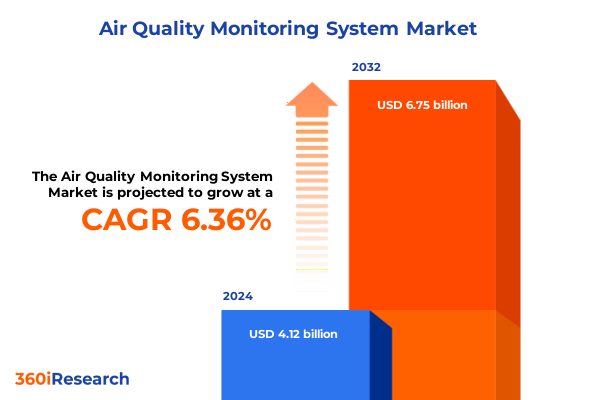

The Air Quality Monitoring System Market size was estimated at USD 4.33 billion in 2025 and expected to reach USD 4.56 billion in 2026, at a CAGR of 6.53% to reach USD 6.75 billion by 2032.

Rising Environmental Awareness and Technological Breakthroughs Are Transforming How Organizations Monitor and Manage Air Quality Standards Worldwide

In an environment where public health concerns and regulatory oversight converge, air quality monitoring systems have become indispensable tools for governments, industries, and communities seeking to safeguard well-being. This report offers a targeted examination of the air quality monitoring landscape, contextualizing its evolution amid tightening environmental regulations, heightened public awareness, and technological breakthroughs. By tracing the trajectory from standalone sensor deployments to integrated monitoring networks, we highlight how the market has shifted to accommodate real-time data demands and predictive capabilities.

Against a backdrop of increasing concerns over urban air pollution, industrial emissions, and the health impacts of particulate matter and gaseous pollutants, organizations face mounting pressure to deploy reliable, scalable monitoring solutions. This introduction frames the scope of our analysis, outlining the key thematic areas explored in subsequent sections, including technology innovation, tariff implications, segmentation nuance, regional behavior, and competitive positioning. With a professional lens, we offer decision-makers a concise yet comprehensive overview, setting the stage for deeper insights into how market participants can navigate emerging challenges and opportunities.

Emerging Data Analytics, IoT Integration, and Regulatory Evolution Are Redefining the Capabilities and Effectiveness of Modern Air Quality Monitoring Systems

The intersection of advanced sensor technologies and emerging data analytics platforms is redefining the capabilities of air quality monitoring systems. In recent years, miniaturized sensor modules and low-power semiconductor innovations have enabled more extensive deployment of fixed and portable monitoring units, empowering stakeholders to gather granular environmental data across diverse settings. Simultaneously, integration with Internet of Things networks and cloud-based platforms has elevated real-time analysis, visualization, and alerting functionalities, fostering more agile regulatory compliance and risk management processes.

Concurrently, the adoption of machine learning algorithms has enhanced predictive maintenance of monitoring hardware, optimized data calibration, and improved anomaly detection. This convergence of AI-driven analytics and robust sensing infrastructure supports proactive decision-making, enabling operators to forecast pollution spikes and implement mitigation strategies before thresholds are exceeded. Moreover, digital twins of urban environments are emerging as valuable tools, simulating pollutant dispersion under different operational scenarios and informing policy interventions.

On the regulatory front, tighter emission standards and increased transparency requirements have accelerated the transition from periodic manual sampling to continuous automated monitoring. Governments and environmental agencies are mandating broader pollutant coverage, driving demand for both gas-specific analyzers and fine particulate sensors. This shift toward comprehensive multi-pollutant stations underscores the market’s pivot to solutions that can seamlessly integrate diverse sensor technologies and data streams.

Finally, citizen science initiatives and community-driven air quality networks are reshaping stakeholder expectations, raising the bar for data accuracy, accessibility, and public engagement. As a transformative force, this democratization of environmental monitoring compels industry leaders to deliver solutions that balance cost-efficiency with high-fidelity measurement, aligning commercial objectives with broader societal imperatives.

United States Tariff Measures on Imported Monitoring Equipment and Components Are Reshaping Supply Chains and Cost Structures in Air Quality Monitoring Solutions

United States tariff measures enacted in 2025 have introduced significant cost pressures across the air quality monitoring equipment supply chain. By imposing additional duties on imported analyzers, sensor modules, and display units, policymakers have elevated the landed cost of key hardware components. This increase in procurement expenses has prompted many end users to reassess vendor contracts, renegotiate pricing terms, or explore alternative sourcing arrangements to mitigate budget impacts.

In response to these evolving trade dynamics, manufacturers have accelerated efforts to localize production, investing in domestic assembly lines and forging partnerships with regional electronics suppliers. Such strategic reshoring enhances supply chain resilience, reduces lead times, and alleviates exposure to cross-border tariff volatility. At the same time, some organizations are adopting modular system architectures that allow for component substitution without redesigning entire monitoring stations.

The ripple effects extend beyond hardware pricing. Services revenues, particularly in installation and maintenance, are experiencing upward pricing pressure as service providers adjust for higher replacement part costs. However, the tariffs have also stimulated innovation in software-driven calibration and remote diagnostics, which can reduce on-site maintenance visits and offset elevated service fees over the product lifecycle.

Looking ahead, sustained tariff uncertainty underscores the importance of flexible sourcing strategies and robust supplier diversification. Stakeholders who proactively monitor trade policy developments and engage in scenario planning will be best positioned to maintain cost-effective access to high-performance monitoring solutions.

Insights into Product Type Variations Deployment Mode Choices Application Contexts End User Verticals and Pollutant Categories Illuminate Market Dynamics

Insights into Product Type Variations Deployment Mode Choices Application Contexts End User Verticals and Pollutant Categories Illuminate Market Dynamics by revealing how discrete segments drive differentiated demand profiles. Within the hardware domain, analyzers deliver high-precision pollutant quantification while display units and sensor modules enable distributed sensing networks that capture localized air quality data. Transmitters further facilitate centralized monitoring by sending real-time readings to cloud platforms or on premise servers.

Meanwhile, services offerings such as consulting guide installation best practices, installation teams ensure precise system configuration, and maintenance contracts preserve uptime through scheduled calibrations. In the software dimension, cloud based solutions offer scalability and remote accessibility, whereas on premise deployments prioritize data sovereignty and low-latency operations. Fixed monitoring stations anchor long-term environmental stewardship programs, while portable devices empower rapid assessments in emergent scenarios or construction zones.

Applications vary from indoor commercial environments that demand continuous airflow analysis for occupant health to industrial facilities seeking emissions compliance. Residential monitoring solutions now cater to homeowners concerned about indoor pollutants, while outdoor deployments support environmental monitoring networks and research institutions modeling air dispersion patterns. End user segments span commercial enterprises focusing on workplace safety, government agencies enforcing air quality regulations, healthcare facilities safeguarding vulnerable populations, industrial operators ensuring compliance, and residential clientele monitoring indoor air.

Pollutant type segmentation bifurcates the market into gas detection systems that track volatile organic compounds, ozone, and nitrogen oxides, and particulate sensors that measure fine particulates down to PM2.5 and PM1 levels. Understanding these nuanced segment interdependencies allows stakeholders to tailor product roadmaps, align marketing strategies, and optimize resource allocation across varied technology, service, and application requirements.

This comprehensive research report categorizes the Air Quality Monitoring System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment Mode

- Pollutant Type

- Application

- End User

Comparative Regional Market Behaviors in the Americas EMEA and Asia Pacific Reveal Varied Adoption Patterns Technology Priorities and Growth Drivers

Comparative analysis of regional behaviors in the Americas EMEA and Asia Pacific uncovers distinct adoption patterns and technology priorities. In the Americas, mature regulatory frameworks and well-established environmental agencies have fueled widespread deployment of integrated monitoring networks. Private sector investment in smart city initiatives further amplifies demand for high-accuracy sensors and cloud based analytics platforms.

In Europe Middle East & Africa, stringent air quality directives and cross-border pollution concerns drive adoption of advanced analyzers and real-time data exchange among national monitoring bodies. The region’s mix of developed and emerging economies promotes both large-scale stationary stations for urban centers and portable units for rapid field assessments, reflecting a dual-track strategy aligned with varying infrastructure maturity levels.

The Asia-Pacific region is characterized by robust growth led by rapid urbanization, industrial expansion, and escalating public awareness of pollution health impacts. Markets in China, India, and Southeast Asia prioritize cost-effective sensor modules and modular system designs that can be rapidly deployed across diverse geographies. Governments in the region are also investing in dense sensor grids and satellite-based complement technologies to enhance coverage, reflecting a holistic approach to air quality management.

Collectively, these regional distinctions underscore the importance of adaptive go-to-market strategies that account for differing regulatory requirements, technology preferences, and infrastructure readiness. Tailored offerings and localized partnerships emerge as critical success factors when navigating these three dynamic markets.

This comprehensive research report examines key regions that drive the evolution of the Air Quality Monitoring System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning Research and Innovation Efforts of Leading Air Quality Monitoring Manufacturers and Software Providers in a Competitive Landscape

The competitive landscape in air quality monitoring is defined by manufacturers and software providers that combine sensor innovation with digital service offerings. Leading hardware companies continue to refine multi-pollutant modules capable of simultaneous gas and particulate measurement while reducing power consumption and footprint. Investments in novel sensing materials, such as metal-organic frameworks and laser-based detection, are enabling new levels of selectivity and sensitivity.

Software vendors are expanding platform capabilities to include advanced analytics, machine learning-driven anomaly detection, and flexible API integrations for enterprise resource planning systems. Many have forged alliances with cloud infrastructure providers to ensure scalable data storage and seamless integration with other facility management or environmental health systems. This interoperability-driven approach enhances customer value by centralizing data from fixed stations, portable monitors, and satellite sources within unified dashboards.

Some companies differentiate themselves through service-centric models that bundle consulting, installation, and ongoing maintenance into subscription packages. These end-to-end solutions align with the growing demand for predictable cost structures and reduced technical complexity. Firms that prioritize customer success methodologies and rapid field support see higher retention rates and broader adoption across highly regulated industries.

Strategic mergers and acquisitions are reshaping the industry by consolidating complementary capabilities-pairing sensor specialization with data analytics prowess. This trend continues to foster a more integrated ecosystem in which platform providers and hardware manufacturers collaborate to deliver turnkey offerings tailored to specific verticals such as industrial process compliance, healthcare facility monitoring, and urban air quality management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Quality Monitoring System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Agilent Technologies, Inc.

- AMETEK, Inc.

- Danaher Corporation

- Emerson Electric Co.

- Honeywell International Inc.

- Horiba, Ltd.

- Mitsubishi Heavy Industries Ltd.

- Siemens AG

- Teledyne Technologies Incorporated

- Thermo Fisher Scientific Inc.

Strategic Recommendations Designed to Enhance Operational Efficiency Drive Market Expansion and Strengthen Regulatory Compliance in Air Quality Monitoring

Leaders can enhance operational efficiency by prioritizing investments in modular hardware designs that support easy component upgrades and lower replacement costs. Developing flexible software architectures with open APIs will facilitate integration with enterprise systems and accelerate customer deployments. To expand market reach, organizations should cultivate partnerships with local service providers, leveraging their regional expertise to navigate regulatory complexity and optimize installation timelines.

In light of supply chain challenges, diversifying component sourcing and investing in domestic assembly capabilities will mitigate tariff exposures and shorten lead times. Simultaneously, embedding remote calibration and diagnostics functionalities into monitoring platforms can reduce on-site maintenance frequency and improve service margins. Emphasizing transparent data sharing and community engagement will strengthen stakeholder trust and position companies as committed partners in public health initiatives.

To secure regulatory compliance and future-proof product portfolios, research and development efforts should focus on emerging pollutant detection methods, such as real-time ultrafine particle analysis and compound-specific gas monitoring. Finally, establishing clear service level agreements and performance guarantees will foster long-term client relationships and differentiate offerings in a crowded market.

Research Methodology Outlining Data Collection Analytical Techniques Validation Processes and Quality Assurance Protocols Underpinning Industry Insights

Our research methodology integrates primary and secondary approaches to ensure data validity and analytical rigor. The primary research phase involved structured interviews with environmental regulatory authorities, equipment manufacturers, software developers, and end users across commercial, government, and industrial sectors. Survey instruments captured quantitative adoption rates and qualitative assessments of emerging technology drivers.

Secondary research encompassed a review of public policy documents, environmental agency reports, and academic publications to contextualize regulatory trends and scientific advancements. Market intelligence databases were consulted to verify company profiles, partnership announcements, and product launch timelines. Triangulation across these sources ensured consistency and minimized information gaps.

Analytical techniques included segmentation analysis to isolate demand drivers by product type, deployment mode, application, end user, and pollutant category. Scenario modeling projected the potential impact of tariff regimes and regulatory changes on supply chain configurations and pricing dynamics. All findings underwent internal peer review and quality assurance protocols, including data cross-validation and sensitivity checks, to confirm robustness of insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Quality Monitoring System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Quality Monitoring System Market, by Product Type

- Air Quality Monitoring System Market, by Deployment Mode

- Air Quality Monitoring System Market, by Pollutant Type

- Air Quality Monitoring System Market, by Application

- Air Quality Monitoring System Market, by End User

- Air Quality Monitoring System Market, by Region

- Air Quality Monitoring System Market, by Group

- Air Quality Monitoring System Market, by Country

- United States Air Quality Monitoring System Market

- China Air Quality Monitoring System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives on How Technological Innovation Regulatory Shifts and Market Dynamics Will Continue to Shape the Future of Air Quality Monitoring

As environmental imperatives intensify and technological capabilities advance, the air quality monitoring industry stands at a pivotal juncture. Innovations in sensor miniaturization and data analytics are enabling more comprehensive, cost-effective monitoring frameworks, while regulatory shifts and tariff policies continue to reshape supply chain strategies. Market participants that embrace modular architectures, open software standards, and strategic partnerships will be well-positioned to adapt swiftly to evolving stakeholder demands.

Looking ahead, success will hinge on balancing rapid adoption of emerging detection technologies with sustainable service models that emphasize data integrity and customer-centric outcomes. Those who align their product roadmaps with diverse application environments, regional regulatory landscapes, and end user priorities will secure competitive advantage in this dynamic market environment.

Empower Your Organization with Actionable Insights by Engaging with Ketan Rohom to Secure a Comprehensive Air Quality Monitoring Systems Market Research Report

To unlock the full potential of your operational and strategic planning, engage with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the comprehensive air quality monitoring systems market research report. By partnering directly with our research leadership, you will gain tailored insights into market dynamics, competitor strategies, and regulatory shifts that can inform your next investment or product development cycle. Take the next step in ensuring your organization remains at the vanguard of environmental monitoring innovation by securing your copy today and tapping into expertise that drives informed decision making in a rapidly evolving landscape

- How big is the Air Quality Monitoring System Market?

- What is the Air Quality Monitoring System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?