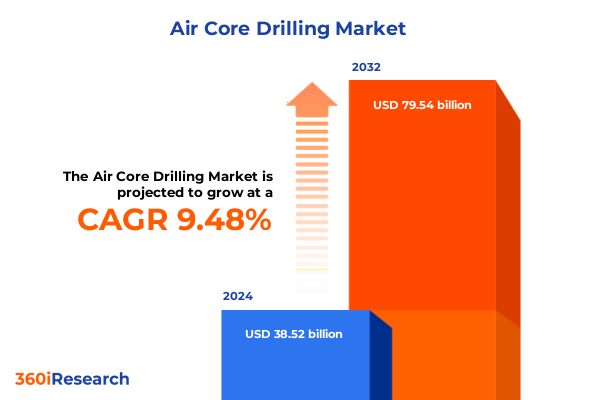

The Air Core Drilling Market size was estimated at USD 42.09 billion in 2025 and expected to reach USD 46.00 billion in 2026, at a CAGR of 9.51% to reach USD 79.54 billion by 2032.

Setting the Stage for Air Core Drilling Evolution by Highlighting Its Strategic Importance in Modern Subsurface Exploration and Environmental Monitoring

Air core drilling has emerged as a pivotal technique in subsurface exploration, offering a versatile and cost-effective solution for a wide range of geotechnical, environmental, and mineralogical investigations. By utilizing high-pressure air to advance hollow drill rods, this approach minimizes contamination risks and delivers rapid sample recovery, making it ideally suited for preliminary surveys and continuous core sampling in diverse geological settings. As industries continue to prioritize sustainability, efficiency, and data integrity, air core drilling stands at the forefront of innovation, bridging the gap between traditional rotary methods and advanced coring technologies.

This introduction sets the context for an in-depth examination of the air core drilling market, emphasizing its growing significance in decision-making across exploration, environmental assessment, and infrastructure development. The subsequent sections will explore transformative shifts that redefine operational paradigms, analyze the ripple effects of recent United States tariff policies on industry economics, and unpack granular insights across equipment, application, and end-user segmentation. Through this executive summary, stakeholders will gain a cohesive overview of emerging trends, competitive forces, and strategic imperatives necessary to navigate a rapidly evolving landscape.

Revolutionary Technological and Operational Developments Reshaping the Air Core Drilling Landscape for Enhanced Precision and Efficiency

Recent advancements in drill rig automation and real-time data integration have fundamentally altered the competitive dynamics of the air core drilling sector. High-precision guidance systems, combined with digital monitoring of downhole parameters, enable operators to optimize penetration rates while reducing non-productive time. These technological breakthroughs not only enhance the quality of core samples but also support predictive maintenance regimes, thereby extending rig lifespan and improving safety outcomes.

Equally significant are shifts in workforce skills and collaborative frameworks, as operators increasingly rely on multidisciplinary teams that blend geoscience expertise with data analytics. This confluence of talent ensures that drilling campaigns are planned and executed with a higher degree of accuracy, leveraging predictive geological models and machine learning algorithms. As a result, service providers are redefining value propositions by delivering holistic drilling solutions rather than standalone equipment offerings.

Assessing How Recent United States Tariff Measures in 2025 Have Altered Supply Chains Procurement Strategies and Cost Structures in Air Core Drilling

In 2025, the United States enacted new tariff measures targeting key components and machinery used in air core drilling operations, triggering a cascade of adjustments across sourcing and procurement functions. Equipment manufacturers and end users faced elevated costs for imported rigs and accessories, prompting a strategic reassessment of supply chain architectures. Many participants have shifted toward domestic suppliers or diversified import origins to mitigate exposure and secure uninterrupted access to critical parts.

These tariff-induced cost pressures have accelerated interest in modular rig designs and local aftermarket capabilities that reduce reliance on premium-priced imports. Companies are investing in rapid manufacturing technologies and stocking essential wear components domestically to avoid operational delays. Although initial capital outlays have increased, the longer-term operational resilience achieved through supply chain localization is poised to deliver substantial value in volatile trade environments.

Deriving In-Depth Insights from Equipment Type Application End User Drilling Depth Operation Mode and Bit Type Segmentation Perspectives

A comprehensive examination of equipment type segmentation reveals distinct performance and application profiles among fixed rigs, handheld rigs, and truck mounted rigs. Fixed rigs continue to dominate applications requiring stable platform setups, while handheld rigs maintain a niche in constrained environments demanding mobility. Within the truck mounted category, self contained units have gained traction in remote regions where self-sufficiency is essential, while tracked and trailer mounted variants offer superior maneuverability for complex terrain.

Application-based segmentation underscores the versatility of air core drilling across environmental exploration, geotechnical investigation, mineral exploration, and water well drilling. Environmental assessment projects benefit from minimal footprint sampling, whereas geotechnical investigations leverage consistent core logs for foundation design. Mineral exploration is bifurcated into base metal and precious metal pursuits, each necessitating specialized bit selections and depth capabilities. Water well drilling spans agricultural, industrial, and municipal segments, each driven by distinct water quality and volume requirements. Understanding these dimensions provides stakeholders a nuanced perspective on demand drivers and equipment selection criteria.

This comprehensive research report categorizes the Air Core Drilling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Drilling Depth

- Operation Mode

- Bit Type

- Application

- End User

Uncovering Distinct Regional Dynamics Influencing Air Core Drilling Adoption and Growth Trends across Americas EMEA and Asia Pacific

Regional dynamics play a critical role in shaping investment priorities and technology adoption rates within the air core drilling market. In the Americas, sustained infrastructure expansion and robust mineral exploration pipelines have driven demand for advanced truck mounted rigs capable of high throughput. North American environmental regulations also propel operators to invest in low-emission drilling platforms and comprehensive sampling protocols to comply with stringent oversight.

Across Europe, the Middle East, and Africa, diverse regulatory frameworks and geological endowments create a mosaic of opportunity and challenge. Western Europe’s emphasis on environmental rehabilitation projects fuels demand for handheld and fixed rigs optimized for shallow depth sampling, while exploration hotspots in Africa attract high-capacity truck mounted rigs designed for challenging climates. Meanwhile, the Asia Pacific region is characterized by rapid urbanization and industrial growth, leading to a surge in water well drilling for municipal and agricultural needs and driving interest in semi automatic and automated operation modes to enhance productivity.

This comprehensive research report examines key regions that drive the evolution of the Air Core Drilling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Air Core Drilling Providers to Reveal Strategic Positioning Innovations and Competitive Advantages Driving Industry Leadership

Leading companies in the air core drilling sector have carved out unique competitive positions by integrating advanced technologies and forging strategic partnerships. Many have developed proprietary guidance and data management systems that differentiate their rigs through enhanced real-time analytics, while others focus on modular design platforms that allow for rapid configuration changes across multiple drilling scenarios.

Collaborations with geological service firms and OEM component suppliers have become a hallmark of top-tier providers, enabling end-to-end solutions that address sampling accuracy, environmental compliance, and operational safety. Additionally, investment in local service networks and training programs ensures that customers receive consistent support and knowledge transfer, reinforcing brand loyalty and facilitating long-term project planning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Core Drilling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Copco AB

- Ausdrill Limited

- Baker Hughes Company

- Barminco Pty Ltd.

- Boart Longyear Ltd.

- Capital Drilling Ltd.

- Driconeq AB

- Epiroc AB

- Foraco International SA

- Geodrill Plc

- Halliburton Company

- Major Drilling Group International Inc.

- Master Drilling Group Ltd.

- Orbit Garant Drilling Inc.

- Reich Drill, Inc.

- Rosond Pty Ltd.

- Schlumberger N.V.

- Strata Drilling Group

- Technodrill S.A.

- Wallis Drilling Pty Ltd.

- Weatherford International PLC

Strategic Initiatives for Air Core Drilling Stakeholders to Capitalize on Market Opportunities Mitigate Risks and Drive Sustainable Performance

Industry leaders should prioritize investments in integrated data ecosystems that unify real-time drilling metrics with geological modeling outputs. By adopting open architecture platforms, organizations can enhance interoperability among legacy systems and next-generation telematics, fostering collaborative decision making and streamlined reporting across multidisciplinary teams.

Moreover, establishing localized supply and maintenance hubs near key markets will mitigate tariff impacts and reduce downtime. Partnerships with additive manufacturing firms can ensure rapid fabrication of critical components, while robust training initiatives will cultivate the skilled workforce required for advanced rig operation. Executing these initiatives will position stakeholders to capture emerging opportunities in environmental remediation, resource exploration, and infrastructure development.

Outlining a Robust Research Methodology Employing Multi-Source Data Collection Industry Expert Engagement and Rigorous Analytical Frameworks

This research employed a multi-pronged data collection approach, integrating primary interviews with industry executives, rig operators, and geological consultants alongside secondary analysis of trade publications and regulatory filings. Field observations of drilling campaigns provided empirical insights into rig performance metrics, maintenance cycles, and environmental compliance practices.

Analytical rigor was maintained through a structured framework encompassing competitive benchmarking, technology readiness assessments, and scenario planning. Qualitative findings were validated through cross-examination with industry databases and corroborated by expert panels to ensure accuracy and relevancy. This methodology underpins the reliability of insights and recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Core Drilling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Core Drilling Market, by Equipment Type

- Air Core Drilling Market, by Drilling Depth

- Air Core Drilling Market, by Operation Mode

- Air Core Drilling Market, by Bit Type

- Air Core Drilling Market, by Application

- Air Core Drilling Market, by End User

- Air Core Drilling Market, by Region

- Air Core Drilling Market, by Group

- Air Core Drilling Market, by Country

- United States Air Core Drilling Market

- China Air Core Drilling Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Reflections on Air Core Drilling Market Evolution Strategic Imperatives and Next Steps for Stakeholders to Secure Competitive Edge

The air core drilling market is undergoing a transformative phase characterized by technological innovation, evolving regulatory landscapes, and strategic supply chain adaptations. As environmental and resource-driven applications expand, the sector’s ability to deliver rapid, contamination-free sampling will remain its defining strength.

Stakeholders who embrace integrated data systems, modular rig architectures, and localized support frameworks will be best positioned to navigate tariff uncertainties and sustainability imperatives. By aligning strategic initiatives with emerging industry trends, decision makers can enhance operational resilience and unlock new avenues for growth in both established and frontier markets.

Empowering Decision Makers to Accelerate Growth through In-Depth Air Core Drilling Market Insights and Direct Engagement for Customized Strategic Support

By engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, stakeholders can gain tailored insights into project-specific challenges and opportunities. This personalized dialogue will offer clarity on advanced drilling technologies, optimal equipment configurations, and customized operational strategies that align with unique environmental and geological conditions. The tailored consultation ensures that decision makers can confidently navigate regulatory complexities and achieve strategic objectives with precision and agility.

Secure direct access to exclusive sections of the comprehensive Air Core Drilling market research report, including in-depth case studies, proprietary cost-benefit analyses, and peer benchmarking insights. Scheduling a call unlocks a partnership-driven approach designed to translate research findings into actionable plans, accelerate time to value, and enhance return on investment for exploration, environmental, and infrastructure projects. Reach out to initiate a focused conversation that transforms market intelligence into tangible business outcomes.

- How big is the Air Core Drilling Market?

- What is the Air Core Drilling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?