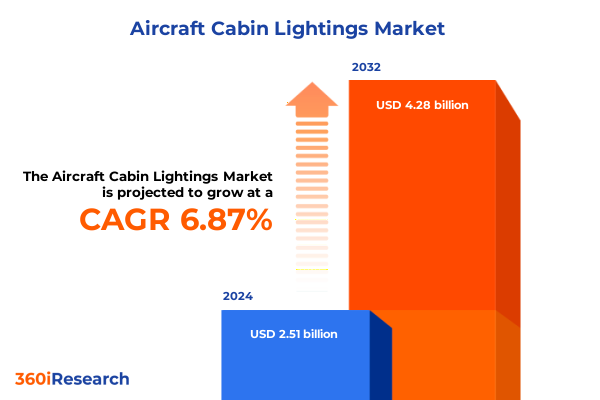

The Aircraft Cabin Lightings Market size was estimated at USD 2.63 billion in 2025 and expected to reach USD 2.76 billion in 2026, at a CAGR of 7.17% to reach USD 4.28 billion by 2032.

Establishing the Vital Role of Innovative Cabin Lighting Solutions in Elevating Passenger Comfort and Operational Efficiency Across Aircraft Interiors

Aircraft cabin lighting has transitioned from a purely functional necessity to a strategic differentiator in modern aviation. Once confined to basic fluorescent fixtures, today’s illumination solutions encompass advanced LED arrays and programmable systems designed to influence mood, enhance safety, and optimize energy consumption. As passenger expectations evolve alongside tighter environmental regulations and operational cost pressures, airlines and manufacturers are increasingly prioritizing lighting innovations to set their cabins apart. Understanding these developments is critical for stakeholders aiming to deliver compelling passenger experiences while maintaining stringent efficiency targets.

Furthermore, the interplay between lighting aesthetics and human factors engineering has never been more pronounced. Studies on circadian rhythm alignment have spurred the integration of tunable color temperature controls that mimic natural daylight cycles, reducing passenger fatigue on long flights. At the same time, the demand for lightweight, energy-efficient fixtures challenges suppliers to engineer solutions that meet rigorous certification requirements while minimizing system weight and power draw. These converging trends underscore the need for comprehensive market intelligence that can guide product development, procurement, and retrofit initiatives.

In light of these dynamics, this executive summary offers a consolidated overview of the transformative shifts reshaping the aircraft cabin lighting landscape. Drawing upon primary interviews with design engineers, airline cabin teams, and OEM procurement experts, coupled with extensive secondary research into regulatory filings and industry publications, the following sections deliver actionable insights into segment performance, regional variations, tariff impacts, and competitive strategies. By synthesizing these elements, stakeholders will be equipped to make informed decisions that align with both passenger well-being goals and operational imperatives.

Navigating the Emergence of Circadian Rhythm Lighting and Personalized Illuminated Environments in Transforming the Inflight Experience

Rapid technological advancements have catalyzed profound changes in the cabin lighting ecosystem, moving beyond static illumination to dynamic, adaptive systems that respond to passenger needs in real time. Circadian lighting solutions, capable of shifting color temperature and intensity throughout a flight, have emerged as a cornerstone for enhancing passenger wellness and minimizing jet lag. Complementing this, personalized lighting environments that synchronize with individual seats and cabin zones enable airlines to deliver bespoke experiences, reinforcing brand identity and passenger loyalty.

Meanwhile, the integration of Internet of Things (IoT) capabilities has introduced new opportunities for smart cabin management. Operators can now monitor fixture performance, diagnose potential failures, and schedule predictive maintenance based on real-time data streams. This shift not only improves reliability but also optimizes maintenance cycles and reduces unexpected downtime. Additionally, advances in material science and light-emitting diode engineering have yielded components that are significantly lighter, more durable, and more energy efficient than their halogen or fluorescent predecessors.

Consequently, manufacturers and airlines are forging partnerships to co-develop solutions that align with next-generation cabin architectures. These collaborations explore embedded lighting within seat structures, interactive mood lighting tied to in-flight entertainment systems, and even augmented reality overlays for safety briefings. The resulting convergence of illumination, digital media, and passenger engagement platforms heralds a new era in cabin design that prioritizes adaptability, efficiency, and enhanced customer satisfaction.

Evaluating the Cumulative Repercussions of United States Tariff Adjustments on Cabin Lighting Supply Chains and Component Pricing Structures

Shifting trade policies have introduced fresh complexities into the procurement of cabin lighting components. Recent tariff adjustments enacted in early 2025 have applied additional duties on imported lighting modules and raw materials, notably affecting products sourced from key manufacturing hubs in Asia. As a result, suppliers face increased landed costs, prompting both OEMs and retrofit specialists to reassess their vendor portfolios and explore alternative sourcing strategies to preserve cost competitiveness.

In response to these cost pressures, some aircraft lighting technology providers have begun relocating portions of their assembly operations to regions with favorable trade agreements. This geographic diversification helps mitigate the impact of duty escalations while preserving lead times essential for maintenance and retrofit programs. Meanwhile, direct negotiations with material suppliers have intensified, with buyers seeking long-term contracts or volume-based discounts to offset incremental tariff expenses.

Although these adjustments have raised short-term procurement hurdles, they have also accelerated the trend toward vertical integration within the industry. Leading companies are investing in in-house production capabilities and forging strategic partnerships with electronics manufacturers to safeguard critical supply chains. By emphasizing design modularity and interchangeability, stakeholders can navigate tariff fluctuations more effectively, ensuring uninterrupted access to next-generation lighting modules without compromising on quality or delivery schedules.

Uncovering Critical Insights through Diverse Technology and Installation Segmentation to Enhance Understanding of Cabin Illumination Dynamics

The technology segmentation reveals a marked departure from legacy fluorescent and halogen solutions in favor of LED and induction systems, driven by their superior energy efficiency and extended service life. LED modules have captured the lion’s share of new installation projects due to their ability to deliver tunable color temperatures and advanced control architectures, while induction lighting maintains a niche presence in scenarios demanding exceptionally long lifespans. This diverse technology mix underscores the importance of product portfolios that address both legacy retrofit needs and cutting-edge OEM specifications.

Turning to aircraft types, narrow body platforms remain the centerpiece for airlines seeking cost-effective short- to medium-haul operations, favoring lighting systems that combine efficiency with modularity. In contrast, wide body cabins, with their larger real estate and premium service offerings, frequently adopt comprehensive ambient lighting schemes capable of creating immersive environments for business and leisure travelers. These platform distinctions drive design priorities, with narrow body fittings emphasizing standardized form factors and wide body configurations accommodating more elaborate integrated fixtures.

Within cabin zones, lighting requirements diverge between the cockpit’s functional intensity, business class’s mood-enhancing luminance, economy class’s balanced brightness for passenger comfort, and first class’s bespoke ambient scenarios. The installation channel further differentiates OEM projects characterized by deep integration during the manufacturing cycle from retrofit initiatives that prioritize ease of installation and compatibility with existing wiring harnesses. Distribution pathways vary from direct engagements with airline procurement teams to aftermarket specialists serving maintenance, repair, and overhaul providers. Finally, distinct end users including business and private jet operators, commercial airlines, and military clients exert unique demands; while commercial carriers emphasize passenger appeal and operational economics, military applications focus on ruggedized solutions capable of withstanding extreme conditions and mission-critical lighting requirements.

This comprehensive research report categorizes the Aircraft Cabin Lightings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Aircraft Type

- Technology

- Cabin Zone

- End User

- Distribution Channel

- Installation

Synthesizing Diverse Regional Market Dynamics to Reveal Opportunities and Challenges in Cabin Lighting Across Global Aviation Hubs

Regional dynamics significantly influence cabin lighting strategies, reflecting varying fleet compositions, regulatory environments, and refurbishment cycles. In the Americas, mature fleets and an established aftermarket ecosystem drive robust demand for retrofit solutions that enhance passenger experience without extensive cabin overhauls. Airlines leverage localized supplier partnerships to expedite installations and capitalize on incentives aimed at upgrading legacy aircraft with energy-efficient LED and circadian lighting systems.

In Europe, Middle East & Africa, stringent environmental regulations and growing fleets of wide body and premium short-haul aircraft power investments in advanced ambient lighting. Operators in EMEA focus on certifications that align with sustainability targets, spurring collaborations between lighting manufacturers and research institutions to validate reduced energy consumption and extended component lifecycles. Meanwhile, the region’s diverse climatic conditions spur demand for fixtures with resilient thermal management and corrosion-resistant housings.

Across Asia-Pacific, rapid fleet expansions among low-cost and full-service carriers create significant opportunities for both OEM and retrofit channels. Emerging markets emphasize cost-effective, modular lighting solutions that can be scaled across narrow body fleets, while established carriers integrate premium lighting packages into new aircraft deliveries. Supply chain proximity to major manufacturing hubs also affords Asia-Pacific operators advantages in lead times and customization options, reinforcing the region’s status as a hotspot for cabin lighting innovation.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Cabin Lightings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives and Collaborative Endeavors Undertaken by Leading Aerospace Corporations Shaping Cabin Lighting Innovations

Leading aerospace suppliers have adopted multifaceted approaches to capture opportunities in cabin illumination. One prominent manufacturer has unveiled a new family of tunable LED fixtures that integrate seamlessly with existing cabin management systems, offering airlines modular upgrade kits that reduce retrofit complexity. Concurrently, another global supplier has expanded its strategic alliance network, partnering with avionics and inflight entertainment providers to deliver synchronized lighting experiences tied to passenger media engagement.

In parallel, a long-standing cabin interiors specialist has invested heavily in research and development centers focused on advanced optical materials and miniaturized driver electronics. This commitment has yielded lighting arrays with improved luminous efficacy and system-level intelligence, enabling predictive maintenance based on embedded sensor data. Meanwhile, a diversified aerospace technology group has leveraged its broad portfolio to introduce a turnkey cabin lighting platform that encompasses fixture design, control software, and lifecycle support services, thereby offering airlines a one-stop solution for modernizing their fleets.

Across the competitive landscape, firms are increasingly differentiating through acquisition and joint development agreements, seeking to combine core competencies in electronics, software, and materials science. These collaborative endeavors underscore a shift toward ecosystem-driven innovation, where integrated cabin lighting solutions form a central pillar of holistic passenger environment strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Cabin Lightings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astronics Corporation

- BWF Kunststoffe GmbH & Co. KG

- Cobalt Aerospace Group Limited

- Collins Aerospace, Inc.

- Diehl Stiftung & Co. KG

- Honeywell International Inc.

- Luminator Aerospace LLC

- Lumitex LLC

- Solitron Devices, Inc.

- STG Aerospace Limited

- Thales Group

Delivering Actionable Strategies and Foresight to Propel Aircraft Cabin Lighting Stakeholders Toward Sustainable Growth and Competitive Differentiation

To capitalize on the current momentum in cabin lighting evolution, industry leaders should prioritize the adoption of tunable LED systems capable of delivering circadian-friendly lighting sequences and creating immersive cabin moods. By embedding intuitive control interfaces that allow flight crews to tailor lighting schemes midflight, airlines can enhance brand differentiation and respond in real time to passenger comfort feedback. Further, close collaboration with inflight entertainment and connectivity providers can facilitate synchronized audiovisual experiences, driving ancillary revenue opportunities.

Moreover, stakeholder programs should explore diversification of supplier networks, focusing on partners that offer localized manufacturing or assembly within key operational regions. This approach mitigates the financial impact of shifting trade policies and ensures continuity of supply for critical lighting components. Investing in modular fixture designs that support both OEM integration and simplified retrofit installations will further enable airlines to manage cabin refresh cycles with minimal downtime and capital expenditure.

Finally, airlines and lessors alike should integrate predictive maintenance protocols leveraging IoT-enabled lighting systems. Continuous performance monitoring and data analytics can identify wear and degradation trends early, reducing unscheduled maintenance events and optimizing component replacement schedules. By adopting these actionable strategies, cabin lighting stakeholders can secure tangible enhancements in passenger satisfaction, operational reliability, and lifecycle cost management.

Detailing Rigorous Data Gathering Approaches and Analytical Techniques Undergirding the Integrity of Cabin Lighting Market Research Outcomes

This research employed a rigorous mixed-methods framework to ensure the validity and comprehensiveness of findings. Primary data collection involved structured interviews with cabin lighting engineers, procurement executives at leading airlines, and retrofit program managers. These discussions provided granular insights into technology preferences, regional regulatory considerations, and tariff response strategies. Complementing the qualitative interviews, an extensive review of industry publications, certification dossiers, and patent filings offered further context on innovation trajectories and competitive positioning.

Secondary research sources included publicly available technical specifications from major OEMs, trade journal analyses focusing on recent cabin refurbishment projects, and white papers authored by lighting component manufacturers. Data triangulation protocols were applied to reconcile discrepancies across sources, and thematic analysis techniques synthesized recurring trends and strategic themes. Additionally, a cross-validation exercise with independent industry consultants helped confirm the reliability of segmentation insights and regional performance patterns.

Throughout the research process, strict adherence to confidentiality agreements ensured that proprietary information shared by corporate participants was treated with the highest ethical standards. The combination of robust primary engagement and comprehensive secondary validation underpins the credibility and relevance of the market insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Cabin Lightings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Cabin Lightings Market, by Aircraft Type

- Aircraft Cabin Lightings Market, by Technology

- Aircraft Cabin Lightings Market, by Cabin Zone

- Aircraft Cabin Lightings Market, by End User

- Aircraft Cabin Lightings Market, by Distribution Channel

- Aircraft Cabin Lightings Market, by Installation

- Aircraft Cabin Lightings Market, by Region

- Aircraft Cabin Lightings Market, by Group

- Aircraft Cabin Lightings Market, by Country

- United States Aircraft Cabin Lightings Market

- China Aircraft Cabin Lightings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Perspectives on How Evolving Illumination Trends Are Set to Redefine Passenger Experiences and Operational Paradigms in Aviation

The evolving landscape of aircraft cabin lighting is poised to redefine both passenger experience and operational paradigms in aviation. Advances in tunable LED and induction technologies promise significant gains in energy efficiency and system longevity, while circadian rhythm lighting and personalized mood settings will become standard expectations among discerning travelers. At the same time, supply chain agility and tariff resilience remain critical considerations as stakeholders navigate shifting trade dynamics and component sourcing complexities.

Regional nuances will continue to shape adoption curves, with mature markets in the Americas leading retrofit initiatives and fast-growing fleets in Asia-Pacific driving OEM innovation. Collaborative ecosystems are emerging as the primary vectors for breakthrough lighting solutions, integrating electronics, software, and materials science into cohesive passenger environment offerings. As commercial carriers, business jet operators, and military clients each pursue tailored illumination packages, a deep understanding of segmentation drivers and regional performance variables will be essential.

In conclusion, cabin lighting stands at the nexus of technological, regulatory, and human-centric trends that collectively influence airline competitiveness and passenger loyalty. The insights detailed in this executive summary provide a comprehensive foundation for shaping strategic decisions, ensuring that industry participants can harness the full potential of innovative lighting solutions while navigating the challenges of modern aviation supply chains.

Motivating Aviation Leaders to Gain Unparalleled Cabin Lighting Market Intelligence by Engaging Directly with Associate Director of Sales & Marketing

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, provides aviation stakeholders with unparalleled clarity on the evolving dynamics of cabin illumination solutions. By initiating a dialogue, decision makers can explore how tunable LED systems and circadian rhythm lighting can be tailored to their specific fleet requirements, while understanding the nuanced supply chain considerations influenced by current trade policies. This direct engagement ensures that procurement strategies are informed by the latest primary insights and field-proven best practices, minimizing risk and accelerating time to market.

Moreover, a conversation with Ketan Rohom unlocks access to deeper analytical layers of the research, including detailed segmentation analysis and regional performance breakdowns that are critical when evaluating retrofit versus OEM adoption strategies. Investing in this dialogue equips aviation leaders with a strategic roadmap, enabling them to confidently navigate regulatory landscapes and partner with leading technology providers to achieve superior passenger experience and operational efficiency. Reach out today to secure your competitive edge through a bespoke briefing that will transform your cabin lighting initiatives.

- How big is the Aircraft Cabin Lightings Market?

- What is the Aircraft Cabin Lightings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?