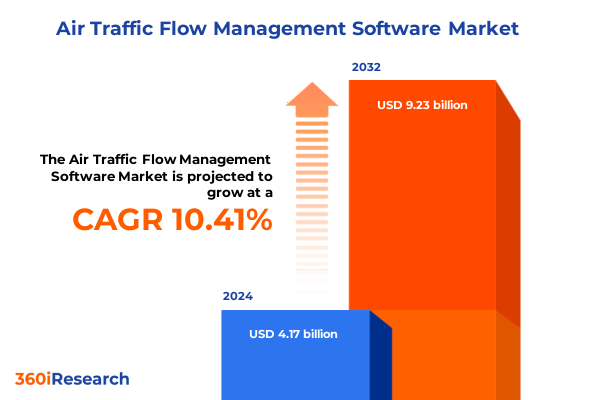

The Air Traffic Flow Management Software Market size was estimated at USD 4.51 billion in 2025 and expected to reach USD 4.88 billion in 2026, at a CAGR of 10.75% to reach USD 9.23 billion by 2032.

Setting the Stage for Modernizing Air Traffic Flow Management with Innovative Software Solutions That Enhance Efficiency Safety and Operational Resilience

The introduction to contemporary air traffic flow management software must first acknowledge the unprecedented convergence of technological advancement, regulatory evolution, and escalating operational complexity. As global passenger volumes rebound and exceed pre-pandemic levels, air navigation service providers and commercial carriers face intensifying pressure to coordinate flight trajectories, optimize runway throughput, and mitigate delays triggered by weather volatility. Meanwhile, next-generation aircraft, unmanned aerial vehicles, and performance-based navigation frameworks add layers of technical and procedural nuance. In this context, software solutions have emerged as the linchpin for holistic network orchestration, leveraging real-time data sharing, predictive analytics, and dynamic slot allocation to preserve safety, efficiency, and environmental sustainability.

This Executive Summary encapsulates the critical developments shaping the air traffic flow management sector, beginning with a review of transformative shifts in technology, operations, and policy. It then examines the ramifications of the United States’ 2025 tariff adjustments on procurement and deployment costs, before presenting nuanced segmentation insights across end-user categories, solution types, deployment modalities, and installation pathways. Key regional dynamics and competitive landscapes are profiled to reveal adoption patterns, while strategic recommendations guide decision-makers in navigating emerging challenges. The methodology underpinning these findings is transparently detailed, culminating in a conclusive overview that synthesizes core takeaways and charts a course for future action.

Exploring the Technological Operational and Regulatory Disruptions Reshaping Air Traffic Flow Management for a More Connected and Sustainable Aviation Ecosystem

The air traffic flow management landscape is undergoing a rapid metamorphosis driven by a confluence of technological, operational, and regulatory forces. Artificial intelligence and machine learning algorithms now underpin demand forecasting models, enabling precise predictions of traffic peaks and potential bottlenecks. In parallel, collaborative decision-making frameworks facilitate synchronized information exchange among airlines, airports, and air navigation service providers, thereby reducing misalignment and ensuring more efficient slot allocation. Furthermore, performance monitoring tools deliver continuous visibility into network health, allowing real-time adjustments to flight sequencing and route planning. Collectively, these innovations are redefining traditional silos, ushering in an era of interconnected operations that prioritize agility and resilience.

Regulatory programs such as NextGen in the United States and SESAR in Europe are catalyzing further transformation, mandating the adoption of data-driven practices and environmental performance targets. Pressure to reduce carbon emissions has elevated trajectory optimization and continuous descent operations to strategic imperatives. Simultaneously, the integration of unmanned aerial systems and urban air mobility platforms presents new traffic flow complexities that demand advanced deconfliction and automation capabilities. Consequently, stakeholders are increasingly investing in cloud-native architectures and modular platforms that can adapt to evolving standards, ensure scalability, and support continuous innovation.

Assessing the Cumulative Cost Pressures and Supply Chain Constraints Imposed by the 2025 United States Tariff Measures on Air Traffic Flow Management Technology Procurement

The implementation of United States tariff measures in 2025 has introduced notable pressure on procurement budgets and supply chain dynamics for air traffic flow management solutions. Import duties on specialized hardware components-ranging from surveillance sensors and radar systems to networking infrastructure-have elevated capital expenditure requirements. These cost increases ripple through software licensing agreements, particularly when integrated systems rely on proprietary onboard processing units or bespoke data acquisition devices. As a result, both end users and solution providers are compelled to reassess sourcing strategies, often considering domestic manufacturing or open-source hardware alternatives to mitigate price escalations while maintaining performance benchmarks.

Beyond hardware, cloud service providers that utilize data center equipment subject to tariffs are passing additional fees onto subscribers. This has a direct impact on organizations that have embraced public and private cloud deployments for capacity management, collaborative decision-making portals, and real-time analytics platforms. Contract renegotiations are underway as clients seek more favorable terms or hybrid deployment approaches to spread costs over existing on-premise assets. In light of these developments, strategic planning must account for multi-year tariff trajectories, explore supply chain diversification, and incorporate flexible licensing models that balance financial prudence with the imperative to harness next-generation capabilities.

Unveiling Critical Insights from End User Solution and Deployment Mode Segmentation That Illuminate Diverse Requirements and Adoption Patterns

A granular examination of market segmentation reveals distinct requirements and adoption behaviors among end users and solution types for air traffic flow management software. Air navigation service providers prioritize collaborative decision-making modules and performance monitoring dashboards to align airspace operators with airport authorities and airlines, thereby reducing delays and optimizing runway usage. Commercial airlines, by contrast, place greater emphasis on demand forecasting tools that enable dynamic schedule adjustments and capacity reallocation across fleets. Ground handling services focus their investments on capacity management solutions that streamline apron operations, minimize turnaround times, and improve gate assignment procedures. Meanwhile, defense and military entities require secure, customizable systems capable of integrating with national command-and-control infrastructures.

The choice between capacity management, collaborative decision-making, demand forecasting, and performance monitoring reflects each stakeholder’s strategic objectives, whether enhancing throughput, driving cost efficiencies, or enforcing compliance. Similarly, deployment mode decisions hinge on operational priorities: cloud environments-both private and public-offer rapid scalability and lower upfront costs, while on-premise installations deliver direct control over mission-critical data and system uptime. Installation type further differentiates opportunities, with new implementations driven by airport expansion and greenfield projects, and upgrade scenarios encompassing hardware retrofits and software version migrations. Together, these segmentation layers provide a comprehensive lens through which vendors and buyers can tailor their approaches and align investments with organizational mandates.

This comprehensive research report categorizes the Air Traffic Flow Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution

- Deployment Mode

- Installation Type

- End User

Highlighting Regional Dynamics in the Americas Europe Middle East Africa and Asia Pacific That Drive Varied Adoption and Innovation Trajectories in Air Traffic Flow Management

Regional dynamics exert a profound influence on the deployment and evolution of air traffic flow management software across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, initiatives led by federal aviation administrations and major carriers have accelerated the rollout of NextGen technologies, emphasizing trajectory-based operations and integrated data services. Private cloud adoption is particularly high as organizations seek to leverage advanced analytics without sacrificing control over sensitive flight information. Concurrently, partnerships between airports and technology providers are fostering proof-of-concept projects that demonstrate performance gains in traffic sequencing and arrival management.

In Europe, the SESAR framework continues to guide harmonization efforts among member states, driving interoperable systems and standardized communication protocols. Public cloud platforms have gained traction, underpinned by strong regional data-protection regulations that encourage local cloud sovereignty solutions. Africa and the Middle East exhibit growing interest in performance monitoring to manage congested airspaces, with several national carriers investing in real-time runway throughput tools. Meanwhile, Asia Pacific’s booming passenger traffic and rapid infrastructure expansion are fueling demand for modular, scalable systems that can address the challenges of urban air mobility, remote aerodrome operations, and multi-stakeholder coordination across vast geographic spans.

This comprehensive research report examines key regions that drive the evolution of the Air Traffic Flow Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Positioning and Innovation Focus of Leading Vendors That Are Shaping the Competitive Landscape in Air Traffic Flow Management Software

The competitive landscape for air traffic flow management software is characterized by a blend of established integrators and agile newcomers pursuing differentiation through advanced analytics, service models, and strategic alliances. Major global entities have pursued acquisitions of specialized analytics firms, strengthened partnerships with leading cloud providers, and introduced AI-driven modules that enhance predictive scheduling and anomaly detection. These players emphasize end-to-end solutions that span surveillance, communications, navigation, and air traffic management, positioning themselves as one-stop partners capable of delivering large-scale, mission-critical deployments.

Amid this consolidation, smaller and mid-market vendors are carving out niches by offering modular platforms with open APIs, rapid implementation cycles, and subscription-based pricing. Their focus on user-centric design and managed-service frameworks appeals to organizations seeking flexibility and lower total cost of ownership. Additionally, a wave of startups is entering the fray with cloud-native orchestration layers and microservices architectures tailored to emerging use cases such as unmanned aerial systems integration and citywide drone corridors. As competition intensifies, success will hinge on the ability to balance heavy-duty performance with seamless interoperability, robust cybersecurity, and ongoing customer support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Traffic Flow Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adacel Technologies Limited

- ADB SAFEGATE AB

- Aireon LLC

- BAE Systems plc

- Boeing Company

- CAS

- Collins Aerospace

- COMSOFT Solutions GmbH

- DFS Deutsche Flugsicherung GmbH

- ENAV S.p.A.

- Esterline Technologies Corporation

- Honeywell International Inc.

- Jeppesen

- Leidos Holdings, Inc.

- Lockheed Martin Corporation

- Metron Aviation, Inc.

- NATS Holdings Limited

- NAVBLUE SAS

- Northrop Grumman Corporation

- SITA ONAIR

- Unisys Corporation

Proposing Strategic Actionable Recommendations for Industry Leaders to Enhance Resilience Drive Innovation and Maintain Competitive Advantage in the Evolving Air Traffic Flow Management Sector

Industry leaders must take deliberate steps to navigate the evolving air traffic flow management landscape and secure long-term value. First, investing in cloud-native platforms with containerization and microservices capabilities will foster modular upgrades, minimize downtime, and support rapid deployment of new features. Coupling these platforms with AI-driven demand forecasting engines can optimize resource allocation under varying traffic conditions, enhancing both throughput and passenger experience. Additionally, establishing robust collaborative decision-making ecosystems that integrate airlines, airports, and air navigation service providers will reduce silos and enable proactive conflict resolution across the network.

Equally important is the adoption of flexible procurement and licensing models to mitigate the impact of tariff volatility. Diversifying hardware supply chains, pursuing strategic partnerships with domestic manufacturers, and exploring open-source alternatives can dampen cost volatility and reinforce resilience. Leaders should also prioritize workforce development-providing training programs on new software tools, data analytics, and cybersecurity best practices-to ensure that teams can fully exploit technological advancements. Finally, engaging in multi-stakeholder R&D consortia will accelerate the entry of next-generation solutions, facilitate regulatory alignment, and drive industry-wide progress toward more connected, sustainable air traffic operations.

Detailing a Robust Research Methodology Combining Primary Expert Engagement Secondary Data Analysis and Rigorous Validation Protocols to Ensure Comprehensive Market Intelligence

The research presented in this report is founded upon a rigorous methodology combining primary qualitative engagement with secondary quantitative analysis. Primary research encompassed structured interviews and workshops with air navigation service providers, commercial airline operators, ground handling organizations, and defense agencies across key geographies. These interactions explored operational pain points, future requirements, procurement preferences, and technology adoption roadmaps. Quantitative data was gathered via targeted surveys and data-sharing agreements, capturing metrics on deployment timelines, technology performance benchmarks, and cost structures.

Secondary research involved a comprehensive review of regulatory frameworks, including NextGen and SESAR program documentation, environmental compliance guidelines, and tariff schedules. Vendor whitepapers, technical standards, and academic studies informed comparative assessments of solution architectures and deployment models. Data triangulation and cross-validation techniques ensured consistency across disparate sources, while thematic coding provided structured insights into segmentation categories-end user, solution type, deployment mode, and installation pathway. This multi-layered approach guarantees that findings are robust, reproducible, and reflective of real-world dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Traffic Flow Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Traffic Flow Management Software Market, by Solution

- Air Traffic Flow Management Software Market, by Deployment Mode

- Air Traffic Flow Management Software Market, by Installation Type

- Air Traffic Flow Management Software Market, by End User

- Air Traffic Flow Management Software Market, by Region

- Air Traffic Flow Management Software Market, by Group

- Air Traffic Flow Management Software Market, by Country

- United States Air Traffic Flow Management Software Market

- China Air Traffic Flow Management Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Reflections on the Imperative for Agile Adaptation and Collaborative Innovation to Navigate Future Challenges in Air Traffic Flow Management Software

In conclusion, the air traffic flow management sector stands at a pivotal juncture, driven by accelerating traffic volumes, heightened environmental mandates, and ongoing digital transformation initiatives. Organizations that embrace modular, cloud-native platforms augmented by AI and collaborative decision-making frameworks will be best positioned to handle unpredictable traffic patterns and regulatory shifts. At the same time, stakeholders must remain vigilant of external pressures such as tariff changes, supply chain constraints, and the integration demands of unmanned aerial systems.

As the industry navigates this complex landscape, success will depend on proactive adaptation, strategic investment in interoperability, and sustained collaboration among airlines, airports, air navigation service providers, and technology partners. The insights contained within this Executive Summary offer a roadmap for stakeholders seeking to enhance operational resilience, drive innovation, and forge a more efficient, secure, and sustainable aviation future.

Engaging Industry Stakeholders to Connect with Ketan Rohom Associate Director Sales and Marketing to Secure In-Depth Insights and Access the Comprehensive Air Traffic Flow Management Market Report

The complexity and critical nature of air traffic flow management demand a tailored approach to market intelligence that aligns with your organization’s strategic objectives. By securing direct access to the comprehensive report, you will gain an in-depth understanding of evolving trends, regulatory shifts, and advanced technology roadmaps that are defining the future of the industry.

To explore how these insights can inform your operational planning, investment decisions, and partnership strategies, connect with Ketan Rohom, Associate Director, Sales and Marketing. Engage in a detailed conversation to uncover bespoke recommendations, clarify data-driven findings, and negotiate enterprise-level access. Take the next step in transforming your air traffic flow management strategy by reaching out today to unlock premium research and position your organization at the forefront of aviation innovation

- How big is the Air Traffic Flow Management Software Market?

- What is the Air Traffic Flow Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?