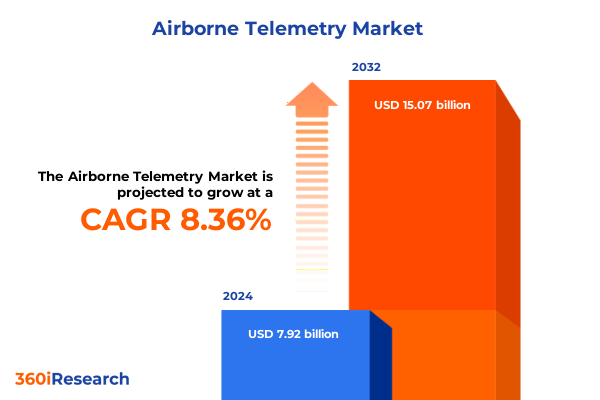

The Airborne Telemetry Market size was estimated at USD 8.49 billion in 2025 and expected to reach USD 9.09 billion in 2026, at a CAGR of 8.54% to reach USD 15.07 billion by 2032.

Exploring the Evolving Realm of Airborne Telemetry and Its Critical Role in Modern Aerospace and Defense Operations Worldwide, Highlighting Emerging Challenges

Airborne telemetry has emerged as a foundational pillar for modern aerospace missions and defense operations, seamlessly transmitting real-time performance and environmental data from airborne platforms to ground stations. Over recent years, advancements in sensor miniaturization, digital signal processing, and software-defined radio have converged to elevate the precision, reliability, and scope of telemetry applications. These cutting-edge capabilities enable engineers, researchers, and mission planners to execute increasingly complex flight tests, reconnaissance sorties, and environmental surveillance endeavors with confidence and agility.

Within this dynamic landscape, the interplay between mission-critical requirements-such as high data throughput, low-latency communication, and secure data links-and evolving regulatory frameworks has driven continuous innovation. As airworthiness authorities introduce new spectrum allocations and cybersecurity guidelines, telemetry system designers are challenged to strike a balance between stringent compliance and optimal performance. This introduction sets the stage for a comprehensive exploration of market drivers, technological inflection points, and strategic considerations that will define the next wave of airborne telemetry deployments globally.

Unveiling the Key Technological, Regulatory, and Market Transformations Reshaping Airborne Telemetry Capabilities and Strategic Applications Across Industries

The airborne telemetry landscape is undergoing a profound metamorphosis driven by emerging technologies and shifting market forces. Ultra-wideband digital architectures, artificial intelligence–powered signal analysis, and increasingly agile software-defined radios are converging to deliver unprecedented data fidelity and adaptive communication capabilities. As these innovations mature, telemetry systems are transitioning from single-function data pipes to integrated platforms that autonomously manage spectrum, optimize power consumption, and detect anomalies in real time.

Simultaneously, regulatory bodies worldwide are revisiting frequency allocations and emission standards to accommodate expanding satellite constellations and unmanned systems. This regulatory recalibration, coupled with rising defense budgets and heightened demand for commercial space missions, is catalyzing partnerships across industry verticals. Consequently, telemetry solution providers are forging alliances with satellite operators, avionics manufacturers, and cybersecurity firms, resulting in holistic ecosystem models that extend beyond legacy vendor-client dynamics.

In turn, these transformative shifts are redefining competitive boundaries. New entrants leveraging cloud-native telemetry analytics and open-architecture platforms are challenging established players to innovate or face obsolescence. The result is a landscape marked by accelerated product roadmaps, modular system offerings, and an unwavering focus on end-to-end service delivery that spans design, deployment, and lifecycle management.

Assessing the Aggregate Effects of 2025 United States Tariff Policies on Airborne Telemetry Supply Chains, Cost Structures, and International Collaboration

The 2025 United States tariffs introduced on critical avionics components and raw materials have exerted a cascading effect on global airborne telemetry supply chains. Key elements such as high-sensitivity receivers and precision transmitter modules have experienced cost pressures due to increased import duties, prompting design engineers to reevaluate sourcing strategies. This shift has accelerated regional sourcing initiatives, particularly in Asia-Pacific, where component manufacturers are scaling capacity to meet redirected demand that once flowed to US-based suppliers.

Beyond component cost concerns, the tariff environment has influenced cross-border research collaborations. International flight test programs, traditionally reliant on US-made data acquisition systems, have begun to diversify partner networks to mitigate financial risk and maintain project timelines. These adjustments have, in some cases, resulted in extended development cycles but have also fostered stronger partnerships in allied markets, reinforcing resilience against sudden policy changes.

Looking forward, industry stakeholders are recalibrating procurement frameworks to embed tariff risk assessments, renegotiating long-term supply contracts, and exploring tariff-avoiding configurations. While near-term budgets face incremental increases, this realignment has spurred innovation in modular telemetry architectures and alternative material research, setting the stage for more agile and cost-optimized telemetry ecosystems.

Deriving Strategic Insights from Multifaceted Application, Component, Frequency Band, and Platform Segmentation of the Airborne Telemetry Market

A nuanced understanding of market segmentation is pivotal for stakeholders aiming to tailor offerings and unlock niche opportunities. From an application perspective, this market encompasses aerospace flight testing, defense missions-spanning reconnaissance, surveillance, and training-remote sensing for environmental and resource monitoring, academic and industrial research projects, and weather monitoring platforms gathering atmospheric data. Each domain imposes unique performance and reliability requirements, influencing system architecture choices and vendor selection processes.

Examining component segmentation reveals a spectrum of hardware and software elements. Telemetry systems integrate advanced antenna assemblies, data acquisition subsystems, receivers available in high-sensitivity and standard variants, software analytics platforms that decode and visualize telemetry streams, and transmitter units ranging from high-power models for extended-range missions to low-power variants optimized for compact or endurance-focused platforms. This component-based perspective enables suppliers to align R&D investments with evolving customer demands and performance benchmarks.

Frequency band segmentation further refines market opportunities, with systems operating across C-Band, Ka-Band, Ku-Band, L-Band, and S-Band frequencies. Within S-Band, distinct downlink and uplink channels cater to bidirectional communication needs, offering trade-offs between data rate and atmospheric penetration. Platform segmentation completes the analytical matrix, covering manned aircraft-specifically fighter jets and transport aircraft-as well as unmanned aerial vehicles, including both fixed-wing and rotary-wing configurations. This holistic segmentation framework empowers decision-makers to craft targeted go-to-market strategies and product roadmaps that resonate with end-user requirements.

This comprehensive research report categorizes the Airborne Telemetry market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Frequency Band

- Platform

- Application

Interpreting Critical Regional Trends in the Americas, Europe, Middle East & Africa, and Asia-Pacific to Guide Strategic Investments in Airborne Telemetry

Regional dynamics play a defining role in shaping airborne telemetry demand and innovation trajectories. In the Americas, robust defense modernization initiatives and commercial space launch activities are fueling investments in high-throughput telemetry systems and next-generation software analytics. Domestic manufacturers are collaborating with academic research institutions to develop resilient data links for extreme-environment testing, reinforcing the region’s technological leadership.

Across Europe, Middle East & Africa, strategic partnerships between governments and private aerospace contractors are driving demand for telemetry platforms tailored to surveillance and civil aviation safety applications. Regulatory harmonization efforts within European Union member states facilitate cross-border testing programs, while emerging Gulf cooperation councils are launching indigenous initiatives to support unmanned systems, prompting suppliers to adapt solutions for diverse climatic and infrastructural conditions.

In Asia-Pacific, an upsurge in regional defense budgets and commercial drone deployments is accelerating adoption of scalable telemetry architectures. Local manufacturers are expanding production capacity to serve both domestic and export markets, and joint ventures between multinational corporations and regional technology firms are introducing hybrid telemetry solutions that blend cloud-based analytics with edge-processing capabilities. These varied regional landscapes underscore the importance of localized strategies for market entry and expansion.

This comprehensive research report examines key regions that drive the evolution of the Airborne Telemetry market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Leading Industry Players Driving Innovation, Partnerships, and Competitive Dynamics within the Global Airborne Telemetry Ecosystem

Several leading companies anchor the competitive environment, each distinguished by unique portfolios and strategic alliances. A cohort of established aerospace and defense contractors continues to drive system-level integration, leveraging decades of avionics expertise to deliver turnkey telemetry solutions. These players are expanding their footprints through acquisitions of niche software analytics firms and partnerships with satellite communications providers to offer seamless end-to-end services.

Concurrently, pure-play telemetry specialists are gaining traction by focusing on modular, software-defined platforms that facilitate rapid customization for mission-specific requirements. Their agility in adopting open standards and integrating commercial off-the-shelf components has accelerated innovation cycles and reduced total cost of ownership for customers.

New entrants, often spin-outs from research institutions or cloud analytics startups, are challenging legacy providers with AI-driven signal processing engines and secure, decentralized data networks. By forging strategic alliances with unmanned system integrators and ground segment operators, these disruptive players are carving out growth paths in both established defense markets and burgeoning commercial sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airborne Telemetry market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstroNova, Inc.

- BAE Systems plc

- Cobham Limited

- Curtiss-Wright Corporation

- General Dynamics Corporation

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Orbit Communications Systems Ltd.

- RTX Corporation

- Safran S.A.

- Teledyne Technologies Incorporated

- Thales Group

Crafting Pragmatic Strategies and Actionable Recommendations to Accelerate Adoption and Optimize Operations for Strengthened Positioning in Airborne Telemetry

To capitalize on emerging opportunities, industry leaders should prioritize investments in adaptive, software-driven telemetry architectures that can scale across diverse platforms and frequency spectrums. This approach reduces hardware dependencies, accelerates feature rollouts, and enables over-the-air updates to address evolving mission parameters. Concurrently, organizations should establish cross-functional teams to embed cybersecurity protocols early in the system development lifecycle, safeguarding critical data links against growing cyber threats.

Supply chain resilience must also be elevated to a strategic imperative. Diversifying component sourcing, qualifying secondary suppliers for high-power transmitter modules and high-sensitivity receiver chips, and negotiating tariff-risk clauses in vendor contracts will mitigate exposure to policy fluctuations. Additionally, forging partnerships with regional manufacturing hubs in Asia-Pacific and Middle East & Africa can secure access to localized production capabilities while reducing lead times.

Finally, forging collaborative R&D alliances with satellite operators, cloud analytics providers, and academic institutions will unlock next-generation capabilities. Joint ventures focused on AI-based signal processing, low-earth-orbit telemetry relays, and hybrid edge-cloud architectures will position organizations to deliver differentiated solutions and accelerate market entry across both defense and commercial segments.

Detailing Rigorous Research Methods, Data Collection Processes, and Analytical Frameworks Employed to Deliver Comprehensive Insights into Airborne Telemetry

This research leveraged a rigorous mixed-methodology approach to ensure comprehensive and unbiased insights. Primary data collection included structured interviews with avionics engineers, mission planners, and procurement executives across defense agencies and commercial aerospace firms. These firsthand perspectives elucidated emerging requirements, pain points, and procurement drivers shaped by regulatory and technological shifts.

Secondary research encompassed a thorough review of open-source technical papers, aerospace and defense regulatory filings, patent databases, and industry white papers. Market intelligence triangulation was achieved by cross-referencing supplier press releases with conference presentations and government procurement notices, validating trends across multiple data sources.

Analytical frameworks employed include segmentation matrices based on application, component, frequency band, and platform, as well as SWOT and PESTEL analyses to appraise macroenvironmental factors. Quantitative data modeling techniques projected cost impact scenarios under varying tariff regimes, while scenario planning workshops with domain experts refined forward-looking strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airborne Telemetry market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airborne Telemetry Market, by Component

- Airborne Telemetry Market, by Frequency Band

- Airborne Telemetry Market, by Platform

- Airborne Telemetry Market, by Application

- Airborne Telemetry Market, by Region

- Airborne Telemetry Market, by Group

- Airborne Telemetry Market, by Country

- United States Airborne Telemetry Market

- China Airborne Telemetry Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing the Critical Findings and Forward-Looking Perspectives that Will Shape Strategic Decisions and Drive Innovation in the Airborne Telemetry Sector

The executive summary encapsulates key insights on technological innovation, market segmentation, tariff implications, regional dynamics, and competitive landscapes that define today’s airborne telemetry sector. Advanced digital architectures and AI-enabled signal processing are driving next-generation capabilities, while new regulatory frameworks create both risks and opportunities for system developers and end users. Segmentation analysis reveals targeted growth areas across diverse applications and platforms, underscoring the necessity for tailored product portfolios.

Tariff-induced supply chain realignments have prompted a strategic pivot toward diversified sourcing and modular system design, reinforcing innovation in high-power transmitters, high-sensitivity receivers, and software analytics platforms. Regional trends indicate that the Americas lead in defense and space applications, Europe, Middle East & Africa emphasize surveillance and civil aviation safety, and Asia-Pacific is emerging as a high-growth market for unmanned telemetry deployments.

Leading companies are differentiated by their ability to integrate ecosystem partnerships, adopt open-architecture models, and deliver seamless end-to-end solutions. Actionable recommendations focus on adaptive architectures, supply chain resilience, and collaborative R&D to sustain competitive advantage. Stakeholders equipped with these insights are well positioned to navigate complexities and seize emerging opportunities across the global airborne telemetry landscape.

Connect with Ketan Rohom to Unlock the Full Airborne Telemetry Market Research Report and Empower Your Organization with Actionable Insights Today

To acquire the comprehensive market research report on airborne telemetry and tap into unparalleled industry insights, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Leveraging deep expertise in telemetry technologies and market dynamics, Ketan can guide you through tailored service options and ensure you receive the data-driven analysis needed to inform critical business decisions. Whether you require detailed segmentation intelligence, tariff impact assessments, or regional trend evaluations, his consultative approach will align the deliverables to your strategic objectives.

Engaging with Ketan unlocks exclusive access to in-depth commentary on technological innovations, competitive benchmarking, and forward-looking market scenarios. By partnering with him, organizations can expedite their research timelines and gain clarity on emerging opportunities in aerospace, defense, remote sensing, and weather monitoring applications. His proven track record in facilitating high-value research engagements guarantees a seamless process from initial briefing to final report delivery.

Reach out today to request a personalized briefing or to learn more about custom research services. Empower your teams with actionable intelligence and take the next step toward strengthening your competitive edge in the evolving airborne telemetry landscape. Your strategic roadmap to enhanced operational efficiency and market leadership begins with this single action-partner with Ketan Rohom now.

- How big is the Airborne Telemetry Market?

- What is the Airborne Telemetry Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?