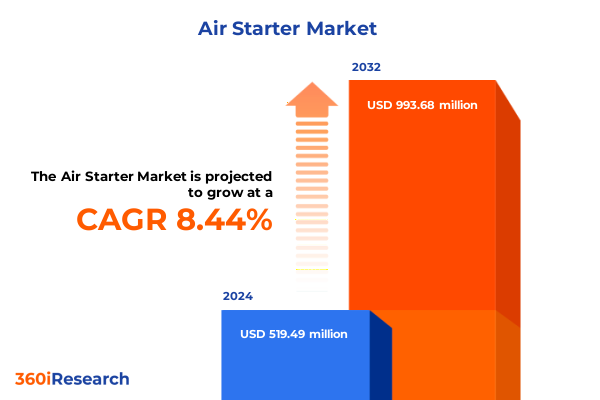

The Air Starter Market size was estimated at USD 560.13 million in 2025 and expected to reach USD 605.99 million in 2026, at a CAGR of 8.53% to reach USD 993.68 million by 2032.

Charting the Air Starter Market Landscape as Rapid Industrial Growth Converges with Technological Advancements and Regulatory Dynamics

The air starter market is at a pivotal juncture where intensifying industrial activity and stringent regulatory frameworks are converging to drive innovation and operational excellence. As manufacturing sectors worldwide accelerate production to meet rising demand, the need for reliable and efficient starter solutions has never been more critical. Air starters, prized for their simplicity, safety, and high torque generation, are increasingly favored in applications where durability and quick restart capability are non-negotiable elements of operational continuity.

Moreover, sustainability mandates and emissions regulations have reshaped how end users evaluate power generation and equipment reliability. Industries such as marine propulsion, heavy manufacturing, and mining are under growing pressure to minimize downtime while ensuring compliance with environmental directives. Consequently, suppliers are investing in advanced materials, high-precision machining, and modular design philosophies that deliver both performance gains and lifecycle cost reductions. This evolution reflects an overarching trend toward expecting equipment that not only performs at peak efficiency but also integrates seamlessly with digital maintenance platforms.

Finally, the interplay between global supply chain realignments and technological transformation underscores the importance of strategic vendor partnerships. Companies that cultivate agile procurement strategies and partner with innovators capable of rapid customization stand to gain a competitive edge. As these forces coalesce, stakeholders must rethink traditional starter selection criteria, prioritizing products that support predictive maintenance, remote diagnostics, and scalability across diverse industrial environments.

Illuminating the Transformative Forces Reshaping the Global Air Starter Industry Through Technological Innovation and Geopolitical Realignment

Today’s air starter industry is being reshaped by a combination of technological breakthroughs and shifting geopolitical landscapes that compel both suppliers and end users to adapt swiftly. Advances in additive manufacturing have enabled the production of lightweight, high-strength components that reduce starter inertia and improve response times. At the same time, smart sensor integration and IoT connectivity are transforming legacy equipment into intelligent systems capable of real-time performance monitoring and predictive maintenance alerts, thus reducing unplanned downtime and maintenance costs.

Concurrently, trade policy adjustments and emerging tariff regimes have introduced layers of complexity to global sourcing strategies, making supply chain resilience a strategic imperative. Companies are diversifying manufacturing footprints to mitigate the risk of localized disruptions, while leveraging regional engineering hubs to tailor solutions to specific market needs. This geographical dispersion is complemented by renewed emphasis on cybersecurity protocols for connected equipment, as heightened digitization amplifies vulnerability to malicious actors.

Taken together, these shifts are driving an era of collaborative innovation, where partnerships between industrial equipment manufacturers and technology providers yield integrated solutions that surpass traditional boundaries. As a result, industry participants are transitioning from purely transactional relationships to strategic alliances, aligning product roadmaps with end-user digital transformation goals and regulatory compliance requirements to secure long-term competitive advantage.

Assessing the Cumulative Economic Reverberations of United States Tariff Measures Introduced in Early 2025 Across Air Starter Supply Chains

The introduction of comprehensive tariff measures by the United States government in early 2025 has created significant ripple effects throughout the air starter supply chain. The initial wave included a 20% levy on all imports from China that took effect on February 4 and was increased on March 4, closely followed by a uniform 25% duty on automobile imports announced on February 12 and enforced April 2, with exemption criteria linked to U.S. content thresholds and allowances under the USMCA. Shortly thereafter, tariffs on aluminum and steel imports rose by 25% on March 12, with an explicit focus on closing loopholes that had previously permitted foreign material to be processed overseas and re-exported to the U.S. duty-free.

As the 2025 tariff landscape further evolved, March witnessed the imposition of a 25% surcharge on all imports from Mexico and on Canadian goods not covered under the USMCA, except for energy and potash which were subject to a 10% tariff. These measures, effective March 4, triggered retaliatory actions from both Ottawa and Mexico City, resulting in reciprocal duties on U.S. exports. On April 2, a universal reciprocal tariff of 10% was enacted for most countries, briefly stayed by judicial intervention before being reinstated on April 5. The subsequent April 9 announcement introduced country-specific reciprocal duties ranging from 11% to 50%, temporarily paused until August 1.

The cumulative effect of these policy actions escalated the average effective tariff rate (AETR) from a 2024 baseline of 2.3% to 9.9% following the January–March measures. When accounting for the April announcements, the AETR surged to 27.5%, marking one of the most abrupt shifts in U.S. trade policy in recent decades. This unprecedented spike in import levies has prompted equipment manufacturers and distributors to reevaluate sourcing strategies, accelerate domestic supply chain development, and explore tariff engineering solutions to mitigate cost implications and preserve market competitiveness.

Unveiling Critical Segmentation Insights to Illuminate Diverse Starter Types End User Industries Applications and Performance Parameters

A nuanced understanding of market segmentation is imperative for identifying growth vectors and tailoring product offerings to specific customer needs. Starting with the categorization by starter type, the distinction between piston and vane designs underpins choices linked to operational requirements. The reciprocating piston variant excels in delivering high torque for intermittent start cycles, whereas its rotary piston counterpart provides smoother acceleration profiles for more continuous applications. Conversely, multi-vane starters leverage multiple radial vanes to optimize air flow management and durability in demanding duty cycles, while the single-vane design remains a cost-effective choice for lighter service profiles.

Turning to end user industries reveals divergent performance and reliability priorities. Manufacturing clients in heavy sectors often demand robust starters capable of withstanding extreme loads, whereas light manufacturing environments favor compact, energy-efficient units that integrate easily with automated production lines. Marine operators differentiate between commercial shipping, where air starters must function reliably during long voyages without shore-side support, and naval vessels that require rapid response capabilities under critical mission conditions. In mining, surface operations stress starters with high particulate environments and frequent startups, while underground applications amplify safety concerns and demand anti-explosion features. The oil and gas sector further subdivides into upstream exploration, midstream transportation, and downstream refining segments, each imposing distinct thermal, chemical, and reliability requirements.

The application domain further dictates material selection and maintenance frequency. Diesel locomotives demand starters engineered for high torque output and resilience to vibration, while electric locomotives benefit from air starters that offer silent operation and reduced maintenance intervals. In power generation, gas turbines require starters with rapid acceleration profiles and precise control, hydro turbines place emphasis on starters that excel in low-temperature environments with minimal icing risk, and steam turbines call for specialized materials to resist corrosion and frequent cycling. Beyond these drivers, factors such as operating pressure levels, whether high or low, and mounting type choices between base and flange options contribute significantly to installation complexity and lifecycle costs. Horsepower ratings spanning up to 100 HP, the 101 to 300 HP bracket, and machines above 300 HP create further stratification, while distribution channels from traditional aftermarket dealers and direct sales to online platforms-whether via company websites or third-party e-commerce portals-shape the purchasing journey and service expectations.

This comprehensive research report categorizes the Air Starter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Starter Type

- Application

- Pressure Level

- Mounting Type

- Horsepower Rating

- End User Industry

- Distribution Channel

Exploring Pivotal Regional Dynamics Impacting Air Starter Demand Across The Americas Europe Middle East Africa And Asia Pacific

The air starter market’s regional dynamics reflect the interplay between industrialization trends, regulatory environments, and infrastructure investments. Within the Americas, strong capital expenditure in mining and upstream oil and gas operations continues to underpin demand for high-performance starters. The United States remains a focal point for technology adoption and stringent emissions controls, driving the need for low-leakage, precision-engineered units. In contrast, Latin American markets exhibit a growing appetite for cost-effective solutions capable of withstanding variable grid reliability and challenging operating conditions, with many players seeking aftermarket packages that extend starter life and reduce maintenance intervals.

Across Europe, Middle East & Africa, regulatory rigor around emissions and energy efficiency is accelerating the shift toward advanced starter alternatives. European manufacturers are integrating predictive analytics into their service models, while Middle Eastern oil and gas operators prioritize starters that can endure extreme temperatures and dust exposure. In Africa, infrastructure modernization and mining expansions in key territories have catalyzed demand for robust products designed for rapid deployment, alongside local service networks that minimize logistical complexity.

Turning to Asia-Pacific, this region stands out for its rapid industrialization, particularly in heavy manufacturing hubs such as China, India, and Southeast Asia. Here, volume-driven procurement often balances cost sensitivity with the need for high-performance designs tailored to continuous operation. Emerging markets in the Asia Pacific are increasingly investing in automation and digital maintenance tools, prompting suppliers to offer integrated solutions that couple air starters with remote diagnostic platforms and modular upgrade pathways. As infrastructure projects expand and energy portfolios diversify, this region is set to remain a critical driver of global air starter demand.

This comprehensive research report examines key regions that drive the evolution of the Air Starter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants And Analyzing Their Strategic Priorities And Technological Capabilities Shaping Market Competition

The competitive landscape in the air starter market is characterized by a blend of established global conglomerates and specialized regional manufacturers, each pursuing differentiated strategies to capture market share. Global industrial technology leaders have leveraged deep engineering capabilities and expansive service networks to introduce modular platforms that span broad horsepower ranges and environmental conditions. These players are increasingly focusing on digital enhancements, embedding sensors and control modules that facilitate real-time performance tracking and maintenance forecasting.

At the same time, niche suppliers with expertise in ruggedized designs have carved out strong positions in sectors such as marine and heavy mining. By emphasizing customization and rapid prototyping, these firms can tailor products to meet stringent application requirements, from high-vibration offshore installations to underground mining environments with heightened safety standards. Partnerships with local distributors and service providers further strengthen their market reach, allowing for localized aftermarket support and field service deployment.

Meanwhile, emerging entrants are differentiating through innovative manufacturing approaches such as additive techniques and advanced composite materials that reduce weight and enhance corrosion resistance. These newer players are also exploring subscription-based maintenance models and digital twin simulation environments that allow end users to validate starter configurations in virtual settings before physical installation. Collectively, these strategies underscore a competitive environment where technological leadership, supply chain agility, and customer-centric service offerings define the pathways to sustained growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Starter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Starter Components, Inc.

- Atlas Copco AB

- Austart Pty Ltd.

- Caterpillar Inc.

- Gali Internacional S.A.

- Hilliard Corporation

- Honeywell International Inc.

- Ingersoll Rand, Inc.

- IPU Group Ltd.

- KH Equipment Pty Ltd.

- Maradyne Corporation

- Multi Torque Industries Pty Ltd.

- Shin Hueng Precision Co., Ltd.

- Tech Development Inc.

- The Rowland Company

Delivering Actionable Strategic Recommendations To Empower Industry Leaders To Navigate Market Complexities And Drive Sustainable Growth

Industry leaders seeking to capitalize on evolving market conditions should prioritize the integration of digital monitoring tools and predictive analytics within product offerings. Embedding sensors that track parameters such as pressure, temperature, and vibration enables proactive maintenance scheduling, reducing downtime and extending equipment lifecycles. To complement these digital enhancements, developing robust software platforms that provide actionable insights and seamless integration with enterprise asset management systems will differentiate suppliers in a crowded marketplace.

Additionally, optimizing supply chain resilience through diversified sourcing and localized assembly hubs can mitigate exposure to tariff fluctuations and geopolitical disruptions. By establishing regional manufacturing footprints and fostering partnerships with local service networks, organizations can improve lead times and reduce logistical costs. Leveraging tariff engineering strategies-such as design modifications that facilitate change in customs classifications-can further minimize the financial impact of import levies and protect margin profiles.

Finally, directing R&D investments toward modular and scalable designs will address the broad spectrum of customer requirements across horsepower ranges and application environments. Offering configurable starter packages that can be quickly adapted for specific end users accelerates time to market and enhances customer satisfaction. In parallel, pursuing collaborative product development initiatives with key end users ensures that innovation roadmaps align closely with emerging industry needs, securing long-term partnerships and driving sustainable revenue growth.

Outlining A Rigorous Multi-Stage Research Methodology Combining Primary Interviews Secondary Analysis And Data Triangulation For Robust Insights

The research methodology underpinning this report is grounded in a multi-stage approach designed to deliver comprehensive and reliable market insights. Initially, secondary research was conducted through a thorough review of industry literature, regulatory filings, and trade publications to establish baseline understanding of market dynamics and existing segmentation frameworks. This phase included analysis of government tariff announcements, industry association reports, and technical white papers to capture evolving policy and technology trends.

Building on these findings, primary research was executed via in-depth interviews with a cross section of stakeholders, including equipment manufacturers, distributors, system integrators, and end-user maintenance engineers. Each interview was structured to elicit qualitative insights on purchasing criteria, application challenges, and future roadmap expectations. Quantitative data gleaned from these engagements was cross-verified with inputs from regional experts to ensure accuracy and consistency across diverse geographic contexts.

Finally, all qualitative and quantitative inputs were subjected to rigorous triangulation, aligning data points from multiple sources to validate trends and eliminate potential biases. This iterative validation process involved peer reviews with industry advisors and scrutiny by regulatory specialists to confirm compliance implications. The combined methodology ensures that the conclusions and recommendations presented are robust, actionable, and reflective of the latest market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Starter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Starter Market, by Starter Type

- Air Starter Market, by Application

- Air Starter Market, by Pressure Level

- Air Starter Market, by Mounting Type

- Air Starter Market, by Horsepower Rating

- Air Starter Market, by End User Industry

- Air Starter Market, by Distribution Channel

- Air Starter Market, by Region

- Air Starter Market, by Group

- Air Starter Market, by Country

- United States Air Starter Market

- China Air Starter Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2703 ]

Synthesis Of Key Findings And Strategic Implications That Define The Future Trajectory Of The Air Starter Market Amidst Evolving Industry Dynamics

In summary, the convergence of advanced manufacturing technologies, stringent regulatory policies, and shifting trade landscapes is reshaping the air starter market at an unprecedented pace. Growth opportunities are being driven by demand for products that not only deliver high torque and rapid restart capabilities but also align with digital transformation and sustainability objectives. Regional variations underscore the necessity of tailoring solutions to diverse operating conditions, from extreme climates in the Middle East to cost-sensitive volume markets in Asia Pacific.

Competitive dynamics are evolving as legacy suppliers invest in connected equipment platforms and specialized entrants leverage innovative materials and service models. Meanwhile, the significant tariff interventions enacted in early 2025 have prompted a reexamination of global supply chains and accelerated the adoption of domestic sourcing and tariff mitigation strategies. Moving forward, success will hinge on the ability to harmonize product innovation, digital enablement, and strategic partnerships across the value chain.

Ultimately, organizations that proactively adapt their offerings to these multidimensional shifts and foster close collaboration with end users and policymakers will be best positioned to capture market share and drive long-term profitability in the transforming air starter landscape.

Connect With Ketan Rohom To Unlock In-Depth Market Intelligence And Secure Your Customized Air Starter Industry Research Solution Today

For tailored insights and comprehensive data on the air starter market’s evolving dynamics, reach out to Ketan Rohom, the Associate Director of Sales & Marketing, to explore how our detailed analysis can empower your strategic initiatives. Discover customized research solutions designed to address your most pressing challenges and uncover growth opportunities within this critical industrial segment. Engage directly with an expert who can guide you through our in-depth market intelligence offerings and ensure you secure the precise information needed to drive competitive advantage.

Contact Ketan today to discuss your requirements, arrange a personalized briefing, or obtain a full copy of the air starter market research report complete with actionable data, forward-looking analysis, and strategic recommendations that will equip your organization for sustained success.

- How big is the Air Starter Market?

- What is the Air Starter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?