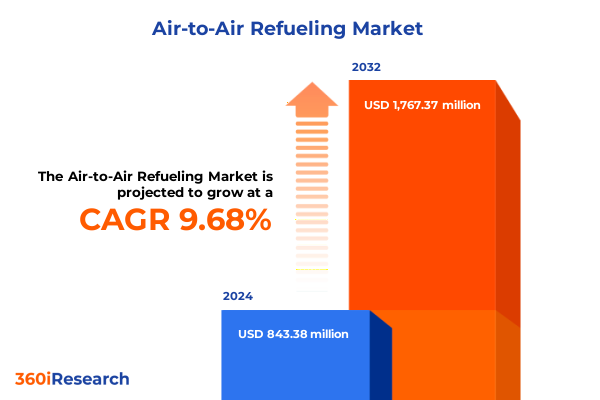

The Air-to-Air Refueling Market size was estimated at USD 916.26 million in 2025 and expected to reach USD 997.58 million in 2026, at a CAGR of 9.83% to reach USD 1,767.37 million by 2032.

Strategic Prelude into the Evolving Air-to-Air Refueling Arena Unveiling Core Drivers Shaping Technological Advancements and Operational Synergies

Air-to-air refueling stands as one of the most critical enablers of sustained air power projection, allowing modern air forces to extend mission reach, enhance operational flexibility, and maintain persistent deterrence. Since its inception in World War II, refueling techniques have advanced from rudimentary grappling lines to highly sophisticated boom and pod systems capable of seamless integration with a diverse array of receiver platforms. Today’s environment challenges defense planners to balance ever-growing mission requirements with fiscal and regulatory constraints, demanding solutions that are both technologically robust and cost-effective. Furthermore, geopolitical shifts and rising global tensions underscore the strategic necessity of aerial refueling in ensuring rapid force deployment across remote theaters.

Against this backdrop, this executive summary distills the latest developments, market drivers, and strategic imperatives shaping the air-to-air refueling domain. It synthesizes insights on transformative technological shifts, the implications of recent United States tariff adjustments, and the nuanced segmentation dynamics that define solution offerings. By articulating regional variations and competitive landscape nuances, this summary equips leaders with the context needed to navigate complex procurement decisions and partnership opportunities. Ultimately, this introduction sets the stage for a deeper exploration of how innovations, policy shifts, and industry collaboration are jointly reconfiguring the future of refueling operations.

Fundamental Shifts Redefining Air-to-Air Refueling Landscape Driven by Digitalization Autonomous Capabilities and Cross-Domain Integration

The air-to-air refueling landscape is undergoing fundamental transformation as emerging technologies, shifting doctrines, and multipolar security dynamics converge to redefine operational paradigms. Autonomous capabilities now allow unmanned platforms to conduct refueling missions with minimal human intervention, leveraging advanced sensor fusion and artificial intelligence for precise rendezvous and station-keeping. Additionally, digitalization of maintenance and logistics processes is enhancing fleet readiness by providing real-time health monitoring for boom and hose drum units. This shift towards predictive maintenance reduces unscheduled downtime and extends the service life of critical refueling assets.

Simultaneously, cross-domain integration is broadening the traditional concept of air-to-air refueling. Innovative pod-based systems can now be rapidly mounted on various platforms, enabling fighter aircraft, transport jets, and rotary wing assets to receive fuel in disparate operational contexts. Interoperability standards are being formalized to ensure coalition partners can seamlessly share refueling capabilities, while modular system architectures accommodate rapid technology upgrades and payload variations. As a result, defense establishments worldwide are prioritizing flexible, multi-role refueling solutions that can adapt to contested environments, support humanitarian relief operations, and sustain extended patrols across vast maritime and terrestrial theaters.

In essence, the combination of autonomy, digital integration, and modular design is unlocking a new era of aerial refueling, one in which agility, resilience, and interoperability become the defining measures of success.

Compounding Consequences of 2025 United States Tariff Policies on Global Air-to-Air Refueling Supply Chains Procurement Strategies and Cost Structures

In 2025, the United States implemented a series of tariff adjustments targeting key aerospace components and subsystems integral to air-to-air refueling platforms. These measures, designed to protect domestic manufacturing, have imposed additional duties on imported booms, pods, and specialized fuel pumps, thereby increasing the landed cost of critical assemblies. As defense contractors and prime integrators adjust procurement strategies, many have encountered higher unit expenses and elongated supply lead times. To mitigate these challenges, several original equipment manufacturers have initiated nearshoring of component production or renegotiated long-term supplier contracts that include price escalators capped to inflation indices.

The ripple effects of these tariff policies extend beyond direct cost impacts. Organizations are reassessing their global supply chain footprints, seeking alternative suppliers in allied nations that benefit from preferential trade agreements. This retooling process, while necessary for tariff exposure management, introduces complexity in quality oversight and certification protocols. Some defense departments have temporarily extended maintenance intervals to conserve inventory of spare parts, while others are investing in reverse engineering and in-house fabrication capabilities. Over the medium term, the cumulative impact of these tariffs is accelerating industry consolidation and prompting a strategic shift towards vertically integrated supply models. Consequently, stakeholders must balance the imperative for rate-of-flight readiness with the need for fiscal prudence in an environment of evolving trade policies.

Intricate Market Segmentation Perspectives Revealing Process Platform System Fuel Application and Operation Mode Trends Shaping Refueling Solutions

A nuanced understanding of market segmentation reveals how diverse operational demands and technological preferences shape air-to-air refueling architectures. When viewed through the lens of process type, rigid boom systems contrast with telescoping booms in terms of structural complexity, maintenance cycles, and compatibility with next-generation tankers. Meanwhile, probe drogue assemblies-spanning basket, fixed wingtip drogue, and hose drum unit variants-remain favored by rotary wing platforms and allied jets lacking rigid boom receptacles. Platform segmentation further illustrates this diversity: fifth-generation fighters prioritize low-observable boom designs that minimize radar cross-section, whereas aerial refueling tankers and cargo aircraft leverage reinforced boom stations to maximize fuel offload rates. Likewise, narrow body and wide body medium transport aircraft balance payload flexibility with fuel carriage capacity, and tiltrotor platforms demand lightweight, compact refueling pods for shipboard operations.

System type segmentation underscores the coexistence of boom, pod, receptacle, and wingtip drogue systems within modern fleets. Deployable wingtip drogues afford rapid mission turnaround for rotary wing aircraft, while integrated receptacle systems in stealth fighters require precision-engineered receptacle doors and retractable booms. Fuel type preferences-including Jet A1, JP-5, and JP-8-reflect variations in thermal stability, flash point, and compatibility with shipboard or austere base environments. Application-based segmentation captures the breadth of operational use cases, from strategic long-haul sorties to tactical battlefield refueling, humanitarian relief missions, firefighting support, and dedicated crew training. Finally, operation mode delineates the emerging role of autonomous and unmanned refueling platforms complementing traditional manned missions, each mode demanding distinct control software, certification regimes, and safety protocols.

This comprehensive research report categorizes the Air-to-Air Refueling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process Type

- Platform Type

- Fuel Type

- Application

- Operation Mode

Diverse Regional Dynamics in Air-to-Air Refueling Illuminating Key Drivers Challenges and Growth Paths across Americas Europe Middle East Africa Asia-Pacific

Regional dynamics within the air-to-air refueling market manifest in distinct procurement strategies and partnership frameworks across major territories. In the Americas, robust defense budgets and legacy tanker fleets drive a focus on modernizing boom-equipped tankers alongside pod-based systems for rotary wing and UAV operations. Collaborative programs between the United States, Canada, and select Latin American nations emphasize joint exercises and interoperability standards, underscoring a commitment to hemispheric security and rapid crisis response.

Meanwhile, Europe, the Middle East, and Africa exhibit a mosaic of requirements shaped by regional security priorities and multilateral defense initiatives. European militaries increasingly invest in multi-role tankers underpinned by advanced command and control integration, while Gulf Cooperation Council states prioritize high-tempo operations and capacity expansion to secure critical maritime chokepoints. African air forces, often operating within NATO or EU training missions, seek cost-effective pod-based refueling solutions to bolster peacekeeping and anti-piracy deployments across the continent’s vast littoral zones.

In the Asia-Pacific region, strategic competition and maritime domain awareness have spurred significant investment in both boom and probe drogue refueling capabilities. Nations such as China and India pursue indigenous tanker programs, while Australia and select Southeast Asian allies acquire versatile pods to extend patrol ranges over expansive maritime zones. This dynamic environment underscores a shared imperative: ensuring persistent air presence amid contested airspaces and dispersed basing infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Air-to-Air Refueling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Probing the Strategic Footprints of Leading Air-to-Air Refueling Providers Highlighting Innovation Collaborations and Strengths Driving Market Leadership

Leading players in the air-to-air refueling domain maintain strategic footprints that span design, integration, and lifecycle support services. Boeing’s KC-46 Pegasus continues to anchor U.S. tanker modernization efforts, integrating advanced fly-by-wire booms and digital maintenance platforms. Airbus’s A330 Multi Role Tanker Transport leverages reinforced wing structures to support both boom and pod configurations, appealing to NATO and non-aligned partners seeking dual-use capabilities. Lockheed Martin and Northrop Grumman have each advanced their proprietary autonomous refueling pods, targeting unmanned combat aerial vehicles and offering retrofit options for legacy fleets.

On the subsystem front, specialized suppliers such as Cobham and Esterline focus on delivering high-reliability drogue couplings and receptacle systems, while Eaton and Parker Hannifin provide precision-engineered fuel handling and pressure regulation components. Engineering and support service firms, including KBRwyle and Amentum, complement these offerings through integrated sustainment programs that emphasize predictive analytics and flexible contract models. Emerging entrants from Asia and the Middle East bring competitive pressure, particularly in pod manufacturing and rapid deployment services, thereby driving established players to intensify R&D investments in lightweight composite booms and augmented reality–enabled maintenance tools. Collectively, these companies are shaping the competitive landscape through technology partnerships, targeted acquisitions, and collaborative research initiatives aimed at reducing total cost of ownership while enhancing mission readiness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air-to-Air Refueling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Ametek Inc.

- BAE Systems plc

- Circor International Inc.

- Cobham Limited

- Crane Aerospace & Electronics

- Curtiss-Wright Corporation

- Eaton Corporation plc

- GE Aviation

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Liebherr-International AG

- Lockheed Martin Corporation

- Marshall Aerospace and Defence Group

- Meggitt PLC

- Northrop Grumman Corporation

- Parker-Hannifin Corporation

- Raytheon Technologies Corporation

- Rolls-Royce Holdings plc

- Safran SA

- Thales Group

- The Boeing Company

- Triumph Group Inc.

- Woodward Inc.

Transformative Roadmap for Industry Leaders to Capitalize on Air-to-Air Refueling Opportunities through Technology Integration Sustainability and Partnerships

To maintain a leadership position in the evolving air-to-air refueling arena, industry stakeholders should prioritize a series of strategic initiatives that foster innovation and operational resilience. Embracing digital twins and predictive analytics for refueling assets can significantly enhance readiness rates by enabling condition-based maintenance and reducing unscheduled downtime. Concurrently, firms should diversify their supplier base to mitigate exposure to tariff fluctuations, exploring partnerships with vendors in allied countries that benefit from stable trade relations. This approach will ensure a resilient supply chain while maintaining access to critical subsystems.

Moreover, companies must accelerate the development of autonomous refueling platforms by investing in robust collision-avoidance systems and secure datalink architectures. Integrating these platforms into existing manned tanker fleets through modular design philosophies will offer customers a smoother transition to mixed-manning operations. At the same time, aligning product roadmaps with emerging sustainability mandates-such as alternative fuel certifications and energy-efficient engine modifications-will position organizations to meet both environmental targets and defense logistics objectives. By forging strategic alliances with academic institutions, military test centers, and allied defense contractors, industry players can pool R&D resources, validate technologies under realistic conditions, and create standardized interfaces that facilitate coalition interoperability.

Research Methodology Revealing Systematic Approaches Data Collection Framework and Analytical Techniques Driving the Air-to-Air Refueling Market Analysis

This market study was underpinned by a rigorous methodology combining primary and secondary research to ensure analytical rigor and comprehensive coverage. The primary research phase included in-depth interviews with program managers, maintenance chiefs, and procurement officers across multiple air forces, as well as consultations with engineering experts and system integrators. These insights were triangulated against a curated database of global defense spending, procurement contracts, and aircraft fleet deployments.

Secondary research encompassed a thorough review of government defense white papers, industry association publications, and technical journals to map the evolution of refueling technologies and regulatory frameworks. Proprietary datasets on system reliability, service intervals, and lifecycle costs informed the segmentation analysis and competitive benchmarking. Quantitative models were validated through cross-referencing open-source defense budget allocations and publicly disclosed capital expenditure plans. Finally, a series of workshops with subject-matter experts refined the report’s key findings, ensuring that all conclusions reflect both operational realities and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air-to-Air Refueling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air-to-Air Refueling Market, by Process Type

- Air-to-Air Refueling Market, by Platform Type

- Air-to-Air Refueling Market, by Fuel Type

- Air-to-Air Refueling Market, by Application

- Air-to-Air Refueling Market, by Operation Mode

- Air-to-Air Refueling Market, by Region

- Air-to-Air Refueling Market, by Group

- Air-to-Air Refueling Market, by Country

- United States Air-to-Air Refueling Market

- China Air-to-Air Refueling Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Perspectives on the Future of Air-to-Air Refueling Synthesizing Key Discoveries Strategic Imperatives and Next-Generation Considerations for Stakeholders

Drawing together the multilayered insights presented in this summary, it is clear that the future of air-to-air refueling will be defined by agility, interoperability, and technological integration. Emerging autonomous platforms, modular system architectures, and advanced analytics are poised to transform how air forces project power and sustain global operations. At the same time, policy shifts-such as the 2025 United States tariffs-highlight the necessity for supply chain resilience and strategic sourcing.

As stakeholders chart their strategic courses, they must synthesize these findings into cohesive action plans that balance innovation with fiscal discipline. Whether modernizing legacy fleets or investing in next-generation booms and pods, decision-makers will benefit from a holistic approach that aligns technological capabilities with evolving operational doctrines. Ultimately, the organizations that successfully navigate this complex landscape will secure enduring advantages in readiness, cost efficiency, and coalition interoperability.

Take Action Today Connect with Ketan Rohom to Unlock Exclusive Air-to-Air Refueling Market Insights Empower Your Decisions with Our Definitive Report

Engaging directly with Ketan Rohom unlocks access to the most comprehensive air-to-air refueling market report designed to empower strategic decision-making. Drawing on a rich tapestry of data, analysis, and expert insight, this definitive study offers unparalleled clarity on emerging technologies, regional dynamics, and competitive positioning. By initiating contact today, you gain a personalized consultation that aligns the report’s offerings with your organization’s unique objectives and operational challenges. Ketan Rohom will guide you through the report’s most pertinent sections, highlighting opportunities for cost optimization, supply chain resilience, and technology adoption. His expertise will ensure that you extract maximum value from the report, supporting both immediate tactical needs and long-term strategic planning. Reach out now to transform abstract insights into actionable strategies, securing a competitive edge in the rapidly evolving air-to-air refueling landscape.

- How big is the Air-to-Air Refueling Market?

- What is the Air-to-Air Refueling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?