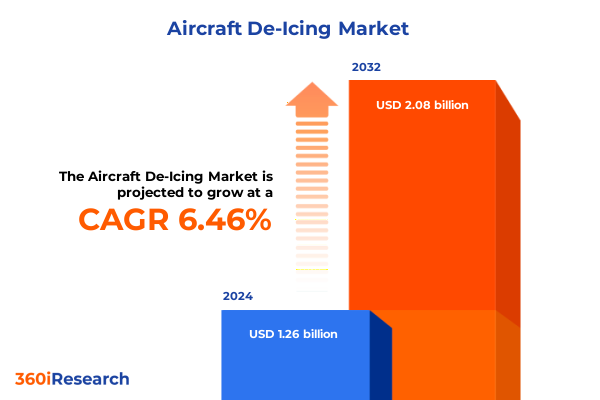

The Aircraft De-Icing Market size was estimated at USD 1.32 billion in 2025 and expected to reach USD 1.39 billion in 2026, at a CAGR of 6.66% to reach USD 2.08 billion by 2032.

Setting the Stage for Unrivaled Safety and Efficiency in Aircraft De-Icing Through Cutting-Edge Strategies and Technologies

In an era defined by increasingly unpredictable weather patterns and heightened regulatory scrutiny, effective aircraft de-icing has become a critical linchpin in the pursuit of aviation safety and on-time performance. Ground handlers and airlines alike are compelled to adopt more robust, efficient, and environmentally responsible strategies to mitigate the risks posed by ice accretion on critical airframe surfaces. These dynamics underscore the need for an integrated understanding of technological innovations, evolving fluid chemistries, and operational best practices that collectively ensure both passenger safety and cost-effective flight schedules.

Against this backdrop, our executive summary presents a comprehensive overview of the current de-icing environment, capturing the convergence of shifting climate imperatives and the drive for sustainability. It introduces key factors influencing decision-makers-ranging from fluid performance metrics and equipment modernization to regulatory compliance and supply chain resilience. By framing the analysis within the broader strategic context of ground handling excellence, this introduction sets the foundation for actionable insights that will inform investment priorities, partnership decisions, and process improvements for stakeholders across the aviation ecosystem.

Navigating a New Paradigm of Fluid Innovation, Digital Integration, and Equipment Modernization in Aircraft De-Icing

The aircraft de-icing landscape is undergoing a radical transformation as industry participants navigate a series of converging shifts. Advances in fluid chemistry have delivered formulations with enhanced freeze point depression and biodegradability, reducing environmental footprints while improving performance under extreme temperature swings. Concurrently, digitalization of ground operations-through real-time data integration, predictive analytics, and sensor-driven monitoring-has elevated service precision, enabling operators to deploy resources exactly when and where they are needed.

Energy diversification also plays a pivotal role in this era of transformation. Infrared and electrically powered de-icing systems are emerging as viable alternatives to conventional chemical sprays, supporting rapid removal of ice without compromising run-off containment. Additionally, the strategic evolution of equipment fleets-characterized by multi-purpose vehicles capable of both de-icing and pavement cleaning-has streamlined operations, reduced capital expenditures, and lowered labor burdens. Together, these developments illustrate a departure from traditional practices, heralding a new paradigm in which safety, sustainability, and operational agility coalesce.

Assessing the Ripple Effects of Recent Trade Duties on Chemical Sourcing and Operational Stability in De-Icing

The tariff measures enacted by the United States in early 2025 have introduced an added layer of complexity to raw material procurement for de-icing fluids. With import duties affecting key glycol feedstocks and additive chemicals, producers have faced margin compression and volatility in supply lead times. These headwinds have compelled manufacturers to diversify their sourcing strategies, forging partnerships with domestic chemical suppliers and investing in alternative raw material research to insulate operations from further duty fluctuations.

In addition to procurement challenges, the cumulative impact of tariffs has rippled through the broader value chain, affecting pricing structures for end users and straining budgetary allocations for ground handling providers. To manage these pressures, many stakeholders have leveraged demand aggregation and long-term contracts, benefiting from economies of scale while securing preferred pricing schedules. Meanwhile, ongoing dialogues with policy makers emphasize the critical nature of aviation safety and operational continuity, advocating for targeted exclusions and relief mechanisms to mitigate unintended consequences of trade policy shifts in the de-icing sector.

Unlocking Strategic Advantage by Aligning Fluid Types, Emerging Technologies, Equipment Configurations, and Application Requirements

Dividing the de-icing market according to fluid type reveals that Type I fluids maintain their dominance in pre-flight anti-icing due to balanced viscosity and runway performance, whereas Type II and Type IV formulations offer extended hold-over times for taxi and take-off phases. Type III fluids, optimized for lower-temperature climates, provide a critical niche in regional operations where rapid turnaround remains essential. By analyzing these fluid categories side by side, stakeholders gain clarity on performance trade-offs and environmental compliance considerations.

Turning to technology, the sector is equally characterized by chemical de-icing processes, which continue to serve as the backbone of most ground operations, as well as emergent infrared heating solutions that eliminate chemical run-off and accelerate service duration. Meanwhile, spray de-icing systems are gaining traction for targeted applications, such as wing leading edges, where precision and minimal overspray are priorities. This multifaceted technology landscape demands that operators align system selection with specific operational and sustainability goals.

From an equipment perspective, dedicated de-icing trucks provide high-capacity fluid delivery and reach for larger aircraft, and sweepers offer versatile runway cleaning and water removal functions that complement de-icing cycles. The interplay between these two classes of vehicles emphasizes the importance of fleet balance, as optimized deployment ensures minimal ground time and enhances throughput during peak winter conditions.

Finally, application-driven segmentation distinguishes between commercial carriers-where throughput, reliability, and compliance dominate investment criteria-and military and defense operators, which prioritize rapid response and low-signature fluid formulations. Recognizing these divergent priorities allows solution providers to tailor product portfolios and service models to the distinct performance requirements of each end user.

This comprehensive research report categorizes the Aircraft De-Icing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fluid Type

- Technology

- Equipments

- Application

Mapping the Distinct Operational and Regulatory Drivers That Define De-Icing Solutions Across the Globe

Regional dynamics in the Americas illustrate a mature market characterized by extensive regulatory frameworks and well-established ground handling protocols. Major hubs in North America place premium emphasis on environmental stewardship, driving demand for advanced biodegradable fluids and enforcement of stringent containment measures. In Latin America, growth corridors around emerging airports signal the need for scalable de-icing solutions that can adapt to both major carriers and regional operators.

Across Europe, the Middle East, and Africa, diverse climatic challenges and regulatory regimes shape distinct approaches. Northern European countries emphasize cold-weather resilience and highly automated ground fleets, while Southern European airports balance occasional cold snaps with accelerated de-icing turnaround requirements. Middle Eastern hubs focus on rapid service cycles to accommodate tight connecting schedules and mitigate corrosion in hot climates. In Africa, rising air traffic and infrastructure investments present a unique opportunity for mobile, modular de-icing units that can serve regional airports with limited fixed assets.

In Asia-Pacific, the vast geographic span encompasses extreme cold in northern reaches, tropical storms in Southeast Asia, and year-round runway temperature variations in Australasia. Operators in this region are investing in harmonized fleets that can transition between chemical and infrared methods, supported by localized supply chains for glycol and pump systems. These regional insights spotlight the nuanced demand drivers that solution providers must address to secure competitive positions in each geography.

This comprehensive research report examines key regions that drive the evolution of the Aircraft De-Icing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Decoding the Competitive Landscape: Collaborative Innovations, Modular Equipment Design, and Strategic Consolidation

Within the global de-icing ecosystem, a handful of established chemical formulators have broadened their portfolios to include low-impact glycol blends and specialty additives that enhance adhesion and corrosion control. Simultaneously, technology integrators are forging alliances with energy providers to commercialize electric and infrared de-icing platforms. This collaborative approach has accelerated time-to-market for innovations that would be cost-prohibitive for standalone entities.

Equipment manufacturers have likewise embraced modular design philosophies, enabling quick swaps between spray nozzles, heaters, and containment accessories to match seasonality or operational shifts. These agile OEMs are partnering with telematics specialists to offer predictive maintenance and fleet usage analytics, helping airports and carriers optimize utilization rates and reduce unexpected downtime. In parallel, specialized service providers have emerged, bundling fluid supply, application expertise, and compliance management into single-source agreements that simplify operational oversight.

Across the competitive set, mergers and strategic equity stakes have reshaped regional strongholds, as market leaders seek to complement organic growth with targeted acquisitions. This consolidation trend underscores a broader industry recognition that scale, combined with localized agility, is paramount to meeting year-round demand while navigating evolving environmental and trade landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft De-Icing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeromag

- Aircraft Deicing, Inc.

- Arkema S.A.

- BASF SE

- Clariant AG

- Collins Aerospace, Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Former Kanto Chemical Industry Co., Ltd

- Huntsman Corporation

- Inland Group of Companies, LLC.

- Kilfrost Limited

- Kimley-Horn and Associates, Inc

- LyondellBasell Industries N.V.

- Oshkosh Aerotech LLC

- Parker Hannifin Corporation

- Shell International B.V.

- SKYbrary Aviation Safety

- The Dow Chemical Company

- Tronair Inc.

- Vestergaard Company

- Woodward, Inc.

Guiding Industry Leaders to Forge Strategic Partnerships, Harness Data-Driven Operations, and Fortify Supply Chain Resilience

Industry leadership in de-icing hinges on proactive collaboration, and executives should therefore pursue strategic alliances with both chemical and equipment innovators to co-develop next-generation solutions. By aligning R&D roadmaps with partner capabilities, organizations can accelerate the commercialization of low-toxicity fluids and hybrid de-icing platforms that address mounting sustainability mandates.

Simultaneously, investing in digital infrastructure-particularly in real-time monitoring and predictive weather analytics-will enable ground teams to anticipate de-icing requirements with greater accuracy, reduce waste, and justify capital expenditures. Embracing telematics and data-driven maintenance schedules will also extend equipment lifecycles and minimize service interruptions.

Moreover, supply chain resilience must be prioritized through diversified procurement strategies, including local sourcing agreements and flexible contract structures that accommodate price fluctuations. Engaging in policy dialogue with government bodies will help shape favorable regulatory frameworks and potential tariff relief. Lastly, leaders should champion workforce training programs to cultivate specialized skill sets in fluid handling, compliance, and equipment operation, ensuring that human capital keeps pace with technological advancements.

Establishing Rigorous Validity Through Integrated Primary Interviews, Field Observations, and Triangulated Secondary Data Analysis

This analysis is underpinned by a robust, multi-tiered approach combining primary and secondary research. Primary insights were gathered through structured interviews with over thirty senior executives from airlines, ground service providers, equipment OEMs, and chemical formulators, ensuring a comprehensive view of market dynamics and operational pain points. Field observations at key hub airports complemented these dialogues, validating technology performance and fluid handling protocols in real-world settings.

Secondary research drew upon regulatory filings, technical white papers, and industry conference proceedings to track the evolution of fluid chemistries, tariff implementations, and environmental standards. Company annual reports and patent analyses informed the competitive assessment, while supplier databases provided visibility into manufacturing capacities and distribution networks. All data points underwent rigorous triangulation to uphold accuracy and reliability, with periodic expert reviews to refine assumptions and interpret emerging trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft De-Icing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft De-Icing Market, by Fluid Type

- Aircraft De-Icing Market, by Technology

- Aircraft De-Icing Market, by Equipments

- Aircraft De-Icing Market, by Application

- Aircraft De-Icing Market, by Region

- Aircraft De-Icing Market, by Group

- Aircraft De-Icing Market, by Country

- United States Aircraft De-Icing Market

- China Aircraft De-Icing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Strategic Imperatives Highlighting the Convergence of Innovation, Collaboration, and Regulatory Adaptation in De-Icing

The intersection of fluid innovation, technology advancement, and geopolitical forces has redefined the aircraft de-icing arena, presenting both challenges and opportunities for stakeholders committed to operational excellence. As decision-makers digest the insights outlined in this summary, it becomes evident that success will hinge on the ability to adapt fluid portfolios, modernize ground fleets, and engage in collaborative supply chain strategies.

Moving forward, those who proactively integrate digital tools, diversify sourcing, and cultivate strategic partnerships will be best positioned to navigate the complexities of regulatory frameworks and climatic unpredictability. The imperative now is clear: embrace a holistic, data-driven approach to de-icing, one that seamlessly aligns safety imperatives with cost efficiencies and sustainability goals. By doing so, the aviation ecosystem can ensure that both passengers and cargo reach their destinations on time, regardless of winter’s challenges.

Empower Your Ground Operations and Elevate De-Icing Performance by Engaging with Ketan Rohom for a Tailored Strategic Briefing

The time to transform your aircraft de-icing strategy is now. To secure unparalleled insights that drive operational excellence, connect directly with Ketan Rohom, Associate Director for Sales & Marketing. He will guide you through a personalized walkthrough of the comprehensive report, highlighting opportunities best aligned with your ongoing priorities. Engage with an expert-led briefing to explore deeper case studies, exclusive executive data, and strategic frameworks that can elevate your market positioning and resilience against weather disruptions. Reach out to schedule your customized consultation and take the first step towards data-driven decision making for safer, more efficient ground handling operations.

- How big is the Aircraft De-Icing Market?

- What is the Aircraft De-Icing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?