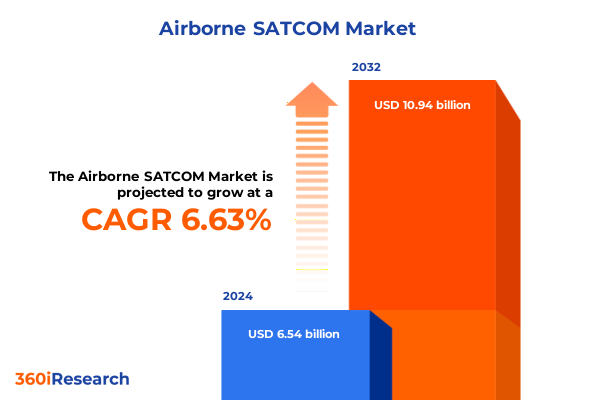

The Airborne SATCOM Market size was estimated at USD 6.93 billion in 2025 and expected to reach USD 7.35 billion in 2026, at a CAGR of 6.73% to reach USD 10.94 billion by 2032.

Unveiling the Critical Role of Airborne Satellite Communications in Modern Connectivity, Operational Efficiency and Mission Success Worldwide

The rapid convergence of aviation and satellite communications has reshaped how organizations maintain connectivity, manage missions, and deliver services from the skies. In an era defined by seamless data exchange and real-time decision making, airborne satellite communications have emerged as a critical enabler for business jets, commercial airliners, rotary- and fixed-wing unmanned aerial systems, and military platforms alike. This introduction lays the groundwork for understanding why airborne SATCOM solutions have transitioned from niche applications to indispensable assets across both civilian and defense sectors.

As airspace becomes an increasingly congested theater for information flow, operators and integrators are navigating complex considerations ranging from network architecture design to regulatory compliance. Against this backdrop, the following analysis illuminates the technological, economic, and policy-driven forces shaping current and near-term trajectories. By examining the core drivers and bottlenecks, we present a cohesive framework for appreciating the strategic significance of satellite-based connectivity in airborne operations.

Charting the Rapid Evolution of Airborne Satellite Communications Through Technological Innovations, Network Architectures, and Emerging Operational Use Cases

Airborne SATCOM is undergoing a profound metamorphosis propelled by advances in satellite payload design, ground segment virtualization, and aircraft-based hardware miniaturization. High-throughput satellites have shattered traditional capacity constraints, while low Earth orbit constellations are introducing lower-latency pathways that redefine expectations for in-flight broadband and real-time data links. Simultaneously, the rise of software-defined networks allows dynamic allocation of bandwidth and prioritization of mission-critical traffic, ensuring that vital command-and-control functions and live sensor feeds coexist seamlessly with passenger entertainment channels.

These architectural and service innovations are also unlocking new use cases. Commercial airlines are integrating onboard connectivity into ancillary revenue strategies and passenger experience roadmaps, whereas defense agencies are embedding resilient SATCOM links into multi-domain operations to support beyond-line-of-sight targeting and unmanned systems control. In parallel, helicopter operators are pushing for robust data links to enhance public safety and emergency response outcomes. The net effect is a landscape in which flexibility, interoperability, and service agility have become non-negotiable prerequisites for market participation.

Assessing How 2025 United States Tariffs Are Reshaping Supply Chains, Costs and Strategic Planning in Airborne SATCOM Deployments and Mitigation Strategies

In 2025, the United States implemented a series of tariffs targeting critical hardware imports used in satellite communications systems, significantly altering the cost structure for component sourcing. These measures have raised the entry threshold for new market entrants and prompted incumbent providers to reassess supply chain configurations. Faced with elevated duties on antenna assemblies, modems, and routing equipment, many stakeholders are exploring domestic manufacturing partnerships and strategically redesigning platforms to rely on alternative frequency bands less dependent on affected parts.

Beyond cost implications, the tariff landscape has accelerated a broader push toward supply chain resilience and diversification. Providers are forging alliances in friendly jurisdictions, investing in local assembly lines, and expanding aftermarket service offerings to offset increased upfront procurement expenses. As a result, risk management strategies now encompass both tariff mitigation and proactive engagement with regulatory authorities to anticipate future trade policy developments. The cumulative impact of these adjustments is a rebalanced ecosystem where agility in procurement and design translates directly into competitive differentiation.

Uncovering Critical Market Segmentation Insights Based on Platform, Service Type, Frequency Band, and Component Dynamics

A nuanced understanding of airborne SATCOM requires dissecting the market along several interrelated dimensions. From the perspective of platform diversity, business jets seek lightweight, high-data-rate terminals that complement premium service expectations, whereas commercial airlines prioritize scalable architectures that support hundreds of simultaneous users. Rotary and fixed-wing unmanned aerial vehicles demand ultra-compact modem and antenna combinations to meet stringent size, weight, and power parameters. Military aircraft integrate hardened hardware and encryption modules to satisfy rigorous security and performance criteria.

Service type segmentation reveals distinct value propositions tied to broadband connectivity, which drives passenger and mission efficiency, versus command-and-control data links essential for remote piloting and situational awareness. Telemetry systems, whether deployed for flight-test instrumentation or health monitoring, require reliable, low-latency channels to feed critical analytics engines. Frequency band selection further influences terminal form factors and service ranges; while C and Ku bands have been long-standing workhorses, Ka band’s capacity surge encourages new deployments, and L/S band solutions remain vital for legacy compatibility and backup resiliency.

Component-level insights underscore the balance between hardware investments-in the form of antennas, modems, and routers-and the growing role of services such as aftermarket support, connectivity management led by cloud-native platforms, and network management orchestrated via software-centric control layers. As providers bundle these offerings, end users benefit from streamlined deployments and lifecycle assurance, making component and service integration a key competitive battleground.

This comprehensive research report categorizes the Airborne SATCOM market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Service Type

- Frequency Band

- Component

- Application Area

Examining Regional Dynamics Driving Airborne SATCOM Adoption Across the Americas, Europe Middle East and Africa, and Asia-Pacific Hubs

Regional dynamics are instrumental in shaping airborne SATCOM adoption patterns and service innovation cycles. In the Americas, entrenched commercial airline networks and a robust business aviation segment drive continuous demand for advanced broadband connectivity upgrades. Meanwhile, defense modernization efforts within North American armed forces emphasize the integration of SATCOM-enabled platforms across multi-domain operations, stimulating partnerships between US-based integrators and satellite operators.

Within Europe, the Middle East, and Africa, regulatory alignment and infrastructure cooperation dictate the pace of technology rollouts. European aerospace primes focus on harmonizing transnational frequency regulations, while Gulf states invest heavily in next-generation satellite constellations to bolster domestic aerospace capabilities. African markets, characterized by vast remote territories, view satellite-enabled rotary platforms as vital tools for emergency medical services and resource exploration, creating unique demand vectors.

Asia-Pacific exhibits some of the most dynamic growth trajectories, driven by dense commercial aviation corridors and escalating defense budgets. Northeast Asian nations are at the forefront of adopting low Earth orbit-based SATCOM services, while Southeast Asian operators explore regional satellite partnerships to expand connectivity over archipelagic routes. Across these hubs, local ecosystem development, spectrum policy frameworks, and industrial partnerships are key levers influencing market maturation.

This comprehensive research report examines key regions that drive the evolution of the Airborne SATCOM market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves, Partnerships and Innovation Portfolios of Leading Airborne SATCOM Providers Driving Market Leadership and Technological Advancement

Leading airborne SATCOM providers are actively refining their portfolios through strategic alliances, targeted acquisitions, and continuous R&D investment. Industry stalwarts known for robust antenna manufacturing are entering joint ventures to accelerate the development of electronically steered arrays optimized for airborne platforms, while modem specialists are partnering with satellite operators to co-develop integrated terminal solutions that guarantee end-to-end performance.

At the same time, nimble disruptors are carving out niches by offering cloud-native connectivity management services and AI-driven network orchestration tools that empower real-time service optimization. These new entrants often collaborate with aftermarket services experts to deliver complete lifecycle support packages, from initial installation through to predictive maintenance. Tier-one aerospace and defense contractors are meanwhile embedding SATCOM capabilities into next-generation combat and transport helicopter programs, leveraging in-house integration expertise to secure long-term programmatic wins.

Collectively, these corporate maneuvers reflect a marketplace in which the interplay of legacy incumbents, innovative challengers, and satellite operators is driving a wave of consolidation and capability convergence. As boundaries between hardware, software, and service blur, collaborative ecosystems are shaping the competitive frontier for airborne SATCOM.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airborne SATCOM market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aselsan A.Ş.

- BAE Systems plc

- Cobham Limited

- General Dynamics Corporation

- Gilat Satellite Networks Ltd.

- Gogo LLC

- Honeywell International Inc.

- Hughes Network Systems, LLC

- Inmarsat Global Limited

- Intelsat S.A.

- Iridium Communications Inc.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Mitsubishi Electric Corporation

- Northrop Grumman Corporation

- Panasonic Avionics Corporation

- RTX Corporation

- SES S.A.

- Teledyne Technologies Incorporated

- Thales Group

- Viasat Inc.

Empowering Industry Leaders with Targeted Strategies to Navigate Technological, Regulatory and Competitive Challenges in Airborne SATCOM

To remain competitive in the evolving airborne SATCOM ecosystem, industry leaders should prioritize investments in hybrid network architectures that marry geostationary and low Earth orbit connectivity to optimize latency and throughput. By diversifying supplier portfolios across multiple jurisdictions, organizations can reduce exposure to trade policy shifts and avoid single-point failure in critical component sourcing.

Cross-industry partnerships warrant special attention: collaboration with satellite operators, ground segment integrators, and software platform developers accelerates time-to-market for next-generation terminals and service offerings. Executives should also champion workforce development initiatives focused on network engineering, cybersecurity, and data analytics, ensuring teams possess the requisite skills to deploy and manage complex SATCOM infrastructures.

Finally, proactive engagement with regulatory bodies and spectrum authorities will be indispensable for shaping favorable policy outcomes. Leaders are advised to participate in industry consortia and standards working groups to influence harmonized regulations that support innovation while maintaining interoperability and national security safeguards.

Detailing the Robust Research Methodology Underpinning Market Analysis, Data Collection and Validation Processes for Airborne SATCOM Insights

This analysis is founded on a rigorous research framework combining primary and secondary methodologies. Primary research involved in-depth interviews with aviation operators, satellite service providers, avionics integrators, and regulatory experts to validate market drivers and technical priorities. Survey instruments were deployed to capture quantitative insights into platform adoption cycles, service preferences, and procurement criteria.

Secondary research encompassed a comprehensive review of industry white papers, technical journals, regulatory filings, and patent databases to chart historical trends and emerging technology roadmaps. Company financial reports and public strategy disclosures were examined to identify thematic investment patterns. Data triangulation techniques were employed to cross-validate findings, ensuring consistency across disparate sources. An expert advisory panel provided continuous feedback and peer review throughout the study, reinforcing the credibility and actionable nature of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airborne SATCOM market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airborne SATCOM Market, by Platform

- Airborne SATCOM Market, by Service Type

- Airborne SATCOM Market, by Frequency Band

- Airborne SATCOM Market, by Component

- Airborne SATCOM Market, by Application Area

- Airborne SATCOM Market, by Region

- Airborne SATCOM Market, by Group

- Airborne SATCOM Market, by Country

- United States Airborne SATCOM Market

- China Airborne SATCOM Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing the Strategic Imperatives, Market Dynamics and Future Trajectories Shaping Airborne Satellite Communications Ecosystem

In conclusion, airborne satellite communications stand at the intersection of rapid technological innovation and evolving operational demands. The synthesis of high-throughput payloads, software-driven network management, and strategic supply chain realignment heralds a new era of connected aviation and mission-critical data services. Stakeholders equipped with a deep understanding of platform-specific requirements, regional regulatory landscapes, and the competitive environment will be best positioned to harness these transformative trends.

As the market continues to mature, the ability to integrate hardware and service offerings into cohesive, lifecycle-oriented solutions will differentiate success stories from laggards. Embracing collaborative ecosystems, investing in cutting-edge terminal technologies, and maintaining agility in procurement strategies are central to capturing value in this dynamic environment. With the right strategic focus, organizations can convert airborne SATCOM’s vast potential into sustainable competitive advantage.

Unlock Deep Insights and Drive Business Growth by Securing Your Comprehensive Airborne SATCOM Market Research Report Today

If you are poised to elevate your strategic outlook and capitalize on the transformative opportunities within the airborne satellite communications space, reach out to Ketan Rohom, our Associate Director of Sales & Marketing. He is ready to guide you through the customization options and provide the detailed insights that will inform your next move in a dynamic market environment.

By securing the full market research report today, you will gain instant access to in-depth analyses, proprietary data visualizations, and expert commentary tailored to your operational and investment needs. Take advantage of this opportunity to partner with an authoritative resource and ensure your organization remains at the forefront of innovation and competitive advantage in the airborne SATCOM domain. Contact Ketan Rohom now to initiate your report acquisition and begin driving impactful decisions.

- How big is the Airborne SATCOM Market?

- What is the Airborne SATCOM Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?