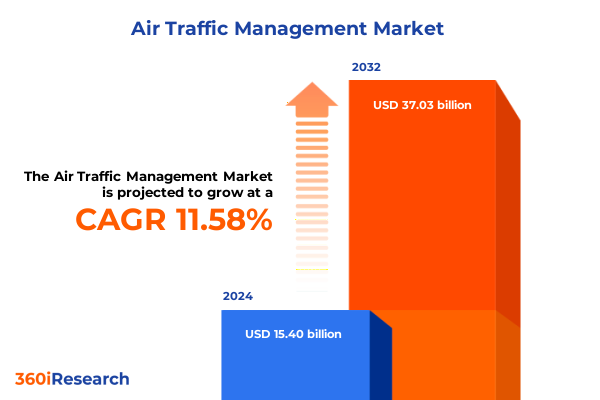

The Air Traffic Management Market size was estimated at USD 17.09 billion in 2025 and expected to reach USD 19.00 billion in 2026, at a CAGR of 11.68% to reach USD 37.03 billion by 2032.

Setting the Stage for Modern Air Traffic Management with Comprehensive Context on Global Challenges, Technological Innovations, and Strategic Imperatives

In today’s rapidly evolving aviation landscape, air traffic management stands at the crossroads of technological innovation, regulatory pressure, and operational complexity. Stakeholders across the ecosystem-ranging from air navigation service providers and airports to airlines and equipment manufacturers-face mounting expectations for safety, efficiency, and sustainability. Emerging challenges such as growing passenger volumes, the integration of unmanned aerial systems, and the imperative to reduce environmental impact have intensified the need for robust, adaptable management frameworks.

Against this backdrop, air traffic management must pivot toward holistic, data-driven solutions that can scale with global demand. Decision-makers require clarity on how advanced communications, navigation, surveillance, and automation tools intersect with market forces, tariff regimes, and regional priorities. This introductory section frames the core themes of the report by underscoring the strategic importance of modernizing legacy infrastructures, harmonizing standards, and fostering innovation partnerships. It sets the stage for a comprehensive exploration of transformative shifts, tariff impacts, segmentation insights, and actionable recommendations that will guide industry leaders through an era defined by both unprecedented challenges and remarkable opportunities.

Exploring Transformative Shifts Redefining Air Traffic Management through Technological Advances, Regulatory Evolution, and Operational Paradigm Changes

Air traffic management is undergoing a profound transformation driven by rapid technological advances, evolving regulatory frameworks, and shifting operational paradigms. Digitization initiatives are unlocking predictive analytics for traffic flow optimization, while cloud-native platforms and artificial intelligence are redefining how trajectory planning and conflict detection occur in real time. These innovations promise to enhance safety margins and throughput, yet they also demand careful integration with legacy systems and a coordinated approach to cybersecurity resilience.

Meanwhile, regulatory bodies around the world are introducing performance-based navigation mandates and data-sharing protocols to harmonize operations across national boundaries. Such shifts necessitate collaborative governance models and new certification pathways for emerging technologies. At the operational level, the proliferation of remotely piloted aircraft systems and urban air mobility concepts compels air navigation service providers to develop flexible corridor management and dynamic airspace allocation strategies. Collectively, these trends signal that the future of air traffic management hinges on interoperable solutions, agile regulatory responses, and a steadfast commitment to operational excellence.

Assessing the Cumulative Impact of United States Air Traffic Management Tariffs in 2025 on Supply Chains, Technology Adoption, and Service Economics

In 2025, adjustments to United States tariffs have rippled across global supply chains for air traffic management equipment and services, influencing the cost structures of communications, navigation, and surveillance technologies. Import duties on avionics modules and radar systems have led manufacturers to reevaluate their sourcing strategies, with several firms shifting component production closer to end markets to mitigate tariff exposure. This realignment has, in turn, affected lead times and inventory management practices among maintenance and support service providers.

Moreover, the imposition of additional levies on software licensing and cloud-based applications has prompted industry stakeholders to negotiate new contract terms that share cost burdens between suppliers and clients. Airlines and airports are increasingly exploring hybrid sourcing models-combining on-premises installations with select cloud offerings-to balance compliance requirements with budgetary constraints. Ultimately, the cumulative impact of these tariff measures has accelerated the adoption of flexible supply chain configurations, incentivized local assembly partnerships, and heightened the importance of proactive trade compliance functions for sustaining operational continuity.

Uncovering Comprehensive Insights Across Critical Component Types, System Categories, Diverse End User Profiles, and Application Domains to Illuminate Market Dynamics

A nuanced understanding of market segmentation reveals the multifaceted nature of air traffic management solutions. Component type analysis highlights that hardware encompasses communications equipment, navigation equipment, and radar equipment, while services span consulting, maintenance & support, and system integration. Software solutions further differentiate the market by delivery mode, with on premises platforms coexisting alongside rapidly expanding cloud-based offerings that facilitate real-time data analytics and remote accessibility.

System-level segmentation underscores the diversity of automation, communication, navigation, and surveillance technologies. Automation systems rely on advanced flight data processing and flow management tools to optimize trajectories and sector capacities. Communication infrastructures integrate digital data links with legacy VHF radios to ensure uninterrupted voice and data exchange. Navigation services leverage GNSS and ILS capabilities to maintain precision approaches and enroute guidance, and surveillance frameworks harness ADS-B alongside primary and secondary radar modalities to deliver layered situational awareness.

End users range from air navigation service providers overseeing airspace management to airlines seeking streamlined operations and airports focused on passenger flow and ground movement efficiency. Application categories, including data communication, surveillance monitoring, traffic flow management, voice communication, and weather monitoring, further demarcate specialized use cases. Together, these segmentation dimensions illuminate a landscape where solution providers must tailor offerings to distinct user requirements and operational contexts.

This comprehensive research report categorizes the Air Traffic Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Deployment Model

- System

- Application

- End User

Revealing Distinct Regional Dynamics in Americas, Europe Middle East Africa, and Asia Pacific Air Traffic Management Ecosystems with Tailored Strategic Perspectives

Regional dynamics in air traffic management reflect varying levels of infrastructure maturity, regulatory sophistication, and investment capacity. In the Americas, a combination of established airspace modernization programs and private sector-led digital transformation initiatives has driven early adoption of ADS-B networks and collaborative decision-making frameworks. Meanwhile, performance-based navigation routes have proliferated across major corridors, shortening flight paths and reducing fuel consumption in North and South American markets.

Europe, the Middle East, and Africa exhibit a mosaic of approaches shaped by differing regulatory bodies and economic priorities. European Union mandates on Single European Sky have catalyzed cross-border harmonization, yet national sovereignty concerns continue to influence the pace of implementation. In the Middle East, rapid airport expansions and ambitions for smart air travel hubs have accelerated investments in integrated command centers. Conversely, parts of Africa are prioritizing partnerships with international organizations to strengthen basic surveillance and communication infrastructures.

Asia-Pacific stands out for its scale-driven challenges and solutions. High-density airspaces over Southeast Asia necessitate advanced flow management systems, while significant growth forecasts have spurred investments in remote tower services and augmented reality-assisted operations. Government-led digital aviation roadmaps across China, Japan, and Australia are guiding the rollout of interconnected network infrastructures and predictive analytics platforms to support one of the world’s busiest air traffic domains.

This comprehensive research report examines key regions that drive the evolution of the Air Traffic Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Positioning, Strategic Initiatives, and Innovation Trends Among Leading Air Traffic Management Companies Driving Industry Transformation

Key players in the air traffic management market are distinguishing themselves through strategic partnerships, portfolio diversification, and technology-driven service offerings. Established avionics manufacturers are expanding into software-as-a-service models, integrating cloud-native analytics with traditional navigation and surveillance product lines to deliver end-to-end solutions. Meanwhile, specialized system integrators are deepening their consulting and maintenance capabilities, leveraging cross-industry best practices to streamline deployment cycles and enhance operational reliability.

A subset of agile technology firms is carving out niches in digital data link infrastructures and artificial intelligence–based flow management tools. These innovators focus on modular architectures that facilitate incremental upgrades and simplify certification processes. Concurrently, global service conglomerates are forming alliances with regional integrators to tap into localized market nuances, ensuring compliance with diverse regulatory frameworks and supporting customized training programs for air traffic controllers and technical personnel.

Collectively, these competitive dynamics underscore an industry in flux, where incumbents and new entrants alike are racing to secure leadership in high-growth segments. Success hinges on the ability to deliver interoperable, scalable solutions that address the complex requirements of modernization programs, system refurbishments, and cross-border harmonization efforts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Traffic Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adacel Technologies Limited

- Aeronav Inc.

- ALTYS Technologies Inc

- Avinor AS

- BAE Systems PLC

- DFS Deutsche Flugsicherung GmbH

- Frequentis AG

- Honeywell International Inc.

- HUBER+SUHNER AG

- Indra Sistemas S.A.

- Intelcan Technosystems Inc.

- L&T Technology Services

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Midwest ATC Service, Inc.

- NATS Limited

- Nav Canada

- Northrop Grumman Corporation

- RTX Corporation

- Saab AB

- Saipher ATC

- SITA

- SkySoft-ATM

- Thales Group

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Technological Shifts, Regulatory Changes, and Competitive Pressures in Air Traffic Management

Industry leaders aiming to capitalize on evolving air traffic management trends should prioritize strategic investments in interoperable technology platforms. By adopting modular architectures and open data standards, organizations can facilitate seamless upgrades, streamline certification pathways, and foster collaboration across ecosystem partners. This approach reduces vendor lock-in and supports the incremental integration of emerging capabilities such as predictive analytics and machine learning–driven decision support.

Moreover, executives must cultivate cross-functional teams with expertise in trade compliance, cybersecurity, and operational performance management. This multidisciplinary focus ensures that hardware and software deployments align with tariff requirements, adhere to stringent safety protocols, and optimize resource utilization. Investments in continuous training and digital skill development for air traffic controllers, engineers, and systems integrators will reinforce organizational resilience and adaptability.

Finally, forging public–private partnerships and participating in multilateral standardization bodies will enable companies to shape regulatory frameworks and influence global interoperability norms. Such collaborative initiatives can accelerate the deployment of performance-based navigation routes, unified surveillance networks, and collaborative decision-making platforms that ultimately enhance safety, capacity, and environmental sustainability.

Outlining Rigorous Research Methodology Combining Secondary Data Analysis, Expert Interviews, and Validation Protocols to Ensure Robust Air Traffic Management Insights

This research leverages a rigorous, multi-stage methodology to ensure the robustness and credibility of insights. Secondary research sources include white papers from aviation authorities, published technical specifications, and academic journals focusing on air traffic management innovations. These materials provide foundational context on system architectures, regulatory proceedings, and technology roadmaps.

Primary research was conducted through structured interviews with senior executives at air navigation service providers, airlines, and major equipment vendors, complemented by in-depth discussions with regulatory officials. These interviews yielded firsthand perspectives on implementation challenges, procurement strategies, and performance measurement frameworks. In addition, a validation protocol was implemented whereby key findings were cross-checked against publicly available performance reports and industry benchmarking studies.

Quantitative data analysis techniques were applied to historical flight movement records, tariff schedules, and technology adoption metrics to identify trends and inflection points. Triangulation of qualitative and quantitative inputs ensured that conclusions reflect a balanced view of market drivers, regional disparities, and competitive dynamics. This methodological rigor supports the actionable nature of the report’s strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Traffic Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Traffic Management Market, by Component Type

- Air Traffic Management Market, by Deployment Model

- Air Traffic Management Market, by System

- Air Traffic Management Market, by Application

- Air Traffic Management Market, by End User

- Air Traffic Management Market, by Region

- Air Traffic Management Market, by Group

- Air Traffic Management Market, by Country

- United States Air Traffic Management Market

- China Air Traffic Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Critical Findings to Frame the Future Trajectory of Air Traffic Management in Light of Technological, Regulatory, and Market Forces Shaping the Aviation Sector

The convergence of technological innovation, shifting regulatory landscapes, and complex tariff environments has set the stage for a pivotal period in air traffic management evolution. By synthesizing the key findings, it becomes clear that coordination across public and private stakeholders is essential to harness the full potential of automation, surveillance, communication, and navigation enhancements. Success will depend on the implementation of interoperable systems, the streamlining of certification processes, and the cultivation of collaborative governance models.

Regional variations underscore the necessity of tailored strategies: what succeeds in the Americas may require adaptation for Europe, the Middle East, Africa, or the Asia-Pacific context. Meanwhile, market segmentation insights reveal opportunities for solution providers to align their offerings with specific end user needs and application demands. As tariff regimes continue to influence supply chain decisions, companies that proactively manage trade compliance and local partnership networks will gain a competitive edge.

In conclusion, the future trajectory of air traffic management will be shaped by those organizations that can seamlessly integrate advanced technologies, navigate complex policy frameworks, and foster cross-industry collaboration. The strategic roadmap outlined herein provides a foundation for decision-makers seeking to lead their operations into this new era of aviation excellence.

Engage with Ketan Rohom for Exclusive Access to In-Depth Air Traffic Management Insights and Accelerate Your Strategic Decision Making Today

Take the next step toward mastering air traffic management today by connecting directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise in market dynamics and strategic sales insights ensures that you receive personalized guidance tailored to your organization’s most pressing operational challenges and growth objectives.

By engaging with Ketan, you will gain exclusive access to comprehensive analyses, cutting-edge trends, and actionable recommendations that will empower your team to make informed decisions. Secure your competitive advantage by leveraging his insights to optimize your procurement strategies, technology investments, and partnership opportunities. Reach out now to initiate a conversation and explore how this research can drive tangible value for your business.

- How big is the Air Traffic Management Market?

- What is the Air Traffic Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?