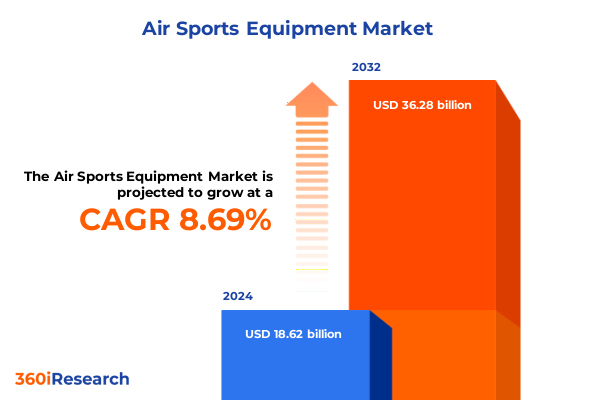

The Air Sports Equipment Market size was estimated at USD 20.28 billion in 2025 and expected to reach USD 21.75 billion in 2026, at a CAGR of 8.66% to reach USD 36.28 billion by 2032.

Exploring the Dynamic Evolution of the Air Sports Equipment Industry Amid Rising Adventure Enthusiasm and Technological Innovation

In an era where adventure tourism and recreational sports command a growing share of consumer leisure time, the air sports equipment industry stands at a pivotal juncture of transformation and expansion. Fueled by rising disposable incomes and a generational shift toward experiential pursuits, enthusiasts across the globe are embracing activities such as paragliding, hot air ballooning, and skydiving with renewed vigor. This surge in participation underscores the critical need for advanced, reliable equipment that not only enhances the user experience but also complies with increasingly stringent safety and environmental standards.

Simultaneously, technological breakthroughs in composite materials and digital fabrication have unlocked new frontiers in design and performance. Manufacturers are leveraging carbon fiber composites, high-tenacity fabrics, and precision-engineered metal alloys to produce lighter, stronger, and more aerodynamic gear. These innovations are complemented by the integration of data-driven solutions, including flight analytics platforms and augmented reality training tools, which together elevate safety protocols and empower users with real-time performance feedback. As regulatory bodies tighten certification requirements and global supply chains adapt to shifting geopolitical landscapes, industry participants face both challenges and opportunities.

Against this backdrop, decision-makers must navigate a complex matrix of consumer expectations, technological advancements, and policy developments. This executive summary distills the core dynamics reshaping the air sports equipment market, offering actionable insights for stakeholders seeking to harness growth, mitigate risks, and solidify their competitive positioning in a rapidly evolving landscape.

Uncovering the Pivotal Technological Breakthroughs and Consumer Behavior Shifts Redefining the Air Sports Equipment Market Landscape

The contemporary air sports equipment sector is undergoing transformative shifts driven by both macroeconomic trends and micro-level innovations. To begin with, digital transformation has redefined how products are designed, manufactured, and marketed. Additive manufacturing techniques enable rapid prototyping of paramotor frames and hot air balloon baskets, reducing time to market and allowing for bespoke configurations that cater to niche requirements. Meanwhile, cloud-based flight simulation and virtual reality training environments are democratizing access to skill development for recreational pilots and professional instructors alike.

Moreover, sustainability imperatives are permeating every aspect of the value chain. Manufacturers are increasingly sourcing recycled fabrics for canopies and baskets, adopting low-carbon metal processing methods, and implementing end-of-life recycling programs for composite components. These ecologically oriented practices not only resonate with environmentally conscious consumers but also anticipate future regulatory mandates that will penalize excessive carbon footprints. In tandem, the industry’s supply chains are being reconfigured for resilience; companies are diversifying their sourcing geographies and forging strategic partnerships to buffer against trade uncertainties and logistical bottlenecks.

Concurrently, evolving consumer preferences are catalyzing a shift towards integrated service offerings. Operators are bundling equipment leasing, maintenance programs, and digital training subscriptions into unified packages that enhance customer loyalty and recurring revenue streams. Consequently, market leaders are those willing to transcend traditional product-centric models and embrace platform-based ecosystems that deliver end-to-end value. As these converging forces gain momentum, industry stakeholders must remain agile, leveraging cross-disciplinary innovation to maintain differentiation and capture emerging opportunities.

Assessing the Far-Reaching Consequences of Newly Enacted United States Tariffs on Air Sports Equipment Supply Chains and Pricing Dynamics

In January 2025, the United States government implemented a new tariff schedule on imported air sports equipment, raising duties by 10 to 25 percent under a broader effort to protect domestic manufacturing and address trade imbalances. This policy recalibration has reverberated throughout the supply chain, compelling importers, distributors, and end users to recalibrate procurement strategies and cost structures. Gear sourced from traditional manufacturing hubs has become more expensive to bring into the domestic market, leading to extended lead times as buyers navigate alternative sourcing arrangements and domestic production capacities ramp up.

These additional levies have also triggered a reassessment of price positioning across product lines. Premium segments such as advanced sailplanes and competition-grade paragliding wings now encounter greater sensitivity to retail markups, prompting some suppliers to absorb portions of the tariff impact through margin realignment. At the same time, smaller operators have sought to offset cost pressures by negotiating volume-based discounts and exploring nearshoring options in Mexico and Central America, where established aviation supply clusters can deliver component subassemblies with shorter transit times.

Beyond immediate financial implications, the tariff environment has accelerated domestic investment in manufacturing infrastructure. United States–based fabricators and composite shops have attracted fresh capital inflows aimed at expanding capacity for carbon fiber layup and high-performance fabric weaving. These developments underscore a longer-term shift toward regionalized production ecosystems. While the short-term effect has been an uptick in unit costs for imported goods, medium-term prospects point to a more robust domestic supplier base, enhanced supply chain visibility, and improved turnaround for aftermarket services.

Deriving Strategic Insights from Product, Distribution, End User, and Material Segmentation Trends Influencing Air Sports Equipment Demand Patterns

Insight into the intricate segmentation of the air sports equipment market reveals differential growth drivers and competitive dynamics across product, distribution, end user, and material categories. When exploring product diversification, the industry spans a broad continuum from motorgliders to sailplanes, each benefitting from precision-engineered carbon fiber and advanced fabric lamination. Hang gliders range from entry-level beginner class wings designed for ease of use and safety to competition- and sport-class variants optimized for agility and speed. In the realm of free-flight systems, hot air balloons are sectioned into envelope assemblies, durable basket frameworks, and high-efficiency burner systems, while paragliders cater to pilots across the experience spectrum, from beginner wings with forgiving flight characteristics to advanced competition wings engineered for maximum glide performance. Paramotors present another dimension, with caged configurations suited for novice thrust control and foot-launch setups favored by experienced pilots seeking portability. Skydiving equipment completes the picture, encompassing a comprehensive array of canopies engineered for specific descent profiles, rugged containers that secure the canopy and pilot, and specialized accessories that enhance safety and maneuverability.

Distribution channels further fragment market behavior, as direct sales channels leverage company-owned outlets and distributor networks to cultivate brand engagement and technical support. Mass retail channels broaden exposure through experiential pop-up events, whereas online platforms-spanning third-party eCommerce marketplaces and manufacturer webstores-offer convenient access and digital product customization. Specialty stores, including adventure sports shops and aviation supply outlets, serve as critical touchpoints for expert guidance and hands-on equipment trials.

From the perspective of end users, commercial applications encompass aerial advertising, photographic services capturing high-resolution landscapes, and tourism ventures that package flight experiences for leisure travelers. Competitive segments focus on specialized disciplines such as hang gliding races, precision paragliding championships, and skydiving tournaments. Meanwhile, the recreational cohort encompasses a diverse range of hobbyists, and training schools provide structured certification pathways for aspiring pilots.

Material composition exerts a defining influence on performance and durability. Composite elements, predominantly carbon fiber and fiberglass, deliver unmatched strength-to-weight ratios; high-performance fabrics ensure aerodynamic stability and UV resistance; and metal substructures, spanning aluminum alloys to steel reinforcements, underpin critical load-bearing assemblies. Understanding these intersecting segmentation layers allows stakeholders to pinpoint high-value niches and tailor strategies for product development, channel optimization, end-user engagement, and material sourcing.

This comprehensive research report categorizes the Air Sports Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Distribution Channel

- End User

Evaluating Regional Divergences and Growth Trajectories Across Americas, Europe Middle East & Africa, and Asia-Pacific Air Sports Equipment Markets

Regional market dynamics underscore the heterogeneous nature of air sports equipment demand and supply ecosystems. In the Americas, domestic innovation hubs drive rapid uptake of next-generation gear, with the United States leading due to its robust general aviation infrastructure and growing adventure tourism sector. Canada contributes through its specialized manufacturing clusters in composite fabrication, addressing both local demand and export opportunities. Mexico’s emerging aviation supply corridors are also gaining prominence as nearshore alternatives for component production and assembly.

Traveling eastward to Europe, Middle East & Africa, the region’s mature regulatory frameworks and established sporting federations foster consistent demand for certified equipment. Western Europe continues to invest in sustainable manufacturing processes, while Eastern European workshops capitalize on cost efficiencies for small-batch production. In the Middle East, luxury tourism projects have spurred bespoke hot air balloon experiences, and African markets show nascent potential as infrastructure investments unlock new adventure tourism corridors in countries like South Africa and Morocco.

Meanwhile, Asia-Pacific represents a landscape of dual-speed growth. Mature markets such as Australia and Japan demonstrate steady interest in recreational flying and professional skydiving operations, supported by stringent safety standards. Conversely, Southeast Asia and India are experiencing an emerging wave of interest, driven by rising middle-class incomes and government initiatives to promote tourism. Manufacturers are responding by tailoring equipment to tropical climates, incorporating UV-resistant fabrics and corrosion-resistant alloys to withstand regional environmental challenges.

Across these three regions, adaptive strategies that leverage localized manufacturing partnerships, tailor product offerings to cultural preferences, and navigate varied regulatory environments will define leadership in the global air sports equipment market.

This comprehensive research report examines key regions that drive the evolution of the Air Sports Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Positions, Innovative Initiatives, and Partnership Strategies of Leading Players Shaping the Air Sports Equipment Industry

Leading players within the air sports equipment landscape are distinguished by their commitment to innovation, strategic alliances, and agile supply chain management. Companies at the forefront are channeling R&D investments into lightweight composite formulations and next-generation fabric technologies, enabling them to deliver products that align with industry safety standards and emerging performance benchmarks. In parallel, several manufacturers have forged partnerships with flight training academies and tourism operators to embed product trials into experiential packages, transforming user acquisition strategies and deepening brand loyalty.

Consolidation activities have also shaped the competitive environment, as larger entities acquire specialized niche manufacturers to broaden their product portfolios and capture new segments. Strategic collaborations extend beyond M&A: cross-sector alliances with aerospace suppliers, technology incubators, and sustainability consultancies have yielded advancements in material circularity and digital integration. These synergistic collaborations empower brands to optimize cost structures, accelerate innovation cycles, and respond more effectively to tariff-induced supply disruptions.

Furthermore, top-tier firms are leveraging digital ecosystems to augment after-sales services. By deploying IoT-enabled sensors in paramotor frames and hot air balloon burners, for instance, companies can offer predictive maintenance subscriptions that reduce downtime and extend equipment lifespans. These value-added offerings not only differentiate established players from emerging competitors but also cultivate recurring revenue streams that bolster financial resilience.

As competitive pressures intensify, market leaders will continue to refine their strategic playbooks, balancing investments in proprietary technology with open innovation models that harness external expertise. The ability to integrate advanced materials, digital services, and global distribution networks will determine the next wave of frontrunners in the air sports equipment domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Sports Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advance Thun AG

- Airborne Systems, LLC

- Aviation Industry Corporation of China, Ltd.

- Dudek Paragliders

- Fly & more Handels GmbH

- Fresh Breeze GmbH & Co. KG

- Gin Gliders Co., Ltd.

- GoPro, Inc.

- ICON Aircraft, Inc.

- MacPara Technology s.r.o.

- Nova Performance Paragliders GmbH

- Ozone Gliders Ltd.

- Performance Designs, Inc.

- Petzl

- Safran Aerosystems SAS

- Skywalk GmbH & Co. KG

- SOL SPORTS INDÚSTRIA E COMÉRCIO LTDA

- Supair SAS

- Swing Flugsportgeräte GmbH

- U-Turn GmbH

- United Parachute Technologies, LLC

Actionable Strategies for Industry Leaders to Navigate Tariff Pressures, Accelerate Innovation, and Strengthen Market Position in Air Sports Equipment

Industry leaders must adopt multifaceted strategies to prosper amid evolving regulatory frameworks, heightened tariff regimes, and shifting consumer expectations. First, diversifying supply chains beyond traditional sourcing geographies is imperative. Firms should cultivate relationships with nearshore suppliers in Mexico and Central America, as well as local fabricators in North American and European markets, to minimize exposure to import tariffs and reduce transit times.

Next, investing in digital transformation across the value chain will unlock operational efficiencies and customer engagement opportunities. Manufacturers can implement advanced manufacturing execution systems that integrate additive fabrication, CNC machining, and quality assurance workflows, ensuring tighter tolerances and faster iteration cycles. On the customer facing side, integrating eCommerce capabilities with interactive product configurators and virtual flight previews will enhance the buying journey and support premium pricing models.

Sustainability must also be elevated from peripheral initiative to core strategic pillar. By adopting closed-loop recycling programs for composite and fabric waste, firms can not only mitigate environmental impact but also appeal to an increasingly eco-conscious consumer base. Equally important is engaging with regulatory bodies to shape emerging safety and environmental standards, ensuring that product innovations align with forthcoming requirements and that compliance costs remain manageable.

Finally, leaders should explore collaborative innovation frameworks, partnering with aerospace research centers, materials science institutes, and technology startups to co-develop breakthrough solutions. Such open innovation ventures can accelerate time to market for advanced composites and sensor-enabled systems. By simultaneously addressing cost optimization, technological advancement, and regulatory adherence, industry participants will be well-positioned to capture growth and sustain competitive advantage.

Detailing the Comprehensive Research Framework Combining Primary Interviews, Secondary Data Analysis, and Expert Validation for Market Insights

This research leverages a rigorous, multi-tiered methodology designed to provide robust and actionable market insights. At the outset, secondary data collection encompassed public and proprietary databases, industry publications, patent filings, and regulatory dossiers to map the competitive and regulatory landscape. These data sets offered a foundational understanding of material trends, regional market structures, and historical trade policy impacts.

Building on this quantitative groundwork, primary research was conducted via in-depth interviews with a cross-section of industry stakeholders, including equipment manufacturers, certification authorities, distribution channel leaders, and end-user representatives. These qualitative discussions illuminated evolving operational practices, customer pain points, and strategic responses to tariffs and digital disruption. Furthermore, site visits to manufacturing facilities and training academies provided first-hand observation of production processes and user interactions.

Data triangulation ensured the validity of findings, with insights from secondary sources cross-verified against primary interview responses and real-world case studies. A structured approach to segmentation analysis was applied to isolate unique growth drivers across product types, distribution channels, end users, and material compositions. Finally, expert validation sessions were convened with academic researchers, trade association officials, and materials scientists to refine conclusions and confirm that recommendations remain aligned with emerging technological and policy trends.

This comprehensive framework underscores the credibility of the study’s strategic implications, offering stakeholders a reliable basis for informed decision-making in an evolving air sports equipment market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Sports Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Sports Equipment Market, by Product Type

- Air Sports Equipment Market, by Material

- Air Sports Equipment Market, by Distribution Channel

- Air Sports Equipment Market, by End User

- Air Sports Equipment Market, by Region

- Air Sports Equipment Market, by Group

- Air Sports Equipment Market, by Country

- United States Air Sports Equipment Market

- China Air Sports Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings and Strategic Implications for Stakeholders to Seize Opportunities and Mitigate Challenges in Air Sports Equipment Market Dynamics

The air sports equipment industry is at a transformative crossroads, propelled by robust consumer interest in adventure experiences, technological advancements in materials and digital integration, and evolving regulatory and trade landscapes. Stakeholders who align their strategic roadmaps with these dynamics will be best positioned to capture new growth vectors. Core findings highlight the significance of segmentation-driven product development, the imperative to diversify supply chains in light of tariff adjustments, and the growing importance of digital ecosystems that blend product innovation with subscription-based services.

Regional markets present distinct opportunities: the Americas benefit from established manufacturing and aviation networks, Europe Middle East & Africa derives strength from regulatory maturity and luxury tourism demand, and Asia-Pacific exhibits promising growth fueled by rising incomes and government tourism initiatives. Industry leaders are distinguished by their R&D commitments, strategic partnerships that extend into aerospace and sustainable materials, and the deployment of predictive maintenance and customer engagement platforms that unlock recurring revenue streams.

Looking ahead, proactive investment in sustainable practices, nearshore manufacturing, and collaborative technology development will be essential. Companies that cultivate agility in responding to policy shifts, particularly tariff realignments, while also fostering open innovation alliances will set the standard for resilience and long-term value creation. By synthesizing these insights, stakeholders can craft data-driven initiatives that balance performance, cost optimization, and regulatory compliance to secure sustainable competitive advantage.

Engage with Ketan Rohom to Unlock Comprehensive Air Sports Equipment Market Insights and Maximize Growth Potential Through Strategic Investments Today

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, offers a streamlined path to secure the complete air sports equipment market research report and gain unparalleled strategic foresight. This comprehensive study equips you with deep-dive analyses into emerging trends, regulatory impacts, and competitive strategies, enabling you to craft data-driven initiatives and outpace rivals. By partnering with Ketan, you access personalized guidance on leveraging report insights to optimize supply chains, refine product portfolios, and identify high-growth segments. Reach out today to discover how this specialized intelligence can accelerate decision making and fuel sustainable growth across your organization’s air sports equipment ventures

- How big is the Air Sports Equipment Market?

- What is the Air Sports Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?