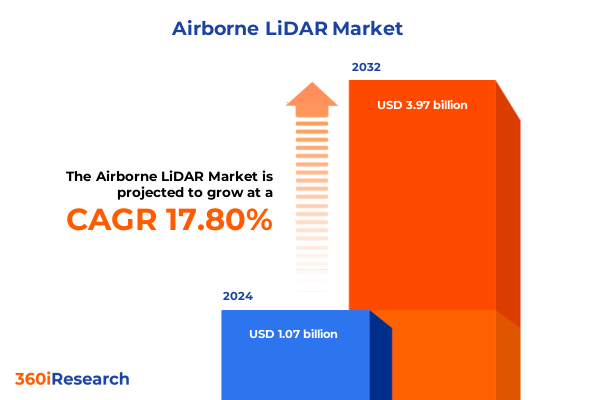

The Airborne LiDAR Market size was estimated at USD 1.25 billion in 2025 and expected to reach USD 1.46 billion in 2026, at a CAGR of 17.91% to reach USD 3.97 billion by 2032.

Innovative Airborne LiDAR Systems Reimagine Geospatial Surveying with Unprecedented Accuracy, Enabling Next-Generation Environmental, Infrastructure, and Safety Applications

Airborne LiDAR has rapidly evolved from a specialized niche solution into a foundational backbone for precision geospatial data acquisition. By emitting laser pulses from aerial platforms and measuring the reflected signals, these systems generate high-density three-dimensional point clouds that reveal topographic and structural details with sub-meter accuracy. This precision enables stakeholders across environmental management, civil infrastructure planning, and public safety to derive actionable intelligence from vast landscapes with unprecedented speed and reliability.

As sensor miniaturization and processing capabilities have advanced, airborne LiDAR deployments have diversified beyond traditional manned fixed-wing aircraft to include rotary-wing platforms and unmanned aerial vehicles. These versatile configurations cater to missions ranging from large-scale corridor mapping to targeted inspections of critical assets. Coupled with increasingly sophisticated software for point cloud classification, feature extraction, and integration with geographic information systems, airborne LiDAR is unlocking new frontiers in remote sensing and geospatial analytics.

How Technological Evolution and Data Integration Are Reshaping the Airborne LiDAR Ecosystem Toward Smarter, Faster, and More Accessible Solutions

Recent shifts in the airborne LiDAR landscape reflect a convergence of technological, regulatory, and market forces that collectively redefine industry possibilities. On the technological front, the introduction of full-waveform sampling has enhanced the ability to capture multiple returns per laser pulse, enriching vegetation and subsurface penetration data. At the same time, the fusion of LiDAR outputs with multispectral and hyperspectral imaging is fostering richer datasets that support advanced analytics in agriculture, forestry, and environmental monitoring.

Parallel to these hardware innovations, the rise of cloud-native processing architectures and machine learning–driven feature extraction software is dramatically reducing turnaround times from data collection to insight delivery. Remote sensing experts can now automate classification of terrain features, infrastructure elements, and vegetation types at scale. This shift is amplified by an expanding ecosystem of off-the-shelf solutions and open data initiatives, which lower barriers for new entrants and stimulate collaborative research. As a result, stakeholders are recalibrating their investment and operational strategies to leverage real-time analytics, dynamic modeling, and decision-support tools previously confined to laboratory environments.

Assessing the Ramifications of 2025 United States Tariff Policies on Airborne LiDAR Supply Chains, Cost Structures, and Competitive Positioning Across the Industry

In 2025, the implementation of revised United States tariff policies on imported sensors, optical components, and geospatial subsystems has introduced new complexities for airborne LiDAR supply chains. Manufacturers that previously relied on cost-competitive imports have faced increased component pricing, prompting a reevaluation of procurement strategies. As duties apply to key hardware elements such as laser scanners and inertial measurement units, domestic and allied-country production capabilities are receiving renewed investment to mitigate exposure to cross-border cost fluctuations.

The cascading effects of these tariffs extend to service providers and end users, who are balancing the immediate uptick in capital expenditures against long-term considerations of supply chain resilience. Some organizations are establishing inventory buffers and entering strategic partnerships with regional component producers, while others are exploring modular system architectures that facilitate component substitution without comprehensive equipment overhauls. Amid these adjustments, the competitive dynamic is shifting: vendors with diversified manufacturing footprints and integrated component design are positioned to capture market share from those constrained by single-source dependencies.

Deep Dive into Component, Type, Platform, Range, Application, and End-User Segmentation Revealing Key Drivers and Strategic Focus Areas in Airborne LiDAR

Analyzing component segmentation reveals a tripartite industry focus spanning hardware, services, and software. Within hardware, the critical elements extend from global positioning systems and inertial measurement units to laser scanners and supplementary sensors that ensure precise geolocation and motion compensation. Services complement these physical systems through data acquisition, processing, and maintenance offerings, while software solutions encompass 3D modeling applications, automated classification and feature extraction platforms, and specialized geospatial and remote sensing suites designed to handle vast point cloud volumes.

Type-based categorization delineates applications of bathymetric LiDAR in measuring waterbody depths, discrete-return systems optimized for clear terrain modeling, full-waveform solutions offering dense vertical profiling, and topographic scanners adept at capturing solid-surface features. Platform diversity ranges from long-endurance fixed-wing aircraft for continental-scale surveys to rotary-wing assets suited for targeted missions and unmanned aerial vehicles supporting nimble operations in constrained environments. Distance considerations further segment offerings into long-range systems capable of high-altitude acquisitions and short-range devices engineered for detailed inspections. Observing application-driven distinctions highlights uses across agriculture and forestry, archaeological site documentation, coastal monitoring, disaster response planning, environmental assessment, and high-fidelity mapping. Finally, the end-user landscape spans defense and aerospace initiatives, government and public sector mandates, infrastructure and mining projects, oil and gas exploration, and transportation and logistics optimization.

This comprehensive research report categorizes the Airborne LiDAR market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Platform

- Range

- Application

- End-User

Comparative Regional Examination Highlights Americas, EMEA, and Asia-Pacific Dynamics Influencing Airborne LiDAR Adoption, Investment, and Regulatory Frameworks

The Americas present a mature ecosystem propelled by robust investment in defense capabilities, critical infrastructure maintenance, and commercial mapping services. The presence of leading research institutions, coupled with supportive regulatory frameworks for unmanned aerial operations, has accelerated innovation cycles. North American vendors benefit from a large-scale customer base with sophisticated technical requirements, driving continuous advancements in system performance and data processing efficiency.

Meanwhile, Europe, the Middle East and Africa exhibit diverse adoption patterns shaped by regional regulatory standards and infrastructure priorities. European Union directives on environmental monitoring and smart cities have led to demand for standardized, interoperable LiDAR datasets, whereas Middle Eastern and African markets are exploring LiDAR applications for water resource management, urban planning, and renewable energy siting. These regions prioritize partnerships between local governments and global technology providers to bridge capability gaps and ensure scalable deployments.

In Asia-Pacific, rapid urbanization and large-scale infrastructure initiatives have spurred significant airborne LiDAR usage for corridor mapping, erosion assessment, and topographic modeling. Government-led surveys across Australia, Japan, China, and Southeast Asia leverage both manned and unmanned platforms, fostering a competitive environment where cost-effective UAV-based solutions coexist with high-end aerial systems. Additionally, regional manufacturing hubs are emerging to serve domestic demand and export opportunities, further broadening the market’s depth and resilience.

This comprehensive research report examines key regions that drive the evolution of the Airborne LiDAR market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Airborne LiDAR Innovators and Emerging Challenger Brands Shaping Market Directions through Technology Differentiation and Strategic Alliances

Leading technology providers are distinguishing themselves through targeted innovation, strategic alliances, and ecosystem development. One segment focuses on high-performance hardware, delivering laser scanners capable of capturing multi-return signals with enhanced range and angular resolution. Another front centers on software vendors that integrate machine learning algorithms to automate feature classification and deliver actionable terrain intelligence with minimal manual intervention.

In parallel, full-solution partners are bundling hardware, services, and software into turnkey offerings that streamline project workflows from mission planning to data delivery. These integrators often collaborate with platform manufacturers and navigation subsystem suppliers to optimize system interoperability and minimize calibration overhead. Emerging players are carving out niches by specializing in UAV-mounted LiDAR systems or tailoring bathymetric scanners for coastal management tasks, thereby capturing pockets of high-growth demand.

Across the competitive landscape, mergers and acquisitions continue to reshape the vendor ecosystem. Established companies are acquiring innovative startups to bolster their product portfolios, while smaller firms seek joint ventures and reseller agreements to expand geographic reach. This dynamic fosters a rich pipeline of joint technology roadmaps, pilot programs, and proof-of-concept deployments that collectively accelerate the pace of industry-wide innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airborne LiDAR market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AEVEX Aerospace, LLC.

- Barr GeoSpatial Solutions, LLC

- Beijing SureStar Technology Co., Ltd.

- Digital Aerial Solutions, LLC

- FARO Technologies, Inc. by AMETEK, Inc.

- Firmatek, LLC

- Fugro N.V.

- GreenValley International Inc.

- IGI mbH

- L3Harris Technologies, Inc.

- LeddarTech Holdings Inc.

- Leica Geosystems AG by Hexagon AB

- LiDAR Services International

- Lockheed Martin Corporation

- mdGroup Germany GmbH

- NV5 Global, Inc. by Acuren Corporation

- Ouster Inc.

- Oxford Technical Solutions Limited

- Phoenix LiDAR Systems

- Quanergy Systems, Inc.

- RIEGL Laser Measurement Systems GmbH

- Saab AB

- SICK AG

- Teledyne Technologies Incorporated

- Trimble Inc.

- Virtual Geomatics, Inc.

- YellowScan

Actionable Strategies for Industry Executives to Capitalize on Technological Convergence, Supply Chain Resilience, and Cross-Sector Partnerships in Airborne LiDAR

To navigate the evolving airborne LiDAR landscape, industry leaders should prioritize vertically integrated system architectures that allow for rapid component replacement and modular upgrades. Strengthening relationships with multiple sensor suppliers reduces exposure to single-source disruptions, while investing in in-house calibration and testing facilities ensures consistent data quality. Furthermore, expanding service offerings to include end-to-end analytics-spanning mission planning, data collection, processing, and visualization-differentiates providers in a competitive environment.

Collaborations with artificial intelligence and cloud-computing partners can accelerate the development of real-time classification engines and predictive modeling tools. At the same time, forging alliances with academic institutions and standards bodies facilitates the adoption of interoperable data formats and validation protocols. Given the implications of recent tariff policies, companies should also evaluate nearshoring and regional manufacturing strategies to maintain cost competitiveness and supply chain transparency. By proactively shaping ecosystem partnerships and technology roadmaps, organizational leaders can capitalize on emerging application niches and unlock new revenue streams.

Overview of Rigorous Academic and Industry-Centric Research Methodology Ensuring Data Integrity, Stakeholder Alignment, and Accurate Market Insights

The research methodology underpinning this report integrates both primary and secondary data sources to deliver a comprehensive, unbiased view of the airborne LiDAR sector. In the secondary phase, industry publications, regulatory filings, technical whitepapers, and patent databases were scrutinized to chart technology trajectories and competitive dynamics. Complementing this desk research, primary insights were gathered through in-depth interviews with senior executives from leading hardware manufacturers, software developers, service providers, and end-user organizations.

Additionally, a series of expert workshops and roundtables brought together thought leaders across defense, infrastructure, environmental science, and geospatial analytics to validate key findings and explore emerging application scenarios. Quantitative analyses of public procurement records and corporate announcements provided further granularity around strategic partnerships, product launches, and regional deployments. Rigorous cross-validation and triangulation techniques were applied at each stage to ensure data integrity, stakeholder alignment, and actionable insight delivery.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airborne LiDAR market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airborne LiDAR Market, by Component

- Airborne LiDAR Market, by Type

- Airborne LiDAR Market, by Platform

- Airborne LiDAR Market, by Range

- Airborne LiDAR Market, by Application

- Airborne LiDAR Market, by End-User

- Airborne LiDAR Market, by Region

- Airborne LiDAR Market, by Group

- Airborne LiDAR Market, by Country

- United States Airborne LiDAR Market

- China Airborne LiDAR Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Reinforcing Airborne LiDAR’s Strategic Role in Modern Geospatial Intelligence and Future-Proofing Infrastructure and Environmental Planning

This report has highlighted the transformative potential of airborne LiDAR in enabling high-fidelity geospatial intelligence for diverse sectors. Technological advances in sensor design, signal processing, and data analytics are converging to deliver solutions that are more accurate, faster to deploy, and adaptable to a wide range of mission profiles. At the same time, evolving tariff landscapes and supply chain considerations underscore the importance of strategic planning and regional diversification.

Segmentation analysis reveals that hardware innovation, software automation, platform versatility, and application-specific customization drive competitive differentiation. Regional insights demonstrate varying adoption patterns shaped by regulatory environments, infrastructure priorities, and public-private collaborations. Leading companies are forging ecosystem partnerships, pursuing targeted M&A activity, and investing in modular architectures to stay ahead of shifting market dynamics.

Collectively, these findings underscore the strategic imperative for organizations to integrate airborne LiDAR into their core operational and planning processes. By embracing a holistic approach to technology adoption-one that balances hardware excellence with software capabilities and service delivery-industry players can seize the opportunities presented by next-generation geospatial sensing and analytics.

Contact Ketan Rohom to Unlock Comprehensive Airborne LiDAR Insights and Empower Strategic Decisions with an Exclusive Market Research Report Purchase

Ready to delve deeper into how airborne LiDAR technologies can transform your organizational intelligence, efficiency, and competitive positioning, connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report. Ketan can provide you with tailored insights that align with your strategic goals, including detailed segmentation analysis, regional dynamics, and guidance on navigating emerging tariff environments. Engage now to receive exclusive excerpts, bespoke advisory sessions, and a demonstration of actionable data points that will empower you to make informed investment and operational decisions.

- How big is the Airborne LiDAR Market?

- What is the Airborne LiDAR Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?