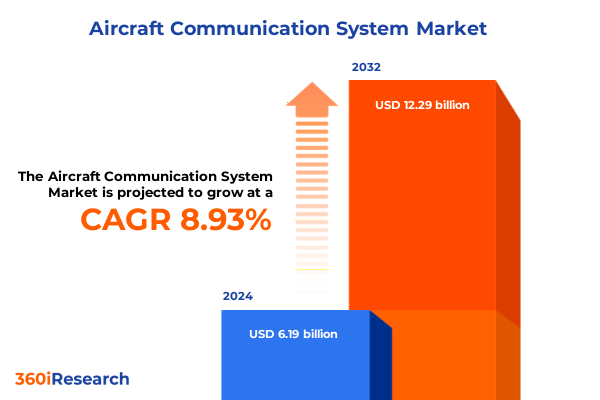

The Aircraft Communication System Market size was estimated at USD 6.75 billion in 2025 and expected to reach USD 7.31 billion in 2026, at a CAGR of 8.91% to reach USD 12.29 billion by 2032.

Establishing the Foundations of Next-Generation Aircraft Communication Systems Amid Technological Convergence and Evolving Global Connectivity Demands

The increasing complexity of global air traffic and the relentless pace of technological evolution have thrust aircraft communication systems into the spotlight. Modern aviation demands robust, reliable connections not only for operational safety but also to support real-time data exchange, enhanced situational awareness, and passenger connectivity. In this environment, decision makers must grasp the foundational trends shaping component architectures, frequency management, and platform integration to anticipate emerging requirements and mitigate potential risks.

In response to these pressures, stakeholders across the ecosystem have accelerated the development of modular communication suites, integrated digital signal processing, and adaptive networking protocols. As we embark on this exploration of the aircraft communication system market, we begin by outlining the critical imperatives driving innovation and investment across commercial, business, and military aviation segments. By framing the technological and regulatory backdrop, this introduction sets the stage for a comprehensive understanding of the market’s transformative shifts and strategic opportunities.

Uncovering the Paradigm-Shifting Technological Advances and Regulatory Dynamics Redefining Aircraft Communication Systems in a Digitally Driven and Resilient Aviation Ecosystem

Over the past decade, the convergence of digitalization, artificial intelligence, and satellite-based networking has upended traditional approaches to aircraft communication. High-frequency transceivers once confined to military domains are now complemented by satellite links spanning Ka, Ku, and L-Band, enabling global coverage and seamless handovers. Regulatory bodies have responded by revising spectrum allocation policies to facilitate efficient coexistence of HF, VHF, and SATCOM channels, while safety authorities mandate stricter data integrity and encryption standards.

Furthermore, the proliferation of software-defined radios has empowered aircraft manufacturers and retrofit providers to deploy flexible communication management units that adapt to evolving protocol requirements in flight. As such, the landscape has shifted from monolithic hardware implementations toward software-centric solutions that integrate antenna arrays, audio management units, and tuners into cohesive, upgradable platforms. These paradigm shifts reflect a growing emphasis on lifecycle cost optimization, cybersecurity resilience, and rapid certification pathways, reshaping how operators and suppliers approach system design and procurement.

Analyzing the Multifaceted Consequences of 2025 United States Tariff Measures on Global Supply Chains Component Costs and Industry Competitiveness in Aircraft Communication Systems

In 2025, the United States implemented a suite of tariffs targeting key electronic components and communications hardware, a move that reverberated across global supply chains. Aviation OEMs and retrofit specialists experienced a pronounced increase in component acquisition costs, particularly for software-defined radios and transceivers sourced from major Asian manufacturing hubs. In turn, these cost pressures prompted a wave of supplier consolidation as smaller vendors struggled to absorb the new levy, while established players leveraged scale to negotiate tariff exemptions and optimize logistics strategies.

Additionally, the tariff-induced inflation accelerated research into alternative materials and domestic production capabilities. U.S. defense aviation stakeholders, in particular, sought to mitigate dependency on foreign transponders and receivers by investing in local engineering ventures. Simultaneously, commercial airlines re-evaluated retrofit schedules and line-fit decisions, prioritizing critical safety upgrades over passenger connectivity enhancements. Ultimately, the 2025 tariff measures underscored the market’s vulnerability to geopolitical developments and reinforced the imperative for diversified procurement strategies and resilient manufacturing footprints.

Gaining Comprehensive Insights into Market Dynamics Through Component Technology Platform Fit Connectivity and Application Perspectives in Aircraft Communication Systems

The industry’s segmentation reveals a mosaic of interdependent components and technologies that collectively define system performance and customer value. Component-wise, antennas form the critical interface between the aircraft and external networks, while audio management units and communication management units serve as the nerve center for signal processing and channel allocation. Radio tuning units, receivers, software-defined radios, transceivers, transmitters, and transponders each play specialized roles in ensuring signal clarity, frequency agility, and redundancy.

Shifting to technology perspectives, high-frequency links continue to serve niche long-range communication roles, whereas satellite communication across Ka, Ku, and L-Band channels provides ubiquitous coverage for oceanic and remote operations. VHF remains the bedrock of line-of-sight communications, with next-generation enhancements improving data throughput. Platform segmentation differentiates between business jets requiring bespoke connectivity solutions, commercial airliners demanding scalable line-fit integration, and military aircraft prioritizing mission-critical tactical communications. Fit considerations further distinguish between line-fit installations integrated during manufacture and retrofit packages designed to extend the operational life of legacy fleets.

Connectivity options range from traditional data links enabling flight data monitoring to SATCOM and VHF/UHF/L-Band networks supporting voice, text, and streaming telemetry. Applications encompass air traffic control coordination, flight crew communication for operational commands, mission-critical tactical data transmission for defense scenarios, and passenger communication systems that underpin in-flight entertainment and broadband services. By appreciating these granular segments, stakeholders can pinpoint areas of high-value innovation and tailor investment strategies to address the precise demands of each market niche.

This comprehensive research report categorizes the Aircraft Communication System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Communication Technology

- Platform

- Fit

- Connectivity

- Application

Mapping Distinct Regional Growth Drivers and Market Nuances Across the Americas Europe Middle East Africa and Asia Pacific for Aircraft Communication Systems

Geographic nuances shape both demand drivers and implementation challenges within the aircraft communication ecosystem. In the Americas, a mature regulatory environment and extensive domestic manufacturing capabilities foster a competitive landscape dominated by OEM integration and advanced retrofit schedules. The presence of major network providers further accelerates the rollout of broadband passenger connectivity solutions across North and South America, while defense investment underscores the significance of resilient communication architectures for national security.

Across Europe, the Middle East, and Africa, heterogeneous regulatory frameworks necessitate adaptive solutions capable of navigating divergent frequency allocations and certification processes. European carriers emphasize sustainability-driven upgrades, integrating lightweight antennas and energy-efficient transceivers, whereas operators in the Middle East focus on high-throughput satellite links to support long-haul operations. African markets, though nascent, display growing demand for cost-effective communication suites that enhance both safety and passenger experience in rapidly expanding regional networks.

Asia-Pacific presents a dual narrative of robust commercial aviation growth and strategic military modernization. Major hubs like China, India, and Southeast Asia exhibit accelerating retrofit demand, driven by fleet expansions and competition for superior in-flight connectivity. Satellite communication providers are investing heavily in regional Ka- and Ku-band satellites to supplement terrestrial infrastructure, reflecting the region’s willingness to adopt cutting-edge technologies in pursuit of operational efficiency and passenger satisfaction.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Communication System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Extracting Strategic Differentiators from Leading Aircraft Communication System Providers to Illuminate Competitive Strengths Collaborative Ventures and Technological Leadership

Leading participants in the aircraft communication system arena demonstrate distinct approaches to delivering end-to-end connectivity solutions. Established avionics OEMs leverage their deep engineering heritage to offer integrated platforms that encompass line-fit installation, certification support, and global maintenance networks. These incumbents often bundle communication management units with transceivers and antennas to provide turnkey solutions that minimize time-to-market for airframers and airlines.

Simultaneously, specialized subsystem providers differentiate through software-centric offerings, deploying modular audio management units and SDR platforms that can be rapidly updated to comply with emerging cybersecurity and interoperability standards. Satellite communication specialists maintain strategic alliances with regional operators to secure bandwidth capacity and ensure seamless service across oceanic and polar routes. In parallel, defense-focused vendors emphasize hardened transponder designs, encryption protocols, and mission-critical tactical communication suites optimized for interoperability with allied forces.

Collectively, these diverse vendor strategies reflect a market in which collaboration between OEMs, software developers, satellite operators, and systems integrators is key to unlocking the next wave of innovation. By analyzing each company’s core strengths-whether in antenna design, SDR development, SATCOM partnerships, or retrofit engineering-industry stakeholders can identify the optimal alliance models to fast-track technology deployments and achieve differentiated service offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Communication System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Aselsan A.S.

- Astronics Corporation

- BAE Systems plc

- Cobham Aerospace Communications

- Elbit Systems Ltd

- Garmin Ltd

- General Dynamics Corporation

- Gogo Inc

- Honeywell International Inc

- Iridium Communications Inc

- Kratos Defense & Security Solutions Inc

- L3Harris Technologies Inc

- Leonardo S.p.A

- Northrop Grumman Corporation

- Orbit Communication Systems Ltd

- Rohde & Schwarz GmbH & Co KG

- RTX Corporation

- Safran SA

- SITAONAIR

- Thales Group

- The Boeing Company

- United Aircraft Corporation

- Universal Avionics Systems Corporation

- ViaSat Inc

Empowering Industry Stakeholders with Actionable Strategic Pathways to Address Supply Chain Challenges Technological Integration and Regulatory Compliance in Aircraft Communications

Industry leaders must proactively align their strategies with the accelerating pace of digital transformation and shifting regulatory priorities. First, establishing flexible supply chain frameworks that incorporate dual-source component strategies and localized manufacturing can mitigate the impact of future tariff fluctuations or geopolitical disruptions. By fostering regional partnerships and qualifying alternative suppliers, organizations can ensure consistent access to critical communication hardware without compromising performance or certification standards.

Second, prioritizing software upgradability through SDR platforms and modular communication management units positions stakeholders to respond swiftly to evolving data security mandates and spectrum allocation changes. Investing in open-architecture designs and robust cybersecurity protocols will not only streamline compliance but also facilitate interoperability across multi-vendor ecosystems. Engaging early with certification authorities on digital update pathways can further reduce time-to-market for critical enhancements.

Finally, cultivating cross-industry collaborations-linking avionics specialists, satellite operators, cybersecurity experts, and system integrators-will drive synergies that accelerate the rollout of next-generation connectivity solutions. Through co-development programs and shared technology roadmaps, stakeholders can distribute research costs, diversify risk, and bring unified communication suites to market more rapidly, ultimately reinforcing their competitive position in an increasingly interconnected aviation environment.

Detailing the Rigorous Research Methodology Combining Primary Expert Engagement and Secondary Data Triangulation to Ensure Robust Insights into Aircraft Communication Systems

The findings presented in this report are underpinned by a robust research framework combining primary and secondary insights. Primary research involved structured interviews and consultations with senior executives, systems engineers, and procurement specialists across airlines, airframers, defense organizations, and subsystem vendors. These engagements provided nuanced perspectives on technology adoption timelines, certification challenges, and procurement priorities.

Secondary research encompassed the analysis of technical white papers, industry publications, regulatory filings, and patent databases to triangulate emerging trends in antenna design, SDR adoption, and satellite spectrum utilization. Market intelligence on tariff developments, regional regulatory initiatives, and defense procurement plans was synthesized from government reports and open-source documentation. Data validation protocols ensured that all quantitative and qualitative inputs were verified through multiple independent sources, reinforcing the report’s accuracy and reliability.

Moreover, the research methodology incorporated a cross-sectional segmentation analysis to map insights across components, communication technologies, platforms, fit types, connectivity options, and application scenarios. This multilayered approach enabled the development of granular market perspectives and actionable recommendations, ensuring that stakeholders receive targeted intelligence aligned with their strategic objectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Communication System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Communication System Market, by Component

- Aircraft Communication System Market, by Communication Technology

- Aircraft Communication System Market, by Platform

- Aircraft Communication System Market, by Fit

- Aircraft Communication System Market, by Connectivity

- Aircraft Communication System Market, by Application

- Aircraft Communication System Market, by Region

- Aircraft Communication System Market, by Group

- Aircraft Communication System Market, by Country

- United States Aircraft Communication System Market

- China Aircraft Communication System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Illustrate the Future Trajectory of Aircraft Communication Systems and Highlight Critical Industry Imperatives for Sustained Innovation

This executive summary synthesizes the critical themes shaping the future trajectory of aircraft communication systems, from transformative technological shifts to the repercussions of U.S. tariff policies. The integration of software-defined radios, satellite link expansions, and adaptive network protocols underscores a collective industry drive toward resilient, upgradable communication architectures. Meanwhile, regional nuances-from mature networks in the Americas to regulatory diversity in EMEA and rapid growth in Asia-Pacific-highlight opportunities for tailored deployment strategies.

Benchmarking leading vendors reveals a competitive landscape governed by collaborative innovation, with OEMs, subsystem developers, and satellite operators forging alliances to deliver end-to-end connectivity solutions. The strategic imperatives articulated herein-spanning supply chain resilience, software modularity, and cross-industry partnerships-provide a roadmap for stakeholders to navigate regulatory complexities and capitalize on emerging opportunities. As the market continues to evolve, those who adopt flexible, technology-agnostic approaches will be best positioned to secure enduring competitive advantage and drive the next generation of aviation communication capabilities.

Seize the Opportunity to Leverage Comprehensive Aircraft Communication Systems Research Insights by Engaging with Ketan Rohom Associate Director Sales Marketing at 360iResearch

For decision makers seeking to deepen their understanding of the aircraft communication system landscape and unlock actionable intelligence tailored to their strategic objectives, an in-depth report awaits. Engage directly with Ketan Rohom Associate Director Sales & Marketing at 360iResearch to explore custom insights, clarify methodological nuances, and secure a comprehensive market guide that empowers your organization to navigate complex regulatory frameworks and technological disruptions with confidence. Reach out today to transform market intelligence into decisive competitive advantage.

- How big is the Aircraft Communication System Market?

- What is the Aircraft Communication System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?