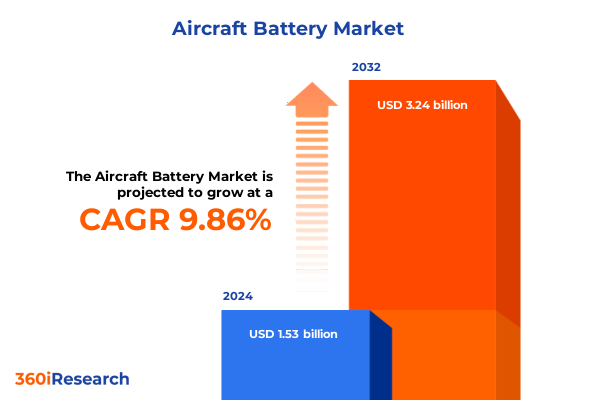

The Aircraft Battery Market size was estimated at USD 1.67 billion in 2025 and expected to reach USD 1.83 billion in 2026, at a CAGR of 9.95% to reach USD 3.24 billion by 2032.

Navigating the Accelerating Shift to Advanced Energy Solutions in Aviation with the Latest Insights on Aircraft Battery Innovation and Strategic Imperatives

The aviation sector stands on the brink of a profound transformation as it grapples with the dual imperatives of enhancing operational performance and drastically reducing its environmental footprint. Accounting for up to 2.5% of global CO₂ emissions, aircraft operations have emerged as a critical target for decarbonization, prompting manufacturers, regulators, and technology providers to seek alternative propulsion and energy storage solutions that can deliver both safety and sustainability. As traditional fuel-based systems reach their performance limits, the aviation industry is looking to advanced battery technologies to unlock new possibilities for electrified flight.

Amid mounting regulatory pressures and market demand for green alternatives, next-generation battery chemistries are progressing rapidly. From solid-state lithium metal cells being tested for small drones to public–private collaborations akin to NASA’s partnership with air taxi pioneer Archer Aviation, the push for lighter, denser, and more reliable energy storage is accelerating. This report provides a comprehensive overview of the current landscape of aircraft battery technology, strategic drivers shaping the sector, and the opportunities and challenges that lie ahead.

Revolutionary Shifts Redefining Aircraft Power Systems Through Electrification, Sustainable Aviation, and Next-Generation Battery Technologies

A convergence of technological breakthroughs and environmental imperatives is redefining how aircraft are powered. Leading the charge are cutting-edge battery chemistries that promise to deliver energy densities once thought unattainable. Solid-state and lithium metal solutions are gaining traction, offering up to 70% greater energy per unit weight compared to incumbent lithium-ion designs, thereby extending range and payload capacity for electric and hybrid-electric aircraft alike. At the same time, established lithium-ion technologies continue to evolve through enhancements in cathode materials and cell architectures, reinforcing their role in emerging segments such as unmanned aerial vehicles and short-haul eVTOL operations.

Alongside chemistry advancements, the industry is witnessing unprecedented collaboration between aerospace incumbents and new mobility entrants. Public-private partnerships are fueling disruptive concepts, from hydrogen-powered demonstrators aiming for zero-emission circumnavigation to battery-powered air taxis that promise to reshape urban mobility. NASA’s alliance with Archer Aviation exemplifies this trend, as joint research into high-performance cells and thermal management systems seeks to overcome the hurdles of weight, safety, and rapid charging in advanced air mobility platforms. Meanwhile, startups and specialized battery developers are vying for leadership in next-generation cell formats, leveraging innovations like silicon-anode composites to deliver both high power output and energy retention for vertical lift applications.

Despite these promising advances, widespread adoption hinges on regulatory alignment and infrastructure readiness. Certification pathways for electrified powertrains and energy storage systems are in development, with authorities balancing the need for rigorous safety assessments against the urgency of decarbonizing flight. Concurrently, airports and maintenance facilities are beginning to integrate fast-charging and high-voltage distribution networks to accommodate electric and hybrid operations. Together, these transformative shifts are establishing a new foundation for aviation, driving the integration of sustainable technologies into the heart of aircraft design and operation.

Assessing the Far-Reaching Effects of Newly Imposed United States Tariffs on Aircraft Battery Imports and Supply Chain Dynamics in 2025

In 2025, a significant escalation of tariffs on imported battery components and finished cells has introduced new complexities to the global supply chain. The U.S. administration’s decision to raise duties on lithium-ion battery parts from 7.5% to 25% and to apply similar levies on natural graphite and other critical materials has been justified as a means of counteracting unfair trade practices and protecting domestic manufacturing. While these measures align with broader industrial policy objectives, they have also led to cost pressures for original equipment manufacturers and system integrators that rely on cost-competitive imports to meet the performance and safety standards of aviation applications.

Beyond batteries themselves, the aviation sector continues to contend with tariffs on aircraft and component imports. Executives from airlines and aerospace suppliers have described paying duties on imported parts and fully assembled airframes as economically challenging, prompting calls for exemptions under longstanding trade agreements that previously supported duty-free exchanges. The cumulative effect is a potential slowdown in capital investment, as higher input costs are passed along the value chain and can influence pricing strategies. For technology providers and battery innovators, navigating this tariff landscape requires careful sourcing strategies, investment in domestic production capabilities, and proactive engagement with policymakers to secure carve-outs or phased implementation that safeguard the transition to electrified flight.

Illuminating Market Potential Across Diverse Battery Technologies, Aircraft Configurations, Capacity Ranges, Distribution Channels, and Varied End-Use Scenarios

A deeper understanding of the aircraft battery market is grounded in its diverse segmentation framework, which reflects the nuanced requirements of different chemistries, platforms, capacities, distribution channels, and end-use scenarios. Battery technologies span established platforms such as lead acid-offering flooded and valve-regulated variants-and nickel-cadmium systems tailored for high-temperature or standard environments, through to more advanced nickel-metal hydride formats available in high-capacity and standard configurations. At the forefront, lithium-ion chemistries break down further into lithium cobalt oxide, lithium iron phosphate, and lithium nickel manganese cobalt oxide, each selected for its balance of energy density, thermal stability, and lifecycle performance.

Platform segmentation distinguishes between fixed-wing and rotary-wing aircraft, where power profile demands and weight constraints dictate differing battery pack designs and integration approaches. Capacity classifications range from below 100 Ah for auxiliary power and emergency backup systems to above 500 Ah for primary propulsion in hybrid and electric aircraft. Sales channels unfold across original equipment manufacturers and aftermarket suppliers, the latter playing a critical role in maintenance, repair, and overhaul cycles that extend battery life and ensure operational readiness.

End-use segmentation further contextualizes demand dynamics across commercial aviation-comprising cargo freighters and passenger liners-as well as general aviation, including business jets and private aircraft. Military aviation introduces specialized requirements for fighter, surveillance, and transport platforms, each valuing robust performance under extreme conditions. Finally, unmanned aerial vehicles span combat drones, delivery drones, and reconnaissance drones, where batteries must deliver a precise blend of endurance, reliability, and quick-response power delivery. Together, these segmentation insights provide a structured lens through which stakeholders can pinpoint investment priorities and tailor solutions to the distinct needs of each submarket.

This comprehensive research report categorizes the Aircraft Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Technology

- Aircraft Type

- Battery Capacity

- End Use

- Sales Channel

Analyzing Regional Dynamics Driving Aircraft Battery Adoption and Innovation Across the Americas, EMEA, and the Asia-Pacific Hubs

Regional dynamics play a pivotal role in shaping innovation trajectories and commercial adoption of aircraft batteries. In the Americas, the United States leads with robust government initiatives, substantial R&D funding, and a growing ecosystem of advanced air mobility projects. Partnerships between NASA and private ventures exemplify a supportive policy environment, while domestic battery producers are expanding energy storage system capacity as emerging supply chain strategies respond to new tariff regimes.

Across Europe, the Middle East, and Africa, a blend of regulatory mandates and collaborative alliances drives the pursuit of sustainable aviation. European governments are investing in hydrogen and electric propulsion research, while trade negotiations continue to influence cost structures for imported components. The imminent implementation of mutual tariffs with the United States underscores the importance of regional supply hubs and localized value chains. In the Middle East, sovereign wealth funds are financing advanced mobility projects, and Africa is exploring opportunities to leapfrog infrastructure constraints through electric and hybrid aircraft solutions.

In the Asia-Pacific, China’s dominance in lithium-ion battery manufacturing-with an estimated 80–90% of global production capacity-underscores its pivotal influence on raw material sourcing and cell supply. Japan complements this with dedicated public–private investments totaling over 30.6 billion yen to support electric aircraft systems, signaling a strategic commitment to next-generation propulsion platforms. Meanwhile, South Korea and other regional players are advancing partnerships and assembly operations to capture value within rapidly evolving supply chains. These regional distinctions highlight both the opportunities and complexities inherent in global market engagement.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning, Collaborations, and Technological Leadership of Leading Aircraft Battery Providers and Innovators

Leading organizations are charting distinct pathways toward leadership in the aircraft battery domain. Amprius has emerged as a pioneer with its silicon-anode SiCore cells, offering power densities up to 3,000 W/kg and energy densities of 370 Wh/kg, ideal for the high-demand profiles of eVTOL applications. Cuberg, now part of Northvolt, continues to develop lithium metal batteries that can increase energy content by approximately 70% over conventional lithium-ion cells, positioning itself for full-scale aviation demonstrations by 2026.

Traditional battery giants are also adapting. LG Energy Solution, while primarily focused on electric vehicle and energy storage markets, is leveraging its U.S. production footprint to mitigate tariff impacts by repurposing EV lines for aviation-grade cells and expanding ESS capacity in Michigan through 2026. Collaborative efforts feature prominently, as seen in NASA’s public-domain research with Archer Aviation to accelerate cell architecture innovations for advanced air mobility, ensuring knowledge transfer across the broader industry. As these and other players scale manufacturing, optimize supply chains, and engage with certification authorities, they collectively define the competitive contours and innovation frontiers of the aircraft battery market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Concorde Batteries

- EaglePicher Technologies

- Emergency Beacon Corporation

- Enersys, Inc.

- HBL Power Systems Limited

- LG Chem

- MarathonNorco Aerospace, Inc. by Transdigm Group, Inc.

- MGM COMPRO International s. r. o.

- Mid-Continent Instrument Co., Inc.

- Parker-Hannifin Corporation

- Saft Groupe SAS by TotalEnergies SE

- Sichuan Changhong Battery Co., Ltd.

- SolarEdge Technologies, Inc.

- Teledyne Technologies Incorporated

- The Boeing Company

Crafting Strategic Imperatives for Aviation Stakeholders to Capitalize on Emerging Battery Technologies, Supply Chain Resilience, and Regulatory Compliance

Industry leaders should prioritize targeted investment in advanced chemistries, such as silicon-enhanced and solid-state cells, to secure differentiated performance advantages and anticipate the certification requirements of aviation regulators. Simultaneously, diversifying supplier relationships and exploring regional manufacturing partnerships can help mitigate the cost impacts of tariffs and trade volatility documented in recent policy shifts. Engaging proactively with government agencies to seek carve-outs or phase-in schedules for aviation-specific battery imports will further strengthen supply chain resilience.

Collaboration across the value chain remains essential. Forming consortia that unite OEMs, battery developers, and research institutions can accelerate standardization efforts, particularly for testing and validation protocols. Integrating digital battery management and predictive maintenance tools will optimize lifecycle performance and support aftermarket services, creating new revenue streams while ensuring safety. Lastly, industry stakeholders should maintain open dialogue with airports and infrastructure providers to coordinate the rollout of charging networks and high-voltage distribution systems, thereby enabling seamless operations for electrified aircraft fleets.

Unveiling the Comprehensive Research Framework Integrating Primary Interviews, Expert Analyses, and Secondary Data to Ensure Robust Market Insights

This report harmonizes insights from multiple research pillars to deliver a robust understanding of the aircraft battery landscape. Primary interviews with C-level executives, technology officers, and procurement specialists provided firsthand perspectives on operational challenges and strategic priorities. Secondary research drew upon peer-reviewed journals, industry publications, and validated news sources to capture the latest technological developments and policy changes. Quantitative data was sourced from customs records, trade databases, and company filings to map production capacities, import/export flows, and tariff structures.

Analytical frameworks such as SWOT analysis and five forces assessments were applied to evaluate competitive positioning, supply chain risks, and regulatory dynamics. Findings were peer-reviewed by subject-matter experts in aerospace engineering, sustainability, and energy storage to ensure accuracy and relevance. The final deliverable reflects an integrated approach, combining qualitative judgments with empirical data to guide strategic decision-making across diverse stakeholder groups.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Battery Market, by Battery Technology

- Aircraft Battery Market, by Aircraft Type

- Aircraft Battery Market, by Battery Capacity

- Aircraft Battery Market, by End Use

- Aircraft Battery Market, by Sales Channel

- Aircraft Battery Market, by Region

- Aircraft Battery Market, by Group

- Aircraft Battery Market, by Country

- United States Aircraft Battery Market

- China Aircraft Battery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Reflections on the Pivotal Role of Battery Innovation in Accelerating Sustainable Aviation and Shaping the Next Generation of Aircraft Power Systems

Emerging battery technologies are redefining the boundaries of what is possible in aviation, enabling solutions that balance performance, safety, and sustainability. The shift toward electrified propulsion represents not only a transformative leap for aircraft design but also an opportunity to reconfigure global supply chains, regulatory frameworks, and business models. As regions advance at different paces, stakeholders must remain agile, leveraging partnerships and strategic foresight to navigate evolving trade policies and certification requirements.

By integrating insights on technological breakthroughs, regional dynamics, and competitive strategies, industry players can position themselves to lead the next era of aviation energy. The transition to electric and hybrid-electric flight will demand coordinated efforts from policymakers, infrastructure providers, and technology innovators. With the foundation laid by pioneering developments highlighted in this report, the aviation community is poised to accelerate decarbonization while sustaining operational excellence and economic viability.

Engage with Ketan Rohom to Secure Your In-Depth Market Research Report and Propel Strategic Decision-Making in Aircraft Battery Innovations

To explore how these findings can inform your strategic initiatives and investment decisions, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Mr. Rohom will provide you with a tailored overview of the full market research report, including exclusive data, expert interpretations, and an executive briefing aligned with your organizational priorities. Don’t miss the opportunity to gain a competitive advantage through bespoke insights and dedicated support for navigating the evolving aircraft battery landscape.

- How big is the Aircraft Battery Market?

- What is the Aircraft Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?