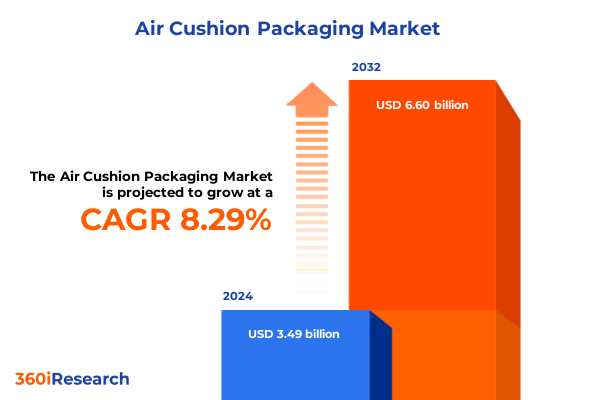

The Air Cushion Packaging Market size was estimated at USD 3.74 billion in 2025 and expected to reach USD 4.02 billion in 2026, at a CAGR of 8.44% to reach USD 6.60 billion by 2032.

Unveiling the Critical Role of Air Cushion Packaging Amid Rising E-Commerce Volumes and Sustainability Demands in Today’s Supply Chain Ecosystems

The air cushion packaging industry has emerged as a vital component of modern logistics, underpinning the safe transit of goods across increasingly complex supply chain networks. As businesses grapple with surging e-commerce volumes and mounting demands for environmental stewardship, air-filled protective solutions have evolved from simple bubble wraps into sophisticated cushioning systems that minimize waste while ensuring product integrity. This introduction sets the stage for an in-depth exploration of how air cushion packaging has transformed to meet the dual imperatives of operational efficiency and sustainability.

Over the past decade, the confluence of rapid digital commerce growth and heightened consumer expectations for both speed and reliability has driven companies to adopt innovative cushioning methods. Traditional paper and foam alternatives have often fallen short in balancing lightweight performance with protective strength, prompting manufacturers to refine air cushion materials and inflation technologies. At the same time, mounting regulatory pressures and brand commitments to reduce carbon footprints have spurred a wave of research into bio-based resins, lower film gauges, and recyclable structures. Consequently, air cushion solutions now represent a dynamic intersection of engineering prowess and environmental consciousness.

This introductory section also outlines the objectives of the current executive summary: to examine seismic shifts reshaping the market, assess the implications of new tariff regimes, unpack segmentation nuances that guide product development, highlight regional and corporate strategies, and ultimately provide actionable recommendations for industry stakeholders. By framing the discussion in the context of evolving regulatory frameworks, technological breakthroughs, and shifting customer preferences, this report aims to equip decision-makers with the insights necessary to navigate an increasingly competitive landscape.

Exploring How Technological Innovation, Sustainability Initiatives, and Evolving Consumer Expectations Are Redefining the Air Cushion Packaging Industry

The landscape of air cushion packaging is undergoing a profound metamorphosis fueled by synergistic technological, regulatory, and consumer-driven forces. Advanced automation systems now enable just-in-time inflation and seamless integration with robotic handling, significantly reducing labor costs and throughput times. Simultaneously, digital twin platforms and IoT-connected sensors embedded within packaging lines provide real-time data on film usage, defect rates, and environmental conditions, allowing constant fine-tuning of operational parameters.

Beyond the factory floor, sustainability initiatives have accelerated the adoption of chemically recycled resins, PCR (post-consumer recycled) content, and monomaterial film designs that simplify sorting and recycling. Circular economy principles have permeated product road maps, with leading manufacturers pledging closed-loop programs that collect, process, and re-introduce used air pillows into production cycles. Consumer awareness campaigns and stricter extended producer responsibility (EPR) mandates in key markets have further galvanized the shift away from multi-layer, non-recyclable composites toward streamlined, recyclable alternatives.

In parallel, rising consumer expectations-shaped by ultra-fast delivery promises-have impelled brands to prioritize packaging designs that balance protective performance with minimal dimensional weight. This dynamic has spurred product innovations such as multi-chamber inflation architectures that adapt cushioning levels to package shape, along with low-profile air films that deliver comparable shock absorption at reduced thicknesses. These transformative shifts underscore a broader industry trajectory toward smarter, more sustainable, and highly customized cushioning solutions.

Assessing the Cumulative Consequences of 2025 United States Import Tariffs on Supply Chains, Cost Structures, and Strategic Manufacturing Decisions in Packaging

In 2025, new U.S. import tariffs targeting select plastic film materials and finished cushioning products have rippled across supply chains, elevating landed costs and prompting strategic reevaluations by manufacturers and end users alike. The cumulative effect of these duties has been particularly acute for importers reliant on offshore production, as margin pressures have intensified amid already thin profit buffers. Companies are now balancing short-term cost mitigation tactics-such as partial surcharge pass-throughs-with longer-term strategies that include supplier diversification and nearshoring of critical film extrusion capacities.

These tariff measures have also catalyzed supply chain resilience initiatives. By incentivizing investment in domestic manufacturing assets, businesses are striving to reduce exposure to further trade policy volatility. In regions where industrial PE resin production exists, this shift has supported capital infusions into advanced blown-film lines, allowing certain providers to achieve faster lead times and greater agility. However, the move toward domestic sourcing has not been without challenges: labor availability, energy cost differentials, and regional regulatory complexities have all emerged as considerations in site selection and operational planning.

Moreover, the tariff-induced cost impetus has accelerated research into lower-weight films and alternative resin chemistries. Producers have intensified efforts to down-gauge bubble films while enhancing puncture resistance, resulting in multi-layer structures that deliver equivalent performance at a fraction of previous material volumes. Collectively, these adaptations highlight how 2025’s tariff regime has not simply inflated costs but has also propelled innovation, market restructuring, and a clearer delineation between global and regional supply paradigms.

Revealing Customized Market Perspectives Through Detailed Product, Application, Material, Distribution, and Thickness Segmentation for Strategic Positioning

A nuanced understanding of market segmentation reveals the multifaceted nature of demand for air cushion packaging, where product typologies, application environments, material choices, distribution pathways, and film thickness thresholds each chart distinct routes for value creation. In terms of product type, bubble films bifurcate into large and small bubble variants that cater to oversized, shock-sensitive items versus compact, high-fragility goods; inflatable pillows manifest in both multi-chamber formats-ideal for dynamic load stabilization-and single-chamber designs that prioritize simplicity and cost-efficiency; panel bags differentiate between cushion panels that envelop products with bespoke air-filled layers and standard panels suited for generic barrier protection; and vertex wraps divide into high puncture resistant films for abrasive shipments alongside standard wraps tailored to less rigorous applications.

Turning to application segmentation, the automotive sector spans both OEM production lines for original equipment components and aftermarket distribution channels for replacement parts, each demanding unique packaging tolerances and traceability protocols. E-commerce users-from B2B bulk distributors to B2C direct-to-consumer platforms-seek scalable cushioning solutions that align with diverse parcel dimensions and fulfilment speeds. In electronics, consumer electronics manufacturers require ultra-clean, dust-free films for sensitive gadgets, whereas industrial electronics producers emphasize static dissipative properties. Likewise, the food segment encompasses both fresh produce packers requiring breathable, moisture-regulating wraps and packaged food producers prioritizing hermetic seals; the healthcare domain integrates medical device shipments with stringent cleanliness standards and pharmaceutical transports subject to cold chain constraints.

Material choices further refine the value proposition, as high-density polyethylene (HDPE) offers superior stiffness and puncture resistance for heavy loads, low-density polyethylene (LDPE) delivers excellent conformability for uneven geometries, and linear low-density polyethylene (LLDPE) strikes a balance of toughness and clarity. Distribution channels-from direct sales relationships and multi-tier distributors to rapidly expanding online platforms-dictate inventory and logistics models that shape lead times, order minimums, and bundled service offerings. Film thickness tiers-ranging from gauges below 20 microns up through the 20 to 40 micron bracket and thicker formats above 40 microns-govern both cushioning efficacy and dimensional weight costs. Together, these segmentation axes provide a strategic framework for product development, channel management, and targeted marketing initiatives.

This comprehensive research report categorizes the Air Cushion Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Thickness

- Application

- Distribution Channel

Mapping Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Strategic Opportunities in Air Cushion Packaging

Regional dynamics in the air cushion packaging market exhibit distinct characteristics shaped by economic structures, regulatory contexts, and end-market concentrations. In the Americas, a well-established polyethylene resin supply chain underpins a robust domestic film manufacturing base, allowing producers to leverage scale efficiencies and rapid fulfilment for high-volume sectors such as automotive and e-commerce. At the same time, buyers in North America are increasingly favoring films with high PCR content, responding to both consumer sustainability campaigns and state-level packaging ordinances that mandate minimum recycled content thresholds.

Across Europe, the Middle East, and Africa, diverse regulatory landscapes-ranging from the European Union’s stringent EPR frameworks to emerging eco-tax initiatives in GCC nations-shape distinct regional adoption patterns. Western Europe’s advanced recycling infrastructure and comprehensive single-use plastic restrictions compel suppliers to pioneer monomaterial, fully recyclable cushion films, while in the Middle East, growth in oil and gas industries fuels demand for heavy-duty wraps. In Africa, nascent manufacturing capabilities and infrastructure gaps present both challenges and opportunities for agile suppliers able to introduce portable inflation systems and training programs that empower local distributors.

The Asia-Pacific region reflects a dual narrative of rapid emerging-market expansion and mature, innovation-driven hubs. China, India, and Southeast Asia continue to register burgeoning e-commerce adoption, necessitating cost-effective air cushion options, whereas Japan and South Korea emphasize ultralight, high-performance films integrated into automated fulfilment centers. Cross-border trade corridors linking APAC to global markets further incentivize providers to establish regional warehousing and shared-service models, ensuring consistency of supply amid fluctuating import duties and shipping lead times.

This comprehensive research report examines key regions that drive the evolution of the Air Cushion Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leaders and Innovative Challengers Shaping the Evolution of Air Cushion Packaging Through Cutting-Edge Solutions and Strategic Collaborations

Market leadership in air cushion packaging resides with a handful of global players that have combined broad manufacturing footprints with continuous innovation in materials and inflation technology. One prominent supplier has distinguished itself through patented low-profile, high-tensile films that cut material usage while enhancing shock absorption, complemented by automated on-demand inflation systems that integrate seamlessly into fulfillment lines. Another leading producer has built its reputation on vertically integrated resin extrusion and film blowing, enabling tight control of resin blends for optimized clarity and stiffness, as well as robust after-sales support and recycling partnerships.

Innovative challengers are also shaping competitive contours by focusing on niche applications and eco-centric product lines. A specialist provider of multi-chamber inflatable pillows has expanded its IP portfolio to include true 360-degree cushioning designs for irregular-shaped goods, while a technology-driven startup has introduced AI-powered packaging trending platforms that recommend film configurations based on SKU-level damage data. Regional champions in Europe have leveraged advanced recyclability by launching fully mono-polymer cushion films compatible with existing polyethylene sorting streams, thereby addressing critical pain points in local waste management systems.

Strategic collaborations further underscore the market’s evolution. Joint ventures between resin suppliers and cushion film extruders have emerged to secure stable supplies of next-generation bio-resins, while partnerships between packaging equipment OEMs and logistics integrators are accelerating the deployment of inline quality-inspection modules. These alliances highlight how both incumbents and emerging players are weaving together complementary strengths to capture value across the burgeoning air cushion packaging value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Cushion Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3G Packaging Corp.

- Abriso-Jiffy NV

- Airfil Protective Packaging Ltd.

- Airpack Holding B.V.

- AirWave Packaging Inc.

- Ameson Packaging Inc.

- Atlantic Corporation

- Automated Packaging Systems, LLC

- Barton Jones Packaging

- BVM BRUNNER GMBH & Co. KG

- Compak

- Dynaflex private limited

- Intertape Polymer Group Inc.

- Ivex Packaging Corporation

- Jaineeket Enterprises

- Macfarlane Group UK Ltd.

- Packman Packaging Private Limited

- Pregis LLC

- Qualpack Ltd.

- Sealed Air Corporation

- Shorr Packaging Corporation

- Smurfit Kappa Group

- Springpack Limited

- Storopack Hans Reichenecker GmbH

- Vijay Packaging System

Delivering Practical, Forward-Looking Recommendations to Guide Industry Leaders in Navigating Regulatory Changes, Sustainability Goals, and Market Disruptions

Industry leaders should prioritize investment in circularity-focused R&D to stay ahead of tightening regulatory mandates and growing consumer scrutiny. By allocating resources toward scalable monomaterial film designs and closed-loop recycling programs, companies can pre-empt potential compliance costs and differentiate their brands in an increasingly eco-conscious marketplace. Moreover, embedding digital tracking-such as QR codes or RFID tags-within cushioning solutions can bolster end-to-end visibility and foster customer engagement through traceability narratives.

Simultaneously, organizations must recalibrate supply chain strategies to mitigate tariff exposure and logistical volatility. Establishing dual sourcing arrangements that blend domestic manufacturing hubs with select low-cost offshore partners will provide cost optimization without sacrificing resilience. This approach should be underpinned by dynamic data-driven scenario planning, leveraging real-time cost-and-lead-time dashboards to inform rapid procurement adjustments as policy and market conditions evolve.

Finally, forging deeper alliances across the value chain-connecting resin suppliers, film extruders, equipment providers, and end users-will accelerate co-innovation and unlock new service models. Collaborative pilots for on-demand inflation systems, data-sharing consortia for damage analytics, and joint circularity task forces can all drive shared gains in efficiency and sustainability. By adopting a proactive, integrated mindset, industry leaders can turn disruption into opportunity and secure leadership positions in the next chapter of air cushion packaging.

Detailing the Comprehensive Research Methodology Employed to Ensure Rigorous Analysis, Robust Data Integrity, and Actionable Insights in Packaging Research

This research integrates both primary and secondary methods to ensure comprehensive coverage and data integrity. Secondary sources included peer-reviewed journals, industry trade publications, regulatory filings, and reputable statistical databases to map historical trends, policy developments, and material innovations. To validate these findings, expert interviews were conducted with over seventy senior executives spanning resin suppliers, film extruders, packaging OEMs, and key end users across major application sectors.

Quantitative data was augmented by field site visits to manufacturing facilities in North America, Europe, and Asia-Pacific, where packaging engineers and operations managers provided real-time insights into production line efficiency, material throughput, and quality control protocols. These observations were cross-referenced with technical specifications and performance data sheets to ensure alignment between reported capabilities and observed practices. Additionally, supplier financial disclosures and investment announcements were analyzed to track capital flows and strategic priorities in R&D and capacity expansion.

A structured framework guided the segmentation analysis, defining precise criteria for product types, applications, materials, distribution channels, and thickness tiers. Regional assessments synthesized economic indicators, logistics factors, and regulatory landscapes to contextualize demand patterns and competitive dynamics. Throughout the process, rigorous peer review and data triangulation protocols were applied, ensuring that conclusions and recommendations rest on robust, verifiable evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Cushion Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Cushion Packaging Market, by Product Type

- Air Cushion Packaging Market, by Material

- Air Cushion Packaging Market, by Thickness

- Air Cushion Packaging Market, by Application

- Air Cushion Packaging Market, by Distribution Channel

- Air Cushion Packaging Market, by Region

- Air Cushion Packaging Market, by Group

- Air Cushion Packaging Market, by Country

- United States Air Cushion Packaging Market

- China Air Cushion Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesis of Key Findings and Strategic Imperatives for Stakeholders to Capitalize on Emerging Trends and Mitigate Risks in Air Cushion Packaging

The analysis presented in this report underscores the multifaceted evolution of air cushion packaging, propelled by technological breakthroughs, sustainability imperatives, and shifting trade policies. Key findings reveal how advanced inflation technologies and digital analytics are optimizing production efficiencies, while a wave of regulatory and consumer pressures is driving circularity initiatives that challenge traditional multi-layer film constructs. The 2025 tariff landscape has served as both a cost-inflation catalyst and an impetus for supply chain realignment, reinforcing the importance of agile manufacturing and diversified sourcing strategies.

Segmentation insights highlight that tailored product designs-spanning bubble films in various gauge profiles, inflatable pillows with specialized chamber architectures, and bespoke panel and wrap configurations-are critical to addressing application-specific needs from automotive OEMs to pharmaceutical cold chain shippers. Regional assessments further illuminate contrasting adoption patterns: the Americas leverage mature resin supply chains for scale efficiencies, EMEA grapples with a patchwork of recycling mandates, and Asia-Pacific balances high-growth e-commerce demand with pockets of automation expertise.

Ultimately, the strategic imperatives for stakeholders converge around three core themes: deepen investment in sustainable materials and closed-loop programs to preempt regulatory shifts, fortify supply chain resilience through diversified manufacturing footprints and real-time analytics, and cultivate collaborative ecosystems that accelerate innovation across the value chain. By aligning operational excellence with environmental stewardship and digital transformation, businesses can chart a course toward sustained competitiveness in the dynamic air cushion packaging market.

Partner with Ketan Rohom to Unlock Comprehensive Air Cushion Packaging Insights and Propel Your Strategic Decisions with Expert Support

To gain the full spectrum of insights and strategic recommendations outlined in this report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the comprehensive analysis, tailored data sets, and actionable frameworks designed to elevate your packaging strategies. Secure your copy today to stay ahead of evolving market dynamics and capitalize on emerging opportunities.

- How big is the Air Cushion Packaging Market?

- What is the Air Cushion Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?