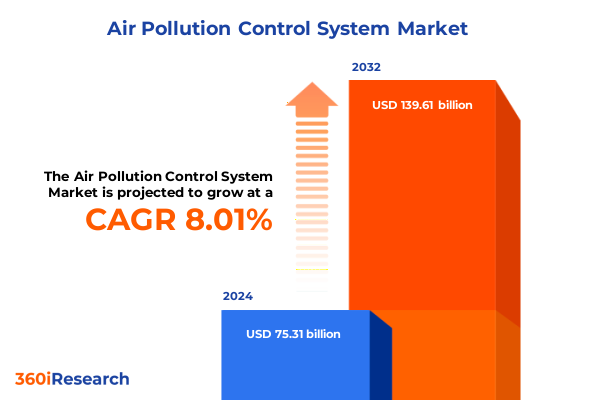

The Air Pollution Control System Market size was estimated at USD 81.49 billion in 2025 and expected to reach USD 87.25 billion in 2026, at a CAGR of 7.99% to reach USD 139.61 billion by 2032.

Capturing the critical urgency for industries to integrate next-generation air pollution control systems amid escalating environmental and regulatory demands

The intensifying convergence of environmental priorities and industrial operations has elevated air pollution control systems from a peripheral consideration to a fundamental business imperative. Across sectors, organizations face mounting pressure to reduce harmful emissions, comply with evolving regulations, and safeguard public health. In this context, advanced pollution control technologies have emerged as essential enablers of operational resilience and sustainability. Leading manufacturers of Adsorbers, Bag Filters, Electrostatic Precipitators, and Scrubbers are advancing modular designs, digital monitoring, and energy-efficient processes to meet the demands of stricter emission limits and rising stakeholder expectations.

Transitioning from traditional filter media to integrated, smart solutions has unlocked new pathways for performance optimization. Dry and Wet Scrubbers now incorporate real-time analytics and automated feedback loops for proactive maintenance and optimized reagent consumption. Similarly, Electrostatic Precipitators benefit from enhanced power supply systems and digital diagnostics that reduce unplanned downtime. Collectively, these innovations are reshaping the competitive landscape, empowering end users in cement, chemical, food & beverage, metal, pharmaceutical, and power generation industries to achieve compliance with greater operational efficiency.

Looking ahead, the intersection of sustainability, digitalization, and regulatory stringency will continue to accelerate transformative change. By adopting next-generation air pollution control systems, organizations position themselves to navigate tightening emission thresholds, mitigate environmental risks, and capitalize on emerging opportunities in a market driven by innovation and compliance imperatives.

How recent regulatory mandates and cutting-edge technological advances are reshaping the air pollution control ecosystem for lasting industrial transformation

Across the air pollution control landscape, regulatory reforms and technological breakthroughs are catalyzing a paradigm shift. The U.S. Environmental Protection Agency’s Final Reconsideration of the National Ambient Air Quality Standards for Particulate Matter strengthened the annual PM₂.₅ limit to 9.0 micrograms per cubic meter, reinforcing the need for high-efficiency filtration solutions in industrial and municipal applications. In parallel, the EPA’s final rule targeting methane and smog-forming volatile organic compounds from oil and natural gas operations introduced stringent New Source Performance Standards and emissions guidelines for existing facilities. These dual actions underscore an integrated, multi-pollutant approach that expands the scope of conventional dust collection and gas treatment systems.

Meanwhile, the agency’s commitment to updating landfill air emissions standards for the first time since 2016 highlights growing attention on solid waste sources. Concurrently, the Multi-Pollutant Emissions Standards for light- and medium-duty vehicles for model years 2027 and later signal a long-term vision for vehicular emissions control that leverages advances in clean car technology. Collectively, these regulatory interventions are driving demand for versatile, scalable pollution control systems that can adapt to diverse pollutant streams, deliver digital insights, and align with decarbonization goals. As a result, industry stakeholders are accelerating investment in R&D, strategic partnerships, and next-generation products to stay ahead of this dynamic regulatory and technological curve.

Exploring the cumulative ramifications of overlapping U.S. trade tariffs on vital components and supply chains for air pollution control equipment in 2025

In 2025, the United States implemented an intricate overlay of trade measures that have significantly impacted the procurement of air pollution control equipment. A Presidential Executive Order addressed the stacking of overlapping tariffs under Section 232 and Section 301 authorities, altering the effective duty rates on steel and aluminum components critical for Scrubbers and Electrostatic Precipitators. Concurrently, the reintroduction of the Foreign Pollution Fee Act proposed tariffs calibrated to the carbon intensity of imported industrial goods, positioning environmental footprint as a new determinant of import costs. These policy shifts are compelling suppliers and end users to reassess global sourcing strategies and build tariff resilience into procurement models.

Moreover, legal challenges to the so-called "Liberation Day" tariffs imposed under the International Emergency Economic Powers Act remain in limbo while appeals proceed, preserving uncertainty over potential retroactive duties on specialty filter media and electronic controls. For manufacturers reliant on imported materials and subassemblies, the confluence of these measures underscores the importance of supply-chain diversification, tariff engineering, and nearshoring. Strategic actors are intensifying collaboration with domestic mill partners and exploring bonded-warehouse solutions to mitigate duty exposure and ensure continuity of critical air pollution control system deployments.

Uncovering the core market segmentation insights that define equipment choices, pollutant-specific solutions, and operational models in air pollution control

Market segmentation for air pollution control systems reveals distinct areas of growth and specialization. Equipment Type encompasses Adsorbers, Bag Filters, Electrostatic Precipitators, and Scrubbers-with Dry and Wet Scrubbers offering nuanced performance trade-offs for acid gas removal in industrial stacks. Pollutant focus spans Gaseous Pollutants such as Nitrogen Oxides, Sulfur Dioxide, and Volatile Organic Compounds; Odor control; and Particulate Matter segmented into PM10 and PM₂.₅-each demanding tailored capture mechanisms and material compositions. Mode of Operation differentiates between Mobile and Stationary systems, addressing both temporary remediation projects and continuous point-source emission control. End-use verticals ranging from Cement and Chemical manufacturing to Food & Beverage, Metal refining, Pharmaceutical processing, and Power Generation dictate unique flow rates, temperature tolerances, and maintenance cycles. Finally, Sales Channel insights-covering Direct Sales, Distributor networks, and Online enablement-highlight evolving buyer preferences and service expectations.

Within this framework, Dry Scrubbers and Electrostatic Precipitators are gaining traction in high-temperature and high-dust environments due to their low reagent consumption and energy efficiency. Conversely, Wet Scrubbers are preferred for highly soluble gases, offering superior removal efficiencies despite higher water usage. Mobile systems are unlocking agile responses to episodic emissions events, while stationary packages integrate remote monitoring and predictive maintenance for continuous compliance. End users in cement and chemical plants increasingly adopt multi-pollutant systems that can handle combined gas and particulate streams, reflecting a shift toward unified treatment solutions. Meanwhile, online sales platforms are streamlining aftermarket filter and spare part procurement, accelerating replacement cycles and support responsiveness.

This comprehensive research report categorizes the Air Pollution Control System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Pollutant Type

- Mode of Operation

- End Use Industry

- Sales Channel

Examining how regional regulatory frameworks and industrial priorities are shaping differentiated demand across the Americas, EMEA, and Asia-Pacific markets

Regional dynamics in the air pollution control sector underscore the diverse market drivers across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, stringent U.S. and Canadian emission standards, coupled with retrofit demand in aging industrial facilities, are fueling orders for high-efficiency filters and turnkey system upgrades. Latin American infrastructure projects and cross-border environmental initiatives are also stimulating growth for modular Bag Filter and Scrubber solutions.

Across Europe, Middle East & Africa, the European Union’s Industrial Emissions Directive and national air quality plans are catalyzing investments in multi-pollutant control systems, while resource-rich Middle Eastern nations are modernizing oil & gas operations with advanced Flare Gas Recovery and VOC capture technologies. In Asia-Pacific, rapid industrialization in China and India, reinforced by new ambient air quality norms and corporate sustainability commitments, is driving large-scale adoption of Electrostatic Precipitators, molecular filtration, and digital monitoring platforms. Japan and South Korea are leading in innovation, deploying IoT-enabled scrubbers and real-time emissions analytics. These regional trends highlight the critical importance of adaptive technology portfolios and localized service capabilities to meet varying environmental, regulatory, and economic imperatives.

This comprehensive research report examines key regions that drive the evolution of the Air Pollution Control System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the strategic moves and innovation agendas of market-leading players driving the evolution of air pollution control solutions

Leading companies are executing strategic initiatives to strengthen their foothold in the air pollution control domain. Camfil has doubled down on its global manufacturing footprint, inaugurating a $100 million sustainable plant in Kilgore, Texas, to produce its full APC product range and advanced molecular filtration media. Simultaneously, Camfil is showcasing its expertise through a YouTube Shorts series on molecular filtration for data centers, emphasizing the role of adsorption-based filters in protecting sensitive electronics from gaseous pollutants.

Donaldson Company, Inc. continues to advance filtration innovation, partnering with Daimler Truck North America on the Hydrogen Freightliner SuperTruck III to integrate next-generation air filter technology for fuel cell applications. The company’s recent Fiscal Year 2024 Sustainability Report outlines ambitious carbon reduction targets, energy efficiency projects, and renewable sourcing strategies that enhance its competitive differentiation and supply-chain resilience.

Across the industry, vendors are leveraging digital services and service-level agreements to drive recurring revenue. Enhanced predictive maintenance platforms and analytics-as-a-service offerings are gaining traction, enabling end users to optimize system uptime, reagent usage, and environmental performance. Collaborative R&D partnerships with universities and technology start-ups are also becoming more prevalent, fostering breakthroughs in low-energy regeneration media, nanofiber filters, and integrated sensor networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Pollution Control System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval Corporate AB

- Babcock & Wilcox Enterprises, Inc.

- CECO Environmental Corp.

- Clyde Bergemann Power Group AG

- Donaldson Company, Inc.

- Ducon Technologies Inc.

- Dürr AG

- Eisenmann SE

- Fives

- FLSmidth & Co. A/S

- Fujian Longking Co., Ltd.

- GEA Group AG

- General Electric Company

- Hamon & Cie (International) SA

- John Wood Group PLC

- Mitsubishi Power, Ltd.

- S.A. Hamon

- Schneider Electric SE

- Siemens Energy AG

- Thermax Limited

Driving sustainable growth through digitalization, modularity, strategic alliances, and forward-looking R&D collaboration

Industry leaders must adopt a proactive, multi-faceted approach to thrive amid evolving regulatory and market landscapes. First, prioritizing investment in digital transformation will unlock operational efficiencies and service differentiation; companies should deploy IoT-enabled sensors and AI-driven analytics to anticipate maintenance needs, optimize reagent dosing, and demonstrate real-time compliance to regulators. Second, expanding modular, plug-and-play system portfolios will address diverse end-user requirements-from rapid-response mobile units to large-scale stationary installations-enhancing agility in carbon-intensive industries.

Third, forging strategic alliances across the value chain can mitigate supply chain risks exacerbated by shifting tariff regimes. Partnerships with domestic steel and aluminum suppliers, bonded-warehouse operators, and logistics specialists will secure critical raw materials and subassemblies. Fourth, intensifying R&D collaboration with academic institutions and cross-industry consortia can accelerate next-generation filter media development, focusing on energy-efficient regeneration techniques and breakthrough materials such as graphene-enhanced membranes. Finally, aligning product roadmaps with evolving region-specific regulations-such as the EU’s upcoming Industrial Emissions Regulation updates and Asia-Pacific ambient air quality standards-will position companies to anticipate compliance cycles and capture early-mover advantages.

Detailing a robust mixed-method research framework combining primary interviews, regulatory analysis, and data triangulation for credible market insights

This research employed a rigorous, multi-phase methodology to deliver actionable insights. Primary research included in-depth interviews with executives, engineers, and procurement specialists from leading end users, Original Equipment Manufacturers, and specialty material suppliers. Interviews were complemented by technical assessments of emerging purification technologies and pilot projects across diverse industry verticals. Secondary research involved a comprehensive review of public filings, regulatory documents, patent databases, and peer-reviewed scientific literature.

Trade data and customs filings were analyzed to quantify the impact of U.S. tariffs on critical import categories, while industry association publications provided context on evolving policy frameworks. Company press releases and sustainability reports informed profiling of corporate strategies and R&D investments. All data were triangulated through cross-validation between sources to ensure reliability and to mitigate potential biases. The final analysis was peer-reviewed by an expert advisory panel, comprising senior engineers, air quality consultants, and former regulators, ensuring robustness and relevance to strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Pollution Control System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Pollution Control System Market, by Equipment Type

- Air Pollution Control System Market, by Pollutant Type

- Air Pollution Control System Market, by Mode of Operation

- Air Pollution Control System Market, by End Use Industry

- Air Pollution Control System Market, by Sales Channel

- Air Pollution Control System Market, by Region

- Air Pollution Control System Market, by Group

- Air Pollution Control System Market, by Country

- United States Air Pollution Control System Market

- China Air Pollution Control System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing the strategic imperatives to navigate regulatory, technological, and regional complexities for sustained competitive advantage

In an era defined by tightening emission limits, trade complexities, and technological disruption, air pollution control systems have become essential enablers of industrial sustainability and operational excellence. The convergence of stringent regulatory actions-from particulate matter standards to methane fees-and the advent of digital, multi-pollutant solutions are reshaping supplier strategies and customer expectations. Companies that embrace agile, data-driven platforms, diversify their sourcing models in response to evolving tariffs, and collaborate on advanced materials development will unlock new growth pathways.

As regional markets diverge in their regulatory and economic drivers, tailored go-to-market approaches and localized service infrastructures will be critical to capturing incremental opportunities. Ultimately, the ability to integrate next-generation filtration technologies with proactive environmental stewardship will define the competitive landscape. Stakeholders who align innovation agendas with emerging compliance frameworks and sustainability objectives will not only drive bottom-line performance but also contribute meaningfully to global air quality improvements.

Unlock strategic growth with our comprehensive air pollution control systems report—connect with Ketan Rohom to secure your competitive intelligence today

For in-depth insights and tailored strategic guidance on the air pollution control system market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Leveraging our comprehensive study, Ketan can provide personalized support to help you navigate emerging trends, regulatory shifts, and competitive dynamics. Don’t miss the opportunity to equip your organization with the critical intelligence needed to accelerate growth and innovation in this rapidly evolving sector. Connect with Ketan today to purchase the full market research report and unlock your competitive edge.

- How big is the Air Pollution Control System Market?

- What is the Air Pollution Control System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?