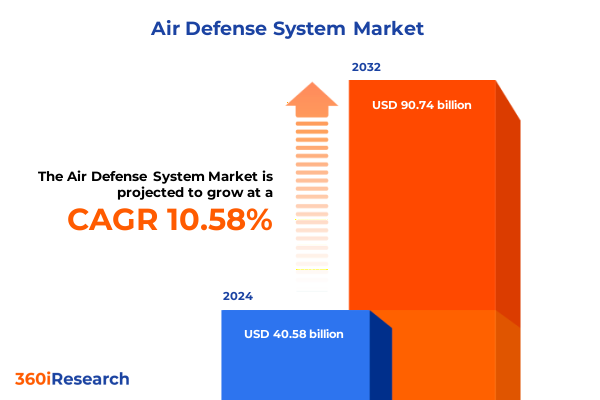

The Air Defense System Market size was estimated at USD 44.72 billion in 2025 and expected to reach USD 49.29 billion in 2026, at a CAGR of 10.63% to reach USD 90.74 billion by 2032.

Opening the Skies of Innovation and Security through a Comprehensive Air Defense System Overview that Sets the Stage for Strategic Insights

Modern air defense capabilities have become the cornerstone of national security strategies in an era defined by rapid technological progress and increasingly complex threat environments. As aerial threats range from unmanned systems to hypersonic missiles, defense planners must reconcile traditional kinetic solutions with emerging digital frameworks. This dynamic landscape demands a holistic evaluation of air defense architectures that integrates strategic imperatives with technological innovations.

The imperative to fortify airspace has compelled governments and industry alike to pursue next-generation solutions that enhance detection, tracking, and engagement capabilities. This executive summary serves as a compass, guiding stakeholders through the salient trends shaping the evolution of air defense. It distills insights on supply chain complexities, regulatory influences, segmentation frameworks, regional dynamics, and competitive postures, offering a coherent narrative of a market in flux.

By synthesizing cross-domain analyses, this summary empowers decision-makers to navigate the intersection of cost pressures, capability gaps, and alliance considerations. It underscores the urgency of adaptive strategies that leverage modular platforms, advanced sensor fusion, and networked command systems. As 2025 United States tariff policies introduce new variables into procurement cost structures, understanding their cumulative effects becomes essential for supply chain resilience. This summary addresses how tariff differentials influence sourcing strategies and cross-border collaborations, setting the stage for deeper analysis in subsequent sections.

Ultimately, the insights herein furnish a strategic foundation for policymakers, program managers, and technology leaders seeking to safeguard airspace sovereignty in the face of rapidly shifting global challenges.

Uncovering Revolutionary Technological and Strategic Shifts Reshaping Modern Air Defense Architectures in an Era of Digital Warfare and Simulation Integration

Over the past decade, air defense architectures have undergone a profound transformation driven by breakthroughs in sensor technologies and artificial intelligence. Advanced radar systems leveraging solid-state electronics and active electronically scanned arrays have supplanted legacy analog platforms, ushering in an era where detection ranges have expanded and target discrimination is more precise than ever. At the same time, electro-optical systems are benefiting from high-resolution thermal imaging and laser rangefinding that complement radar surveillance by enabling rapid threat classification under contested conditions.

Meanwhile, the proliferation of network-centric command and control frameworks has redefined how disparate assets collaborate across domains. Integration of airborne and naval sensors into a unified battlespace picture has enabled seamless interoperability among fixed wing, rotary wing, and sea-based platforms. This convergence not only enhances situational awareness but also facilitates dynamic resource allocation, allowing operators to engage multiple threats simultaneously while mitigating risks of fratricide.

Concurrently, training paradigms are evolving to incorporate hybrid simulation environments that blend live exercises with virtual and constructive elements. Live simulation systems now emulate complex threat scenarios with embedded decision-support tools, while virtual training modules enable distributed learning across geographically dispersed units. These developments have precipitated a shift away from traditional classroom and field drills towards digital training ecosystems that accelerate proficiency and reduce lifecycle costs.

Collectively, these transformative shifts underscore a broader trend towards adaptability and resilience within air defense systems. As threats continue to evolve, the fusion of advanced sensors, AI-driven analytics, and immersive training solutions will define the next frontier in defensive airspace control.

Analyzing the Compound Effects of Escalating United States Tariffs in 2025 on Supply Chains Acquisition Costs and Strategic Procurement Decisions

In 2025, newly imposed United States tariffs have introduced a complex layer of cost considerations for air defense procurement and sustainment. Designed to incentivize domestic manufacturing and protect critical defense supply chains, these measures have altered the calculus for program managers and prime contractors assessing global sourcing strategies. While the intent to bolster local industry aligns with broader national security objectives, the practical ramifications have reverberated across key subsystems, from advanced radar arrays to precision-guided munitions.

For platforms reliant on imported sensor components and electronic modules, elevated duties have increased acquisition costs, compelling engineering teams to evaluate alternative suppliers and component substitutions. Command and control system integrators, for instance, have sought to recalibrate bill of materials by qualifying domestic vendors for high-frequency signal processors and switching fabrics. At the same time, multinational equipment suppliers have responded by restructuring manufacturing footprints, relocating assembly lines to mitigate tariff exposures and preserve competitive pricing.

Moreover, the tariff landscape has prompted defense agencies to prioritize long-term supply chain resilience over short-term cost savings. Joint ventures and strategic partnerships with domestic firms have emerged as a viable pathway to circumvent tariff barriers while fostering technology transfer. Collaborative research initiatives are being recalibrated to incentivize in-country development of critical subsystems, thereby reducing reliance on imported components subject to escalating duties.

Overall, the cumulative impact of the 2025 tariff regime underscores the importance of agile procurement frameworks and strategic sourcing models. Industry leaders must balance cost, capability, and compliance considerations to navigate an increasingly protectionist policy environment without compromising operational readiness.

Distilling Core Segmentation Dynamics across Platforms Services Components Applications and End Users to Illuminate Critical Value Streams

Examining the market through the lens of platform segmentation reveals distinct operational and procurement dynamics across airborne, land, and naval environments. Airborne systems encompass both fixed wing and rotary wing solutions, each calibrated for unique mission profiles ranging from high-altitude surveillance to low-altitude threat engagement. On the ground, towed and vehicle mounted defense assets offer complementary mobility and rapid deployment capabilities, while sea-based platforms such as destroyers and frigates extend layered defense perimeters into littoral and open-ocean theaters. This diversity underscores the necessity of tailored system architectures that address the nuanced requirements of each domain.

Service segmentation further highlights evolving demand for after-sales support and lifecycle optimization. Scheduled and unscheduled maintenance services ensure the reliability of mission-critical systems under varying operational tempos, while system integration offerings enable seamless interoperability among legacy and next-generation components. In parallel, live simulation and virtual simulation training modules are instrumental in maintaining crew proficiency, providing realistic threat scenarios without the logistical constraints of full-scale exercises.

Component-wise, the market is characterized by a nexus of command and control architectures, electro-optical subsystems, missile technologies, and radar platforms. Laser rangefinders and thermal imaging units enhance target acquisition capabilities, while advanced missile systems deliver precise engagement options. Aesa and pesa radar configurations drive long-range detection and track performance, forming the backbone of modern defensive networks.

Within application frameworks, solutions span area defense zones, point defense emplacements, and integrated frameworks that leverage both standalone and network-centric modalities to synchronize multi-layered engagement strategies. This comprehensive approach ensures that air defense solutions align with the operational imperatives of homeland security agencies-encompassing border control and critical infrastructure protection-as well as the strategic priorities of air, land, and naval forces.

This comprehensive research report categorizes the Air Defense System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Services

- Component

- Application

- End User

Mapping the Strategic Influences of Americas Europe Middle East Africa and Asia Pacific Regions on Air Defense Investment and Collaboration Models

Across the Americas, defense modernization initiatives are closely intertwined with indigenous industrial priorities and bilateral cooperation agreements. United States procurement directives emphasize domestic content and interoperability with allied forces, driving demand for modular air defense solutions manufactured within national supply chains. Canada’s strategic alignment through NORAD underscores the value of integrated airspace monitoring and joint operational frameworks. Meanwhile, Latin American nations are gradually expanding their defense budgets, prioritizing multirole systems capable of countering asymmetric threats and enhancing maritime surveillance.

In Europe, Middle East, and Africa, regional dynamics are shaped by a fusion of multilateral collaboration and sovereign acquisition strategies. European allies prioritize cross-border interoperability under NATO mandates, fostering collaborative research and co-development programs. The Gulf Cooperation Council’s accelerated investment in integrated air defense architectures reflects rising security concerns, with a particular focus on missile defense against regional adversaries. African nations, while operating under constrained budgets, are incrementally adopting scalable solutions that blend export-oriented platforms with locally sourced maintenance capabilities.

The Asia-Pacific region is witnessing a surge in defense modernization driven by shifting maritime balances and airspace sovereignty disputes. Leading economies are investing heavily in sensor fusion and long-range detection systems to fortify island chains and coastal approaches. Cooperative partnerships with established defense companies facilitate technology transfer and joint production ventures, enabling countries to bolster domestic manufacturing capacities. This strategic mix of acquisitions and indigenous development underscores the region’s imperative to maintain robust, layered defense postures.

This comprehensive research report examines key regions that drive the evolution of the Air Defense System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Postures Technological Portfolios and Collaborative Networks of Leading Air Defense System Manufacturers and Integrators Worldwide

Leading defense contractors have honed their strategic postures by blending proprietary technology development with targeted acquisitions and strategic alliances. Major corporations such as Lockheed Martin have leveraged advanced radar research and command network capabilities to anchor integrated defense suites. Raytheon Technologies continues to expand its missile and electronic warfare portfolios, augmenting its offerings through selective partnerships that accelerate sensor fusion and systems integration.

European firms are equally active, with BAE Systems emphasizing modular system architectures and open-standards frameworks to facilitate interoperability among allied forces. Thales has distinguished itself by advancing multispectral surveillance solutions and offering turnkey system integration services tailored to complex operational environments. Meanwhile, emerging providers such as Hensoldt focus on compact, high-performance radar systems that bridge capability gaps between legacy platforms and next-generation requirements.

In parallel, mid-tier companies like Leonardo and Saab are carving out specialized niches in electro-optical sensors and networked air defense command modules. These firms have cultivated collaborative R&D consortia with academic institutions and startup innovators, fostering agile technology insertion. Cross-regional joint ventures are also proliferating, enabling technology transfer while aligning production capacities with regional procurement priorities.

As competition intensifies, investment in software-defined architectures and cybersecurity fortifications has become a differentiator. Companies that can offer resilient command and control ecosystems capable of withstanding electronic attack will likely capture market preference. This trend amplifies the importance of cross-domain interoperability and modular upgrade paths for sustaining long-term viability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Defense System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Bharat Electronics Limited

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MBDA S.A.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Thales S.A.

Translating Insights into Actionable Roadmaps for Industry Executives to Optimize Investment Decisions Drive Innovation and Enhance Operational Readiness

Industry leaders should prioritize the adoption of open modular architectures that facilitate incremental capability upgrades while minimizing integration complexity. By standardizing interfaces across command systems, sensors, and effectors, stakeholders can streamline procurement cycles and accelerate the deployment of emerging technologies without necessitating wholesale platform overhauls.

To address evolving tariff environments and supply chain disruptions, procurement and technology leaders must implement dual-sourcing strategies and cultivate domestic supplier networks. Strategic partnerships with local manufacturers and targeted investments in in-country production facilities can mitigate duty-related cost impacts and reinforce supply chain resilience. Regular risk assessments of critical component flows will enable proactive contingency planning and ensure uninterrupted sustainment.

A robust training ecosystem is essential to realize the full potential of advanced systems. Defense organizations should integrate live simulation and virtual training capabilities into a common framework, leveraging data analytics to tailor curricula and measure proficiency gains. Such blended training models not only optimize readiness but also reduce overall lifecycle expenses associated with large-scale exercises.

Finally, collaborative R&D frameworks that unite industry, government, and academic institutions will be pivotal in sustaining innovation momentum. Participating in pre-competitive consortia enables shared investment in breakthrough sensor technologies and artificial intelligence applications. By fostering an open innovation culture, program managers can de-risk emerging capabilities and accelerate fielding timelines, ensuring that air defense postures remain adaptive in the face of rapidly shifting security dynamics.

Detailing a Rigorous Research Architecture Integrating Secondary Insights Primary Validation and Data Triangulation for Comprehensive Air Defense Analysis

The foundation of this analysis rests on a rigorous secondary research phase that encompassed the review of defense white papers, government procurement notices, industry journals, and technical specifications published by leading aerospace and defense agencies. Publicly available records from international tenders and regulatory filings provided contextual clarity on procurement cycles and policy shifts influencing air defense acquisitions.

Building upon this corpus, primary research engaged a diverse cohort of stakeholders, including senior program managers at defense organizations, senior engineers at system integration firms, policy experts in tariff compliance, and end-user representatives from military forces and homeland security agencies. In-depth interviews and structured questionnaires elicited firsthand perspectives on capability gaps, procurement challenges, and technology adoption trajectories.

To ensure the integrity of insights, data triangulation techniques were employed. Quantitative inputs were cross-verified against third-party defense market databases and historical procurement records, while qualitative observations were benchmarked through peer reviews with subject matter experts. This multi-pronged approach facilitated the reconciliation of divergent viewpoints and enhanced the reliability of thematic conclusions.

A continuous validation protocol underpinned the research process, wherein preliminary findings were subjected to iterative review cycles by an advisory panel of defense analysts and academic researchers. This collaborative validation ensured that the resulting strategic insights are robust, actionable, and reflective of the latest technological and policy developments shaping global air defense ecosystems.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Defense System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Defense System Market, by Platform

- Air Defense System Market, by Services

- Air Defense System Market, by Component

- Air Defense System Market, by Application

- Air Defense System Market, by End User

- Air Defense System Market, by Region

- Air Defense System Market, by Group

- Air Defense System Market, by Country

- United States Air Defense System Market

- China Air Defense System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Critical Discoveries and Strategic Perspectives to Illuminate the Future Trajectory of Global Air Defense Ecosystems and Partnerships

The analysis presented in this executive summary highlights the intricate interplay between technological innovation, policy drivers, and strategic procurement imperatives within the air defense domain. Transformative shifts such as advanced sensor fusion, network-centric command and control, and immersive training paradigms are reshaping traditional defense architectures. Concurrently, evolving tariff landscapes have underscored the importance of agile supply chain strategies and collaborative industrial partnerships.

A granular segmentation framework-encompassing diverse platforms, services, components, applications, and end-user requirements-provides a structured lens through which stakeholders can tailor solutions to mission-specific demands. Regional dynamics across the Americas, Europe, the Middle East, Africa, and the Asia-Pacific highlight the nuanced security imperatives and acquisition preferences that will guide programmatic decisions. Additionally, the strategies of leading industry players illuminate best practices in technology development, partnership formation, and operational readiness.

Looking forward, defense decision-makers must embrace a holistic approach that integrates open architectures, robust training ecosystems, and multi-source supply chain resilience. By synthesizing these elements within a cohesive strategic framework, organizations can optimize capability development, mitigate policy-driven cost pressures, and maintain competitive advantage. The insights herein lay the groundwork for informed action and sustained innovation in safeguarding airspace sovereignty.

Engage with Ketan Rohom to Unlock Tailored Strategic Insights and Secure Exclusive Access to the Definitive Air Defense Market Research Report Today

To leverage these comprehensive insights and gain a competitive edge in the evolving air defense landscape, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, for a tailored consultation. His deep expertise in defense market dynamics and strategic engagements can provide direct clarity on how these trends impact your organization’s priorities and procurement roadmaps.

By partnering with Ketan Rohom, you will secure exclusive access to the full market research report, which delves into nuanced analyses, supplier benchmarking, and strategic indices designed to inform high-stakes decision-making. You can explore customized data modules aligned to your unique objectives, whether that involves supply chain optimization, capability development, or regional partnership strategies.

Whether you represent a program office seeking lifecycle analytics or an integration partner aiming to refine your value proposition, this engagement will equip you with the actionable frameworks needed to navigate complex procurement landscapes. Initiating this process is straightforward: reach out to schedule a private briefing where Ketan can demonstrate key report features, answer your specific questions, and outline the support services available to integrate these findings into your operational plans.

Empower your team with actionable intelligence today by connecting with Ketan Rohom to secure your copy of the definitive air defense market research report

- How big is the Air Defense System Market?

- What is the Air Defense System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?