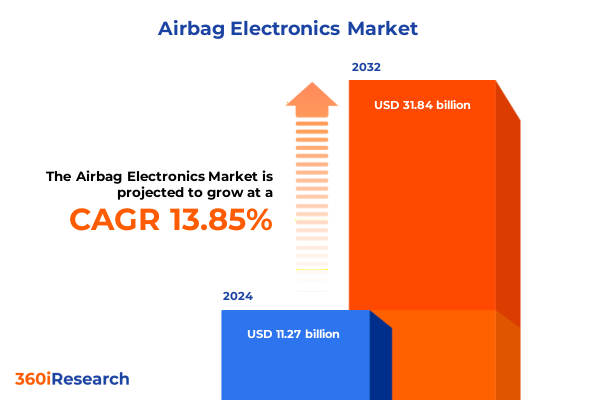

The Airbag Electronics Market size was estimated at USD 12.69 billion in 2025 and expected to reach USD 14.30 billion in 2026, at a CAGR of 14.03% to reach USD 31.84 billion by 2032.

Setting the Stage for Unprecedented Evolution in Airbag Electronics Technologies and Market Dynamics Across Global Automotive Safety Landscapes

In an era defined by rapid technological innovation and escalating safety standards, airbag electronics stand at the forefront of automotive occupant protection systems. Electronic control units, advanced sensors, and actuators have transcended their traditional roles, converging with sophisticated software and data analytics to deliver unprecedented levels of crash detection and passenger safety. As vehicles evolve toward greater autonomy and connectivity, the demands on airbag electronics architectures have intensified, compelling both established suppliers and emerging players to rethink design paradigms and integration strategies.

This executive summary sets the stage for an in-depth exploration of the airbag electronics domain. It distills critical shifts in regulatory mandates across major automotive markets, highlights the transformative innovations driving product differentiation, and examines the dynamic interplay of supply chain pressures. By framing the key drivers, challenges, and emerging growth avenues, this introduction provides stakeholders with a clear understanding of the forces shaping market trajectories. Moreover, it underscores the strategic imperatives that manufacturers and OEMs must address to sustain competitive advantage amid evolving safety requirements and technological complexities.

Identifying the Technological Breakthroughs and Regulatory Catalysts Driving a Paradigm Shift in Airbag Electronics Innovation

The airbag electronics sector is undergoing a fundamental transformation fueled by breakthroughs in sensor technology, miniaturized computing, and advanced materials. Recent advances in microelectromechanical systems have enabled impact sensors to detect collision severity with greater speed and precision, while pressure sensors integrated into occupant compartments provide real-time monitoring of passenger position and weight. These sensor enhancements, coupled with next-generation electronic control units featuring high-performance processors and artificial intelligence algorithms, are empowering adaptive deployment strategies that tailor inflation profiles to individual crash scenarios.

Simultaneously, regulatory catalysts-ranging from updated FMVSS requirements in the United States to the European New Car Assessment Programme’s stricter testing protocols-have accelerated development cycles. Manufacturers are now challenged to harmonize global compliance while shrinking time-to-market windows. In response, industry players are forging strategic partnerships with semiconductor companies, leveraging system-on-chip architectures and secure data connectivity to deliver holistic safety platforms. These collaborative ecosystems are not only driving cost efficiencies but are also laying the groundwork for the integration of airbag electronics into broader vehicle safety domains, such as autonomous emergency braking and adaptive cruise control.

Analyzing the Comprehensive Effects of Newly Implemented United States Tariffs on Airbag Electronics Supply Chains in 2025

The introduction of new tariffs by the United States in early 2025 has reverberated throughout the airbag electronics supply chain, impacting the cost structures of critical components. Semiconductors, specialized plastics, and high-strength steel-all subject to increased duty rates-have experienced price inflation that OEMs and Tier 1 suppliers must now absorb or pass on to aftermarket channels. In particular, gas generator modules and valve assemblies reliant on imported precision components have seen lead-time extensions as manufacturers recalibrate procurement strategies.

As a result, many suppliers have reevaluated their sourcing footprints, opting for near-shoring initiatives within North America to mitigate tariff exposure and strengthen supply resilience. These strategic shifts have not only reduced transit times but have also fostered closer collaboration with domestic raw material providers and sub-tier specialists. At the same time, several automakers have renegotiated long-term contracts to include tariff-adjustment clauses, thereby distributing financial risk across the value chain. Looking ahead, the cumulative impact of these measures will influence competitive positioning, drive innovation in local manufacturing capabilities, and reshape regional cost benchmarks.

Revealing Invaluable Segment-Level Dynamics in the Airbag Electronics Market Based on Type Vehicle Technology and Distribution Channels

Understanding the airbag electronics ecosystem requires a detailed segmentation framework that illuminates product types, vehicle applications, technological components, and distribution pathways. By type, the market is studied across curtain airbags-differentiated into head curtain and roof rail curtain modules-and frontal airbags, encompassing both driver and passenger frontal systems. Complementing these are knee airbags, which include driver knee and passenger knee configurations, as well as side airbags segmented into front side and rear side deployments. This granular categorization enables stakeholders to pinpoint design variations, material specifications, and deployment characteristics unique to each airbag variant.

Equally critical is the vehicle-type segmentation. The market spans heavy commercial vehicles-covering both buses and trucks-light commercial vehicles, including pickups and vans, and passenger cars, which are further classified into coupes, hatchbacks, sedans, and SUVs. These vehicle categories exhibit distinct safety requirements and electronic integration standards, influencing the design complexity and cost structures of onboard airbag control systems. In parallel, technological segmentation distinguishes between actuators-comprising gas generators and valves-electronic control units segmented into standard and advanced variants, and sensors, which are divided between impact sensors and pressure sensors. Finally, the distribution channel perspective divides the landscape into original equipment manufacturer channels and aftermarket routes, the latter encompassing e-commerce platforms, independent workshops, and specialized retailers. Together, these segmentation dimensions provide a comprehensive lens through which to assess product evolution and market opportunities.

This comprehensive research report categorizes the Airbag Electronics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Vehicle Type

- Technology

- Distribution Channel

Uncovering Distinct Regional Trends Shaping Airbag Electronics Demand Across Americas EMEA and AsiaPacific Regions

Regional dynamics in the airbag electronics landscape reveal stark contrasts in growth drivers, regulatory frameworks, and supply chain architectures. In the Americas, stringent safety standards-enforced through federal and state regulations-have catalyzed rapid adoption of advanced airbag systems. The North American market, in particular, benefits from a mature OEM ecosystem, robust aftermarket channels, and a growing emphasis on data-driven predictive maintenance solutions. Investments in manufacturing facilities across Mexico and the United States have further bolstered production capacity while enabling suppliers to navigate tariff landscapes more effectively.

Across Europe, the Middle East, and Africa, harmonized regulatory requirements under the European Union’s Unified Safety Protocol have streamlined product approvals and testing procedures. This regulatory coherence, combined with a high penetration of premium and luxury vehicles, has spurred demand for advanced electronic control units and sensor fusion technologies. Meanwhile, the Middle East and Africa regions present emerging opportunities, with government investments in public transit safety and infrastructure modernization driving incremental adoption of sophisticated airbag modules.

In Asia-Pacific, rapid motorization in markets such as China, India, and Southeast Asia is fueling volume demand for both standard and advanced airbag electronics. Local content regulations in key markets have prompted global suppliers to establish joint ventures and manufacturing hubs, thereby accelerating technology transfer and cost optimization. As urbanization intensifies, the emphasis on two-wheeler and three-wheeler occupant protection is also emerging as a niche focus area, presenting novel avenues for electronics adaptation and innovation.

This comprehensive research report examines key regions that drive the evolution of the Airbag Electronics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Strategic Movements and Competitive Positioning in the Airbag Electronics Domain

The competitive arena of airbag electronics is characterized by a diverse mix of legacy safety specialists and nimble technology innovators. Among the most prominent Tier 1 suppliers, certain global market leaders have leveraged decades of expertise to introduce modular airbag control units capable of seamless integration with advanced driver assistance systems. Their strategic investments in R&D centers across multiple continents have yielded proprietary sensor fusion algorithms that enhance deployment accuracy while minimizing false activations.

Contemporary challengers, including emerging semiconductor and electronics firms, have carved out niches by offering scalable actuator modules and customizable ECU firmware. These entrants often partner with established airbags manufacturers, accelerating time-to-market cycles and injecting fresh innovation into the ecosystem. Additionally, automotive OEMs have begun establishing in-house electronics divisions, seeking to internalize key safety functions and reduce dependence on external suppliers. This dynamic interplay has prompted a wave of consolidation, joint ventures, and co-development agreements designed to balance technological depth with global manufacturing reach.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airbag Electronics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Autoliv Inc.

- Continental AG

- Denso Corporation

- Hyundai Mobis Co., Ltd.

- Mitsubishi Electric Corp.

- Nihon Plast Co. Ltd.

- Ningbo Joyson Electronic Corp.

- NXP Semiconductors NV

- Robert Bosch GmbH

- Toyoda Gosei Co., Ltd.

- Veoneer, Inc.

- Visteon Corp.

- Volvo SA

- Xilinx Inc.

- ZF Friedrichshafen AG

Crafting Strategic Imperatives and Best Practices for Industry Leaders in Airbag Electronics to Secure Competitive Advantage

In light of the evolving safety landscape and supply chain complexities, industry leaders must adopt a multifaceted strategy to secure sustainable growth. First, prioritizing modular architectures will enable rapid customization and scalability across diverse vehicle platforms. By standardizing electronic control units and sensor interfaces, suppliers can streamline integration workflows and reduce inventory fragmentation. Concurrently, advancing sensor fusion capabilities through partnerships with AI-driven analytics firms will fortify system intelligence, enabling real-time adjustment of deployment parameters based on environmental and occupant data.

Second, enhancing supply chain resilience is imperative. Establishing dual-source strategies for critical semiconductors and raw materials will mitigate tariff exposure and geopolitical risks. Near-shoring assembly operations in strategic regions can further minimize logistics disruptions while reinforcing collaborative ties with local sub-tier specialists. Third, investing in predictive maintenance solutions-leveraging over-the-air diagnostics and remote monitoring-will create aftermarket revenue streams and strengthen customer engagement. By offering subscription-based analytics services, manufacturers can transform one-time sales into recurring relationships.

Finally, proactive engagement with regulators and industry consortia will ensure alignment with emerging safety mandates. Participating in standardization working groups and contributing to test protocol development allows companies to anticipate regulatory shifts and influence compliance requirements. Collectively, these strategic imperatives will empower stakeholders to navigate market uncertainties, capture new growth frontiers, and maintain technological leadership.

Outlining a Rigorous Multidimensional Research Methodology Guiding the Robust Analysis of Airbag Electronics Market Dynamics

The insights presented in this report are underpinned by a rigorous research methodology designed to ensure accuracy, relevance, and depth. Primary data collection was conducted through structured interviews with senior executives at leading OEMs, Tier 1 suppliers, and regulatory authorities, providing firsthand perspectives on technology roadmaps and policy developments. Complementing these qualitative interviews, a comprehensive review of technical papers, industry journals, and government filings yielded detailed information on component specifications, certification standards, and patent filings.

Secondary data analysis incorporated financial reports, company presentations, and trade association publications to map historical trends and benchmark competitive performance. Quantitative modeling techniques were then applied to triangulate findings, validate segment interrelationships, and identify causal drivers of market behavior. Statistical tools, including correlation analysis and scenario modeling, were deployed to test hypotheses and assess the sensitivity of key variables. Finally, all results underwent validation by an expert panel comprising safety engineers, semiconductor specialists, and strategic consultants, ensuring that conclusions reflect both technical feasibility and commercial viability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airbag Electronics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airbag Electronics Market, by Type

- Airbag Electronics Market, by Vehicle Type

- Airbag Electronics Market, by Technology

- Airbag Electronics Market, by Distribution Channel

- Airbag Electronics Market, by Region

- Airbag Electronics Market, by Group

- Airbag Electronics Market, by Country

- United States Airbag Electronics Market

- China Airbag Electronics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Critical Insights and Future Outlooks in Airbag Electronics to Empower Stakeholder Decision Making

The convergence of advanced sensor technologies, AI-enabled control units, and evolving regulatory frameworks has positioned airbag electronics at the nexus of automotive safety innovation. Through a detailed examination of segmentation, regional dynamics, tariff impacts, and competitive strategies, this executive summary has illuminated the critical factors shaping the market’s trajectory. Stakeholders that embrace modular design principles, reinforce supply chain resilience, and cultivate collaborative ecosystems will be best positioned to capitalize on emerging opportunities and navigate systemic challenges.

As the industry continues its digital transformation, the integration of airbag electronics into holistic vehicle safety platforms will drive the next wave of differentiation. Forward-thinking organizations must therefore adopt an agile posture, rapidly iterating product portfolios and aligning with global regulatory shifts. By internalizing the insights and recommendations outlined herein, decision-makers can chart a clear path toward sustained innovation, operational excellence, and market leadership in the dynamic world of airbag electronics.

Connect with Ketan Rohom to Secure the Definitive Airbag Electronics Market Research Report Customized to Your Strategic Goals

To unlock the comprehensive insights and strategic depth contained within the full Airbag Electronics market research report, we invite you to connect directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise in automotive safety technologies and market intelligence will ensure that you select the package best aligned with your organization’s specific needs. Reach out today to gain access to proprietary data, exclusive expert commentary, and actionable guidance that will empower your decision-makers to navigate the evolving airbag electronics landscape with confidence and precision

- How big is the Airbag Electronics Market?

- What is the Airbag Electronics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?