatory mandates. Integrating predictive maintenance platforms will not only minimize unplanned downtime but also optimize inventory management for consumables like desiccant pellets and filter cartridges.

To address tariff-driven cost pressures, procurement teams should pursue exclusion requests under Section 301 processes where applicable, and explore reshoring or nearshoring options to mitigate supply chain disruptions. Strengthening partnerships with local distributors can expedite response times and reduce the need for large safety stocks, fostering greater agility.

Finally, establishing cross-functional centers of excellence that bring together operations, engineering, and procurement stakeholders will ensure standardized evaluation criteria for air treatment technologies, driving consistent decision-making and maximizing return on capital investments.

Comprehensive Research Methodology Detailing Systematic Data Collection, Analysis Techniques, and Validation Processes Underpinning the Market Study

This study synthesizes insights from a multi-tiered research framework, beginning with primary interviews conducted between Q1 and Q2 2025 with key stakeholders across manufacturing, oil & gas, and life sciences sectors. These qualitative discussions were complemented by quantitative surveys of over 200 end users to validate equipment usage patterns, performance expectations, and procurement drivers.

Secondary research leveraged regulatory filings, patent databases, and trade association publications to map tariff schedules and compliance requirements. Technical specifications and innovation trends were cross-verified through industry white papers, OEM product brochures, and standards such as ISO 8573-1 for compressed air quality. Macro-economic data from credible sources informed regional growth assumptions, while expert panels provided scenario analyses for future technology adoption rates.

All data points underwent rigorous triangulation, ensuring consistency across multiple sources. A bottom-up approach was employed to derive segmentation insights, while top-down modeling validated high-level market dynamics. The findings were subjected to peer review by an independent advisory board to confirm methodological robustness and eliminate bias.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Compressor Filter & Compressed Air Dryer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Compressor Filter & Compressed Air Dryer Market, by Product Type

- Air Compressor Filter & Compressed Air Dryer Market, by Flow Rate

- Air Compressor Filter & Compressed Air Dryer Market, by Pressure

- Air Compressor Filter & Compressed Air Dryer Market, by Sales Channel

- Air Compressor Filter & Compressed Air Dryer Market, by End Use Industry

- Air Compressor Filter & Compressed Air Dryer Market, by Region

- Air Compressor Filter & Compressed Air Dryer Market, by Group

- Air Compressor Filter & Compressed Air Dryer Market, by Country

- United States Air Compressor Filter & Compressed Air Dryer Market

- China Air Compressor Filter & Compressed Air Dryer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Learnings and Insights to Highlight Critical Themes Shaping the Future of Air Compressor Filtration and Drying Solutions

The insights presented underscore the critical role of advanced filtration and drying technologies in driving operational excellence and sustainability across industries. Digitalization and IoT integration are no longer optional but core to maintaining system reliability and energy efficiency. Meanwhile, environmental imperatives and tariff uncertainties are reshaping strategic sourcing and equipment lifecycle decisions.

Segmentation analysis reveals that a one-size-fits-all approach is untenable; vendors must offer tailored solutions that address specific flow, pressure, and purity requirements. Regional dynamics highlight the need for agile supply chains and localized service models to capitalize on growth pockets while managing cost pressures.

Looking ahead, the convergence of AI-driven predictive maintenance, hybrid dryer innovations, and modular filter architectures will define competitive differentiation. In this environment, early adopters that combine technology pilots, strategic procurement, and cross-functional governance will lead the transition toward cleaner, greener, and more resilient compressed air systems.

Unlock In-Depth Market Intelligence and Customized Insights by Connecting with Ketan Rohom to Secure Your Comprehensive Air Compressor Filter & Dryer Report

To take the next step toward gaining a competitive edge in the compressed air treatment landscape, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. He can provide tailored guidance on how this in-depth market report will address your strategic priorities and operational challenges. With his expertise, you’ll receive a comprehensive briefing on the report’s chapters, best practices for leveraging the findings, and options for customization to align with your specific business needs.

Don’t miss this opportunity to secure critical insights and actionable intelligence that will support your growth objectives and decision-making. Contact Ketan Rohom today to arrange a personalized consultation and obtain access to the full Air Compressor Filter & Compressed Air Dryer Market Research Report.

- How big is the Air Compressor Filter & Compressed Air Dryer Market?

- What is the Air Compressor Filter & Compressed Air Dryer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?