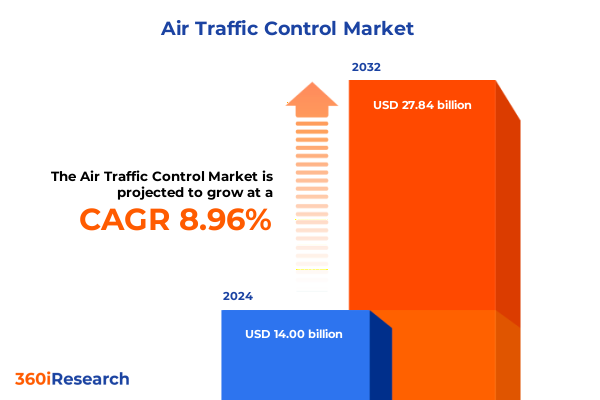

The Air Traffic Control Market size was estimated at USD 15.25 billion in 2025 and expected to reach USD 16.48 billion in 2026, at a CAGR of 8.97% to reach USD 27.84 billion by 2032.

Unveiling the Crucial Role of Modern Air Traffic Control Systems in Ensuring Safe, Efficient, and Resilient Global Aviation Operations

The complexity and scale of modern air traffic control systems have never been more critical as global air travel continues to rebound and expand. Increasing flight volumes, evolving aircraft technologies, and heightened safety expectations place unprecedented demands on navigational infrastructure and operational protocols. Against this backdrop, air navigation service providers and regulatory agencies are accelerating efforts to modernize radar, communications, and surveillance capabilities in order to maintain safety margins while optimizing airspace capacity.

Moreover, strategic initiatives such as satellite-based augmentation systems and advanced data link communications are rapidly shifting from pilot projects to deployment phases in major markets. As a result, air traffic controllers and airport operators face the dual challenge of integrating cutting-edge automation tools with legacy hardware. This introduction sets the stage by framing the transformative journey underway in the air traffic control landscape, highlighting how regulatory momentum, technological innovation, and operational imperatives converge to redefine safety, efficiency, and resilience in the skies.

Exploring Transformative Technological and Regulatory Shifts Reshaping Air Traffic Control for Unprecedented Efficiency, Safety, and Scalability Across Flight Operations

The air traffic control sector is experiencing a paradigm shift driven by digital transformation, automation, and evolving regulatory frameworks. Remote and digital tower technologies, once niche concepts, are now being deployed to extend surveillance reach, reduce infrastructure costs, and deliver flexible staffing across multiple airports. Similarly, artificial intelligence–powered traffic flow management tools are enabling predictive conflict detection and optimized routing that adapt in real time to weather disturbances and traffic surges.

Simultaneously, regulatory bodies worldwide are aligning on data interoperability standards and cybersecurity protocols to safeguard increasingly networked ATC environments. Collaborative efforts under ICAO’s Global Air Navigation Plan and region-specific modernization roadmaps are catalyzing harmonization, thereby lowering barriers for technology adoption. Altogether, these advances are reshaping the operational landscape, fostering more resilient, scalable, and future-ready air traffic control systems.

Assessing the Far-Reaching Cumulative Impacts of 2025 United States Tariff Measures on Air Traffic Control Equipment Procurement and Supply Chain Dynamics

In 2025, the United States government adjusted tariff measures affecting imports critical to air traffic control infrastructure, including advanced avionics components, radar subsystems, and communication hardware. These measures have elevated procurement costs for high-precision equipment sourced from key manufacturing hubs, prompting procurement teams to reassess supplier partnerships and cost-containment strategies.

Moreover, manufacturers and service providers are encountering extended lead times as suppliers recalibrate production and logistics to absorb increased duties. The cumulative effect is driving a shift toward localization of select hardware assembly and an emphasis on modular, upgrade-capable systems to reduce dependency on cross-border shipments. Consequently, stakeholders must navigate a more complex procurement landscape, balancing cost pressures against the imperative to deploy next-generation air traffic control capabilities without compromising performance or safety.

Deriving Actionable Insights from Component, Facility Type, Airport Size, Application, and End User Segmentation to Tailor Air Traffic Control Solutions Effectively

Insights drawn from component segmentation reveal a clear trend: hardware modernization investments are prioritizing radar systems and communication equipment upgrades, particularly units that offer multi-mode surveillance and digital link capabilities. Within hardware, demand is strongest for antenna and radio upgrades that support ADS-B and satellite communications, alongside precision approach radars that enhance all-weather operability. In parallel, services are evolving beyond routine maintenance to encompass holistic lifecycle support, including advanced predictive diagnostics and operator training tailored to digital tower and remote ATC platforms. Software solutions, especially ATC simulation and predictive analytics applications, are increasingly valued for their ability to accelerate controller proficiency and optimize traffic flow management across dynamic airspace conditions.

Facility-type segmentation underscores divergent modernization trajectories: air traffic control towers in major urban airports are transitioning to hybrid digital-analog architectures, while area control centers are integrating cloud-enabled traffic management suites to support cross-regional coordination. Combined center radar approach control facilities are leveraging consolidated displays to unify en route and terminal operations, and terminal radar approach control sites are adopting ground-based augmentation enhancements to reduce approach spacing minima. Meanwhile, airport size segmentation indicates that large hub airports, coping with the highest traffic densities, are leading the charge on full-scale automation deployments, medium hubs are selectively implementing remote tower services, and small hub locations are opting for cost-effective maintenance and incremental radar upgrades.

Application-level analysis highlights that surveillance and communication improvements remain top priorities, though navigation automation tools are gaining traction as stakeholders seek to enable trajectory-based operations. Lastly, end-user discernment shows that commercial aviation entities emphasize capacity optimization and passenger throughput, whereas military aviation operators prioritize resilient communications and secure data links, reflecting divergent performance requirements and mission criticality.

This comprehensive research report categorizes the Air Traffic Control market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Facility Type

- Airport Size

- Application

- End-User

Uncovering Regional Variations in Air Traffic Control Adoption and Development Patterns Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional perspectives reveal nuanced approaches to air traffic control modernization. In the Americas, the United States has advanced its NextGen initiative with widespread ADS-B mandates and data communications implementations, while Canada has focused on system integration projects to bridge vast remote sectors. Latin American operators, constrained by budget cycles, are selectively upgrading radar networks and leveraging performance-based navigation to improve safety.

Across Europe, Middle East, and Africa, the European Union continues to roll out SESAR deployment phases that harmonize cross-border operations, while Gulf states are investing heavily in state-of-the-art digital towers and satellite navigation infrastructure. African nations, though challenged by funding gaps, are collaborating with international partners to modernize legacy systems and expand training programs to meet rising traffic demands. In Asia-Pacific, China’s extensive CNS modernization programs drive rapid adoption of advanced radar and communication suites, India’s airports are embarking on phased digital tower pilots to relieve congestion, and Australia is pioneering remote tower technology to ensure coverage across sparsely populated regions. Together, these regional initiatives underscore diverse investment priorities and regulatory frameworks that shape the evolution of global air traffic control capabilities.

This comprehensive research report examines key regions that drive the evolution of the Air Traffic Control market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strengths and Strategic Focus Areas of Leading Air Traffic Control Technology Providers Driving Innovation and Market Positioning

Leading providers in the air traffic control market are differentiating themselves through specialized portfolios and strategic partnerships. One global integrator has capitalized on its end-to-end radar and communications offering to secure multi-year modernization contracts and bundle service agreements that extend through system lifecycles. A major European systems supplier is advancing digital tower and remote services by leveraging cloud architecture and virtualized displays, enabling rapid site deployments and remote controller collaboration.

A key avionics manufacturer has expanded its ADS-B and satellite navigation portfolio through targeted acquisitions, bolstering its presence in the Asia-Pacific region. Meanwhile, a defense-oriented provider is focusing on robust, hardened communication links, catering to military end-user requirements for network resilience and encryption. Additionally, a specialist software company has gained traction with predictive analytics modules that integrate seamlessly into existing ATC traffic management platforms, enhancing throughput and controller situational awareness. These competitive dynamics highlight an industry in which innovation, strategic alliances, and modular, upgrade-friendly architectures shape market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Traffic Control market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACAMS AS

- Adacel Technologies Limited

- ALTYS Technologies

- ARTISYS, s.r.o.

- Avinor AS

- BAE Systems PLC

- Collins Aerospace

- DFS Deutsche Flugsicherung GmbH

- Frequentis AG

- Honeywell International Inc.

- Huber+Suhner AG

- Intelcan Technosystems Inc.

- L3harris Technologies, Inc.

- Leonardo Group by Indra Sistemas, S.A.

- Midwest Air Traffic Control Service, Inc.

- NATS Limited

- Nav Canada

- Northrop Grumman Corporation,

- Raytheon Technologies Corporation

- Saab AB

- Saipher ATC

- SkySoft-ATM

- Thales Group

Formulating Actionable Strategic Recommendations to Enhance Technological Advancement, Operational Resilience, and Collaborative Partnerships in Air Traffic Control

Industry leaders must seize the momentum of technological advances by forging cross-sector partnerships that bridge traditional equipment vendors, software innovators, and aviation regulators. By co-developing pilot programs for AI-enhanced conflict detection and trajectory optimization, stakeholders can shorten validation cycles and accelerate operational adoption. Furthermore, cultivating diversified supply networks and local assembly capabilities will mitigate the effects of tariff volatility and supply chain disruptions, preserving project timelines and cost structures.

Simultaneously, investing in comprehensive controller training initiatives-encompassing simulation-based skill development and cybersecurity readiness-will be critical to fully realizing the benefits of automated and remote tower environments. Embracing open architecture principles and interoperable data standards will also enable gradual system upgrades and smooth integration across heterogeneous networks. Collectively, these strategic actions will empower organizations to enhance safety margins, boost capacity, and maintain resilience in the face of evolving regulatory and market pressures.

Outlining Robust Research Methodology Incorporating Primary Interviews, Secondary Data Analysis, and Rigorous Validation Processes for Credible Industry Insights

This research leverages a hybrid methodology that combines in-depth primary interviews with air navigation service provider executives, ATC technology architects, and regulatory authority representatives, alongside secondary analysis of publicly available technical papers, industry whitepapers, and regulatory filings. Initial insights were cross-validated through a Delphi panel comprising subject-matter experts to ensure robustness and consensus on emerging trends.

Quantitative data were synthesized through a triangulation process, integrating information from equipment procurement records, service contract disclosures, and case studies of modernization programs. Dedicated workshops with end-users tested hypotheses on system performance, cost drivers, and operational readiness. The resulting framework aligns qualitative thematic analysis with empirical findings, delivering a multi-dimensional view of market dynamics, technological priorities, and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Traffic Control market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Traffic Control Market, by Components

- Air Traffic Control Market, by Facility Type

- Air Traffic Control Market, by Airport Size

- Air Traffic Control Market, by Application

- Air Traffic Control Market, by End-User

- Air Traffic Control Market, by Region

- Air Traffic Control Market, by Group

- Air Traffic Control Market, by Country

- United States Air Traffic Control Market

- China Air Traffic Control Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Future Outlook for Air Traffic Control Evolution to Guide Strategic Decision Making and Investment Priorities

This executive summary has illuminated the pivotal factors driving the air traffic control market, from transformative technological shifts and segmentation-based insights to region-specific modernization priorities and competitive dynamics. It underscores the importance of navigating tariff impacts through supply chain resilience and localization, while leveraging digital towers, automation, and predictive analytics to enhance safety and efficiency. As regulatory harmonization and collaborative innovation accelerate, stakeholders are well positioned to capitalize on next-generation solutions that meet evolving traffic and security demands.

Looking forward, sustained progress will depend on aligning investment strategies with emerging operational paradigms-prioritizing modular architectures, data interoperability, and workforce readiness. By embracing these principles, aviation authorities, service providers, and technology vendors can collaboratively chart a course toward a safer, more efficient, and resilient global air traffic management ecosystem.

Take the Next Step Toward Informed Decision Making by Securing Comprehensive Air Traffic Control Market Intelligence with Expert Support

To take full advantage of the insights and strategic recommendations outlined in this executive summary, secure direct access to the comprehensive air traffic control market research report today. Partner with Ketan Rohom, Associate Director, Sales & Marketing, to gain expert guidance tailored to your organization’s unique objectives and challenges. His deep understanding of industry dynamics ensures you receive the most relevant data and actionable strategies needed to stay ahead in a rapidly evolving aviation environment. Reach out now to transform insights into tangible growth and innovation.

- How big is the Air Traffic Control Market?

- What is the Air Traffic Control Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?