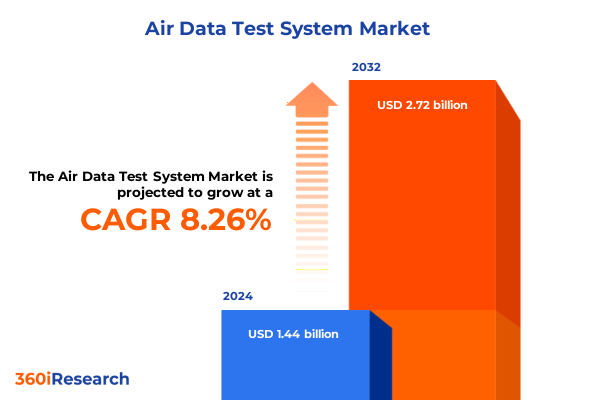

The Air Data Test System Market size was estimated at USD 1.55 billion in 2025 and expected to reach USD 1.67 billion in 2026, at a CAGR of 8.35% to reach USD 2.72 billion by 2032.

Setting the Stage for Understanding Air Data Test System Industry Dynamics and Emerging Opportunities in a Rapidly Evolving Aerospace Environment

In an era defined by accelerated technological innovation and shifting regulatory landscapes, understanding the pivotal role of air data test systems is essential for aerospace stakeholders seeking to maintain operational excellence. These specialized testing solutions underpin critical flight performance validation processes by simulating pressure, temperature, and airflow conditions to ensure instrument accuracy and airworthiness. As both commercial and defense sectors intensify requirements for precision, reliability, and certification speed, air data test systems emerge as foundational tools that support everything from prototype development to ongoing maintenance cycles. Consequently, measuring emerging trends and challenges around system modularity, integration, and data analytics is critical to inform strategic decision-making.

Against this backdrop, this executive summary synthesizes the latest industry developments, drawing attention to transformative shifts in technology adoption, regulatory mandates, trade policy impacts, and competitive dynamics. By examining the cumulative effects of recent tariff policies, dissecting multi-dimensional segmentation trends, and presenting regional outlooks, we offer a panoramic view that equips decision-makers with the insights needed to navigate complexity. Ultimately, this introduction sets the stage for a thorough exploration of the air data test system environment, highlighting key drivers that will shape procurement strategies, R&D investments, and partnership models going forward.

Uncovering Major Technological and Regulatory Transformations Redefining the Air Data Test System Ecosystem and Driving Strategic Innovation

Recent years have seen a confluence of technological breakthroughs and regulatory reforms that are fundamentally redefining the air data test system ecosystem. On the technological front, the integration of digital twins and advanced sensor fusion algorithms is enabling more precise simulation of flight conditions, transforming legacy hardware into intelligent platforms that deliver real-time diagnostics and predictive maintenance capabilities. Moreover, the adoption of IoT connectivity facilitates remote calibration and cloud-based analytics, accelerating decision cycles and reducing aircraft downtime. These advances are supported by machine learning models that can detect subtle drift patterns in pressure or temperature sensors, pre-empting failures and optimizing test procedures.

In parallel, aviation authorities across major jurisdictions have introduced stricter certification standards aimed at harmonizing performance thresholds for new-generation air data sensors. Regulatory bodies have also mandated higher traceability of test data and more rigorous documentation protocols, compelling system providers to embed robust data management modules within their solutions. When taken together, these technological innovations and regulatory drivers are fueling a shift toward modular, software-enabled test rigs that can adapt swiftly to changing certification regimes and platform requirements. This transformative conjunction of software-defined instrumentation and compliance complexity is prompting industry stakeholders to re-evaluate legacy test frameworks and adopt agile development methodologies that support continuous upgrades and feature integration.

Evaluating the Aggregate Effects of 2025 United States Tariffs on Supply Chain Dynamics Procurement Costs and Strategic Sourcing Decisions in Aerospace

In 2025, the United States enacted a series of heightened import duties targeting aerospace and defense-related electronic components, directly affecting key subsystems used in air data test systems. These tariff measures have led to a recalibration of global supply chain networks, compelling manufacturers to reconsider sourcing strategies and supplier diversification. Higher duties on specialized transducers and precision pressure modules have driven up procurement expenses, encouraging some original equipment manufacturers to explore alternative lower-duty jurisdictions or to invest in domestic component fabrication capabilities.

Beyond raw component costs, the tariff-driven supply chain realignment has introduced lead-time variability as firms navigate new customs procedures and port congestion. Consequently, several system integrators have adopted dual-sourcing frameworks, establishing parallel lines of component qualification to mitigate single-source dependency. In addition, the elevated cost environment has accelerated vertical integration initiatives among leading providers, prompting some to acquire testing instrument manufacturers or to develop in-house calibration facilities. As these strategic adjustments take root, stakeholders must continuously monitor policy shifts and maintain flexible contracting terms to balance cost containment with the stringent performance and quality requirements inherent to aerospace testing.

Revealing Critical Insights Across Multiple Segmentation Dimensions of the Air Data Test System Market to Illuminate Customer Preferences and Usage Trends

Examining the market through the prism of product type uncovers differentiated value propositions among modular ADTS, multi-channel ADTS, portable ADTS, and rack-mounted ADTS offerings. Modular systems attract operators requiring rapid reconfiguration for diverse flight test profiles, while multi-channel platforms cater to high-volume test campaigns that demand simultaneous validation of multiple sensor arrays. Portable solutions deliver field-ready flexibility for on-aircraft line-maintenance checks, contrasting with rack-mounted installations that provide comprehensive, centralized test suites in lab or hangar environments.

When viewed through the lens of testing parameters-airspeed, altitude, differential pressure, Mach number, static pressure, and temperature compensation-it becomes evident that certain test rigs excel at simulating extreme flight envelopes, whereas others optimize stability and repeatability for steady-state calibration tasks. Overlaying the platform dimension, systems deployed in in-flight configurations must endure vibration, temperature cycles, and power constraints, while on-ground installations can leverage broader power budgets and environmental controls to achieve higher throughput and data fidelity.

Considering sales channels, direct sales relationships often underpin tailored solution design and ongoing service partnerships, in contrast with distributor-led models that focus on rapid order fulfillment and aftermarket part availability. Finally, in terms of applications ranging from business and general aviation to commercial aviation, helicopters, military and defense aviation, and unmanned aerial vehicles (UAVs), segment demands vary significantly. Business jet operators emphasize minimal downtimes and turnkey service contracts, whereas defense customers prioritize system ruggedness, data encryption protocols, and compliance with MIL-STD standards, and UAV developers seek lightweight, automated test sequences optimized for rapid prototyping cycles.

This comprehensive research report categorizes the Air Data Test System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Testing Parameters

- Platform

- Sales Channel

- Application

Highlighting Key Regional Nuances and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific in the Air Data Test System Landscape

Regional analysis highlights the Americas as a hub of innovation and maintenance activity, driven by substantial military modernizations and the robust presence of legacy commercial carriers. North American test labs are investing heavily in upgrading their instrumentation portfolios to support next-generation stealth and hypersonic platform validations, while Latin American maintenance, repair, and overhaul centers prioritize cost-effective portable systems for legacy fleet overhauls.

Transitioning to Europe, the Middle East, and Africa, regulatory harmonization under EASA and coordinated defense procurement programs in the Gulf have stimulated demand for modular and multi-channel solutions capable of adhering to stringent interoperability requirements. In this region, advanced aerospace clusters are forging public-private partnerships to create shared test facilities that serve both civil and military users. On the African continent, emerging markets are incrementally adopting standardized calibration protocols, gradually expanding their facility footprints and fostering local expertise through joint ventures.

In Asia-Pacific, a dual narrative is unfolding across mature aviation hubs and rapidly growing markets. Established players in Japan, South Korea, and Australia are upgrading on-ground rack-mounted systems to support stringent certification standards, while China and India drive volume adoption of cost-efficient portable and modular rigs to sustain aggressive fleet expansions. In parallel, defense modernization programs in these nations are catalyzing demand for high-performance, in-flight test configurations equipped with autonomous data logging and telemetry.

This comprehensive research report examines key regions that drive the evolution of the Air Data Test System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Air Data Test System Players and Examining Competitive Strategies Innovations and Collaborative Ecosystem Partnerships Shaping the Industry

Leading air data test system providers are distinguishing themselves through continuous product innovation, strategic partnerships, and expanded service offerings. A prominent supplier has integrated AI-powered analytics into their test platform to provide anomaly detection and prescriptive maintenance recommendations. Another global competitor has forged alliances with major aerospace OEMs to co-develop bespoke multi-channel solutions aligned with specific airframe requirements.

Several manufacturers have also embraced aftermarket service expansion, deploying mobile calibration teams and digital support portals to reduce customer downtime. Collaborative ventures between test system vendors and sensor manufacturers are driving enhanced transducer accuracy, enabling finer measurement granularity and faster test cycles. In parallel, some players are securing long-term contracts with defense agencies to supply ruggedized in-flight systems tailored to unmanned platform testing protocols.

Furthermore, consolidation trends are emerging as technology-focused startups offering software-centric test modules attract acquisition interest from established conglomerates seeking to fill portfolio gaps. These acquisitions not only broaden the acquirer’s product suite but also accelerate the integration of cloud-native architectures for data management and compliance reporting. As competitive intensity mounts, firms are prioritizing intellectual property development in areas such as sensor calibration algorithms, digital twin modeling, and secure telemetry integrations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Data Test System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- ATEQ AVIATION

- Baker Hughes Company

- Fluke Corporation

- General Electric Company

- Honeywell International Inc.

- Meggitt PLC

- Parker-Hannifin Corporation

- Raptor Scientific

- Raytheon Technologies Corporation

- Testo SE & Co. KGaA

- Textron Inc.

- Transmille Ltd.

- WIKA Alexander Wiegand SE & Co. KG

- Zealtek Enterprises Pvt Ltd

Formulating Actionable Recommendations to Guide Industry Leaders in Capitalizing on Technological Advances and Navigating Market Complexities in Air Data Test Systems

To capitalize on the wave of technological and regulatory advances, industry leaders should prioritize the development of modular, software-defined test platforms that can be quickly reconfigured via firmware upgrades or cloud-based parameter libraries. By investing in digital twin frameworks and predictive analytics, companies can differentiate their offerings through value-added services such as remote diagnostics and condition-based calibration alerts. In doing so, they will enhance customer retention and create recurring revenue channels beyond the initial equipment sale.

Moreover, forging strategic alliances with sensor manufacturers and systems integrators can accelerate time-to-market for integrated solutions, while co-innovation partnerships with aerospace OEMs or research institutions will help validate emerging capabilities under real-world flight conditions. It is also advisable to diversify supplier portfolios to mitigate tariff-driven supply disruptions, considering joint ventures or technology licensing arrangements that support local production footprint expansion.

Lastly, capturing regional growth opportunities requires a nuanced go-to-market approach that aligns with localized regulatory regimes and purchasing behaviors. Building regional service centers and field calibration teams will not only address maintenance demand more effectively but will also reinforce customer trust by demonstrating a commitment to rapid service turnaround. Collectively, these recommendations will position market participants to navigate complexity, unlock new use cases, and drive sustainable growth in the evolving air data test system domain.

Outlining the Comprehensive Research Methodology Incorporating Primary Secondary Data Expert Consultations and Rigorous Validation for Robust Market Analysis

This analysis is anchored in a blended research methodology that integrates both primary and secondary data sources to ensure a holistic perspective. Primary research activities encompassed in-depth interviews with senior executives and R&D engineers from aerospace OEMs, tier-one suppliers, and defense agencies, complemented by on-site facility visits to leading test laboratories. These engagements provided nuanced insights into emerging requirements and validation protocols, enriching the qualitative narrative.

Secondary research involved systematic reviews of publicly available technical whitepapers, regulatory guidelines, and patent filings, as well as analysis of trade association publications. Data triangulation techniques were employed to reconcile vendor disclosures with end-user feedback, ensuring that the final synthesis reflects operational realities and investment priorities across commercial and military segments.

To maintain analytical rigor, all data inputs underwent structured validation via cross-verification with proprietary supply chain databases and corroborative expert panels. Additionally, thematic coding was applied to interview transcripts to identify recurring pain points, innovation drivers, and service model preferences. This multi-layered approach guarantees that the insights presented here are both actionable and grounded in the most current industry intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Data Test System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Data Test System Market, by Product Type

- Air Data Test System Market, by Testing Parameters

- Air Data Test System Market, by Platform

- Air Data Test System Market, by Sales Channel

- Air Data Test System Market, by Application

- Air Data Test System Market, by Region

- Air Data Test System Market, by Group

- Air Data Test System Market, by Country

- United States Air Data Test System Market

- China Air Data Test System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Drawing Conclusive Perspectives on Air Data Test System Industry Critical Trends Strategic Implications and the Path Forward for Stakeholders and Decision Makers

In closing, the air data test system landscape is undergoing a convergence of digital transformation, heightened regulatory scrutiny, and strategic supply chain realignments. The interplay of AI-enabled instrumentation, modular hardware architectures, and cloud-based analytics is setting new benchmarks for test accuracy, operational efficiency, and compliance assurance. Simultaneously, trade policies such as the 2025 US tariffs are reshaping procurement strategies and prompting vertical integration efforts across the value chain.

By examining segmentation across product types, testing parameters, platforms, sales channels, and applications, as well as the nuanced regional dynamics, stakeholders can craft tailored strategies that align with evolving performance requirements and regional procurement mandates. Key players are responding with collaborative ecosystem partnerships, service innovation, and accelerated R&D investments, underscoring the importance of agility and data-driven differentiation.

As the aerospace industry continues to embrace next-generation vehicles and more stringent certification standards, the capacity to adapt test frameworks rapidly will become a critical competitive advantage. This conclusion underscores the imperative for organizations to adopt an integrated, forward-looking approach that leverages both technological prowess and strategic partnerships to thrive in this complex environment.

Engaging with Senior Leadership to Unlock Full Report Insights on Air Data Test Systems by Connecting Directly with Associate Director Sales Marketing

To gain a comprehensive understanding of the nuanced insights contained within this detailed analysis of the air data test system landscape, we invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. Initiating a dialogue with an industry expert will ensure you obtain all proprietary data, in-depth case studies, and bespoke advisory services tailored to your strategic objectives. By engaging directly with Ketan Rohom, you can explore customization options for research modules, clarify specific analytical frameworks, and discuss volume-based licensing or enterprise-wide deployment. Take the next decisive step to leverage the full breadth of this authoritative research and secure a competitive advantage in the rapidly evolving aerospace testing environment.

- How big is the Air Data Test System Market?

- What is the Air Data Test System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?