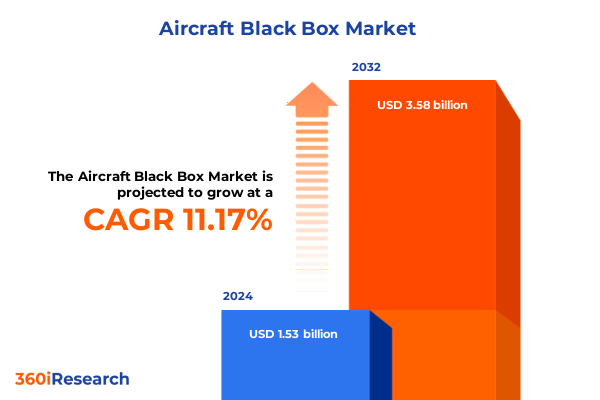

The Aircraft Black Box Market size was estimated at USD 1.69 billion in 2025 and expected to reach USD 1.87 billion in 2026, at a CAGR of 11.26% to reach USD 3.58 billion by 2032.

Unveiling the Pivotal Evolution and Indispensable Role of Aircraft Black Box Systems in Driving Unparalleled Flight Safety Standards and Insights

Aircraft black box systems-the cockpit voice recorder and the flight data recorder-serve as the ultimate guardians of flight safety and investigative precision. By capturing critical audio and flight parameters, these devices provide irrefutable insights into the moments preceding incidents, enabling investigators to reconstruct events, identify causal factors, and recommend effective safety measures. Over decades, breakthroughs in materials science and sensor technologies have enhanced crash survivability, allowing recorders to withstand extreme temperatures, shock, and immersion.

The evolution of recorder capacity from two hours of cockpit audio to modern durations, as well as the expansion of parameter capture in flight data recorders, reflects continuous innovation driven by lessons learned from high-profile accidents. Industry collaboration has fostered standardized protocols for beacon performance and data recovery, underscoring the collective commitment to uncovering the truth behind every anomaly.

Regulatory bodies have played a pivotal role in shaping this trajectory. The International Civil Aviation Organization established foundational specifications for recorder performance and data retention, while national authorities have progressively strengthened mandates. The recent Federal Aviation Administration Reauthorization Act of 2024 requires that aircraft manufactured after May 16, 2024 be line-fit with cockpit voice recorders capable of at least 25 hours of audio recording, with existing fleets to be retrofitted by 2030-aligning U.S. standards with ICAO and EASA requirements.

Charting the Transformational Technological and Regulatory Shifts Redefining Aircraft Black Box Capabilities for Next-Generation Flight Data Integrity

The aircraft black box landscape is undergoing transformative shifts as digitalization and connectivity redefine the boundaries of flight data acquisition. Next-generation systems integrate real-time streaming capabilities via satellite and ground station networks, allowing stakeholders to monitor critical flight parameters continuously rather than relying solely on post-incident retrieval. This evolution enables proactive risk management and rapid anomaly detection, significantly reducing response times during emergencies.

Artificial intelligence and advanced analytics are now embedded within recorder ecosystems, facilitating automated pattern recognition and predictive diagnostics. By processing vast volumes of sensor outputs, AI-driven platforms can flag irregular flight behaviors and suggest maintenance interventions before faults escalate. Concurrently, miniaturization efforts have yielded lightweight, compact designs that maintain rigorous crash-survival standards while lowering installation complexity and weight penalties, contributing to overall fuel efficiency.

Regulatory frameworks are adapting to accommodate these breakthroughs. The European Union Aviation Safety Agency and China’s Civil Aviation Administration have introduced directives mandating cloud-based data retention and streaming capabilities, propelling manufacturers to innovate across both analog and digital product lines. This confluence of cutting-edge technology and policy momentum is redefining recorder functionality and bolstering global aviation safety culture.

Assessing the Widespread Consequences of 2025 United States Steel, Aluminum, and Aircraft-Related Tariffs on Black Box Manufacturing and Supply Chains

In 2025, the United States intensified tariffs on steel and aluminum under Section 232, raising duties to 25% in March and further elevating them to 50% in June to fortify domestic metal industries. These measures directly influence the cost structure of black box manufacturing, as recorder shells and mounting components rely on specialized aerospace-grade alloys. Tier-1 and Tier-2 suppliers face heightened input expenses, compelling original equipment manufacturers to reassess pricing strategies and supply chain resilience.

Beyond raw material levies, an impending 10% tariff on imported aircraft parts, announced in early 2025, poses additional burdens on global avionics suppliers. Airlines and lessors have signaled reluctance to accept new aircraft deliveries under such uncertainty, with the International Air Transport Association cautioning that trade restrictions could resemble an embargo, risking deferred orders and disrupted production timelines.

These cumulative trade measures have also reverberated through retrofit markets, where cost pass-through affects operators’ decisions on upgrading legacy fleets. Amid this landscape, strategic procurement practices and localized sourcing partnerships emerge as critical tactics for stakeholders aiming to mitigate tariff-driven volatility and maintain seamless recorder availability.

Synthesizing Critical Market Segmentation Insights to Illuminate Diverse Product Types, Applications, Distribution Channels, Installation Methods, and Technologies

Deep analysis of the aircraft black box market reveals nuanced dynamics across product types, with standalone cockpit voice recorders serving executive and commercial fleets, combined flight data recorder and voice recorder units offering integrated solutions, and dedicated flight data recorders delivering extensive parameter capture for military, rotorcraft, and heavy jet applications. Each configuration addresses distinct safety and investigative requirements, reflecting diverse procurement rationales adopted by fleet operators.

Applications span the full gamut of aviation sectors. Business aviation clientele prioritize compact, lightweight recorders that align with corporate jet modifications, while commercial airlines emphasize extended recording durations and streamlined maintenance cycles. Helicopter operators, particularly those engaged in search and rescue missions, demand robust under-sea locator beacons, and military end users require hardened units capable of enduring combat environments and classified data isolation protocols.

Distribution channels bifurcate between original equipment manufacturers and aftermarket service providers. While OEMs embed recorder systems during line-fit installation to satisfy new aircraft certifications, aftermarket specialists spearhead retrofit programs under evolving regulatory mandates. Operators navigate installation choices between new installation on fresh airframes and retrofit kits for in-service fleets, balancing upfront investment against compliance timelines.

Technological paradigms have diverged into analog and digital pathways. Legacy magnetic tape and magnetic disk storage systems persist in certain retrofit scenarios, valued for reliability, whereas hybrid memory modules and solid-state memory architectures define the digital frontier, offering enhanced durability, data capacity, and seamless integration with aircraft health monitoring platforms.

This comprehensive research report categorizes the Aircraft Black Box market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offerings

- Installation Type

- Application

- End User

- Distribution Channel

Exploring the Distinct Regional Dynamics Shaping Aircraft Black Box Adoption and Innovation Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics shape strategic priorities and adoption rates for black box systems. In the Americas, stringent FAA mandates and robust aftermarket networks drive a surge in retrofit activity, with airlines scheduling compliance timelines for the 25-hour recording requirements. North American OEMs leverage proximity to flight operators and Tier-1 suppliers to offer bundled safety upgrade packages, while Latin American carriers assess cost-effective installation alternatives amid tariff-impacted material costs.

Across Europe, Middle East, and Africa, the convergence of ICAO standards with EASA directives fosters a cohesive regulatory environment. European carriers prioritize vendor consolidation to navigate complex cross-border certification processes, and Middle Eastern flag carriers invest heavily in next-generation recorders as part of fleet modernization programs. In Africa, nascent commercial aviation markets seek partnerships for technology transfer and training to enhance investigative capabilities and compliance infrastructure.

Asia-Pacific presents a mosaic of regulatory frameworks and growth drivers. China’s CAAC requirements for real-time data streaming and India’s hybrid adherence to ICAO-EASA parameters have spurred domestic R&D, prompting manufacturers to develop region-specific product variants. Meanwhile, Southeast Asian low-cost carriers and burgeoning rotary-wing services embrace retrofit solutions to extend asset lifecycles. Regional alliances and joint ventures accelerate technology localization, ensuring recorder systems meet local certification and operational demands.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Black Box market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Global Aerospace and Avionics Players Driving Innovation and Competitive Positioning in the Aircraft Black Box Market Landscape

Major aerospace and avionics corporations are vying to lead the black box market through innovation and strategic partnerships. Honeywell’s advanced digital recorder platforms, which support AI-enhanced analytics and cloud interoperability, have gained traction in commercial airline retrofit programs. L3Harris Technologies, stemming from its integration of Universal Avionics, emphasizes hybrid memory systems that bridge legacy analog reliability with digital data throughput.

Curtiss-Wright’s Fortress series continues to set benchmarks in cockpit voice recorder durability, leveraging magnetic disk storage configurations validated under extreme shock and heat tests. Thales Group spearheads R&D in solid-state memory modules, collaborating with satellite communications providers to embed real-time flight data streaming capabilities. Emerging specialists, such as Genesys Aerosystems, are carving niches with lightweight recorders optimized for business jets and regional turboprops.

Partnerships with airline OEMs, MRO providers, and certification authorities remain vital. These alliances facilitate co-development of bespoke recorder solutions that align with specific fleet requirements and manufacturer timelines. Collectively, these corporations are shaping competitive dynamics by investing in modular recorder architectures, expanding service networks, and prioritizing cybersecurity protocols within recorder ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Black Box market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Appareo Systems, LLC by AGCO Corporation

- Astronics Corporation

- AstroNova Inc.

- Aversan Inc.

- AVIAGE SYSTEMS

- Avionica

- BAE Systems plc

- Becker & Associates, Inc.

- Curtiss-Wright Corporation

- Donica Aviation Engineering Co., LTD

- Elbit Systems Ltd.

- Flight Data Systems (FDS) by ACR Group

- FLYHT Aerospace Solutions Ltd.

- Garmin Ltd.

- HEICO Corporation

- Hensoldt AG

- Honeywell International Inc.

- iAero Group

- Indra Sistemas, S.A.

- KEITAS SYSTEMS INC.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- LX navigation d.o.o.

- Niron Systems & Projects

- Northrop Grumman Corporation

- NSE Groupe

- Parker-Hannifin Corporation

- RTX Corporation

- Safran SA

- Teledyne Technologies Incorporated

- Thales S.A.

- The General Electric Company

- TL elektronic Inc.

- Universal Avionics Systems Corporation by Elbit Systems Ltd.

Strategic Recommendations for Industry Leaders to Capitalize on Technological Innovations, Regulatory Compliance, and Evolving Market Opportunities

To capitalize on evolving market dynamics, industry leaders should invest in scalable digital recorder platforms that support both real-time streaming and on-board analytics. Establishing strategic alliances with satellite communications providers and cloud service operators can accelerate deployment of continuous flight data monitoring solutions. Concurrently, firms must fortify supply chain resilience by diversifying raw material sources and developing regional assembly capabilities in key markets.

Navigating the tariff-driven cost environment demands proactive engagement with policy stakeholders. By participating in industry consortiums and advocating for targeted exemptions on critical avionics components, manufacturers and airlines can mitigate the financial impact of steel, aluminum, and parts tariffs. In parallel, integrating retrofit services into established MRO networks ensures operators can achieve regulatory compliance with minimal operational disruption.

Emphasizing modular recorder designs will facilitate seamless upgrades across analog and digital technologies, optimizing total cost of ownership. Finally, fostering a robust training and certification ecosystem for maintenance personnel will enhance installation accuracy and data integrity, reinforcing safety culture and sustaining competitive advantage.

Detailing the Robust Research Methodology Leveraging Qualitative and Quantitative Analyses to Ensure Comprehensive and Credible Market Insights

This research leverages a balanced combination of primary and secondary data collection methodologies. Primary insights were obtained through structured interviews with senior executives from OEMs, Tier-1 avionics suppliers, and airline fleet managers, supplemented by surveys addressing procurement strategies and technology adoption timelines. Secondary research encompassed analysis of regulatory publications from the FAA, ICAO, EASA, and CAAC, as well as review of company financial disclosures, press releases, and technical whitepapers.

Quantitative data points were triangulated across multiple sources to validate trends and ensure consistency. Market segmentation frameworks were applied to delineate product types, application verticals, distribution channels, installation modalities, and technology categories. Qualitative assessments, including SWOT and PESTLE analyses, provided strategic context for regulatory, economic, and technological drivers.

Data integrity was maintained through cross-validation against publicly available trade statistics and patent filing databases. The research team adhered to a rigorous verification protocol, ensuring that all conclusions are supported by credible evidence and reflect the most recent industry developments as of mid-2025.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Black Box market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Black Box Market, by Offerings

- Aircraft Black Box Market, by Installation Type

- Aircraft Black Box Market, by Application

- Aircraft Black Box Market, by End User

- Aircraft Black Box Market, by Distribution Channel

- Aircraft Black Box Market, by Region

- Aircraft Black Box Market, by Group

- Aircraft Black Box Market, by Country

- United States Aircraft Black Box Market

- China Aircraft Black Box Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Insights That Reinforce Strategic Imperatives and Future Trajectories Within the Rapidly Evolving Aircraft Black Box Sector

The aircraft black box market stands at the confluence of regulatory rigor and technological revolution. Mandatory 25-hour recording requirements and the rise of real-time streaming capabilities have driven substantial innovation, with manufacturers racing to deliver durable, data-rich, and weight-optimized systems. At the same time, industry stakeholders must navigate cost pressures from heightened steel, aluminum, and parts tariffs, necessitating agile supply chain strategies and collaborative policy engagement.

Segmentation analysis underscores the diversity of recorder configurations and end-use scenarios, from specialized military applications to retrofit programs in mature commercial fleets. Regional disparities-rooted in distinct regulatory regimes and growth trajectories-highlight the critical need for tailored market approaches. Leading corporate players are leveraging R&D partnerships and modular platform architectures to maintain competitive differentiation.

As aviation safety imperatives evolve, recorders will increasingly function as integrated nodes within broader aircraft health monitoring and risk-management ecosystems. Stakeholders who align product innovation with strategic alliances and regulatory foresight will be best positioned to thrive within this dynamic landscape.

Engage Directly with Ketan Rohom to Access the Comprehensive Aircraft Black Box Market Research Report and Empower Strategic Decision Making

Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research report on aircraft black box systems and elevate strategic decision-making with unparalleled insights. This report offers deep analysis of regulatory trends, technology innovations, tariff impacts, segmentation perspectives, and regional dynamics, empowering stakeholders to anticipate market shifts and capitalize on emerging opportunities. By partnering with Ketan, you’ll gain bespoke guidance tailored to your organization’s priorities and access to timely updates and expert advisory support. Reach out today to finalize your purchase and unlock the actionable intelligence needed to drive growth, optimize supply chains, and enhance safety outcomes across the aviation industry.

- How big is the Aircraft Black Box Market?

- What is the Aircraft Black Box Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?