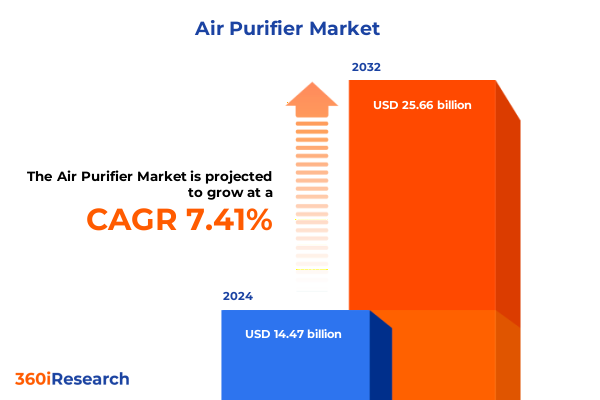

The Air Purifier Market size was estimated at USD 15.50 billion in 2025 and expected to reach USD 16.61 billion in 2026, at a CAGR of 7.45% to reach USD 25.66 billion by 2032.

Unveiling the Critical Landscape of Air Purification Solutions Amidst Evolving Environmental and Technological Demands for Informed Decision-Making

As air quality concerns continue to escalate across residential, commercial, and industrial settings, stakeholders are increasingly seeking reliable insights to guide investment and product strategies in the air purification sector. Heightened health awareness, fueled by a series of high-profile pollution episodes and global respiratory challenges, has elevated indoor and outdoor air treatment from a niche specialty to a mainstream necessity. Simultaneously, the convergence of smart home technologies and environmental monitoring platforms has generated unprecedented demand for devices that not only capture particulates but also integrate seamlessly into connected ecosystems. This report introduces a holistic view of the current air purifier market landscape by highlighting the intersection of consumer preferences, regulatory imperatives, and technological advancements.

With sustainability at the forefront of corporate agendas and individual lifestyles, this analysis underscores critical industry drivers while setting the stage for a deeper exploration of how market participants can navigate emerging complexities. Drawing on a diverse array of data sources and expert interviews, it paints a clear, actionable portrait of opportunities and challenges. By understanding these foundational elements, decision-makers can better align product roadmaps and strategic investments with evolving market dynamics, ensuring readiness for the shifts detailed in the following sections.

Spotlighting Pivotal Disruptions Reshaping the Air Purifier Industry Through Technological Innovation and Changing Consumer Preferences

The air purifier market is undergoing transformative shifts as cutting-edge filtration technologies intersect with changing consumer expectations and regulatory frameworks. In recent years, IoT integration has progressed beyond optional features, with real-time air quality monitoring and AI-driven maintenance alerts emerging as baseline requirements for premium offerings. Simultaneously, multi-stage purification systems that combine HEPA filtration with activated carbon, ultraviolet sterilization, or photocatalytic oxidation are redefining performance standards, enabling devices to address a wider spectrum of pollutants from particulate matter to volatile organic compounds.

Furthermore, distribution paradigms have been disrupted by the accelerated growth of e-commerce platforms, which has prompted manufacturers to rethink traditional retail partnerships and after-sales service models. Smart building initiatives in commercial and public settings have also contributed to this evolution, as facility managers increasingly demand scalable, networked purification solutions. These converging forces have catalyzed product innovations that prioritize adaptability, user engagement, and lifecycle sustainability. As regulatory bodies in key markets tighten air quality guidelines, companies that can rapidly iterate on design, demonstrate verifiable efficacy, and deliver seamless digital experiences will emerge as industry frontrunners

Evaluating the Cumulative Consequences of 2025 United States Tariff Adjustments on Air Purifier Supply Chains and Market Dynamics

In 2025, the United States implemented a series of revised tariff measures affecting a broad range of imported air purification products and components, reinforcing existing Section 301 duties on key supply chain inputs. These adjustments, which expanded the scope of HS codes subject to an additional 25 percent levy, have intensified cost pressures for manufacturers reliant on overseas assembly or raw filter media sourced predominantly from Asian markets. As a result, landed costs for finished units have risen, compelling many producers to absorb margin contraction or pass higher prices onto end users.

This tariff environment has prompted strategic supply chain reconfiguration, with forward-thinking companies exploring regional sourcing alternatives in Southeast Asia and Latin America to mitigate exposure. Others have accelerated investments in domestic manufacturing capacity or forged joint ventures with local partners to benefit from preferential trade terms. Meanwhile, longer lead times and compliance complexities around customs clearance have underscored the importance of inventory optimization and agile production planning. By charting these cumulative impacts, stakeholders can anticipate evolving cost structures and align procurement strategies with shifting trade regulations, thereby preserving competitiveness in an increasingly protectionist global trade landscape

Deep Dive into Diverse Air Purifier Market Segments Highlighting Type Technology Functionality Coverage Range and End Use Variations

A nuanced understanding of market segmentation reveals how distinct customer needs and use cases drive demand across multiple dimensions. The divide between in-duct fixed systems and standalone portable units underscores contrasting priorities: seamless integration with HVAC networks versus flexibility and point-of-use convenience. Technological differentiation further informs buying behaviors, with High Efficiency Particulate Air filters dominating residential and sensitive commercial applications, while electrostatic precipitators and ionic filters address specialized industrial or outdoor environments. Simultaneously, activated carbon stages have become indispensable for odor and gas removal, and hybrid systems that blend multiple technologies command premiums among discerning purchasers.

Functionality considerations delineate indoor solutions-where air quality sensors and smart controls are table stakes-from emerging outdoor purification installations designed for public venues or transit hubs. Coverage range segmentation highlights consumer sensitivity to square footage compatibility, as below-250-square-foot units appeal to urban dwellers, mid-range models serve multi-room residences or offices, and high-capacity devices penetrate large-scale commercial sites. The interplay of end-use applications reveals differentiated requirements: residential markets prioritize quiet operation and design aesthetics, multi-family dwellings demand compact portability, and single-family homes often integrate purification within existing ventilation infrastructure. Commercial adoption spans offices, hospitals, hospitality, and educational institutions, each with unique regulatory and performance benchmarks. Finally, channel dynamics illustrate offline retail’s enduring appeal for immediate purchase and service support, contrasted with online sales growth driven by direct-to-consumer platforms and brand-owned e-commerce sites

This comprehensive research report categorizes the Air Purifier market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Functionality Area

- Coverage Range

- End Use Application

- Sales Channel

Revealing Regional Dynamism in Air Purifier Adoption Across Americas Europe Middle East Africa and Asia-Pacific Powerhouses

Regional dynamics shape the trajectory of air purifier adoption, underscoring the importance of localized strategies. In the Americas, heightened public awareness of wildfire smoke events and urban smog has spurred stringent air quality regulations and robust consumer demand for residential and commercial purification solutions. Regulatory frameworks, including EPA guidelines for indoor air standards, have intensified procurement in both public institutions and private enterprises. Cross-border trade agreements within North America have facilitated parts sourcing, even as import tariffs on finished products remain a consideration.

Across Europe, the Middle East, and Africa, disparate air quality challenges and economic conditions require differentiated go-to-market approaches. Western European markets, driven by EU directives on environmental health, emphasize energy efficiency and carbon footprint reduction, whereas Middle Eastern nations leverage large-scale infrastructure projects to integrate purification into new commercial developments. African urban centers, grappling with rapid population growth and dust pollution, represent emerging opportunities for portable device deployment and public-private partnerships.

In Asia-Pacific, persistent industrial emissions and urban air crises have rendered purifiers essential household items and municipal assets. China and India lead both production and consumption, with local manufacturers innovating around cost efficiency and digital connectivity. Meanwhile, Southeast Asian economies view air treatment as a growth sector, supported by government subsidies for green technologies and expanding digital retail ecosystems

This comprehensive research report examines key regions that drive the evolution of the Air Purifier market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Air Purifier Manufacturers Uncovering Strategic Initiatives Innovations and Competitive Positioning Across the Globe

Industry leading organizations are leveraging differentiated approaches to secure competitive advantage within the air purifier segment. One global conglomerate has distinguished itself by embedding AI-driven modular filtration architecture, enabling users to customize purification stages based on pollutant profiles. A top-tier appliance manufacturer has focused on design-centric bladeless technologies, emphasizing both aesthetics and superior HEPA plus activated carbon performance. Several regional innovators have captured market share in cost-sensitive geographies by optimizing production workflows and pioneering compact, low-energy solutions suited to emerging economies.

Strategic partnerships have become another hallmark of leadership, with alliances between smart home platform providers and purifier OEMs facilitating seamless interoperability across IoT ecosystems. In parallel, some firms have invested heavily in proprietary filter media research-patenting nanofiber membranes that promise extended life and improved capture efficiency. On the commercial front, targeted certifications for medical and food-grade applications have unlocked new revenue streams. The convergence of subscription-based filter replenishment models and cloud-enabled performance analytics underscores an industry shift toward service-oriented revenue. By examining these company-level initiatives, stakeholders can benchmark best practices and identify white-space opportunities in product development, channel optimization, and customer engagement

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Purifier market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerus, LLC

- Alen Corporation

- AllerAir Industries Inc.

- Atlanta Healthcare

- Aura Smart Air Inc.

- Camfil AB

- Carrier Global Corporation

- Coway Co., Ltd.

- Daikin Industries Ltd.

- Dyson Technology Limited

- Hamilton Beach Brands Holding Company

- Honeywell International Inc.

- IQAir

- KENT RO SYSTEMS LTD

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Molekule, Inc.

- Panasonic Holdings Corporation

- Research Products Corporation

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Voltas Limited by Tata Group

- Whirlpool Corporation

- Winix Inc.

- Xiaomi Corporation

Strategic Imperatives for Air Purifier Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Positioning

To maintain a decisive edge, industry leaders should prioritize investments in next-generation connectivity and user-centric design. Developing platforms that integrate seamlessly with smart home networks and commercial building management systems will enhance customer loyalty and open opportunities for recurring service revenues. Concurrently, diversifying manufacturing footprints through regional partnerships or localized assembly can hedge against tariff volatility and supply chain disruptions. Aligning filter media innovation with sustainability benchmarks-such as biodegradable components or closed-loop recycling programs-will resonate with increasingly eco-conscious buyers and regulators.

Moreover, tailoring product offerings to address the distinct needs of multi-family dwellings, educational classrooms, and large-scale office complexes can drive deeper market penetration. Collaborations with public health organizations to validate efficacy and secure certifications can further solidify brand credibility. On the commercial side, bundling air purification within broader indoor air quality management solutions, including HVAC integration and environmental analytics, will establish comprehensive value propositions. Finally, fortifying omnichannel strategies with personalized digital touchpoints-ranging from augmented reality placement tools to AI-powered after-sales support-will streamline the buyer journey and accelerate adoption

Synthesizing Comprehensive Qualitative and Quantitative Research Approaches Underpinning Authoritative Insights into the Air Purifier Market

This analysis draws upon a rigorous blend of secondary and primary research methodologies to ensure both breadth and depth of insight. The secondary phase involved comprehensive reviews of public records, regulatory filings, patent databases, industry journals, and corporate disclosures to map the competitive landscape and technological trajectories. Trade data and customs statistics were synthesized to quantify cross-border flows and assess tariff impacts, while market anecdotes from leading trade associations provided contextual nuance.

The primary research component consisted of structured interviews with executives from OEMs, component suppliers, and distribution partners, supplemented by expert consultations with environmental scientists and regulatory specialists. These interactions validated key hypotheses and uncovered emerging use cases. Data triangulation was achieved by cross-referencing interview findings against quantitative indicators, ensuring consistency and reliability. Finally, segmentation analyses were rigorously tested through scenario modeling to project the potential implications of varying regulatory, technological, and consumer preference shifts, thereby underpinning the report’s strategic recommendations

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Purifier market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Purifier Market, by Type

- Air Purifier Market, by Technology

- Air Purifier Market, by Functionality Area

- Air Purifier Market, by Coverage Range

- Air Purifier Market, by End Use Application

- Air Purifier Market, by Sales Channel

- Air Purifier Market, by Region

- Air Purifier Market, by Group

- Air Purifier Market, by Country

- United States Air Purifier Market

- China Air Purifier Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Consolidating Key Findings to Chart a Clear Path Forward in the Rapidly Evolving Air Purifier Landscape

In summary, the air purifier landscape is at an inflection point defined by increasing environmental awareness, technological convergence, and evolving regulatory regimes. Strategic differentiation will hinge on the ability to innovate across multiple fronts-filtration efficacy, digital integration, and sustainable design-while simultaneously navigating cost headwinds induced by tariff realignments. A targeted segmentation approach, attuned to the nuanced needs of residential, commercial, and industrial end users, will unlock growth pockets overlooked by one-size-fits-all solutions.

Regional variations in demand drivers and distribution channels highlight the necessity of localized strategies, whether through direct investment in manufacturing hubs or adaptive partnership models. Leading companies are already exemplifying best practices in modular design, subscription services, and smart building integrations, offering a roadmap for emergent players. By adhering to the actionable recommendations outlined herein, stakeholders can solidify their market positioning and capitalize on the dynamic opportunities that lie ahead

Connect with Associate Director of Sales Marketing to Secure Comprehensive Air Purification Market Intelligence Tailored to Your Strategic Objectives

Ready to elevate your strategic advantage with a deeply researched and customized air purifier market analysis? Reach out directly to Ketan Rohom, Associate Director for Sales & Marketing, to secure exclusive access to our comprehensive study, unlock actionable insights tailored to your business objectives, and gain a competitive edge in the rapidly evolving air purification industry

- How big is the Air Purifier Market?

- What is the Air Purifier Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?