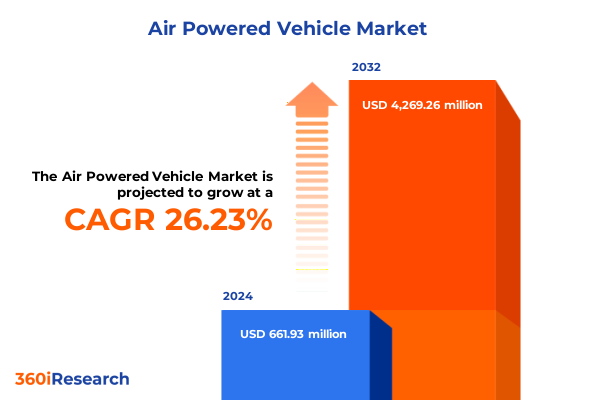

The Air Powered Vehicle Market size was estimated at USD 832.64 million in 2025 and expected to reach USD 1,047.86 million in 2026, at a CAGR of 26.30% to reach USD 4,269.26 million by 2032.

Charting the Advent of Compressed Air Mobility Solutions and Their Role in Driving the Next Wave of Sustainable Transportation Innovation

The introduction to the modern era of air powered vehicles underscores a pivotal shift in sustainable transportation paradigms, as compressed air propulsion technology emerges from laboratory prototypes into tangible mobility solutions. This section unveils the fundamental principles behind air powered vehicles, highlighting how advancements in high-pressure storage, thermodynamic engine cycles, and novel materials have converged to enable a zero-tailpipe-emission alternative that defies traditional energy sources. As global concerns over carbon footprints and resource scarcity intensify, the compressed air model presents a compelling case for a clean, renewable energy vector that complements electrification and hydrogen strategies.

Transitioning from conceptual frameworks to real-world applications, the content explores the myriad ways in which pioneering engineers and forward-thinking municipalities are piloting air driven buses, compact city cars, and two-wheelers optimized for rapid recharge via on-site compressors. By evaluating early deployment scenarios in urban centers and eco-sensitive zones, readers gain perspective on the operational advantages of lower infrastructure costs, reduced charging times compared to battery electric options, and minimal thermal waste. This holistic introduction establishes a clear narrative that positions air powered mobility not as a standalone novelty but as an integral component of the broader clean transport ecosystem.

Unveiling the Critical Transformative Forces Shaping the Global Air Powered Vehicle Ecosystem and Redefining Sustainable Mobility’s Future

The landscape of air powered vehicle development is being reshaped by a confluence of technological breakthroughs, policy realignments, and shifts in consumer expectations. First, materials science innovations have yielded ultra-lightweight composite tanks capable of withstanding pressures exceeding 300 bar while maintaining resilience under repeated charge–discharge cycles. These advances have significantly improved volumetric energy density, narrowing the gap between compressed air systems and conventional liquid fuels.

Simultaneously, regulatory bodies across major markets have introduced increasingly stringent emissions targets and low-carbon vehicle incentives. In Europe, for example, revised greenhouse gas reduction mandates are compelling OEMs to diversify their propulsion portfolios, elevating interest in non-electrified low-carbon alternatives. Likewise, municipal authorities in Asia-Pacific megacities are conducting trials of air powered transit vehicles to alleviate urban pollution hotspots while leveraging existing natural gas pipeline infrastructure for vehicle refueling.

Consumer attitudes are also shifting, as surveys indicate growing willingness to prioritize environmentally responsible mobility if operational costs and convenience barriers are addressed. The intersection of these dynamic forces has established a fertile environment for collaborative R&D consortia, cross-sector partnerships, and pilot projects that collectively accelerate product maturation. As a result, stakeholders are witnessing a transformative realignment that transcends mere technological curiosity, signaling the emergence of air driven vehicles as credible contenders in the broader sustainable mobility revolution.

Analyzing the Cumulative Impact of 2025 United States Tariff Measures on Air Powered Vehicle Supply Chains and Market Dynamics

In 2025, sweeping U.S. tariff measures targeting imported vehicles and components have introduced new variables into the cost structures and supply chain strategies of air powered vehicle manufacturers. The administration’s levies include a 25% tariff on passenger and light-duty vehicles assembled abroad and varying duties on critical parts such as pressure vessels, compressors, and valve assemblies. Industry analyses project that these tariffs could translate into incremental costs in the range of several thousand dollars per imported unit, compelling multinational firms to reassess sourcing footprints and regional assembly options.

Furthermore, adjustments under the United States–Mexico–Canada Agreement (USMCA) stipulate that vehicles with final assembly in North America and a minimum of 85% regional content may qualify for partial or complete tariff exemptions. This provision has spurred component suppliers and OEMs to intensify localization efforts, seeking to secure supply contracts with North American fabricators of high-pressure storage tanks and custom air engines while submitting detailed origin documentation to customs authorities. Despite these mitigations, the remaining non-regional content attracts full tariff exposure, creating a dual cost scenario that heightens complexity in manufacturing cost models.

Tariff-induced cost pressures are not confined to OEMs; aftermarket channels and service providers are also anticipating substantial impacts. Approximately half of spare parts, including piston assemblies and composite valves, have origins in Mexico and Canada, with additional inputs from China and Europe. Industry experts estimate that repair costs could rise by up to 6% as tariffs on imported components cascade through service contracts and warranty provisions. These developments compel air powered vehicle stakeholders to implement agile tariff‐offset strategies, adjust pricing architectures, and explore alternative supply agreements to maintain competitive positioning in the evolving 2025 trade environment.

Exploring Deep Segmentation Insights That Illuminate the Diverse Vehicle Types Propulsion Systems Applications and Distribution Channels Driving Market Differentiation

The market for air powered vehicles unfolds across a rich tapestry of vehicle types, each defined by unique performance criteria, design complexities, and customer use cases. Passenger cars extend from compact subcompact hatchbacks designed for urban micro-mobility to midsize sedans that balance range requirements with cabin comfort, while full-size SUVs address the demand for spacious families and fleets. Bus fleets include coach variants optimized for intercity travel and transit models tailored for inner-city routes, with electric bus adaptations ushering in quieter, emission-free operations. Motorcycle segments range from cruiser designs celebrating classic touring aesthetics to sport configurations engineered for power-to-weight efficiency and agile handling. On the commercial front, trucks span light vehicles servicing last-mile logistics to heavy vehicles engineered for above five-ton payloads, supporting industrial and regional freight corridors.

Beyond vehicle form factors, propulsion system segmentation distinguishes between single-tank vessels offering basic range profiles and multi-tank configurations that extend operational endurance through sequenced reservoir activation. Each configuration presents trade-offs in system complexity, recharge cycles, and safety containment protocols. Applications further subdivide the landscape into passenger and commercial domains. Ride-sharing fleets favor rapid turnaround and centralized refueling, whereas private-use models emphasize user-initiated home or depot charging. In the logistics sector, public transport authorities and third-party integrators leverage air powered assets for lower lifecycle maintenance costs and resilience against grid instability.

Distribution channels also play a pivotal role in market accessibility. OEM sales drive brand visibility through factory warranties and dealer networks, while aftermarket sales enable retrofitting of existing vehicle platforms with compressed air modules, extending the technology’s reach without full fleet replacement. This multidimensional segmentation matrix underscores the necessity for targeted product roadmaps and go-to-market strategies aligned with diverse customer segments and infrastructure realities.

This comprehensive research report categorizes the Air Powered Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Propulsion System

- Application

- Distribution Channel

Mapping Key Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific That Influence Air Powered Vehicle Adoption Patterns

The regional dynamics influencing air powered vehicle adoption vary significantly across the Americas, Europe, Middle East & Africa, and Asia-Pacific, reflecting differences in regulatory frameworks, infrastructure development, and stakeholder priorities. In North America, widespread natural gas pipeline networks present an opportunity for co-located compressor stations, enabling the refueling of air powered fleets without extensive new grid investments. Moreover, municipal pilots in U.S. and Canadian cities demonstrate operational feasibility in transit corridors prone to air quality challenges.

Within Europe, Middle East & Africa, stringent emission reduction mandates and urban low-emission zones drive public sector entities to explore alternative propulsion solutions. European cities are integrating air powered shuttles in heritage and centrally regulated districts to preserve air quality without imposing noise restrictions. Middle Eastern countries, leveraging oil and gas sector expertise, are investigating large-scale compressed air energy storage for grid balancing, creating an ancillary market for vehicle refueling infrastructure.

In Asia-Pacific, a combination of industrial manufacturing prowess and proactive government incentives has catalyzed prototype assembly lines in key automotive hubs. Pilot deployments of air powered mini-buses in densely populated corridors demonstrate reduced heat Island effects and lower noise pollution, complementing national clean air programs. Meanwhile, partnerships between local OEMs and technology licensors have accelerated knowledge transfer, positioning Asia-Pacific as a potential export base for next-generation compressed air vehicles.

This comprehensive research report examines key regions that drive the evolution of the Air Powered Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leading Companies Pioneering Compressed Air Vehicle Innovation Through Strategic Partnerships Technologies and Competitive Positioning

Several pioneering companies are shaping the air powered vehicle ecosystem through strategic collaborations, licensing agreements, and targeted investments in R&D. Motor Development International, the French-Luxembourg consortium originally responsible for compressed air engine patents, continues to influence global licensing frameworks despite limited direct manufacturing output; its intellectual property underpins numerous regional projects and informs safety standards for high-pressure storage systems. Tata Motors, having secured an exclusive license for Indian production, has progressed through early industrialization phases, adapting the compressed air engine concept for local batch assembly with an emphasis on micro-mobility variants.

In the United States, Zero Pollution Motors has emerged as the primary rights holder for commercializing small city cars under the AIRPod brand, securing multi-million dollar investments and venture capital backing to scale manufacturing within domestic automotive clusters. Complementary startups, such as FluidAir Dynamics and GreenCycle Mobility, are experimenting with hybrid compressed air–electric systems, integrating regenerative charging modules to enhance overall efficiency. Meanwhile, component suppliers like AirTankTech and HighPressure Solutions are pioneering advanced composite vessel designs that improve safety margins and reduce per-unit weight, establishing critical supply relationships with OEMs and retrofit specialists.

This network of licensors, assemblers, and component innovators embodies a collaborative model that amalgamates legacy patents, contemporary material science, and agile manufacturing methods. The resulting competitive landscape is characterized by cross-licensing partnerships, pilot contracts with public agencies, and a growing ecosystem of aftermarket service providers focused on compressed air propulsion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Powered Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Power Automotive GmbH

- Engineair Pty Ltd.

- Ford Motor Company

- Groupe PSA

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Jayem Automotives Private Limited

- Motor Development International S.A.

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen AG

- Volvo Group

- Zero Pollution Motors Private Limited

Identifying Actionable Strategic Recommendations for Industry Leaders to Capitalize on Air Powered Vehicle Opportunities and Navigate Emerging Market Challenges

To harness the transformative potential of air powered vehicles, industry leaders should adopt a multi-pronged strategy that aligns manufacturing flexibility with evolving policy incentives. Firstly, establishing dual-sourcing arrangements for high-pressure storage and thermal management components can mitigate tariff risks and streamline customs compliance. By forging partnerships with regional fabricators under USMCA and analogous trade accords, organizations can optimize cost structures while preserving agility in global supply networks.

Secondly, collaborating with municipal authorities and transit agencies to launch demonstrator fleets will foster evidence-based insights into operational efficiencies and public acceptance. Real-world data collection on recharge times, maintenance cycles, and total cost of ownership will inform broader commercialization decisions and support regulatory approval processes. Simultaneously, manufacturers should invest in integrated service platforms that combine digital monitoring, predictive maintenance, and refueling network planning to enhance end-user experience.

Finally, embedding modular design principles into vehicle architectures will allow for seamless integration of compressed air modules across diverse platform variants. This scalable approach reduces development cycles and facilitates co-development projects with traditional OEMs seeking to augment their clean mobility portfolios. By prioritizing interoperability standards and open-architecture controls, industry stakeholders can accelerate technology diffusion and establish robust aftermarket ecosystems that ensure long-term revenue streams.

Detailing the Robust Research Methodology Employed to Provide Comprehensive Insights on Air Powered Vehicle Trends Data Sources and Analytical Frameworks

This report employs a rigorous mixed-methodology framework to deliver comprehensive insights into the air powered vehicle sector. Primary research comprises structured interviews with key stakeholders, including executive leadership from OEMs, component suppliers, regulatory authorities, and fleet operators, complemented by on-site visits to pilot deployment locations across North America, Europe, and Asia-Pacific. Secondary research integrates analysis of policy documentation, patent databases, trade-association white papers, and academic publications to trace technological evolution and legislative trends.

Quantitative data collection leverages proprietary tariffs impact models, component supply chain mapping, and vehicle performance benchmarking. Tariff models account for regional origin rules, duty rates, and exemption thresholds, while supply chain mapping identifies critical nodes and potential bottlenecks in high-pressure storage vessel fabrication and air-compression modules. Performance benchmarks draw on laboratory test results, field trial telemetry, and comparative energy density analyses to evaluate system efficacy.

Analytical techniques include scenario planning to assess regulatory and market contingencies, SWOT evaluations for leading technology licensors and assemblers, and value chain decomposition to pinpoint margin drivers and cost-reduction opportunities. The research also applies a Delphi panel methodology with domain experts to validate emerging trends and forecast technology maturation timelines, ensuring robust and actionable conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Powered Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Powered Vehicle Market, by Vehicle Type

- Air Powered Vehicle Market, by Propulsion System

- Air Powered Vehicle Market, by Application

- Air Powered Vehicle Market, by Distribution Channel

- Air Powered Vehicle Market, by Region

- Air Powered Vehicle Market, by Group

- Air Powered Vehicle Market, by Country

- United States Air Powered Vehicle Market

- China Air Powered Vehicle Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding with a Compelling Synthesis of Key Insights on Air Powered Vehicle Market Evolution and Strategic Imperatives for Stakeholders’ Success

The evolution of air powered vehicles from experimental prototypes to commercially viable mobility solutions underscores a broader commitment to innovation in sustainable transportation. This analysis reveals that advancements in high-pressure storage, modular propulsion configurations, and strategic licensing collaborations have coalesced to create an ecosystem capable of addressing urban pollution, energy security, and infrastructural constraints.

Key insights indicate that regional trade policies, particularly new U.S. tariffs and USMCA adaptations, present both challenges and opportunities for manufacturers seeking localization strategies and tariff exemptions. Furthermore, segmentation analysis highlights the necessity of nuanced product roadmaps-ranging from compact city cars to heavy commercial vehicles-that align with distinct application requirements and refueling network realities. Regional dynamics further emphasize the importance of tailored deployment models informed by local infrastructure and policy incentives.

Ultimately, the most successful market entrants will be those that combine agile supply chain design, strong public-private partnerships, and modular vehicle architectures to deliver reliable, cost-effective, and environmentally responsible mobility solutions. As stakeholders navigate the confluence of regulatory headwinds, competitive pressures, and technological breakthroughs, this report offers a strategic compass for capitalizing on the promise of compressed air propulsion.

Engage with Associate Director Ketan Rohom to Secure the Definitive Air Powered Vehicle Market Research Report and Gain Strategic Advantage

Unlock comprehensive insights into market trajectories policy impacts technological breakthroughs and competitive intelligence tailored to your strategic needs by engaging with Ketan Rohom, Associate Director, Sales & Marketing. Reach out now to discuss how this in-depth analysis of the air powered vehicle landscape can inform your next move and position your organization at the forefront of sustainable mobility innovation. Secure your copy of the definitive market research report today and gain the actionable intelligence required to drive growth and competitive advantage in an evolving industry.

- How big is the Air Powered Vehicle Market?

- What is the Air Powered Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?