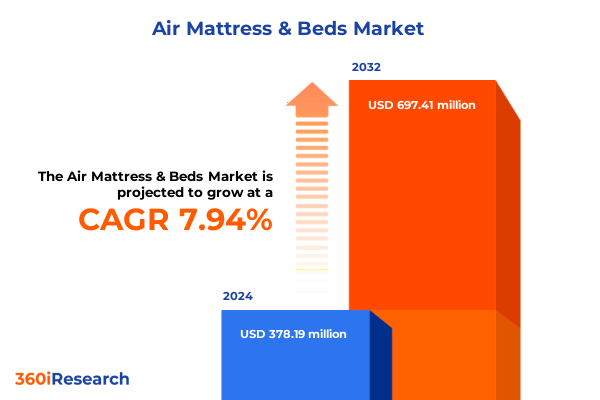

The Air Mattress & Beds Market size was estimated at USD 408.34 million in 2025 and expected to reach USD 441.01 million in 2026, at a CAGR of 7.94% to reach USD 697.41 million by 2032.

Explore the Rapid Transformation of Air Mattresses and Beds as Comfort Technology and Lifestyle Trends Converge

The air mattress and beds market is undergoing rapid evolution as technological advancements, changing lifestyles, and shifting consumer priorities redefine the concept of rest and recuperation. What began as a simple, inflatable solution has transformed into an array of sophisticated products featuring integrated comfort systems, health-focused materials, and digital enhancements. This industry now spans a spectrum of offerings from economical inflatable pads for camping to premium smart beds designed to optimize sleep quality through biometric monitoring.

Global travelers and homeowners alike are embracing these versatile sleep solutions in response to an increasingly mobile and health-conscious society. As remote work blurs the line between home and office, interest in flexible, space-saving bedding solutions has soared. Meanwhile, healthcare providers and hospitality operators are exploring specialized air mattress applications to enhance patient comfort and guest experience. With a renewed emphasis on wellness, ergonomics, and convenience, the stage is set for significant transformation in how air mattresses and beds are designed, manufactured, marketed, and distributed.

Witness How Sustainability, Digital Commerce, and Smart Technology Are Redefining the Air Mattress and Bed Market

In recent years, the landscape of air mattresses and beds has shifted dramatically under the influence of several converging forces. First, sustainability has emerged as a pivotal driver, prompting manufacturers to adopt eco-friendly materials and circular production models. Consumers now demand transparency regarding raw materials, carbon footprint, and end-of-life disposal, pushing brands to innovate with recycled fabrics, plant-based foams, and modular components.

Simultaneously, the rise of direct-to-consumer channels has revolutionized product outreach and customer engagement. Brands are leveraging e-commerce platforms to cultivate deeper relationships, harness data for personalized recommendations, and introduce virtual try-before-you-buy experiences. This digital transformation has lowered entry barriers, enabling new players to challenge incumbents while compelling established companies to enhance their online presence and streamline logistics.

Moreover, smart home integration is redefining the value proposition of premium air beds. Features such as sleep tracking sensors, automated inflation adjustments, and smartphone-controlled firmness settings cater to a growing audience seeking data-driven wellness solutions. Combined with the heightened awareness of sleep health among end users, these technological shifts are reshaping product roadmaps and forging a new competitive landscape within the industry.

Understand How 2025 U.S. Tariffs Are Forcing Supply Chain Realignment and Cost Optimization Across the Industry

The cumulative effect of United States tariff measures introduced in 2025 is reshaping supply chains, cost structures, and strategic priorities across the air mattress and bed industry. Tariffs on imported components such as inflatable chambers, polyurethane foams, and digital control units have elevated input costs, prompting manufacturers to reevaluate sourcing strategies and renegotiate supplier contracts. Many businesses have accelerated the diversification of their procurement networks by exploring manufacturing partnerships in Mexico, Vietnam, and Eastern Europe to mitigate tariff exposure and maintain competitive pricing.

Simultaneously, the increased import duty landscape has spurred interest in localized production, leading to capital investments in domestic facilities and collaborative ventures with regional fabricators. While this transition requires upfront expenditure, it promises greater resilience against policy fluctuations and shorter lead times. From a pricing standpoint, brands are adopting tiered strategies that balance cost recovery with consumer expectations, introducing value-engineered models alongside higher-end offerings that justify premium pricing through enhanced features or sustainable credentials.

In response to these evolving pressures, companies are also leveraging advanced cost accounting techniques and dynamic pricing algorithms to maintain margin integrity. These measures collectively underscore a period of strategic realignment, where agility in sourcing and production has become critical to sustaining growth and profitability amidst the tariff-driven headwinds.

Delve into Critical Market Segmentation Insights Spanning Distribution Channels End Users Price Tiers Sizes and Usage Contexts

Analyzing the market through the lens of distribution channels reveals distinct dynamics emerging across offline and online segments. Traditional brick-and-mortar environments like department stores, specialty retailers, and supermarkets & hypermarkets continue to serve customers seeking hands-on evaluation and immediate availability, while digital storefronts capitalize on convenience and personalized shopping experiences. This channel diversification influences how brands allocate marketing resources and design packaging to resonate with specific consumer touchpoints.

From an end user perspective, the divergent requirements of healthcare, hospitality, and residential consumers drive product variation. Medical applications demand pressure redistribution and hygiene compliance, hospitality operators prioritize durability and ease of maintenance, and homeowners balance aesthetic appeal with everyday comfort. These varied use cases catalyze focused R&D efforts, resulting in tailored solutions that meet rigorous performance and regulatory standards.

Examining the marketplace by price range highlights three core tiers: economical options that emphasize value and functionality, mid-range products offering a blend of comfort and durability, and premium lines featuring advanced materials, integrated technology, and bespoke design. Consumers navigate these tiers based on budget, intended use, and perceived quality. Additionally, size segmentation-spanning full, king, queen, and twin configurations-ensures that offerings align with diverse spatial constraints and personal preferences.

Finally, considering the application context underscores a clear division between indoor and outdoor usage. Indoor air beds incorporate features like reinforced frames and smart controls, whereas outdoor models prioritize portability, rapid inflation, and weather-resistant materials. Together, these segmentation insights illuminate critical pathways for market participants seeking targeted innovation and channel-specific positioning strategies.

This comprehensive research report categorizes the Air Mattress & Beds market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Distribution Channel

- End User

- Price Range

- Size

- Application

Examine How Divergent Regional Market Dynamics Shape Consumer Demand and Supply Chain Strategies Worldwide

Regional analysis of the air mattress and bed landscape reveals markedly different trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, North American consumers demonstrate an appetite for direct-to-consumer brands that emphasize premium features and sustainable credentials, while Latin American markets show growing interest in economical and mid-range options driven by expanding e-commerce penetration and improving logistics infrastructure.

Meanwhile, the Europe Middle East & Africa region exhibits a complex mosaic of maturity levels. Western European markets have a strong preference for eco-certified materials and health-focused innovations, supported by robust regulatory frameworks. Middle Eastern hospitality sectors are investing heavily in differentiated guest experiences, creating demand for custom air bed solutions. Conversely, certain African markets remain price-sensitive, with entry-level offerings predominating amid gradual infrastructure development.

In the Asia-Pacific sphere, rapid urbanization and rising disposable income are fueling demand for both premium and mid-range air mattresses. Countries such as China, Japan, and South Korea are investing in smart home ecosystems, integrating air bed products with broader IoT platforms. Additionally, Southeast Asian manufacturing hubs continue to play a pivotal role in global supply chains, influencing product cost structures and lead times. These regional insights underscore the need for nuanced go-to-market strategies that align with local consumer behaviors and regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Air Mattress & Beds market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover How Industry Leaders Are Innovating Through Smart Technology Strategic Partnerships and Sustainable Design

Leading companies in the air mattress and bed sector are differentiating themselves through innovation, strategic partnerships, and brand positioning. One established player has carved out a niche with smart beds that integrate biometric sleep tracking and automatic firmness adjustment, forging alliances with health technology firms to enhance data analytics capabilities. Another household name leverages its direct-to-consumer model to test product variations rapidly, employing customer feedback loops to refine comfort systems and warranty terms.

A value-oriented manufacturer focuses on optimizing production efficiency in Southeast Asian facilities, launching competitively priced models that target entry-level and mid-tier segments. This company’s agile supply chain and modular design approach allow for swift adaptation to shifting material costs and consumer preferences. Meanwhile, a legacy bedding enterprise has expanded its portfolio to include air mattress offerings under well-known sub-brands, capitalizing on its extensive distribution network across department stores and specialty retailers.

Emerging challengers are also making inroads by emphasizing sustainability and unique design aesthetics. These newer entrants collaborate with material science startups to introduce plant-based foams and recyclable components, appealing to environmentally conscious consumers. Collectively, these key company strategies illustrate a market where technological prowess, channel agility, and brand differentiation are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Mattress & Beds market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroBed

- Bestway Inflatables & Material Corp.

- Drive DeVilbiss Healthcare Ltd.

- Englander Sleep Products

- Exxel Outdoors LLC

- idoo

- Intex Recreation Corp.

- King Koil Airbeds

- Lazery Sleep

- LunoLife Inc.

- Relief‑Mart Inc.

- Restwell Sleep Products

- Saif Care

- Serta, Inc.

- Silverline Meditech Pvt. Ltd.

- Simmons Bedding Company, LLC

- Sleep Number Corporation

- The Coleman Company, Inc.

- The SoundAsleep Company

Uncover Actionable Strategies Emphasizing Innovation Supply Chain Agility and Data-Driven Marketing Excellence

Industry leaders seeking to excel in the competitive air mattress and bed market should prioritize a multipronged innovation roadmap that aligns product development with evolving consumer expectations. Incorporating advanced comfort technologies such as adaptive airflow systems and embedded sleep quality sensors can position brands at the forefront of health-centric bedding solutions. Concurrently, expanding omnichannel distribution strategies-seamlessly integrating online platforms with experiential retail environments-can capture diverse buyer journeys and foster deeper brand loyalty.

Supply chain agility is equally critical; companies should explore diversified manufacturing footprints by leveraging nearshore and onshore partnerships to reduce tariff exposure and shorten lead times. Establishing strategic alliances with logistics providers and material innovators can further strengthen resilience against global disruptions. Additionally, embedding sustainability credentials through eco-friendly packaging, carbon offset programs, and transparent lifecycle communications will resonate with a growing segment of socially responsible consumers.

Finally, data-driven marketing initiatives powered by customer analytics and AI-based personalization tools can transform generic outreach into targeted engagement campaigns. By leveraging granular insights into user preferences and purchase behavior, brands can optimize promotional spend, tailor product bundles, and cultivate lifetime customer value. These actionable recommendations will equip industry leaders to navigate the rapidly transforming air mattress and bed market with confidence and strategic clarity.

Learn About Our Robust Research Approach Combining Primary Interviews Secondary Analysis and Data Triangulation

Our research methodology integrates both primary and secondary research to ensure comprehensive and reliable insights into the air mattress and bed industry. Initially, extensive secondary research involved analyzing industry white papers, regulatory filings, trade publications, and credible online resources to map the competitive landscape and technological developments. This foundation informed the creation of targeted questionnaires and expert interview guides for primary data collection.

Primary research comprised in-depth interviews with key stakeholders, including product designers, procurement executives, retail buyers, hospitality operators, and healthcare administrators. Supplementing these conversations, structured surveys collected quantifiable feedback from distributors and end users across multiple geographic regions and price segments. Rigorous data validation protocols, such as cross-referencing responses with third-party datasets and anonymized sales records, upheld accuracy and integrity.

Finally, our analysis employed data triangulation techniques, layering qualitative insights over quantitative findings to identify convergent themes and outliers. Regular consultations with an advisory board of industry veterans ensured that interpretations aligned with current market realities. This methodology underpins the credibility of our conclusions and recommendations, providing stakeholders with actionable intelligence grounded in robust research practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Mattress & Beds market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Mattress & Beds Market, by Distribution Channel

- Air Mattress & Beds Market, by End User

- Air Mattress & Beds Market, by Price Range

- Air Mattress & Beds Market, by Size

- Air Mattress & Beds Market, by Application

- Air Mattress & Beds Market, by Region

- Air Mattress & Beds Market, by Group

- Air Mattress & Beds Market, by Country

- United States Air Mattress & Beds Market

- China Air Mattress & Beds Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarize the Strategic Imperatives for Thriving Amidst Technological Advancements and Market Realignments in the Sleep Industry

The air mattress and bed market stands at a pivotal juncture shaped by accelerating technological integration, evolving consumer values, and shifting global trade dynamics. As sustainability considerations take center stage, brands that invest in eco-conscious materials and transparent production practices will earn lasting customer trust. Simultaneously, the rise of smart features and personalized comfort solutions offers a compelling avenue for differentiation in a crowded marketplace.

Navigating the complexities of tariff-induced supply chain realignment requires agility and foresight. Companies that proactively diversify manufacturing sources and strengthen regional partnerships will mitigate cost volatility and maintain competitive advantage. Moreover, embracing omnichannel distribution strategies and data-driven engagement will enable businesses to reach discerning consumers across multiple touchpoints, fostering brand loyalty and revenue growth.

In summary, industry participants poised for success will be those that balance innovation with operational resilience, leveraging insights into segmentation and regional dynamics to craft tailored offerings. By adopting the actionable recommendations outlined here, decision-makers can confidently chart a course through the evolving landscape of air mattresses and beds, capitalizing on emerging opportunities and safeguarding against potential challenges.

Unlock Expert Guidance and Secure Your In-Depth Air Mattress and Bed Market Research Report with Personalized Support from Our Associate Director

Don't miss out on the opportunity to gain unparalleled insights and strategic guidance tailored for the air mattress and bed market. Connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your comprehensive market research report today. Whether you require deeper analysis, customized data, or guidance on emerging trends and growth opportunities, Ketan Rohom will ensure you have the intelligence and tools needed to make informed decisions and accelerate your business success. Reach out now to transform your strategic approach and stay ahead of the curve in the rapidly evolving landscape of air mattresses and beds

- How big is the Air Mattress & Beds Market?

- What is the Air Mattress & Beds Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?