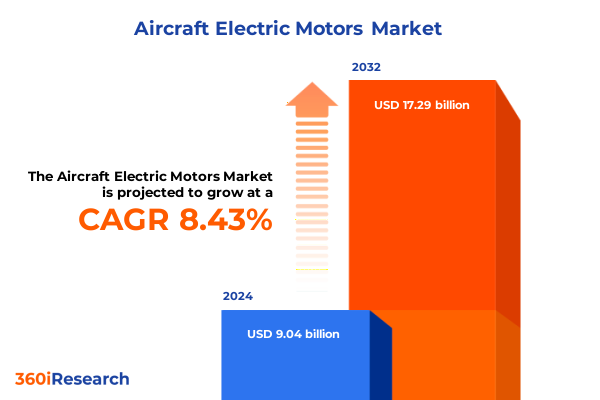

The Aircraft Electric Motors Market size was estimated at USD 9.76 billion in 2025 and expected to reach USD 10.55 billion in 2026, at a CAGR of 8.50% to reach USD 17.29 billion by 2032.

Pioneering the Future of Aviation with Electric Motor Technologies Amidst Regulatory Pressures Efficiency Demands and Sustainability Goals

The aviation industry is entering a pivotal era marked by the convergence of environmental imperatives and technological innovation. As global regulators accelerate emissions reduction targets and airlines seek to minimize operating costs, electric motors have emerged as a critical enabler for cleaner, quieter, and more efficient aircraft propulsion and subsystem applications. This introduction frames the strategic importance of electric motor adoption across all aircraft categories, highlighting how advancements in materials science, power electronics, and energy storage are dissolving traditional barriers to electrification.

In recent years, developments in high-performance permanent magnet alloys, refined manufacturing processes, and advanced thermal management solutions have delivered motors with power densities and efficiency rates that rival conventional turbine-based systems. These achievements dovetail with policy frameworks incentivizing zero-emission aircraft, setting the stage for pilots of advanced air mobility, fixed-wing platforms, rotary-wing vehicles, and unmanned aerial systems to integrate electric drive architectures at scale. In this context, electric motors underpin critical subsystems from door actuation to flight control, establishing their role not only in propulsion but as foundational technologies supporting next-generation aircraft design.

Transitioning from legacy systems to all-electric and hybrid-electric architectures requires a nuanced understanding of component interoperability and system-level optimization. By examining current capabilities alongside anticipated breakthroughs, this section lays the groundwork for comprehending the market’s evolving contours and the strategic decisions that will determine winners and laggards in this dynamic environment.

Navigating Disruptive Technological Breakthroughs Regulatory Mandates and Collaborative Ecosystems Redefining Electric Motor Adoption

The aircraft electric motor sector is experiencing transformative shifts driven by breakthroughs in semiconductor power modules, additive manufacturing, and digital control architectures. Advanced air mobility initiatives have acted as a catalyst, proving the viability of high-power-density electric drives in urban air taxis and regional eVTOL prototypes. Simultaneously, electrification efforts in traditional fixed-wing and rotary-wing platforms are progressing from proof-of-concept demonstrations to full-scale certification programs, emphasizing the need for robust supply chains and regulatory alignment.

Regulators worldwide are reinforcing emissions standards through increasingly stringent CO₂ and noise abatement requirements, compelling OEMs to reevaluate propulsion strategies. Partnership models are evolving accordingly, with motor manufacturers collaborating closely with energy storage providers and avionics specialists to deliver integrated propulsion solutions. This cooperative ecosystem approach reduces time to market and distributes technical risk among stakeholders, thereby encouraging more ambitious electrification roadmaps.

Technological convergence has also accelerated: power electronics architectures originally developed for automotive applications are being repurposed for aerospace, fostering cost efficiencies and rapid iteration cycles. At the same time, digital twins and model-based system engineering tools allow for real-time monitoring and predictive maintenance, shifting the paradigm from reactive repairs to condition-based servicing. Collectively, these disruptive trends underscore a landscape in which agility, cross-industry collaboration, and regulatory engagement are becoming indispensable success factors.

Assessing the Far-Reaching Supply Chain Disruptions and Strategic Realignments Triggered by 2025 U.S. Import Tariffs

The introduction of targeted tariffs on imported electric motor components and raw materials by the United States in early 2025 has introduced a complex layer of trade dynamics. By imposing levies on key inputs such as rare-earth alloys, precision-engineered laminations, and certain semiconductor modules, the policy has driven many original equipment manufacturers and subsystem integrators to reassess their sourcing strategies. Some firms have accelerated initiatives to localize supply chains, partnering with domestic steel producers and specialty alloy refiners to mitigate exposure to tariff volatility and international shipping bottlenecks.

While the tariffs have incentivized investment in onshore production capabilities, they have also increased short-term costs for OEMs with legacy procurement arrangements. This dichotomy has created an environment where nimble, vertically integrated enterprises with captive manufacturing capacity can outmaneuver competitors reliant on imported components. In response, industry consortia have convened to lobby for tariff exemptions on critical aerospace-grade materials, while others have pursued alternative materials that achieve comparable performance metrics.

The strategic recalibration triggered by these policy measures extends beyond cost implications. For instance, the push toward localized manufacturing has catalyzed new government–industry partnerships aimed at establishing advanced electric motor centers of excellence. These initiatives marry federal grant programs with private capital, accelerating workforce development, R&D collaboration, and technology transfer. Consequently, the tariffs’ cumulative impact is redefining supplier landscapes, compelling stakeholders to embrace resilience and agility as foundational business attributes.

Unveiling In-Depth Perspectives on Motor Types Output Power Ratings Component Architectures and Application Domains Informing Strategic Differentiation

Analyzing the electric motor market through the prism of motor type reveals distinct performance and application characteristics between alternating current and direct current architectures. Alternating current motors, with their inherent compatibility with high-voltage grid interfaces and superior efficiency at constant speeds, dominate propulsion drives in larger platforms. Direct current motors, however, continue to offer precise torque control and compact form factors, making them well suited to specialty subsystems requiring rapid response times.

When output power thresholds are considered, motors rated up to 10 kilowatts excel in auxiliary functions such as door actuation and cabin environmental control. Units within the 10–200 kilowatt band form the backbone of hybrid-electric propulsion trials, balancing energy density with weight constraints. Above 200 kilowatts, the focus shifts to full electric propulsion applications for regional and advanced air mobility vehicles, where power density and thermal management define feasibility.

Distinct aircraft types also drive market dynamics. The advanced air mobility segment demands ultra-lightweight, high-reliability motors to support urban air taxi prototypes, while fixed-wing platforms leveraging mild hybrid systems seek motors optimized for both climb and cruise flight profiles. Rotary-wing applications prioritize compact, high-torque solutions for precision maneuvering, and unmanned aerial vehicles require a blend of power efficiency and extended endurance to maximize mission durations.

Component segmentation underscores the criticality of individual elements. Armatures and rotors define core power generation capabilities, while coils and fields influence torque characteristics and heat dissipation. Exciters and stators contribute to electromagnetic precision, and the integration of transformers and solenoids in power electronics assemblies ensures safe voltage regulation. These component-level nuances underpin product differentiation and influence aftermarket service models.

Finally, application areas span from flight control assemblies that demand millisecond-level responsiveness to propulsion systems where continuous operation and thermal resilience are paramount. Environmental control and fuel management systems benefit from motors engineered for high reliability under cyclic loads, whereas landing gear actuation demands strength and fail-safe characteristics. The dichotomy between aftermarket services, where ease of maintenance drives designs, and original equipment manufacturers, which prioritize integrated system performance, further contextualizes how end-user requirements shape motor development and commercialization strategies.

This comprehensive research report categorizes the Aircraft Electric Motors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Motor Type

- Output Power

- Aircraft Type

- Components

- Application Area

- End User

Exploring Distinct Regional Drivers Infrastructure Capacities and Policy Frameworks Shaping Electric Motor Market Growth Across Global Territories

Geographic dynamics play a pivotal role in shaping regional trajectories for electric motor deployment. In the Americas, strong government incentives and a maturing ecosystem of advanced manufacturing facilities have fostered the development of high-power-density motors for next-generation aircraft programs. Collaboration between academic institutions and industry consortia has accelerated workforce training and innovation clusters, reinforcing the region’s leadership in large-scale propulsion applications.

Europe, the Middle East, and Africa present a heterogeneous landscape. Western Europe’s rigorous emissions standards and robust public funding mechanisms have underwritten pilot projects in hybrid-electric regional aircraft, while Middle Eastern carriers pursue strategic partnerships to explore sustainable fleet renewals. In sub-Saharan Africa, limited infrastructure and financing hurdles have slowed adoption, though interest remains high in leveraging electric motors for unmanned aerial systems in humanitarian and logistics missions.

The Asia-Pacific region exhibits a dual narrative of rapid adoption and manufacturing ambition. China and Japan are scaling domestic production of rare-earth-based motor components, targeting both civilian and defense markets. Meanwhile, Southeast Asian nations are integrating electric motor retrofits into existing turboprop fleets to reduce operating costs on short-haul routes. Government-led innovation programs in Australia and South Korea are also notable, focusing on advanced materials research and grid-to-wing electrification pathways.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Electric Motors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Collaborations Vertical Integration Efforts and Service Innovations Driving Competitive Leadership in Electric Motor Solutions

Leading companies in the electric motor domain are diversifying their portfolios to encompass both propulsion and subsystem applications, leveraging core competencies in materials science, precision machining, and digital control systems. Several established aerospace suppliers are collaborating with power electronics firms to deliver integrated motor–inverter packages tailored to electric and hybrid-electric powertrain requirements. These partnerships often extend to joint ventures focusing on vertical integration of rare-earth alloy production and advanced manufacturing techniques such as laser-based winding.

At the same time, disruptive entrants from the automotive electrification space are forging strategic alliances with aerospace OEMs, bringing expertise in scalable mass production and battery integration to the aerospace ecosystem. Their ability to rapidly iterate on motor designs using modular platforms has prompted traditional aerospace players to adopt leaner development cycles and digital prototyping tools.

Corporate strategies increasingly emphasize aftermarket services, with leading motor suppliers deploying predictive maintenance platforms enabled by real-time condition monitoring and advanced analytics. By offering performance guarantees and service-level agreements, these firms deepen customer relationships and create recurring revenue streams. Mergers and acquisitions remain prevalent as stakeholders seek to consolidate complementary capabilities, from 3D-printed electromagnetic components to next-generation thermal management systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Electric Motors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aircraft Electric Motors, Inc.

- AJ Aircraft

- AMETEK, Inc.

- ARC Systems Inc.

- Calnetix Technologies, LLC

- Collins Aerospace

- Diamond Aircraft Industries GmbH

- Duxion Motors Inc.

- Electromech Technologies LLC

- EMRAX d.o.o.

- Evolito Ltd.

- H3X Technologies Inc.

- Honeywell International Inc.

- Horizon Aircraft, Inc.

- Integral Powertrain Limited

- Kawak Aviation Technologies, Inc.

- KDE Direct, LLC

- Kite Magnetics Pty Ltd.

- MAGicALL, Inc.

- magniX USA, Inc

- MGM COMPRO International s. r. o.

- Moog Inc.

- NEMA

- Parker-Hannifin Corporation

- Regal Rexnord Corporation

- Rolls-Royce PLC

- Safran Group

- Siemens AG

- Textron Inc.

- TIGER MOTOR

- Windings Inc.

- Woodward, Inc.

- Wright Electric Inc.

Strategic Imperatives Including Modular Design Digital Transformation Partnerships and Circularity to Secure Long-Term Leadership in Electrification

Industry leaders seeking to maximize the opportunities presented by electrification should prioritize investment in modular motor architectures that accommodate multiple power ratings and application profiles. This flexibility will enable rapid response to shifting customer demands and regulatory requirements. Furthermore, cultivating partnerships with raw material suppliers and semiconductor manufacturers can mitigate supply chain risks and enhance cost stability.

Enhancing in-house digital capabilities, particularly in predictive analytics and model-based design, will accelerate product development timelines and improve reliability outcomes. Companies should also consider forming consortia with academic and government research entities to drive standards development and pre-competitive technology sharing, reducing duplication of effort and fostering a unified path to certification.

On the operational front, establishing centers of excellence for workforce training in advanced manufacturing and system integration will ensure access to specialized skills. Simultaneously, firms must embed circular economy principles into motor design, emphasizing recyclability and end-of-life recoverability of rare-earth materials to align with sustainability mandates and secure long-term resource access.

Implementing a Comprehensive Mixed-Methods Research Design Featuring Expert Interviews Data Triangulation and Scenario Modeling for Robust Insights

Our research framework integrates direct engagement with subject-matter experts across the aerospace propulsion sector, including motor design engineers, certification authorities, and procurement leaders. Extensive primary interviews were conducted to capture firsthand perspectives on emerging technical challenges and strategic imperatives. This qualitative insight was complemented by a rigorous review of peer-reviewed journals, patent databases, and regulatory filings to validate technology readiness levels and compliance trajectories.

Secondary data sources included proprietary manufacturer catalogs, industry association reports, and conference proceedings, which provided context on product line expansions and innovation timelines. Market triangulation was achieved by cross-referencing production capacity data with academic research outputs and investment trends to ensure consistency. Advanced analytical techniques, such as scenario modeling and sensitivity analysis, were applied to assess strategic options under varying regulatory and tariff scenarios.

To maintain methodological integrity, findings were continuously validated through expert workshops, where draft conclusions and recommendations were stress-tested against operational realities. This iterative approach guarantees that the insights presented are not only theoretically robust but also directly applicable to strategic decision-making in the electric motor market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Electric Motors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Electric Motors Market, by Motor Type

- Aircraft Electric Motors Market, by Output Power

- Aircraft Electric Motors Market, by Aircraft Type

- Aircraft Electric Motors Market, by Components

- Aircraft Electric Motors Market, by Application Area

- Aircraft Electric Motors Market, by End User

- Aircraft Electric Motors Market, by Region

- Aircraft Electric Motors Market, by Group

- Aircraft Electric Motors Market, by Country

- United States Aircraft Electric Motors Market

- China Aircraft Electric Motors Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Critical Trends Regional Variations and Strategic Alliances That Define Future Success in Aircraft Electric Motor Electrification

The confluence of sustainability targets, regulatory mandates, and rapid technological evolution has propelled electric motors to the forefront of aviation innovation. Across motor types, output power classes, and component specializations, the industry is embracing a systems-level mindset that integrates materials advancements with digital controls to achieve unprecedented performance metrics.

Regional variation underscores the importance of tailoring strategies to local policy landscapes and manufacturing infrastructures. Meanwhile, the introduction of tariffs has illuminated the strategic value of supply chain resilience and domestic capacity building. Pioneering collaborations between aerospace incumbents and electrification specialists are redefining competitive boundaries, while aftermarket service innovations are opening new avenues for revenue generation.

Ultimately, success in this dynamic environment will require leaders to adopt modular, scalable platforms, invest in digital and circular technologies, and engage proactively with regulatory bodies. By doing so, organizations can navigate the complexities of certification, cost management, and sustainability, ensuring they capture the full potential of aircraft electrification and shape the next chapter of aviation history.

Secure Your Competitive Edge by Engaging with Our Senior Sales Leader to Unlock Full Strategic Insights from the Aircraft Electric Motor Report

To gain an unparalleled understanding of emerging dynamics, technological breakthroughs, and strategic opportunities in the aircraft electric motor market, you are invited to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expert guidance will facilitate access to the comprehensive market research report, complete with in-depth analysis, actionable recommendations, and proprietary insights. Engage today to secure the intelligence needed to inform your strategic planning, drive innovation, and build a resilient roadmap that positions your organization at the forefront of the industry’s next wave of electrification.

- How big is the Aircraft Electric Motors Market?

- What is the Aircraft Electric Motors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?