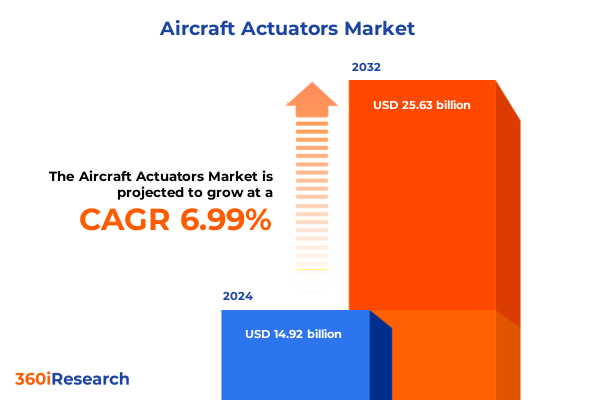

The Aircraft Actuators Market size was estimated at USD 15.90 billion in 2025 and expected to reach USD 16.98 billion in 2026, at a CAGR of 7.05% to reach USD 25.63 billion by 2032.

Unlocking the Critical Role of Aircraft Actuators in Advancing Flight Control Precision, Reliability, and Operational Efficiency Across Aerospace

The realm of aerospace innovation hinges on precision, performance, and the seamless integration of complex systems. At the heart of flight control and actuation lie mechanical, hydraulic, pneumatic, and increasingly, electrical actuators that translate pilot inputs and automated commands into reliable motion. These components serve as critical enablers for everything from rudder deflection during turbulence to thrust vector adjustments on advanced fighter jets. As modern airframes push the boundaries of efficiency, safety, and environmental responsibility, actuators have evolved beyond simple mechanical linkages to incorporate intelligent feedback loops, lightweight materials, and redundant architectures. Consequently, understanding the multifaceted role of aircraft actuators is essential for engineers, OEMs, and decision-makers seeking to navigate today’s competitive aerospace landscape.

In light of rapid technological progress and shifting regulatory frameworks, this executive summary provides a concise yet comprehensive exploration of key market drivers and emerging trends. We begin by examining how digitalization and sustainability imperatives are reshaping actuator design, then assess the implications of new United States tariffs introduced in 2025. Subsequent sections offer nuanced segmentation insights, regional dynamics, and profiles of leading industry participants. Finally, we present actionable recommendations and detail the rigorous research methodology underpinning our analysis. Together, these insights support strategic planning, product innovation, and supply chain optimization for stakeholders committed to enhancing the reliability, efficiency, and performance of the next generation of aircraft actuators.

Exploring Paradigm Shifts Reshaping Aircraft Actuator Technologies from Digital Integration to Sustainable Electrification Transforming Industry Dynamics

The aerospace actuator landscape is undergoing a paradigm shift driven by digital integration, material innovation, and sustainability. Electrification stands out as a transformative force, with brushless and DC actuators gradually replacing traditional hydraulic systems to reduce weight and enhance energy efficiency. Meanwhile, the integration of adaptive closed-loop control architectures is enabling real-time monitoring and predictive diagnostics, reducing unplanned maintenance and optimizing in-service performance. As additive manufacturing techniques mature, lightweight composite materials and bespoke geometries are now feasible, offering novel design freedoms that further enhance actuator responsiveness and durability.

In addition, the convergence of avionics and actuation systems is fostering more intelligent architectures. Flight control actuators are now embedded with sensors and microprocessors that enable continuous health monitoring, while thrust vectoring mechanisms benefit from fine-tuned torque control and rapid response times. Environmental imperatives have also spurred research into pneumatic diaphragms employing advanced seals and materials to minimize leakage and reduce life-cycle impact. Consequently, the industry is witnessing a shift from reactive maintenance paradigms toward predictive models that leverage machine learning algorithms trained on in-service actuator performance data. These collective shifts underscore a broader movement toward digital twins, model-based systems engineering, and closed-loop autonomy in aerospace actuation.

Evaluating How New United States Tariffs on Aircraft Actuators Announced in 2025 Are Influencing Global Supply Chains, Procurement Strategies, and Cost Structures

The introduction of new United States tariffs on imported aircraft actuator components in early 2025 has prompted a series of strategic realignments across the aerospace supply chain. Initially aimed at bolstering domestic manufacturing and reducing dependency on foreign suppliers, the tariffs have increased landed costs for key actuator subassemblies sourced from major export markets. Original equipment manufacturers and tier-one systems integrators have responded by accelerating localization efforts, forging joint ventures with domestic firms, and exploring nearshoring opportunities in North America. These moves aim to mitigate cost pressures while complying with evolving trade regulations.

Furthermore, procurement teams have reassessed their vendor qualification criteria to prioritize suppliers with onshore production capabilities or tariff exemption certifications. In some cases, design teams are revisiting actuator specifications to accommodate alternative materials or streamline assembly processes. As a result, strategic sourcing has emerged as a critical capability, with cross-functional teams collaborating to balance cost, compliance, and performance requirements. This cumulative impact of tariffs is reshaping supplier landscapes and compelling industry stakeholders to adopt more agile supply chain strategies, ensuring resilience in the face of continued geopolitical and trade uncertainties.

Unveiling Comprehensive Segmentation Insights Revealing How Type, End Use Industry, Application, Offering, and Technology Dimensions Drive Market Differentiation

A holistic examination of actuator market segments reveals nuances that drive differentiated strategies for component developers and system integrators. Based on Type, the market spans electrical variants including AC, brushless, and DC actuators, hydraulic solutions segmented into electro-hydraulic and pure hydraulic systems, mechanical units featuring lever and screw jack mechanisms, and pneumatic designs combining diaphragm and piston configurations. Each type presents distinct performance profiles, with electrical actuators prized for precision control and low maintenance, hydraulics for high force output, mechanical units for simplicity and robustness, and pneumatics for rapid actuation cycles.

End Use Industry segmentation further refines the landscape across commercial aircraft applications from narrow-body to wide-body platforms, general aviation comprising single-engine and multi-engine aircraft, helicopters categorized into light, medium, and heavy classes, military aircraft including fighter and transport variants, and unmanned aerial vehicles in both fixed-wing and rotary-wing formats. These industry contexts impose tailored reliability, weight, and certification demands on actuators.

Application insights highlight engine control systems utilizing FADEC and non-FADEC actuators, flight control subsystems divided into primary functions such as aileron, elevator, and rudder operations or secondary elements like flaps, slats, and spoilers, landing gear assemblies for main and nose gear deployment, and thrust vectoring solutions offering two-dimensional or advanced three-dimensional thrust deflection.

Offering segmentation distinguishes core hardware components from value-added services encompassing maintenance, overhaul, and repair, while Technology dimensions segregate closed-loop configurations, including adaptive control algorithms and PID controller systems, from open-loop designs offering automatic or manual operation modes. Understanding these segmentation layers enables stakeholders to tailor R&D investments, align production capabilities, and craft targeted go-to-market strategies.

This comprehensive research report categorizes the Aircraft Actuators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Mechanism Type

- Offering

- Technology

- Aircraft Type

- Application

- End-User

Analyzing Regional Dynamics to Reveal Unique Opportunities, Challenges, and Growth Drivers for Aircraft Actuators Across Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics underscore how local regulations, manufacturing ecosystems, and end-user demands shape actuator strategies. In the Americas, strong defense spending and a robust commercial aviation sector drive demand for high-performance hydraulic and electrical actuators, while domestic tariff policies accelerate investments in localized production and in-region sourcing partnerships. This region’s emphasis on sustainability has also fueled research into energy-efficient electric actuators and smart maintenance systems.

Europe, Middle East & Africa exhibit diverse market drivers ranging from stringent European emissions and noise regulations influencing actuator material selection to defense modernization programs in the Middle East requiring advanced thrust vectoring technologies. Certification standards enforced by EASA encourage modular actuator designs that facilitate rapid maintenance turnaround and interoperability across multiple airframe platforms.

Asia-Pacific continues to expand rapidly, supported by growing airline fleets, regional defense procurements, and significant OEM investments in manufacturing hubs across Southeast Asia and China. This momentum has heightened demand for cost-competitive actuator solutions, resulting in a surge of joint ventures, licensing agreements, and technology transfers focused on hydraulic and mechanical actuator production. Moreover, rising UAV deployment in the region is driving innovation in lightweight, high-speed actuation systems optimized for unmanned applications.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Actuators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players Driving Innovation, Strategic Partnerships, and Competitive Differentiation in the Global Aircraft Actuator Market Landscape

A small cohort of suppliers dominates the global aircraft actuator industry, each leveraging unique technological strengths and strategic partnerships. One prominent leader has distinguished itself through integrated digital twin platforms that synchronize actuator performance data across design, test, and in-service phases. Another has cemented its market position by optimizing hydraulic actuator lines for both civil and defense applications, underpinned by a deep network of service centers spanning multiple continents. A third key player is driving innovation in brushless electric actuators, delivering solutions that reduce weight and simplify maintenance cycles for next-generation airframes.

Meanwhile, specialized firms have carved niches in piston-driven pneumatic actuators for high-cycle UAV operations and adaptive control units tailored to advanced fighter jet thrust vectoring. These targeted offerings have enabled agile entrants to capture share in segments with stringent performance requirements. Across the competitive landscape, alliances between OEMs and actuator specialists have become more prevalent, facilitating co-development of bespoke systems and accelerating time to market. Collectively, these companies are investing in predictive maintenance services, digital analytics, and modular architectures to align with evolving industry imperatives around reliability, cost efficiency, and operational readiness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Actuators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Arkwin Industries, Inc.

- Astronics Corporation

- BAE Systems plc

- Beaver Aerospace & Defense, Inc. by Héroux-Devtek

- Curtiss-Wright Corporation

- DVG Automation Spa

- Eaton Corporation PLC

- Electromech Technologies by Transdigm Group, Inc.

- Honeywell International Inc.

- ITT Inc.

- Kollmorgen Corporation by Altra Industrial Motion Corp.

- Kyntronics

- Liebherr-International Deutschland GmbH

- Moog Inc.

- Nabtesco Corporation

- Parker-Hannifin Corporation

- Pegasus Actuators GmbH

- RTX Corporation

- Saab AB

- Safran Group

- SAM GmbH

- Tamagawa Trading Co., Ltd.

- Tolomatic, Inc.

- Triumph Group, Inc.

- Whippany Actuation Systems LLC

- Woodward, Inc.

Empowering Industry Leaders to Navigate Complexities with Actionable Strategies Focused on Innovation, Supply Chain Resilience, and Regulatory Compliance

Industry leaders must embrace a multifaceted strategy to remain at the forefront of actuator innovation and market responsiveness. First, prioritizing the integration of digital feedback mechanisms and condition-monitoring sensors into actuator designs will enable proactive maintenance regimes and reduce life-cycle costs. Concurrently, investing in additive manufacturing platforms for prototype and low-volume runs can accelerate product development cycles and unlock advanced geometries that improve weight-to-force ratios.

Moreover, diversifying supply chain footprints by aligning with regional production partners mitigates exposure to tariff volatility and geopolitical disruptions. Leaders should evaluate nearshoring opportunities in North America and Europe to capitalize on favorable trade incentives and maintain shorter lead times. Additionally, forging strategic alliances with avionics and software providers can support the development of holistic flight control ecosystems that integrate actuator intelligence with broader aircraft management systems. Finally, adopting sustainable materials and medical-grade sealants aligns with emerging environmental mandates and enhances actuator longevity, positioning companies to meet stricter in-service certifications and eco-design standards.

Demystifying the Rigorous Research Methodology Employing Primary Interviews, Secondary Data Analysis, and Expert Validation to Ensure Credible Market Insights

This analysis rests on a robust methodology combining primary expert interviews, rigorous secondary research, and comprehensive validation protocols. Interviews with aerospace engineers, tier-one procurement managers, and regulatory specialists provided nuanced perspectives on technical requirements, certification challenges, and strategic imperatives. These qualitative insights were supplemented by a thorough review of white papers, patent filings, and industry conference proceedings to capture the latest technological breakthroughs and market narratives.

Secondary data sources included corporate disclosures, trade association publications, and government regulatory databases, which together furnished a factual foundation for understanding tariff implications, regional production trends, and vendor capabilities. Triangulation techniques were employed to cross-verify information and reconcile discrepancies across sources. Draft findings underwent multiple peer reviews and stakeholder workshops to ensure accuracy and relevance. This rigorous approach underpins the credibility of the insights presented, offering a reliable basis for strategic decision-making in the aircraft actuator domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Actuators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Actuators Market, by Type

- Aircraft Actuators Market, by Mechanism Type

- Aircraft Actuators Market, by Offering

- Aircraft Actuators Market, by Technology

- Aircraft Actuators Market, by Aircraft Type

- Aircraft Actuators Market, by Application

- Aircraft Actuators Market, by End-User

- Aircraft Actuators Market, by Region

- Aircraft Actuators Market, by Group

- Aircraft Actuators Market, by Country

- United States Aircraft Actuators Market

- China Aircraft Actuators Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing Essential Insights to Deliver a Concise Synthesis of Aircraft Actuator Market Trends, Strategic Considerations, and Future Outlook Imperatives

In summary, the aircraft actuator domain is at a pivotal juncture defined by digital transformation, evolving trade landscapes, and heightened performance expectations. Electrification and closed-loop intelligence are redefining actuator architectures, while additive manufacturing and advanced materials enable innovative design solutions. The 2025 United States tariffs have prompted a reevaluation of global supply chains, accelerating localization and strategic sourcing initiatives.

Segmentation analysis highlights the diversity of actuator types, end-use applications, and service offerings that shape stakeholder strategies, while regional insights emphasize the distinct regulatory, economic, and defense-driven conditions across the Americas, EMEA, and Asia-Pacific. Leading companies continue to differentiate through digital twin integration, strategic partnerships, and niche innovations in UAV and military thrust vectoring systems. With a clear understanding of market dynamics and a rigorous research foundation, industry participants can confidently pursue growth opportunities, optimize operational efficiency, and advance toward the next frontier of aerospace actuation.

Connect with Ketan Rohom to Discover How a Comprehensive Aircraft Actuator Market Research Report Can Inform Strategic Investments, Partnerships, and Performance Improvements

If you are looking to gain a competitive edge in the rapidly evolving aircraft actuator market, reach out to Ketan Rohom at your earliest convenience. As Associate Director, Sales & Marketing, Ketan can guide you through the comprehensive insights and strategic analyses contained in the full market research report. Uncover critical trends, disruptive technologies, and supply chain dynamics that will inform your next investment, partnership, or product development initiative. Engage with Ketan to secure access to detailed segmentation breakdowns, tariff impact assessments, and actionable recommendations tailored to your organization’s growth objectives. Investing in these cutting-edge insights today could be the difference between leading the pack and playing catch-up tomorrow. Contact Ketan Rohom to elevate your strategic decision-making and position your company for sustained success in the global aircraft actuator industry

- How big is the Aircraft Actuators Market?

- What is the Aircraft Actuators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?