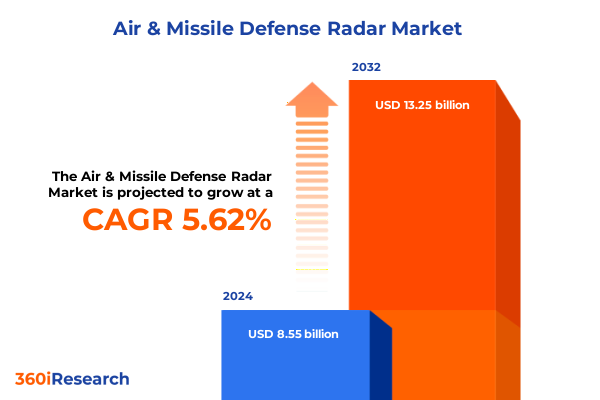

The Air & Missile Defense Radar Market size was estimated at USD 9.02 billion in 2025 and expected to reach USD 9.51 billion in 2026, at a CAGR of 5.64% to reach USD 13.25 billion by 2032.

Setting the Stage for a New Era in Air and Missile Defense Radar with Evolving Threats, Advanced Technologies, and Strategic Priorities

As modern theaters of conflict evolve with unprecedented speed and complexity, air and missile defense radar systems have emerged as the keystone of national security architectures worldwide. Advances in sensing technology, digital signal processing, and network integration have elevated radar from a passive surveillance tool to an active, intelligent component of multi-domain operations. This transformation is driven by the need to detect increasingly stealthy targets, counter the proliferation of hypersonic threats, and maintain uninterrupted situational awareness in contested environments.

Against this backdrop, defense stakeholders are recalibrating procurement strategies, emphasizing modular architectures that enable rapid capability upgrades and interoperability across air, land, and sea domains. Emerging priorities include resilient sensor fusion, adaptive waveform agility, and software-defined upgrades that extend operational lifecycles and future-proof installations. As threats diversify-from low-observable cruise missiles to drone swarms and electronic warfare attacks-radars are no longer isolated platforms but networked nodes in a federated command and control ecosystem.

Looking ahead, sustained investments in research and development, coupled with strategic partnerships between industry innovators and government agencies, will continue to shape the next generation of air and missile defense radars. This report synthesizes these developments, offering a comprehensive examination of market drivers, technological inflection points, regulatory influences, and strategic imperatives guiding decision-makers in this critical domain.

Uncovering the Transformative Shifts Reshaping Air and Missile Defense Radar through Technological Innovation and Geopolitical Realignments

A seismic shift from mechanically scanned arrays to active electronically scanned array (AESA) technology has redefined radar performance and survivability. Programs such as the U.S. Army’s Sentinel A4, slated for initial operational capability in late 2025, exemplify this transition by leveraging solid-state beam steering to track cruise missiles, drones, and artillery rounds with enhanced precision and reduced reaction times. Concurrently, the U.S. Air Force’s decision to retrofit over 600 F-16 fighters with AESA radars underscores the platform-agnostic nature of this innovation, extending advanced detection capabilities and electronic protection features across legacy fleets.

Gallium Nitride (GaN) semiconductor technology has further accelerated radar evolution, offering superior power efficiency, thermal management, and bandwidth compared to earlier Gallium Arsenide designs. Raytheon’s delivery of a GaN-enabled AN/TPY-2 radar to the Missile Defense Agency highlights how GaN integration expands surveillance envelopes and enhances discrimination against hypersonic threats. Industry data confirm that multiple land- and sea-based systems now incorporate GaN transmit-receive modules, paving the way for more compact, resilient, and energy-efficient radar arrays in complex operational theaters.

Simultaneously, artificial intelligence and machine learning are reshaping threat assessment and electronic warfare capabilities. Raytheon’s Cognitive Algorithm Deployment System integrates AI/ML models at the sensor level, enabling real-time classification and prioritization of radar emissions with minimal latency. Flight tests on F-16 platforms demonstrated significant improvements in electronic support measures, reducing false alarms and enhancing pilot survivability. These converging trends-AESA, GaN, and AI integration-signal a transformative era in which radar platforms will deliver multi-function operations, dynamic resource allocation, and adaptive counter-countermeasures across joint all-domain command and control networks.

Assessing the Cumulative Impacts of 2025 United States Tariffs on Air and Missile Defense Radar Supply Chains and Production Costs

The imposition and escalation of U.S. tariffs on critical defense materials throughout 2025 has imposed substantial cost pressures on radar manufacturers and program budgets. Aluminum and steel duties doubled to 50 percent under Section 232, driving a $125 million hit to RTX’s operations in the first half of the year and contributing to a projected $500 million impact on its full-year earnings forecast for 2025. In parallel, combined tariff exposures for key producers such as RTX and GE Aerospace are expected to exceed $1.35 billion, with $850 million attributed to RTX’s global supply chain constraints and an additional $500 million arising from GE’s mitigation measures.

Beyond direct financial erosion, elevated imposition of import duties has triggered procurement schedule delays and contract renegotiations across multiple radar modernization initiatives. Aerospace and defense firms are reworking supply chains to identify domestic sources or alternative low-tariff suppliers, often at the expense of extended delivery timelines and higher non-recurring engineering costs. Analysts warn that unanticipated material price surges could imperil readiness metrics for programs reliant on tight replenishment schedules, while smaller suppliers face disproportionate margin compression and potential exit from the defense industrial base. Embraer’s indication that a threatened 50 percent levy on Brazilian imports could increase per-aircraft costs by $9 million further illustrates how broad tariff policies extend risk into allied defense supply partnerships.

In response, federal initiatives have gained momentum to fortify domestic processing capabilities and reduce critical dependencies. President Trump’s April directive for a Section 232 probe into U.S. reliance on imported minerals such as rare earth elements, uranium, and cobalt underscores a strategic pivot toward reshoring downstream manufacturing capabilities. Moreover, engagement efforts led by the Office of the U.S. Trade Representative are mobilizing defense, space, and energy start-ups to expand onshore production, supported by multibillion-dollar allocations for missile defense and naval technology enhancements. While these shifts promise long-term resilience, interim cost escalations and qualification cycles will challenge program schedules and fiscal stewardship throughout 2025.

Deriving Key Insights from Market Segmentation by Deployment Mode, Component, Platform, Application, and End User Dynamics

Insight into market segmentation reveals differentiated growth drivers and technology adoption patterns across deployment mode, component, platform type, application, and end user domains. Fixed installations continue to underpin strategic homeland defense networks, benefiting from robust site preparation and uninterrupted power infrastructure that accommodate larger aperture arrays and high-power transmit modules. In contrast, mobile radar systems-which include truck-mounted and airborne installations-are gaining traction within expeditionary forces, leveraging compact GaN-based architectures, active cooling solutions, and networked interoperability to support rapidly shifting threat vectors.

Component-level dynamics are equally instructive, as antenna arrays, signal processors, and transmit/receive modules represent the primary focus areas for innovation and supply chain investment. Advances in digital beamforming signal processors and software-defined subsystems are enabling configurable multi-function modes, from air surveillance to electronic attack operations. Software stacks that manage beam steering, threat identification algorithms, and secure data enclaves are evolving into key differentiators for prime contractors and niche suppliers alike.

Platform type segmentation highlights the distinct performance and integration requirements across airborne, ground-based, and sea-based radar systems. Airborne radars demand strict size, weight, and power (SWaP) optimization, driving miniaturization of module assemblies and adoption of AI-enabled processing at the sensor. Ground-based systems focus on long-range detection and interoperability with national air defense command centers, often favoring large-scale AESA arrays capable of multi-target tracking and layered ballistic missile defense functionalities. Sea-based radars must balance shipboard constraints with maritime domain awareness, requiring corrosion-resilient materials, integrated ECMP filtering, and seamless linkage into combat management systems for layered air and missile defense.

Across applications-ranging from air surveillance to missile defense and data link communications-target tracking and early warning functions command growing budgets. Emerging use cases, such as counter-UAV operations and electronic warfare support measures, are accelerating procurement of multi-mode radars capable of simultaneous jamming detection and fire control guidance. Finally, end users in homeland security, military operations, and research institutions each drive distinct procurement profiles: domestic security agencies seek cost-effective short-range detection networks, military clients prioritize integrated multi-domain systems, and research institutions focus on technology validation and experimental sensor platforms.

This comprehensive research report categorizes the Air & Missile Defense Radar market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Component

- Platform Type

- Application

- End User

Exploring Regional Dynamics and Strategic Drivers across the Americas, Europe Middle East Africa, and Asia-Pacific in Air and Missile Defense Radar

Regional analysis underscores a diverse topology of demand and technology adoption across the Americas, Europe Middle East & Africa (EMEA), and Asia-Pacific. In the Americas, sustained defense modernization programs and homeland security initiatives continue to fuel acquisitions of next-generation radars, particularly AESA upgrades for legacy fighter fleets and coastal defense installations. Collaborative research partnerships between government laboratories and private sector innovators are driving rapid prototyping of advanced GaN-enabled sensors and data fusion capabilities, setting the Americas apart in modular and open-architecture deployments.

Within EMEA, evolving threat perceptions in Eastern Europe and the Mediterranean have accelerated investments in layered air and missile defense systems. Nations bordering contested airspace have prioritized ground-based radar networks with mobile and fixed components to bolster interoperability with NATO command structures. Concurrently, Middle Eastern defense budgets are supporting expansion of integrated radar-interceptor ecosystems, often featuring indigenous variants of well-established Western designs. Across Africa, nascent procurement programs focus on coastal surveillance, anti-drug trafficking operations, and border security enhancements, with an emphasis on turnkey solutions and total-life-cycle support models.

Asia-Pacific stands out for its combination of high growth potential and strategic urgency. Multipolar tensions in the South China Sea and Korean Peninsula are driving accelerated procurement of coastal and island-defense radar systems. Major powers are investing in both indigenous AESA platforms and international joint ventures, leveraging technology transfers to build domestic manufacturing capabilities. Additionally, several Asia-Pacific nations are adopting networked multi-domain air defense architectures that integrate ground, naval, and airborne sensors into unified battle management systems. These deployments reflect a shift toward collective deterrence, underpinned by distributed radar nodes capable of synchronized threat tracking and layered interception.

This comprehensive research report examines key regions that drive the evolution of the Air & Missile Defense Radar market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Industry Leaders and Emerging Innovators Shaping the Competitive Landscape of Air and Missile Defense Radar

Industry leaders and emerging innovators occupy distinct but interrelated roles in shaping the competitive environment. Established prime contractors with diversified portfolios continue to dominate heavyweight programs by offering end-to-end solutions that integrate radars with command and control, missile interceptors, and electronic warfare suites. Their scale, legacy relationships, and in-house engineering capabilities enable rapid certification, rigorous testing under classified protocols, and seamless program management across global theaters.

In parallel, specialized radar manufacturers are carving niches by focusing on high-performance subcomponents-such as GaN transmit-receive modules, digital beamforming processors, and hardened aperture arrays. These firms frequently collaborate with academic institutions and government labs to co-develop novel materials and advanced signal processing algorithms. Their agility and focused expertise allow them to respond quickly to emerging threat sets and rapidly iterate design improvements, often outpacing larger competitors in delivering disruptive capabilities.

New entrants and start-ups contribute fresh perspectives, particularly in AI-driven software stacks, secure data link protocols, and autonomous sensor platforms. Backed by venture capital and defense innovation funds, they are introducing cognitive radar warning receivers, dynamic waveform adaptation algorithms, and cyber-resilient architectures. While these entities may lack the volume manufacturing capacity of legacy primes, their intellectual property and algorithmic advancements frequently become strategic acquisition targets or partnership catalysts.

Ultimately, the convergence of scale-based incumbents, component specialists, and software-centric innovators forms an ecosystem in which collaboration and strategic alliances are increasingly vital. Procurement authorities are evaluating consortium bids that bring together multiple expertise verticals, optimizing interoperability and accelerating time to deploy integrated air and missile defense capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air & Missile Defense Radar market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Hanwha Systems Co., Ltd.

- Hensoldt AG

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries, Ltd.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Thales S.A.

Providing Actionable Recommendations to Strengthen Resilience and Competitive Advantage for Industry Leaders in Air and Missile Defense Radar

To maintain technological superiority and operational readiness, industry leaders must embrace a multifaceted approach that combines innovation, resilience, and strategic collaboration. First, firms should prioritize investment in modular open-architecture platforms, enabling incremental integration of next-generation sensors, AI algorithms, and counter-countermeasure suites without requiring full system overhauls. By adopting universal hardware interfaces and interoperable software protocols, companies can reduce upgrade cycle times and facilitate cross-domain sensor fusion.

Second, strengthening domestic supply chain resilience is essential. Stakeholders should broaden sourcing strategies by qualifying multiple domestic and allied-nation suppliers for critical materials such as GaN wafers, rare earth magnet assemblies, and high-performance electronics. Leveraging government programs targeting domestic semiconductor fabrication and rare earth processing can mitigate tariff-induced cost surges and buffer against geopolitical disruptions.

Third, strategic partnerships with emerging technology providers will infuse software-defined capabilities into radar ecosystems. Joint development agreements with AI start-ups, cybersecurity firms, and unmanned systems integrators can accelerate the deployment of cognitive electronic warfare and autonomous tracking features. Co-investment models-such as shared prototyping grants and research consortia-can align public-private interests and distribute R&D risk more effectively.

Finally, adopting continuous learning frameworks-incorporating field data, predictive analytics, and digital twin simulations-will enhance program performance and sustainment. By integrating operational feedback loops into maintenance and upgrade schedules, companies can optimize reliability, reduce lifecycle costs, and anticipate obsolescence windows. This focus on data-driven sustainment will ensure sustained readiness and extend system longevity in rapidly evolving threat environments.

Detailing the Rigorous Research Methodology Underpinning a Comprehensive Analysis of Air and Missile Defense Radar Market Dynamics

This analysis synthesizes insights derived from a rigorous research framework that blends primary and secondary data sources. Primary inputs were gathered through structured interviews with senior defense officials, radar system program managers, procurement officers, and technology executives across leading industry players. These engagements provided qualitative perspectives on strategic priorities, procurement challenges, and technology roadmaps.

Secondary research encompassed a comprehensive review of industry publications, government defense budget documents, regulatory filings, and patent databases. Peer-reviewed journals and conference proceedings in defense electronics and signal processing were examined to validate emerging technology trajectories. Trade press and defense news outlets were monitored to capture real-time program milestones, contract awards, and policy shifts.

Quantitative analysis incorporated supply chain mapping, material cost modeling, and supplier capability assessments to gauge tariff impacts and domestic sourcing viability. Regional demand profiling leveraged open-source intelligence on defense expenditure allocations, force modernization agendas, and joint service roadmaps. Competitive benchmarking employed a curated database of system specifications, contract values, and operational performance metrics across key global programs.

Findings were triangulated through iterative validation workshops with subject matter experts, ensuring robust corroboration of trends, market dynamics, and strategic imperatives. This methodology balances empirical data with forward-looking scenario planning to deliver a holistic, fact-based market intelligence report for stakeholders in the air and missile defense radar domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air & Missile Defense Radar market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air & Missile Defense Radar Market, by Deployment Mode

- Air & Missile Defense Radar Market, by Component

- Air & Missile Defense Radar Market, by Platform Type

- Air & Missile Defense Radar Market, by Application

- Air & Missile Defense Radar Market, by End User

- Air & Missile Defense Radar Market, by Region

- Air & Missile Defense Radar Market, by Group

- Air & Missile Defense Radar Market, by Country

- United States Air & Missile Defense Radar Market

- China Air & Missile Defense Radar Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Insights and Highlighting the Strategic Imperatives for Stakeholders in the Evolving Air and Missile Defense Radar Domain

In sum, the air and missile defense radar landscape is undergoing a profound transformation driven by technological innovation, geopolitical tensions, and supply chain realignments. AESA and GaN advancements have ushered in a new era of sensor agility, power efficiency, and multi-function capability, while AI integration is accelerating threat assessment and electronic warfare readiness. These developments are reshaping procurement strategies, driving modular system architectures, and redefining performance benchmarks across air, land, and sea domains.

Simultaneously, the cumulative impact of U.S. tariffs and trade policies is challenging traditional supply chains, compelling firms to diversify sourcing strategies and collaborate on domestic manufacturing initiatives. Regional dynamics reveal varied adoption patterns, with the Americas emphasizing homeland defense modernization, EMEA focusing on interoperability within alliance structures, and Asia-Pacific prioritizing counter-access and area denial capabilities.

Industry leaders, component specialists, and software innovators must coalesce through strategic partnerships, open-architecture standards, and continuous learning frameworks to sustain advantage. By aligning investment in modular hardware, resilient supply networks, and AI-driven software, stakeholders can navigate evolving threat landscapes and maintain mission readiness.

This executive summary encapsulates essential insights and strategic recommendations designed to guide decision-makers in optimizing air and missile defense radar portfolios. As defense imperatives continue to intensify, this report equips government agencies, prime contractors, and technology suppliers with the actionable intelligence necessary to secure future victories in contested environments.

Engage with Associate Director Ketan Rohom to Access In-Depth Air and Missile Defense Radar Insights and Secure Your Comprehensive Market Research Report Today

To explore comprehensive analyses, proprietary data, and strategic insights tailored to the air and missile defense radar sector, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise ensures seamless guidance through critical market dynamics, enabling you to harness actionable intelligence and inform high-impact decisions. Engage today to secure your organizational advantage and access the fully detailed market research report that will empower your strategic initiatives and long-term planning.

- How big is the Air & Missile Defense Radar Market?

- What is the Air & Missile Defense Radar Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?